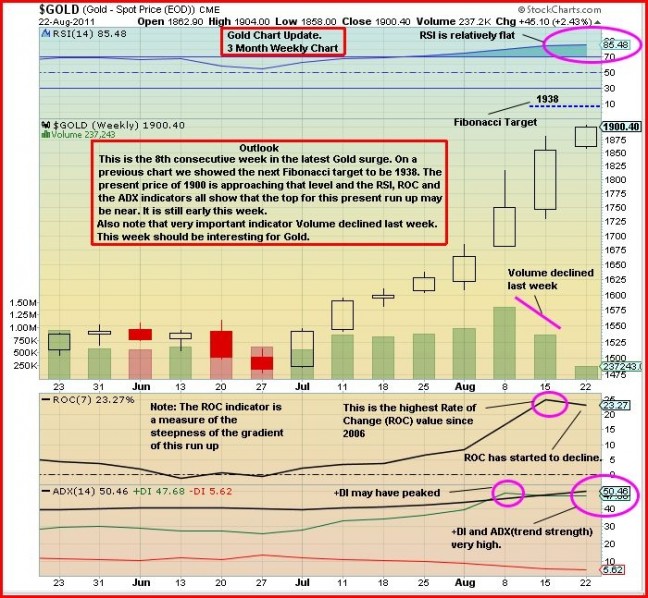

Gold is pulling back this morning, not surprisingly, after surging to another all-time high overnight of nearly $1,920 an ounce (just $18 shy of John’s near-term Fibonacci target)…in what potentially could be the beginning of a much-needed correction, Gold has retreated $32 an ounce at $1,866 as of 9:10 am Pacific…Silver is off 96 cents at $42.76…Copper has gained 4 pennies to $4.00, Crude Oil is up 23 cents at $84.65 while the U.S. Dollar Index is off one-third of a point at 73.87…Gold is up nearly one-third since the start of July and, based on the past 13 weeks, is rising at an annualized pace of about 110%…that compares with a climb of about 50% in the past 52 weeks…even a 10% pullback in Gold would be pretty much a non-event and would set the stage for a powerful advance to $2,000 and potentially higher before the end of the year…of course the so-called experts will be popping out all over the place and saying, “Gold’s ‘bubble’ is over”, assuming of course that what we’re currently witnessing constitutes a “bubble” in the first place (according to some, Gold has been in a “bubble” since it hit $500)…there were some great quotes this morning from John Wadle, the head of research at Mirae Asset in Hong Kong, in an article by Patrick Allen at CNBC.com…”Gold is not money (no, John, it’s actually better than money because it holds its value and is less susceptible to what central banks are doing to their currencies) and has no investment yield and in fact incurs carrying/storage costs…with the 10-year U.S. treasury rate at 2% and storage cost of 1-1.5%, this implies an annual opportunity cost of 3-3.5%…Gold is now in a bubble compared to U.S. blue chip stocks…for those pundits that believe Gold will keep rising to $2,500 an ounce, let’s do some simple math: the current reservoir would be valued at $12 trillion and the next 20 years of production would produce Gold worth about $3.8 trillion, bringing the total value to $15.8 trillion…even assuming earnings for the Dow stocks rise by only 2% (Japanese deflation scenario) over the next 20 years and the market only trades on a P/E of 10x, an investor would still make 130% over this period”…to match this return, according to Mr. Wadle, Gold would need to top $4,400 an ounce…

Mr. Wadle is obviously not a Gold bug but that’s perfectly okay…a bull market requires plenty of naysayers and doubters…Gold remains in a Perfect Storm and Mr. Wadle in our view is more likely to first see $4,400 an ounce for Gold than a 130% return on the Dow…the value of Gold and Gold mining stocks as a percentage of world assets is still miniscule – around 1% – compared to what it used to be, and that is just one of long list of reasons why the yellow metal still has a long way to go on the upside…for now, though, some weakness is not surprising as John’s chart shows…

The bulls are setting the tone in the equity markets today, though the CDNX is fairly quiet as it hovers around the 1760 support area…HSBC’s “flash” survey of China’s manufacturing sector is evidence this morning that, even as more developed nations struggle economically, there remain strong areas of global growth…Bank of Canada Governor Mark Carney made note of that in his testimony before a Commons committee last Friday…although this morning’s China report from HSBC suggested a slowdown in factory output for the world’s second-largest economy, it was still consistent with overall growth of about 8 to 9%…

Another U.S. recession isn’t likely over the next 12 months…neither is any meaningful improvement in the economy…that’s the picture that emerges from an Associated Press survey of leading economists who have grown more pessimistic in recent weeks…they say high unemployment and weak consumer spending will hold back the U.S. economy into 2012…their gloominess comes at a time when Europe’s debt crisis threatens to infect the global financial system…it also coincides with an annual economic conference late this week in Jackson Hole, Wyoming, and speculation about whether Federal Reserve Chairman Ben Bernanke will unveil any new steps there to help the struggling U.S. economy…of course at last year’s meeting, Bernanke set off a stampede in the equity markets when he hinted at what eventually became a $600 billion quantitative easing bond-buying program known as QE2…will Bernanke give the markets a boost again Friday?…we’ll have to wait and see…

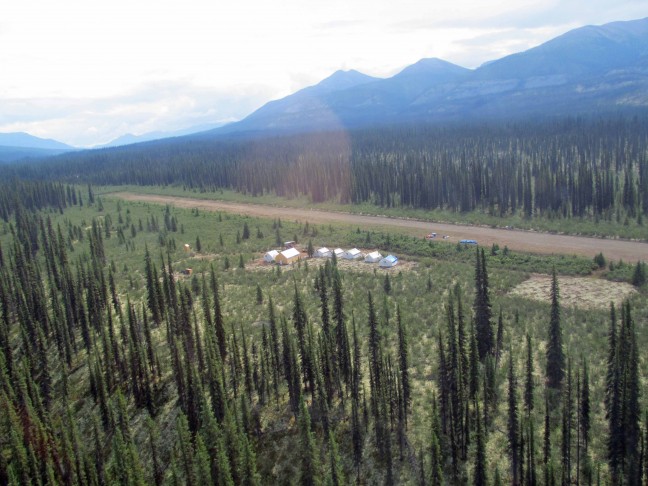

History has shown that this is a prime time of the year for Gold and other discoveries by companies on the Venture Exchange…a tsunami of drill results is about to roll in over the next several weeks, so investors have to pay close attention to breaking news in these “dog dogs” of August…just when people are not too interested in the market, that’s when there’s the greatest potential for a surprise…our advice is that everyone needs to be on alert…the CDNX is currently off 4 points at 1763…Probe Mines (PRB, TSX-V), which we’ve mentioned on several occasions over the past couple of months, has received a very positive initial mineral resource estimate from Micon International for its Borden Lake Gold Project near Chapleau, Ontario…the indicated resource is 305,000 ounces of Gold (11,607,000 tonnes grading 0.82 g/t Au at a 0.3 g/t cut-off) while the inferred resource is 3,755,000 ounces (169,322,000 tonnes grading 0.69 g/t Au at a 0.3 g/t cut-off)…PRB was halted prior to the open this morning and just resumed trading at 8:15 am Pacific…it opened at $1.50, ran to a high of $1.76, and as of 9:10 am Pacific it’s at $1.75 for a 25-cent gain so far today…that gives PRB a market cap of $99 million which values each inferred and indicated ounce of Gold at Borden Lake at just $25…drilling continues…with Gold in a bull market of a lifetime, a company like Probe Mines offers strong intrinsic value…Manitou Gold (MTU, TSX-V) released some interesting results this morning including 31 metres grading 1.8 g/t Au in hole G-11-12 at its Gaffney Extension Project in northwest Ontario…Gold mineralization at Gaffney is hosted within a highly altered quartz eye intrusion which contains narrow quartz veins and stringers with disseminated pyrite and pervasive ankerite alteration…the alteration zone shows considerable widths of Gold mineralization exemplified by hole #12…what’s interesting is that a second style of Gold mineralization has been identified at Gaffney and consists of quartz feldspar porphyry dikes which contain 1-3% disseminated pyrite…the widespread distribution of the dikes along the mineralized trend and the tenor of Gold in the dikes are identified as important indicators of a prolific Gold bearing system…Manitou had working capital of $11 million at the end of March and is worth following closely…it’s currently up a nickel at 50 cents for a market cap of $24 million…below is a picture from one of our geological contacts in the Yukon whose advice is, “keep a close eye on the Yukon”…

Pacific Ridge Exploration (PEX, TSX-V) has received $915,000 from the exercise of 15-cent share purchase warrants with an expiry date of August 20, 2011…the company had working capital of $3.4 million as of the end of June as it continues to drill its promising Mariposa Property in the Yukon’s White Gold District…the stock is currently off a penny at 46 cents but is in a strong support zone, just 2 pennies above its rising 50-day moving average (SMA)…elsewhere in the Yukon, our favorites (besides ATC) include Kaminak Gold (KAM, TSX-V), Golden Predator (GPD, TSX), Silver Quest Resources (SQI, TSX-V), Ethos Capital (ECC, TSX-V), Northern Tiger (NTR, TSX-V) and a low-priced very speculative sleeper (Dawson Gold, DYU, TSX-V) which has arranged a private placement and a share consolidation…DYU is trading at just 6 cents and would be one to tuck away for a while…Visible Gold Mines‘ President and CEO Martin Dallaire slipped in a subtle clue in an interview with the well-known Stanlie Hunt in a Smartstox interview that came out last night…Dallaire was commenting about Wasamac as well as VGD’s drilling at Wasa Creek and stated the core is looking “visually good”…assay results are pending on 8 of 9 holes completed by VGD at Wasa Creek as of last Tuesday…aggressive drilling continues at that project…VGD is unchanged this morning at 35 cents…

16 Comments

OH OH!! Looks like MY prediction of hitting a 52 week LOW on ISD.v is coming true. BMR just last week stated that there was STRONG SUPPORT at .275 cents, and now?? OOPS!! TMMMBBBRRRRRRR!!!!! And a big THANK YOU to whomever sold me another 5500 shares of VGN today at .15.

Probe does look good. Its PP shares recently became free trading. $1.35 -so I imagine a number of folks are happy with a 25% gain and are cashing in. 4 mill ounces, with a shot at twice as many, is nothing to sniff at. Once the pp shares have switched hands, I’d imagine she may start to pick up steam.

John,you keep mentioning ISD and implying BMR has made a bad call on ISD.I think what you need to do is look at VGN and you prediction in July ,that early August “Tony” was going to come out with news that was going to make VGN skyrocket.Hey ,as far as I can see you your prediction is right on!!!You know what VGN reminds me of,”A hole in the ground with a liar on top”!

GBB is getting closer to 35 cents tomorrow and it will go back up to 40 cents ceiling. Obviously, the trading volume will be low as the real players are not there. Unless it goes to 33 cents level, you probably will see some activities. The concept … buy low and sell high remains in this stock until September/ October. BER has lowered to 10.5 cents … it is time to scoop some as it has discounted 40% in recent high. SD, CQX and NAR are still in sleeping mode… My sixth sense tells me, the majority of junior stocks will be in low volume trading and the price will remain 1/3 or lower than their peak….

The questions remain

How many Johns’ frequent this board ?

How many senses do Theodore have ?

Will gold bounce back ?

After being down over $60.00 today, gold is presently trading higher by around $7.00..

Way to go Gold, keep it up. We need to gain back the stock gains’ we gained last week, only

to lose them today. R !

Nice one Bert! 🙂

BMR — ”A hole in the ground with a liar on top”!

Bert — Wow ! in other words the liar is standing on Nothing. Why do i say a hole is

nothing ? Try peeing in the snow & what do you have left, nothing, except a

hole, filled with air, surrounded by snow. Try standing on air Tony. Make

sense ?

Bert, sometimes , my sixth sense does not make sense. The gold is going sky high but most of the junior stocks have potential but they are not in production… therefore, the price was not supported by it’s market value… whoever the first one to put to production… that stock will be the leader… GBB is a good one but still we can still take advantage of high / low to make some money. My sixth sense that the stock will slide down to 35 cents… see what happens…. assuming no other news… as I think the earliest will be September or October….

Hate to break the news to you john, but the TA not looking good on VGN

SD big buy lot at 3 cents…. my sixth sense tells me it will fall…. to 2 cents …. Take it out guys.

A positive durable goods report has turned the U.S. futures

around to the positive….

I notice gold is shown on BNN as being down $23.00, but on Kitco

& World Market report it is shown as being up. R !

Dave

TA is not relevent when the daily voume is this low. This is a case of afew sells hitting a few small bids. When vol. is this low and the fundamentals have not changed there should be no case to worry.

News out for CUI

Thanks bert, live news feed for PowerStream is down, so your comment was invaluable to me!

Wow

wondering what is up with GPD, dropping pretty good with no news, something wrong or buying opportunity?

I did however expertise some technical points using this site, as I experienced to reload the site lots of times previous to I could get it to load correctly.