Gold has traded between the mid-$1,220’s and nearly $1,240 so far today…as of 10:15 am Pacific, bullion is up $3 an ounce at $1,237…Silver has added 5 pennies to $18.00…Copper and Nickel are off slightly…Crude Oil has jumped 94 cents to $54.34 while the U.S. Dollar Index has gained almost half a point to 101.41…

Note: With Kitco site down most of today until this evening, we experienced technical issues with our live commodity chart feeds which interrupted the look of the BMR homepage…we apologize for the inconvenience and technicians continue to address the situation…

Note: With Kitco site down most of today until this evening, we experienced technical issues with our live commodity chart feeds which interrupted the look of the BMR homepage…we apologize for the inconvenience and technicians continue to address the situation…

Investor demand for Gold can be seen in the world’s largest Gold-backed exchange-traded fund, SPDR Gold Trust, holdings of which have risen by more than 5% to 27.044 million ounces since January 31…meanwhile, U.S. stock markets continue to hit record highs and the greenback has also firmed up after its worst January in 3 decades…that makes Gold’s resilience all the more impressive…on the radar of Gold investors is President Trump’s address to Congress on February 28 which will offer more details on the new administration’s fiscal agenda…

Great sign for the commodities sector – mining giant BHP Billiton (BHP, NYSE) reported soaring 1st half earnings today and also raised its dividend…the company earned $3.2 billion in underlying 6-month profit, a 687% year-over-year gain, thanks to higher prices for Iron Ore, Copper and Crude Oil…that topped views based on the consensus according to Dow Jones and Bloomberg…revenue jumped 20% to $18.8 billion…

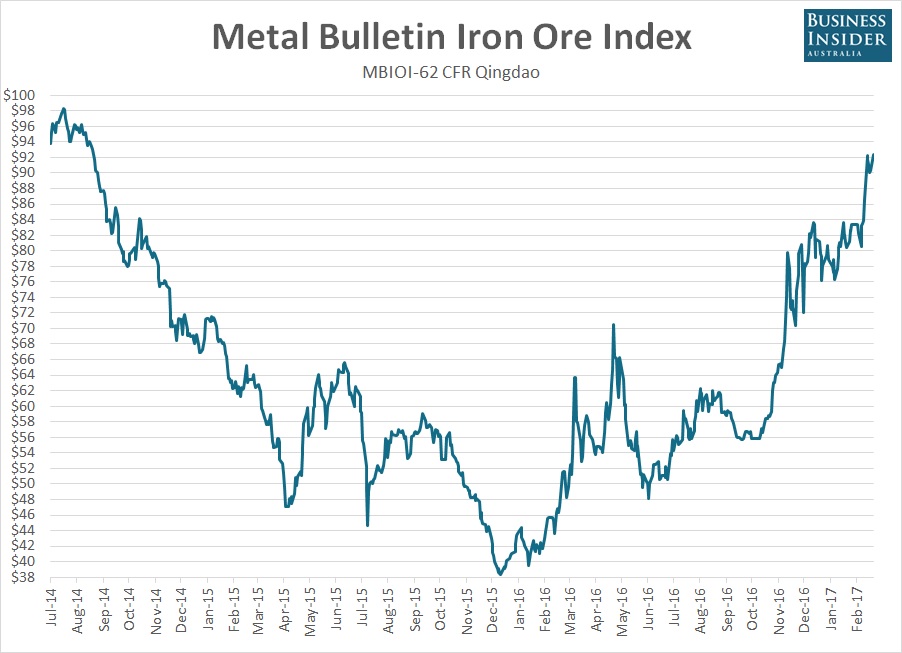

Iron Ore, which surged more than 80% last year, hit a new 30-month high yesterday, fueled by strong Chinese demand…BHP warned that prices are likely to moderate somewhat along with Chinese economic growth, but the miner still struck an optimistic tone for the overall commodity sector…

Oil Update

Oil prices strengthened today after OPEC Secretary General Mohammad Barkindo talked up the recent production cuts, saying Oil inventories would decline further this year…meanwhile, money managers now hold the highest volume of net long Brent futures and options on record, data showed yesterday, betting on higher prices to come…net long U.S. Crude futures and options positions are also at a record high…

In Today’s Morning Musings…

1. Intrigue surrounds CobalTech (CSK, TSX-V) while Paul Matysek gives the northern Ontario Cobalt Camp an even higher profile…

2. Is there something incredible building in Silver?…

3. Another gem under a dime?…

4. Daniel’s Den – opportunities in Oil and Tin stocks…

SAVE 25% on our Winter Special ending Thursday, February 23, with a risk-free BMR Basic, Gold or Pro Subscription TODAY – and we’ll show you our proprietary strategies that have delivered unbeatable documented triple-digit returns.

With an industry-leading 100% money-back satisfaction guarantee for new subscribers, you can enjoy unlimited access to all BMR content with a PRO membership.

Sign up NOW or login as a current subscriber with your username and password.

32 Comments

CSK news out :

CobalTech Mining : Announces LOI to Acquire Fully Permitted Cobalt Processing Facility in Cobalt, Ontario, Canada

02/21/2017 | 07:26pm CET

TORONTO, ON –(Marketwired – February 21, 2017) –

THIS NEWS RELEASE IS NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES FOR DISSEMINATION IN THE UNITED STATES

COBALTECH MINING INC. (TSX VENTURE: CSK) (the “Company” or “CobalTech”), is pleased to announce that it has signed a Letter of Intent to acquire a fully permitted Cobalt Processing Facility, situated in the settlement of North Cobalt, Ontario, Canada, and strategically situated near the Company’s current portfolio of cobalt mineral properties.

This acquisition will enable CobalTech to become one of the first companies in North America to be able to process and refine cobalt. The processing facility is currently fully permitted and production may be expanded to a maximum of 4000t/day before additional permitting is required.

The Company has completed preliminary due diligence and has retained engineering firm BBA of Montréal, Québec to assist in the final process. The Company conducted full site visits with the engineering firm, Story Environmental of New Liskeard, Ontario, which has been responsible for all environmental monitoring and permitting for the last 10 years, and also assisted in the process and provided copies of the compliance reports and various permits. It is anticipated that the transaction will be completed within 60 days.

Under the terms of the LOI signed February 10th, 2017, the Company has the option to buy the refinery. The full terms will be set forth in the final agreement. The Seller remains responsible for debts resulting from previous operations.

“This acquisition will position CobalTech ahead of its competition in supplying the growing demand for ethically sourced cobalt,” comments Bruce Bragagnolo, Chairman of CobalTech.

“CobalTech’s vision of being one the first companies to process cobalt in North America is taking a major advancement with the purchase of this facility. This completes the goal of vertical integration from an operations standpoint. CobalTech will now be assessing whether to proceed alone or actively start looking for a strategic partner to help advance the project,” said Antoine Fournier, President and CEO of CobalTech.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any state in which such offer, solicitation or sale would be unlawful. The securities issued, or to be issued, under the Offering have not been, and will not be, registered under the United States Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements.

About CobalTech Mining:

CobalTech Mining Inc. is a North American cobalt company in Ontario, Canada. The company owns and operates the Duncan Kerr Property located outside of Cobalt, Ontario, in an area known for its geological setting responsible for unique mineralization composed of quartz-carbonate veins enriched in silver-cobalt-nickel-bismuth-arsenic. The company is committed to operating within the strict environmental, health, and safety framework governed by the e3 Plus regulation put forth by the Prospectors & Developers Association of Canada (PDAC).

ON BEHALF OF THE BOARD

Antoine Fournier, Chief Executive Officer

Neither TSX Venture Exchange nor its Regulations Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding “Forward-Looking” Information

Some of the statements contained in this press release are forward-looking statements and information within the meaning of applicable securities laws. Forward-looking statements and information can be identified by the use of words such as “plans”, “expects”, “intends”, “is expected”, “potential”, “suggests” or variations of such words or phrases, or statements that certain actions, events or results “may”, “could”, “should”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking statements and information are not historical facts and are subject to a number of risks and uncertainties beyond the Company’s control. Actual results and developments are likely to differ, and may differ materially, from those expressed or implied by the forward-looking statements contained in this news release. Accordingly, readers should not place undue reliance on forward-looking statements. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking statements, except as may be required by law.

FOR FURTHER INFORMATION PLEASE CONTACT:

Contact Person:

Mr. Antoine Fournier

President & CEO

Telephone: (819) 354-5215

Email: [email protected]

CSK trading resumption = 14hrs today

Site is a little wonky…

Sorry, Laddy, Kitco went down today and as luck would have it, since we live source multiple chart feeds from Kitco, it threw everything off around 11:30 am Pacific….technicians have adjusted things as best they can on our site but we will likely have to wait until Kitco is up and running again to have everything looking normal…Murphy’s Law…

Np Jon, just thought to let you know, if life ran smoothly, we’d be sitting on a beach somewhere!!

You got that right, Laddy…anyway, we’re fully functional though the look may not be back to 100% until tonight or tomorrow morning…

Jon, I am assuming Castle Silver must be working on a financing, hopefully they can do better than CPO as far as dilution is concerned. They do have 6.6 million warrants @ .10 which I assume will be/or have been exercised which will provide some capital. If they are convinced they have the goods then they can be a little patient.

CPO looked strong at the close today.

Danny, no question CSR is going to get financed but much more limited dilution I predict than CPO…I really like what CPO has going and their CEO, a structural geologist who spent many years with Anglo American, has taken a very systematic approach with exploration at their project next to the past producing Deer Horn mine…CSR is more advanced with its projects and can therefore finance higher than CPO…

CSR will be issuing 2.5M warrants as part of the dividend Feb.27th,

so together with the 6.6M already out,if all are exercised could raise

$.91M, which could get them started on drilling.

Jon

Have you spoken to Frank Basa on this trip? Any idea when we wil hear something from him and the plans going forward

Thanks

Indeed I have, Greg; the position he’s in with CSR reminds me a lot of the situation with GBB at the beginning of 2010…and we all know what happened then…this is going to be 2010 GBB 2.0 on steroids…more dollars have gone into his properties the last 6 years than any others in the district; he has worked toward this moment…stay tuned…

Thanks Jon

I just listened to an interview on small cap power with Frank

When asked about castle he said it has “lots of cobalt ”

Seemed very confident

Couldn’t find anywhere on their website where they will be processing? Do they have their own facility?

Greg, you don’t have to worry about catalysts for CSR. There will be plenty. And keep in mind, given Basa’s background, no one in the district understands metallurgy and how to maximize recoveries (Cobalt + Silver) better than him. Important advantage for CSR.

What is happening to Cxo waiting for results of drilling, I would of thought this would of went north not south, I hope they deliver on some awesome holes

Greg, CXO is in the midst of completing a financing and drilling just started 10 days ago—still at least a few weeks away from any potential results. Normal retracement on the chart.

Brixton BBB.V looks great. What do you think Jon/John? cobalt/silver mine in Ontario

We will be commenting on BBB and the entire district in a piece this morning, Dennis.

Also, another company in a space you like Jon is FLT(Drone Delivery) on the cse.

cibc turn today to do ggi selling rbc yesterday drives me CRAZY

GGI selling. Foolish.

What it seems to be me, Laddy, is a trader or 2 playing the very tricky game of selling one stock to get into a hot Cobalt play…given what GGI has in the works, that’s a tricky strategy indeed…it’s also a little ironic in the sense that GGI’s E&L deposit contains significant Cobalt values…also, this is speculation, but keep in mind that new VP Exploration Everett Makela hails from Sudbury which puts GGI in a position where for market strategy/diversification, etc. they may want to pick up some nice Cobalt claims somewhere in that rich northern Ontario district which Makela is so familiar with…hmmm…food for thought!…

jon do do you have a time frame for 3d??

I believe they’re pretty close, bcguy…by about month-end according to latest news…

Jon, so you figure Regoci is going to have something big to say just before PDAC? That would be good timing.

thanks Jon

Jon

When GGI releases the 3D model which should be any day now since the last NR said by end of this month

What kind of impact do you think it will have? I was thinking the same thing re: share price 1 or 2 individuals up on Ggi selling to get into Csr ?

Thanks

I hope GGI doesn’t get into the cobalt space…they have enough projects on the go. Sometimes it can confuse investors when they do not know what the company is concentrating on.

Re GGI. don’t forget tora tora assays also due.

Jon, did Frank Basa besides Castle (CSR) spoke about Granada (GGM) and his view for this year? And what about a near future joint venture between these two for a mill they can jointly use? This also because Castle’s share price is improving a lot these days. Have a good evening. Regards, Arjan

I am a shareholder of GGI. Their E & L project Will send the SP

Into the stratosphere. Those nickel and coppergrades tells

us there is something BIG laying beneath.

I am not so happy with the lack of information.

Hope the E & L results are worth waiting for. What pleases

Me is that the recent appointments of the nickel

Specialists Will force Regoci to move it fast!

Hi Jon

Can you find out what is dollar value to the shafts and underground workings at Castle and Beaver ?

Equator says follow the cobalt to find silver . Which is going to be more valuable in the cobalt region? Silver or cobalt ?

Some good points, Donald…

We’re working on getting an estimate of the dollar value of what was invested into the Castle and Beaver in the 1900’s up to when Agnico Eagle shut things down around 1990, due to plunging Silver prices. Needless to say, it is in the many (tens) of millions of dollars. Countless drill holes, shafts, adits – the expenditures were huge.

Keep in mind, since 2011, about $4 million has been spent at the Castle and Beaver, making these 2 properties the most active over the last 6 years in the district. Another big advantage for CSR – they are ready to roll. I was in the Castle main adit myself on this trip I just made – in excellent condition, and clearly a lot of Silver and Cobalt was left behind in these underground workings at very good grades it appears. Drilling from within the adit for new zones of mineralization would be no problem.

Equator is right—-the oldtimers followed the Cobalt to lead them to the Silver. Today, we’re seeing this incredible interest in Cobalt, and for good reason, due to technology and the unstable supply situation for the metal. My thinking is we’ll see at least $40 a pound for Cobalt. Some are calling for prices as high as $100. Certain hedge funds have been accumulating physical supplies aggressively since last year. The highest grades for ethically sourced Cobalt in the world are found in the northern Ontario Cobalt Camp.

Ironically, though, the high-grade Silver will put the economics over the top in the new mines that will start up in the Greater Cobalt area. Again, that’s where CSR has a big advantage with its properties. And no one understands the Silver/Cobalt metallurgy in this district better than Frank Basa. Few people know that during his time with Agnico Eagle in the 1980’s, Basa was successful in creating a process for optimal recovery of Silver and Cobalt together, along with other metals, a process that leached all the metals into one solution including Gold (and produced tremendously high recoveries, overcoming the arsenic situation). Several million dollars was invested to create this process. Unfortunately, it didn’t all come together until the end of the decade, just when Agnico shut things down due to plummeting Silver prices and union problems. Frank has the formula. This brings a technological dynamic to CSR which will really drive the stock. Now you know why we’re screaming from the rooftop with regard to this play.