Does GFG Resources (GFG, TSX-V) Have The Right Ingredients To Be A Winning Stock Over The Next 6 To 12 Months?

As Jon reminded us yesterday, a rising Venture tide will NOT lift all boats. Investors are still very discriminating and a relatively small percentage of Venture stocks will do most of the heavy lifting for now which creates a fascinating “market within a market”.

Stocks that perform better than average (or trounce the averages) tend to contain a number of similar ingredients. While we place a heavy weighting on communications, because some managers are really bad at telling their company’s story and don’t understand investor psychology (which directly relates to how markets work), we also want to have a good feel for the stock’s behavior.

GFG Has A Young But Experienced Management Team That Has Tasted Success!

They’ve got some market smarts, too.

Back in July we called a bottom on GFG near 20 cents. John’s technical analysis clearly showed the stock was oversold, and his call has been spot on.

In my initial article, I reflected on my positive memories of being a Claude Resources‘ shareholder. BMR subscribers also pocketed huge gains measuring up to +500%.

Claude’s dramatic turnaround and ultimate sale to SSR Mining (SSRM, TSX) for $337 million happened while Brian Skanderbeg was in charge.

He had some help from an important new discovery at Santoy Gap, a capable mining team, plus a nice turn in Gold prices, but Skanderbeg’s leadership must have been an X-factor! Over a period of 18 months, production increased and costs decreased considerably. Claude’s stock rallied from 25 cents to more than $2.

Obviously, not being an employee of the company I can’t speak to every detail. Maybe I’m giving Skanderbeg too much credit, who’s to say? I just don’t think there’s any way that type of turnaround would have happened under Claude’s former CEO.

As I see it, though, Skanderbeg’s really, really good – exceptional in fact (and in this business, it also helps to have a little luck on your side, too, but the good ones tend to create their own luck). Winners also tend to keep on winning! So Skanderbeg’s the kind of guy you’d want to have managing one of your businesses (owning GFG makes you part owner).

Between Skanderbeg and 2 of his board members, Jonathan Awde and Stephen de Jong, more than $1 billion worth of deal making has transpired. Under de Jong’s leadership, Integra was the first company in way too long to replicate Rob McEwen’s “Goldcorp Challenge“. That creative, yet proven idea, surely contributed toward Integra being acquired for $590 million (it also bought millions worth of free publicity for the stock!). Jonathan Awde has more of a sales and trading background, but that hasn’t stopped him from running one of the industry’s best performing Gold stocks, Gold Standard Ventures (GSV, TSX). Understanding the markets has probably helped him and GSV.

I’m no Sherlock Holmes, but there’s gotta be enough clues here to believe these guys have some market smarts.

To further underscore the Skanderbeg factor, it’s likely a combination of his winning personality and technical smarts that attracted such a strong board and management team. They’re dedicating time, brain power and money to GFG for a reason.

It’s got to be something…

It can’t be only that they just like the properties, as good as they are. Skanderbeg is a huge factor.

Much of the leadership team has been accumulating shares in the open market all year. They’ve been averaging down since 60+ cents (and here we sit at 27 cents). Awde owns nearly 4 million shares and Skanderbeg has about 2.5 million.

We won’t attempt to complete a full behavioral analysis on GFG today, but it’s safe to say the stock has bottomed. Since touching 20 cents in July, we’ve seen higher lows and higher highs, so the odds of it dropping below 22 cents (its lowest closing price) are extremely low.

Here’s why GFG is ripe for higher prices…

Highlights from my conversation with CEO Brian Skanderbeg!

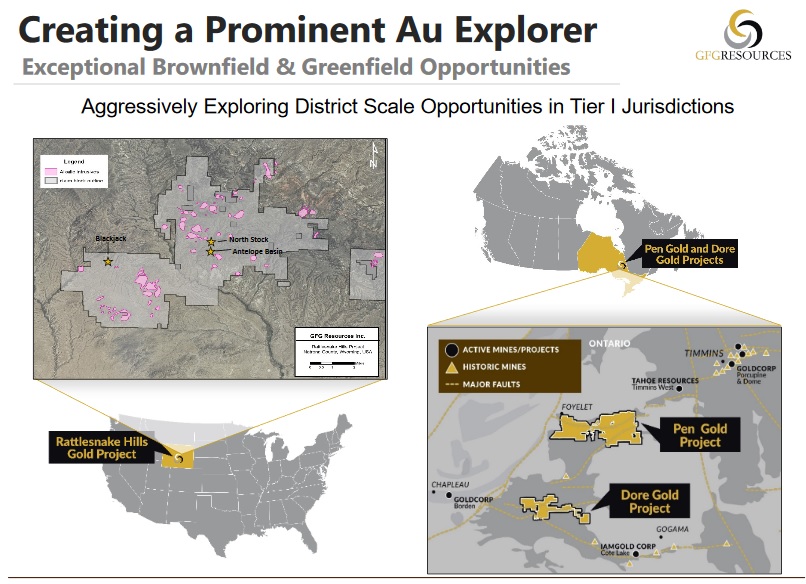

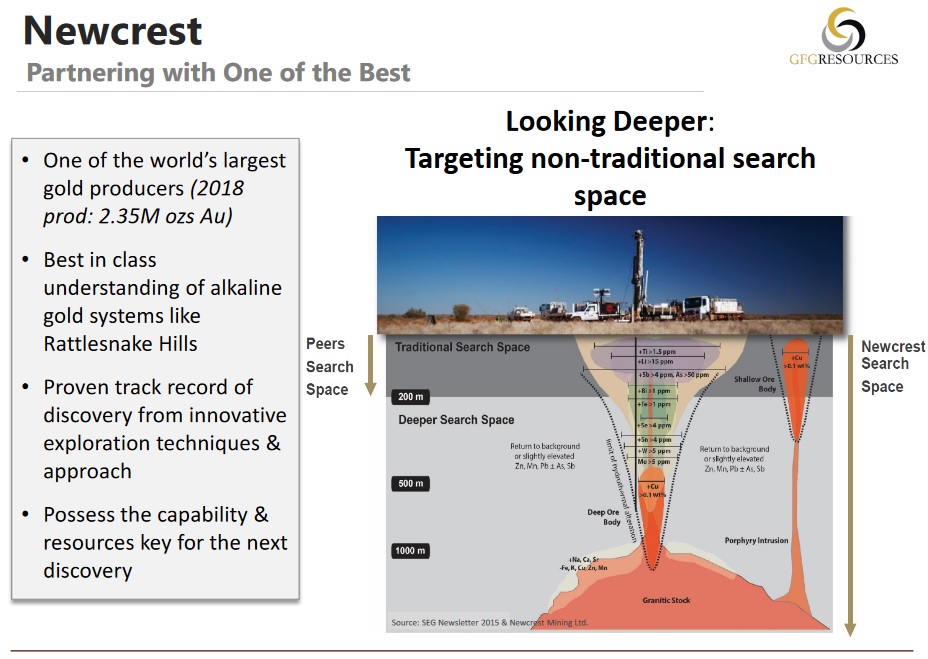

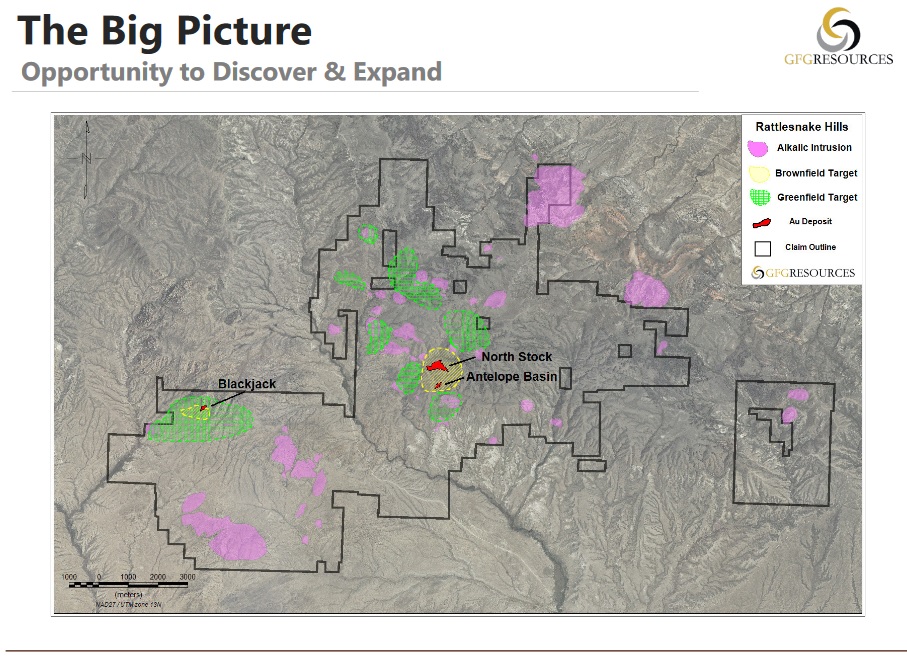

GFG always knew it would need a partner to be successful in advancing Rattlesnake Hills toward becoming a mine. The only question was, who would be that strategic partner?

Since January, the search and courtship process has been ongoing. Numerous companies took the time to visit, but Newcrest Mining (NCM, ASX) ultimately stood above the rest. Now, finally, as of last week, GFG shareholders have a sense of certainty Rattlesnake Hills can move forward without further dilution to GFG.

Here’s a link to the terms of the deal.

Newcrest, one of Australia’s largest Gold miners, became the obvious choice because of their size and experience with alkaline deposits (Rattlesnake Hills is an alkaline deposit). With a market cap of $15 billion, Newcrest has the financial muscle to really make a go of this. If the deal runs its course they’ll be investing upwards of $100 million into Rattlesnake Hills. With that kind of number this project obviously has the potential to be big, even big enough to move the needle for a company already producing nearly 2.5 million ounces annually from 4 mines.

Newcrest brings new ideas to the table!

Even though 100,000 m have been drilled to date, nearly all of it has been quite shallow. Very few holes have been drilled below a depth of 300 m.

By the sounds of it, they’re going deep right out of the gates. Come later this month, and likely thru November, Newcrest could be drilling several 1,000 m holes! At those depths you could be finding a potential porphyry system, according to Skanderbeg, and porphyry deposits often have higher grades within an alkaline system (I didn’t know that). Newcrest will be using its advanced technology and targeting capabilities in the hopes of making a BIG new discovery at Rattlesnake Hills.

They’ll be going deep and drilling some new search spaces, open land that’s never been drilled (and there’s lots of it!).

GFG will be the operator and earn a 10% management fee. That’s important because GFG will have access to all the data generated during exploration (sometimes information isn’t always shared so freely in a JV), plus they’ll earn a few extra bucks.

Also a sign of strength, as per the deal’s terms – Newcrest doesn’t earn any interest in Rattlesnake Hills (zero) until they spend $2.6 million U.S., and they’ve got 18 months to do it. Assuming Newcrest completes this “option phase”, the “earn-in” phase begins.

Compared to what many majors have been doing lately, kind of stealing 19.9% equity stakes, this deal is structured in a way that it should create value right away for GFG (especially if there’s a deep discovery made!) because $2.6 million will be invested in the ground before any equity interests are exchanged. And in GFG’s case, Newcrest will take equity in the project, not the company.

They Planned Ahead!

Do you think Emeril Lagasse just throws his ingredients together?

He could, I’d imagine, and it would work out fine. But no serious chef would prepare an important meal without planning ahead! Yet, unfortunately, it seems many “executives” in the resource industry just wing it. Based on their actions, and inactions, one can only assume 80% of them don’t take their job as seriously as a restaurateur would.

…but that 80/20 rule works for pretty much everything.

We can’t understate how important it is to hook up with the right people. Great people can work their way out of even the worst situations and come out clean, or ahead! Bad people (even mediocre people) seem to find a way to screw up the best opportunities, even when it’s handed to them on a Silver platter! Business is risky enough as it is, especially exploration and mining. Having the wrong people work for you (and with you) is almost always a recipe for disaster.

Of course, the elephant in the room is how the hell do you identify a “great person”?

It’s not easy. With enough experience some people can trust their gut. But aside from that you’ve got to go based off track record, which makes it tough on “newbies” that haven’t established a track record yet.

…on a side note, I heard a story (from a fairly reliable source) that Brian Dalton, Founder and CEO of Altius Minerals (ALS, TSX) often slept in his car so more money could be spent exploring and less on hotels. Now there’s a strong indicator a newbie who doesn’t have a track record could be worth backing!

Knowing Rattlesnake Hills would be optioned out, Skanderbeg set the table by consolidating a large land position in Timmins!

Think about it…if GFG sealed a deal with Newcrest without having a spicy new discovery story to tell, the stock would be milk toast.

Mr. Market would have been, like, congratulations on your JV, but BORING! Now you’re hostage to a major mining company’s timeline (and they’ve got a lot more time than you do). Get back to us 8 years from now!

Here’s the unsettling news!

Most people in this industry would have never thought that far ahead! They would have been shocked when their stock dropped on such “good news” (as GFG would have done without having West Timmins). Then they would have blamed their poor decision making on something else, like a BAD market. So it’s not only that most people who are playing resource professionals in real life don’t understand the market: they don’t understand the market, marketing, or strategic thinking (not good qualities to have if you won’t to run a successful restaurant either).

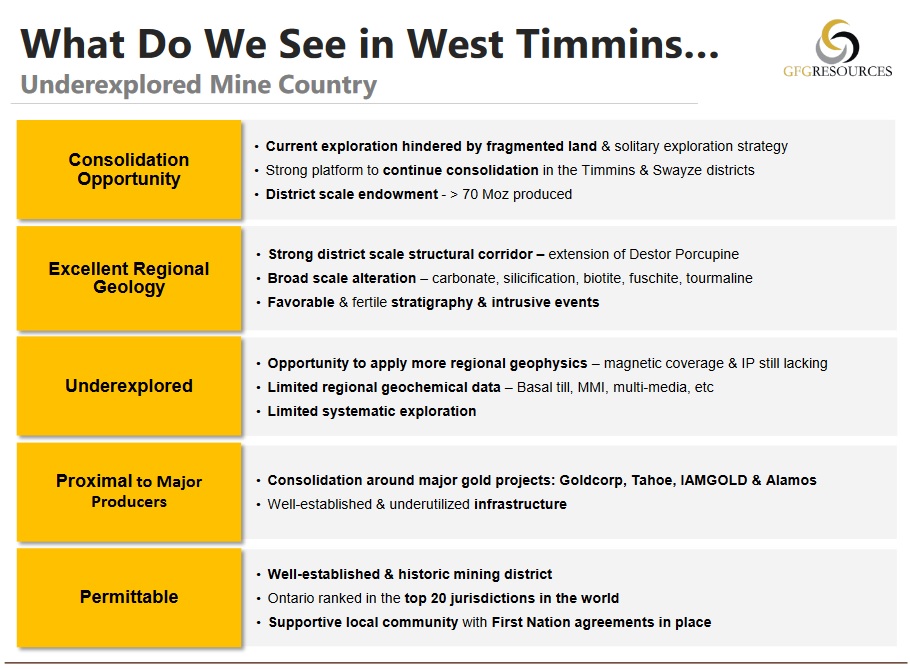

GFG has outlined DISTRICT SCALE targets and has the opportunity to make a new grassroots discovery in West Timmins this year!

And Mr. Market is very hungry for grassroots discoveries.

Before making a new discovery, almost always, you’ve got to build a model for the district.

Skanderbeg and his team have been working on that since last year, when they announced their plans to consolidate a land package in the area (a general area where 70 million ounces have been mined to date!).

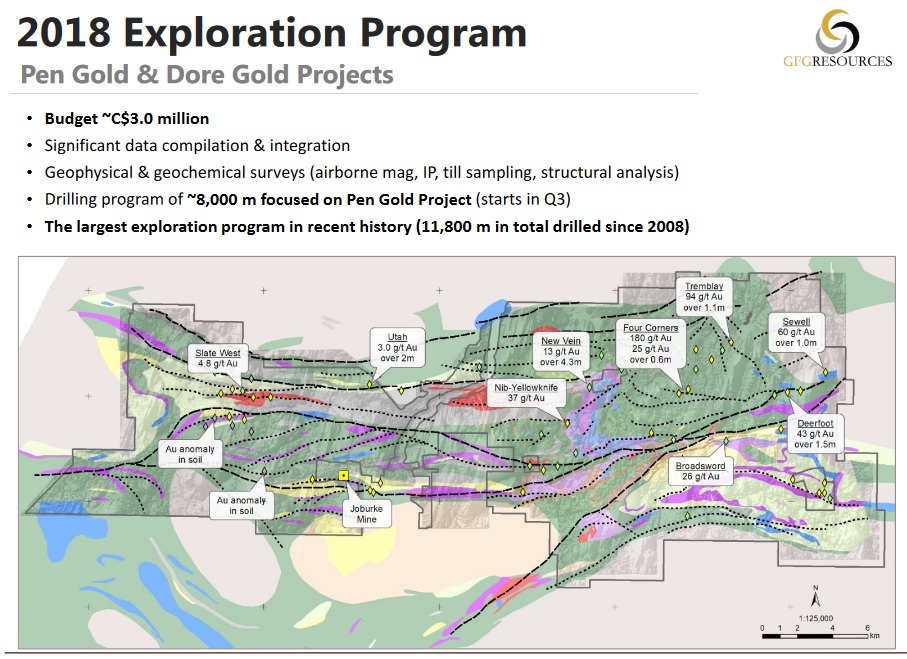

Till sampling generates 5 regional targets for GFG.

An 8,000 m drill program starts soon (late September or October)!

An important early stage exploration tool for modeling a district is the “till sample”. With a till sample you dig a small hole about a metre deep. Then you send roughly 10 kilograms worth of that material to an assay lab for testing. In the process you’re hoping to find grains of Gold (plus indicator minerals) which can be classified into size and shape (like roundness). You also need someone who’s an expert at geochemistry to interpret the results.

Till samples are more data rich than most other types of samples, so they’re more expensive at about $1,000 each. Pricey, but till samples are less biased, say, compared to a chip sample. Therefore it’s a truer sampling method for regional targeting.

GFG has used this method/strategy quite successfully to generate 5+ regional targets thus far. Drilling a 5,000 to 8,000 m program should begin within weeks (or before the end of October at the latest).

In conclusion: Thanks to strategic planning and a pinch of market savvy, GFG has two unique items on its menu that should be appetizing to a broad base of resource investors. Each one is located in a jurisdiction that encourages mining. Rattlesnake Hills features a major mining company that could dish out upwards of $100 million in exploration. It’s a proven discovery and an estimated 750,000+ ounce resource today with huge upside potential (GFG can squirrel away 25% at little to no cost). All good, and West Timmins isn’t to be overshadowed. It’s a 68,000 hectare land package that’s never been thoroughly explored with modern day methods. Even a whiff of discovery there would be very rewarding to shareholders of GFG.

About the writer: Daniel T. Cook, who joined BMR in June of 2016, hails from the great state of Texas and now resides in beautiful Utah. Daniel has a strong passion for the junior resource sector and has followed the Venture and broader markets with great interest since he bought his first stock 18 years ago at the age of 12. He became a licensed investment professional who was a Bright Future’s Scholar at the University of Central Florida, graduating in 2010 with a major in Finance.

Note: Daniel and Jon hold share positions in GFG.

10 Comments

What is BMR most excited for in the near future? Ggi news?

Quite a few things really excite me right now, Shelly…among them, I sense Nickel Mountain is on its way to becoming a mine, and the technical retracement in CCW excites me as well for the opportunity that presents (Battery Mineral’s decisions on the ground strongly support those fundamentals)…

Aurora Cannabis Inc. has been halted at 6:03 a.m. PT on Sept. 18, 2018, pending news.

Warren I just posted on GGI CEO channel. He wants news too. Lol.

CCW, that ask at 50 needs to go

And gone it is, TradingAgent…clearly the bottom was yesterday, and the run back up is going to be fun…

TradingAgent: Gone. As requested. 🙂

Jon, volume is nice today and a couple of day traders see CCW chart boucing. Very good sign imo.

Jon, would prefer GGI just drops the news. Maybe a few more pieces they are adding? Do you have any comments on likelihood GGI finds the feeder this drill season?

Oh, Daniel, great write-up! Thank you.