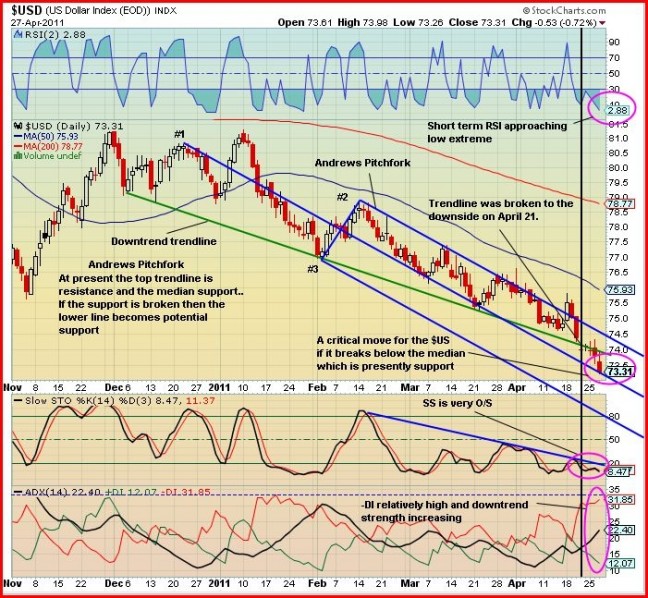

Gold has hit a new record high again this morning, following through from yesterday’s Bernanke Boost after the Fed chairman made it clear that the end of QE2 in June does not mean an end to accommodative monetary policies in the United States…the U.S. Dollar is on a one-way ticket south, which doesn’t seem to bother Bernanke a bit, and many Gold investors clearly hold the view that the Fed remains behind the curve on inflation…this scenario, fueled by cheap money, is bullish for Gold and commodities in general along with the stock market…as of 7:45 am Pacific, the yellow metal is up $8 an ounce at $1,535 (it has traded as high as $1,537) while Silver has climbed $1.42 to $49.19…crude oil is up 24 cents at $113 while the U.S. Dollar Index is trying to rebound after hitting three-year lows below 73 this morning…it’s currently off nearly one-fifth of a point at 73.14…it’s important we keep an eye on the Dollar and right now it’s at a critical technical juncture as John outlines in this chart…

The World Gold Council, in its quarterly Gold Investment Digest Report yesterday, said central banks continued to be net buyers of Gold in the first quarter of 2011…emerging market countries, including Russia and Bolivia, were among the key buyers…as a group, the official sector holds 18% of all above ground stocks of Gold according to the WGC…U.S. economic growth slowed more than expected in the first quarter as higher food and gasoline prices dampened consumer spending and sent a broad measure of inflation rising at its fastest pace in two-and-a-half years…the Commerce Department reported this morning that first quarter GDP growth slipped to a 1.8 percent annual rate (most economists were expecting growth of 2%) after a 3.1% fourth quarter pace…a government report also showed this morning that new U.S. claims for unemployment benefits surprisingly rose last week to their highest level since January (up 25,000 to a seasonally adjusted 429,000) in a sign an anticipated recovery in labor markets may take time…the CDNX staged a reversal yesterday as precious metals and oil rallied after the Fed announcement and Bernanke’s comments…after dropping as low as 2222, just one point above last week’s low, the Index rallied nearly 30 points to finish the day at 2251…as of 7:45 Pacific today, the CDNX is up 1 point at 2253…Currie Rose Resources (CUI, TSX-V), as John showed in his chart last week, is looking particularly bullish from a technical perspective (it has completed a “cup with handle” pattern) and this matches up nicely with the fundamentals as the company is expected to commence a major drill program very soon (during the month of May) in Tanzania…we believe their first target will be the highly prospective Sekenke Project which runs in between and surrounds two former high grade Gold mines including one of Tanzania’s original producers…while CUI holds other properties, we believe Sekenke will emerge as its flagship in Tanzania given its strategic location and very encouraging pre-drilling exploration results…the company has already identified a large structure (12 km x 800 metres) within a shear zone on the margins of a large granite intrusion that hosts numerous quartz reefs of the same type and even larger than those that developed at the nearby historic mines…while this is pure speculation on our part, we also wouldn’t be surprised if Currie Rose even attempts to acquire the former Sekenke Mine…we put that question directly to President and CEO Harold Smith in an interview last January and he essentially gave a “no comment” while CUI’s January 10 news release stated, “We are in a prolific area of Tanzania where of course there are also additional opportunities and potential synergies that we are examining. In that regard our focus is on advanced situations and if they have the potential to enhance shareholder value, we will pursue them”…Currie Rose is currently unchanged at 18 cents…Visible Gold Mines (VGD, TSX-V) has completed two relatively deep holes (756 and 656 metres) within 800 metres of Vantex Resources (VAX, TSX-V) Moriss Zone discovery on its Galloway Project, 30 kilometres west of Rouyn-Noranda…that information was contained in a Cadillac Mining (CQX, TSX-V) news release yesterday as VGD is drilling ground optioned from CQX last December…the interesting thing about Cadillac’s news was what it did not mention…the company has remained silent since a news release near the end of February regarding the very strategic claims it holds that are tied on to Richmont Mines’ (RIC, TSX) growing Wasamac deposit where aggressive drilling continues by RIC…this leads us to believe that Cadillac could be in negotiations to option its “Wasa” claims to another company and that could very well be Visible Gold Mines (a natural partner given their current deal) which has already announced it’s moving a rig to the Wasamac area after completing four holes in total near the Moriss Zone discovery…this is an extremely interesting possible scenario…with a treasury of approximately $8 million and an army of geologists and technicians, not to mention two drill rigs currently at its disposal, Visible Gold Mines is in a unique position to pull off a major exploration play at Wasamac which would be to the benefit of both VGD and Cadillac…CQX has assembled an exciting Gold-Silver land package in southwestern Utah, covering the former Goldstrike mining camp, and they may have (smartly) been holding out for a better deal on their valuable Wasa claims in order to concentrate on Goldstrike…we’re keeping a close eye on how this may all unfold as a possible VGD-CQX deal on Wasa, though pure speculation on our part at the moment, has potentially very bullish implications in our view for both stocks…Abcourt Mines (ABI, TSX-V) released results from five more holes yesterday which support growing open pit reserves and resources at its Abcourt-Barvue Silver-Zinc Property near Val d’Or…two zones continue to produce significant grades including 9.1 metres of 171.73 g/t Ag and 3.48% Zn in hole #20 (zone 1) and 7.3 metres grading 196.32 g/t Ag and 3.73% Zn in hole #19 (zone 1)…the 10,000 metre drill program continues…ABI is unchanged at 17 cents…a current Silver producer we really like is Great Panther Silver (GPR, TSX) which found support near $3 as expected this week and shot up 53 cents yesterday to $3.62…it’s up another dime at the moment to $3.72 which underscores the importance of buying into weakness rather than getting fearful and selling into weakness as too many investors do…another example of that at the moment is GoldQuest Mining (GQC, TSX-V) which hit a low of 21.5 cents yesterday before closing at 23 cents…GoldQuest is clearly technically oversold and the fundamentals are such that it’s hard to imagine GQC dropping below its rising 500-day SMA at 20 cents…Richfield Ventures (RVC, TSX-V), moving in step of course with New Gold Inc. (NGD, TSX) which has entered into a plan of arrangement for an all-share buyout of RVC, is up 27 cents at $9.88…we don’t often focus on TSX producers but given this particular situation, with Richfield a company we added to the BMR model portfolio at $1.20 in December, 2009, we have mentioned New Gold numerous times over the last several weeks as it’s a company that really seems to be on track for exceptional growth and robust earnings…acquiring the Blackwater deposit would only add to the attractiveness of New Gold though the share price is down slightly since the proposed acquisition was announced April 4…in John’s eyes the New Gold chart is also looking very bullish…as of 7:45 am Pacific, NGD is 33 cents higher at $10.81…the company is releasing its first quarter earnings next week…

12 Comments

Recieved the following yesterday from IR at CQX:

Greg,

Thank you for your interest in Cadillac Mining Corporation. I will try to

answer your questions to the best of my ability.

Yes, there was an announcement made regarding a work program on the Wasa

project and I’m sorry, but I don’t have anything new to report on that

matter except that as I understand it there is still a plan to drill, but

the specifics have not yet been nailed down. Also, in regards to the

geophysical program announced in the same press release we have learned a

little more about the specific area that was to have this survey flown over:

it seems that there are a number of obstructions (power lines, and other

structures) that, while they don’t hinder the actual flight route, they can

and will affect the results, so that part is on hold pending further

evaluation. In the mean time there is an extensive drill program currently

being carried out on the rest of our Break project by our JV partner Visible

Gold, in fact I do expect to see a progress report on that in the near

future.

As for the new website, all I can say is Rome wasn’t built in a day.

I hope this helps, if you need further information or clarification don’t

hesitate to call or email again.

Thanks Greg, I got the CQX news release when it came out yesterday to my desktop from TMX Quotestream. Rome wasn’t built in a day but I don’t think CQX would manage it in a month of Sundays! 🙂 (Just a guess, but this is a hobby for them and they will retire soon). I sold my CQX holdings and put them in VGD – I don’t see the point in holding both and CQX isn’t doing any drilling(then again VGD’s sp is static or dropping – I had to remove my stop loss). Maybe CQX will option everything?

All the portfolio share prices are at what would seem to be “bargain” prices – but I’m not convinced they are. It has been such a poor year and no turn around into the second quarter. What’s the better bargain today SFF or GCU? 🙂

Yeah its very disconcerting to see all these stocks in the dumpster. I thought the rally before Christmas would have sustained itself longer, ho-hum I am married to them now and so I have to wait it out. I think by August of this year we will look back and wish we had bought more at these levels. Remind me to sell when I am feeling euphoric the next time (hopefully there will be a next time) 🙂

Sorry; meant SFF or GQC?

SLV:US would have been a good bet for this year – up 50% so far – maybe still a good investment, easy to trade in and out, doesn’t drop when there’s a news release and the speculation’s gone. Put in a stop loss and Bob’s your uncle! 🙂

andrew, you hit that on the head, which one – sff or gqc. wheww. i am watching some iron ore stocks, they have done well, gold stocks not moving while gold makes new highs and May upon us. As I stated in March, I can see the CDNX at 1920 soon, no matter where support is now. Support and resistance are guides, and they are made to be broken.

I happen to disagree with the call for CDNX at 1920 soon. Its just a matter of time before these higher gold and silver prices will be reflected in the sp’s of the juniors. When the next breakout comes it should be a big one but I don’t see too much donwside from the current poor levels. Gold is up 15% and Silver over 60% this year so its just a matter of time before this reaches the share prices.

Yeah

I agree with alot of the comments above, I want to buy more of SFF,GQC,GBB and others,as I am married to them also at this point, but for some nagging reason I think being patient unfortunately will get me a better buy. At some point these juniors are going to explode and we will all be high fiving! I hope.

It looks like SFF’s latest private placement is being sold off at a loss. The private placement shares became free trading after Apr 23. Hence increased volume since Monday. Those people are selling at a lose up to 50% (pp done at $0.50).

Another crazy thing that I noticed is the price of the warrant. The expiry date is a year and 8 months away. But with the underlying share price at $0.26 and warrant trading at $0.07 when the strike price is $0.75? It is trading as if the strike price is $0.35. I don’t know what people are thinking…

Nothing in this market seems to make sense nowadays.

Bruce, that’s entirely normal….with the expiry date not until December, 2012, investors are having no problem paying a nickel or a bit more for the Seafield warrants given the potential…..let’s say you pick up some warrants at 6 cents……one has to say there’s a decent chance that sometime over the next 18 months or so, Seafield may make a hit at Quinchia and the stock will jump to $1 per share or more……that’s certainly a possibility……in that case your 6 cent warrants would likely jump to 6-fold or more which is a tremendous return…..so from a risk-reward standpoint, it’s an interesting play right now with great leverage……obviously the premium built into the warrants will start to decrease over time as the expiry date draws closer…..

patrick, I agree with the gold and silver going up, hence, they need a breather and will correct. This will allow the market to fall also, before the next major run.

In my opinion, SFF warrant is over valued, based on the expiry date, the underlying stock price, and using 30% volatility. There are number of sites out there where you can plug in the numbers and find out fair value of the warrant.

My point is why would I buy warrant that seem over valued when I can buy the stock that seem under valued?

Warrants are highly leveraged play and price can move up or down really quickly. The SFF warrant can go from 6 cents to 3 cents in a hurry (that is 50% loss). With the stock, that kind of price movement is doubtful (from 26 cents to 13 cents).