During our visit to northwest Quebec beginning next week, we’ll be taking a much closer look at Adventure Gold’s (AGE, TSX-V) intriguing and very promising Pascalis-Colombiere Gold Property which covers 637 hectares in the eastern portion of the highly productive Val-d’Or-Malartic Gold district. This area has produced more than 25 million ounces of Gold.

One of the best ways to pick a successful Gold stock these days is to find a company that’s enjoying exploration success at a significant, under-explored former producing property in a friendly jurisdiction (look, for example, at what Richmont Mines is doing at Wasamac). Adventure Gold has been getting excellent results from Pascalis and all indications are that this property, which includes the past producing L.C. Beliveau Mine, has much more potential than Cambior realized when it carried out mining operations there between 1989 and 1993 (1.8 million tonnes grading 3.2 g/t Au from surface to 300 meters was mined at L.C. Beliveau for total production of 167,000 ounces).

Adventure Gold started a 5,000-metre Phase 2 program at Pascalis more than three months ago and initial results are expected very soon. Given the numbers from Phase 1 including 33.1 metres grading 4.8 g/t Au (Hole #20) and 16.2 metres grading 6.7 g/t Au (Hole #17), we’re looking forward to seeing what AGE may have discovered in Phase 2. This round of drilling should give the company a much better understanding of the continuity of grade and structure at Pascalis. With the discovery of numerous parallel zones, a new model for this deposit is taking shape and it appears to be an exciting one. A NI-43-101 resource calculation is in progress and should be ready prior to year-end. The property is adjacent to Richmont’s Beaufor Mine, creating speculation that Pascalis – in the event of a very positive resource estimate – could be a profitable addition to the Richmont portfolio. Richmont has made no secret of the fact it’s looking to acquire another potential producing property in the general area.

In the current bullish Gold environment, any company that has an advanced project such as Pascalis has a valuable asset on its hands. Adventure Gold actually has several high quality projects which is one of many reasons we like the company so much. Pascalis, though, is the star of that group in our view and it could be a significant value-driver for AGE between now and year-end. We encourage readers to perform their own due diligence on this up-and-coming property.

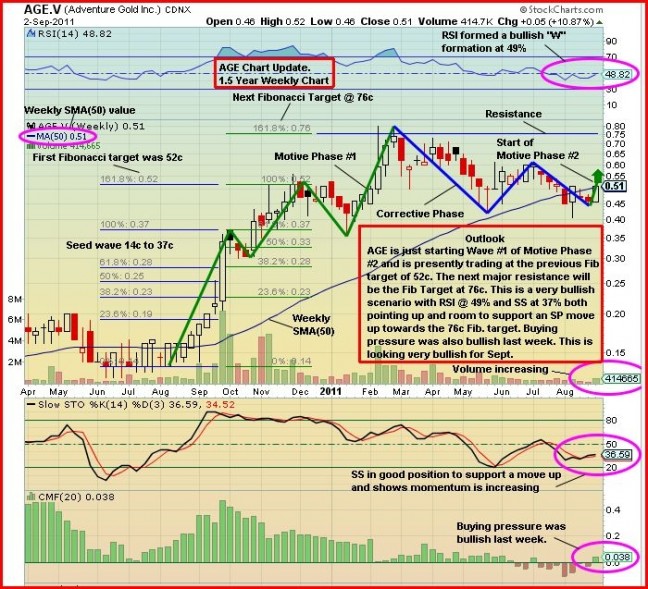

Technically, the stock is looking quite bullish as John shows below. AGE has out-performed the CDNX this year and closed Friday at 51 cents, just a few pennies below its 100 and 200-day moving averages.

Note: John and Jon hold positions in Adventure Gold (Terry does not).

12 Comments

I am thinking this morning, like a thinker would. I am wondering why would anyone would

be excited about gold moving up, except that is, the money pockets, who can afford to own

gold. When Gold goes up, it indicates something out there is negative & when something is

negative the indices move down & the reason for the indices moving down, is there are more

sellers than buyers, so down goes our stocks. I would prefer to see the indices up, gold

leveling off & you & i making money. It’s all about making money, greed & fear they say,

but fear is dominant these days. There’s no way anyone can predict anything, up one

minute, down the next. Anyway, we have to keep going & when the going gets tough, i hope

the tough get going. Have a good day. R !

Hi Bert,

Was reading one of your earlier posts and you mentioned DW…can’t seem to find it on the CDX. Is that the right symbol? Cheers, Wayne

Wayne, on behalf of Bert – the symbol is DVV (D V V)Company is: Driven Capital Corp.

Thanks Andrew, should get these ol’ peepers of mine checked out…sure looked like ‘DW’ on my screen. What do you know about this company, if you don’t mind me asking. Not trying to get you to do my dd but is it worth a look? Pretty impressive rock samples though.

Wayne

Wayne — The BRM group seem to be good folks, so i will take a chance a post a writeup from

the Gold Stock Investor.

Driven Capital Corp.

(TSXV: DVV)

August 25, 2011

New Canadian Explorer Initiates

First Drill Program at Yukon Silver Play

With Strong Basis for Major Discovery.

Historic Drilling at Driven Capital’s Lyn Project Includes 7.9 meters @ 4,354 grams/tonne Silver + 32% Zinc, and 2.4 meters @ 1,397 g/t Silver + 48% Lead and 15% Zinc – all near-surface. New sampling results include +10,000 g/t Silver and +30% Lead.

• With just 16 million shares outstanding and a $2-1/2 million market cap, Driven’s near-term discovery potential could make early shareholders very happy.

• The Company’s second project is equally appealing – directly on strike with and adjacent to the east of New Gold’s massive Blackwater gold project (+4 million oz. gold and growing) in central British Columbia.

• Experienced management team includes prior CEO of Silver Quest, which discovered the northern portion of the Blackwater gold resource, and earlier director of Richfield, acquired by New Gold for $550 million for the Blackwater Project.

Dear Reader,

With the potential of new discoveries in the air in the Yukon this year, we would like to draw your attention to a new public company’s very exciting Lyn Silver Project 100 km north of Whitehorse. Driven Capital Corp. (TSXV: DVV) has just initiated a 1,000-meter, shallow drilling program that holds exceptional potential for near-term fireworks.

Corporate Info

Email

Website

Click Here

Because the company is new and not known, we believe you may want to be among the first to know of this drilling campaign. In fact, even before results from this program will be known, which won’t be long, the company will be releasing additional sampling and trenching results that – based on other current sampling and a small drilling program that was completed by a prior owner in the 1980s – could also bring early market excitement to Driven.

Get Driven Capital on your radar screen now for breaking news by registering at the company’s website at drivencapital.ca, or by calling 1-604-569-0799 or emailing info@driven capital.ca.

Driven Capital’s Lyn Silver Project, Yukon

The company’s Lyn Silver Project lies 13 km southeast of the Faro Mine in the Yukon, and 4 km south of the Robert Campbell Highway. The project area consists of 4,760 hectares and is controlled 100% by option. Driven gained control of the project in May this year, and has made rapid progress. Historical work plus current sampling results demonstrate strong potential to uncover a new high-grade gold and silver district.

Just 5 km to the northeast lies Golden Predator’s Grew Creek Project. In the past two years, drilling here has found a major gold discovery with results including 146.3 meters grading 1.72 grams/tonne; 92 meters grading 2.02 g/t; 98.3 meters grading 1.83 g/t; and 46.7 meters grading 3.78 g/t.

While a small portion of the Lyn property has undergone minor historical trenching and drilling, company geologists report that it does not appear to have been systematically explored. A total of 13 shallow drill holes were completed in the general area of high-grade silver mineralization; however, only summary data is available. All 13 holes drilled in 1988 are reported to have intersected mineralization. The best drill intercepts included 7.9 meters @ 4,354 g/t Ag and 32% Zn; 3.0 meters @ 2,400 g/t Ag; and 2.4 meters @ 1,397 g/t Ag, 48% Pb and 15% Zn.

Historic rock chip samples assayed up to 4,328 g/t Ag, 53% Pb and 11% Zn. Trenching exposed a NW-SE striking network of veins over a distance of at least 275 meters, which remains open along strike at both ends. Individual veins measured up to 15 meters long and 2m wide, and returned silver assays including 0.3 meters @ 4,328 g/t, 0.9 meters @ 575 g/t, 2.0 meters @ 284 g/t and 10.0 meters @ 120 g/t. (Note: historical results are not compliant with National Instrument 43-101 and should not be relied upon.)

Driven’s own work, which has led to the drill program that has now commenced, indicates very strong potential indeed. The first 100 samples have assayed up to 2,770 g/t silver and 26.3% zinc. Other samples have been certified by ALS Canada, the assaying company, to have assayed greater than 10,000 grams/tonne silver and more than 30.0% lead. The company has ordered ALS to re-run these samples in ore-grade form, as well as to implement concentrate and titration methods to measure and report for ultra-high silver and lead grades.

Driven has also performed 232 meters of trenching and taken a total of 157 rock samples, and results from these are anticipated shortly.

Meanwhile, the company’s second project is following directly behind the Lyn Project, and is equally exciting for investors seeking highly prospective plays that could become major discoveries in the near-term.

Driven’s Kuyakuz Mountain Project, British Columbia

Driven’s Kuyakuz Mountain Gold Project totals approximately 7,345 hectares, and is located approximately 125km southeast of the municipality of Vanderhoof in central British Columbia.

The project adjoins the eastern boundary of New Gold Inc.’s Blackwater gold project, where New Gold controls one of Canada’s most exciting recent gold discoveries. The present NI 43-101-qualified indicated resource at Blackwater consists of 1.83 million oz. of gold contained in 53.4 million tonnes grading 1.06 g/t gold. The inferred resource is 75.4 million tonnes grading 0.96 g/t gold containing 2.34 million oz. gold. At the time of the estimate, the resource was open at depth and in all directions. Drill results coming after the resource estimates stated above have been the strongest results to date by far.

New Gold has five drill rigs active on the site and has expanded its camp to service eight to ten rigs in the near-term. Blackwater is expected to become one of Canada’s largest gold resources. New Gold is an intermediate-size gold producer with targeted production this year of 380,000 to 400,000 oz. gold and a cash position of approx. $500 million.

Driven entered into a service contract with Terracad Geoscience Services Ltd. in April this year to carry out prospecting, mapping, sampling and permit applications for geophysical surveying and drilling. A thorough survey and geological mapping of the property is ongoing, while over 1,500 geochemical soil samples taken from the property’s magnetically anomalous regions are now in the assaying lab. Terracad has meanwhile initiated the permitting processes for both a geophysical IP survey and a planned 2,000-meter drill program. Initial results from geochemical sampling are anticipated by the end of this summer, with an IP survey to be designed and implemented around those results before the field season closes out. The drill program is anticipated to commence in May, 2012.

The Management Team

Driven has a competent and experienced management team with more than 100 years of exploration and financing experience combined.

Toma S. Sojonky, President, Chief Executive Officer and Director – Mr. Sojonky brings over 15 years of venture capital and business development experience to the company. He has served as an officer, director and financier of a variety of privately held resource and technology companies in the mining (precious and industrial mineral exploration), oil & gas (upstream), and technology (Internet/information, clean) sectors. Mr. Sojonky was a founding officer and director of Ansell Capital Corp. (TSXV: ACP). He has been in the construction aggregates business since 1992, specializing in acquiring/tenuring, exploring and permitting sand, gravel, rock and industrial mineral resources in British Columbia. He has also been involved in the financing, planning, development and marketing of over 1,300 residential (single and multifamily) and hospitality units in Western Canada. Mr. Sojonky holds a BA from the University of British Columbia.

Lindsay Bottomer, Director – Mr. Bottomer is a professional geologist with almost 40 years of experience in global mineral exploration and development with several major and junior mining companies. He is currently the Vice President of Business Development for Entrée Gold Inc., a TSX and NYSE-AMEX listed company focused on the worldwide exploration and development of copper and gold projects.

Before joining Entrée Gold, Mr. Bottomer served for over four years as President & CEO of Southern Rio Resources Ltd. (now Silver Quest Resources Ltd.). During this time Southern Rio was one of the few companies focused on exploration in the Nechako region of Central BC, including the acquisition and initial drilling of the Davidson gold-silver property, which is the northern portion of New Gold’s Blackwater project adjacent to Driven’s Kuyakuz Mountain Project. In fact, this is the area of Blackwater with the strongest drill results and with five rigs now active.

Mr. Bottomer also served as an independent director of Richfield Ventures Corp. – the company that drilled out most of the Blackwater Gold Project, and which was acquired by New Gold for $550 million in June this year – prior New Gold’s acquisition.

Krister A. Kottmeier, Director – Mr. Kottmeier has been involved in the structure and financing of public companies since 2004. He has been an investor relations and corporate consultant since 1996, having served a number of exchange-listed companies. Mr. Kottmeier was chief investor relations consultant to TSX-listed Minera Andes Inc. (TSX: MAI) from early 1998 to 2009. He is currently President, CEO and a director of TSX-V-listed StoneShield Capital Corp. (TSXV: STS) and was a founding director of Rockgate Capital Corp. (TSX: RGT). Mr. Kottmeier attended the University of British Columbia from 1993 to 1996 with a focus on languages and business.

U. Peter Kurisoo, Director and Consulting Geologist – Mr. Kurisoo is a self-employed geologist with 35 years of diverse mineral exploration and mining experience. He has conducted exploration for precious metals, base metals and industrial minerals in a wide variety of geologic environments in North America, South America, Southeast Asia and the Caribbean basin. He has managed numerous advanced-stage mineral projects and has generated many projects through regional grassroots exploration. During his 18 years with Canyon Resources Corp, he established an exploration subsidiary in the Dominican Republic and was responsible for regional exploration and management at the open-pit, heap-leach Kendall gold mine in Montana. Mr. Kurisoo graduated from the University of Montana in 1975 with a B.A. in geology.

Outlook

For a 15-cent to 18-cent stock with a tight share structure, Driven Capital is drawing a lot of respect among the few gold stock investors who know of the company because of the quality of its first two projects. With the initial drilling program now commenced at its Lyn Silver Project in the Yukon, news will be coming rapidly, and the company is very likely to hit strong silver, zinc and lead values in this first program.

It is noteworthy that the company’s Kuyakuz Project is adjacent to one of the industry’s most exciting gold discoveries which is expanding rapidly. The company’s second project may be as big or bigger than the first.

Start to follow Driven Capital now by visiting drivencapital.ca and register for the company’s news flow. Email [email protected] for additional information or call the president, Toma Sojonky, at 1-604-569-0799.

Thank you,

The Editors

Gold Stock Investor

It appears my post # 5 on DVV was pulled. This is the second time it has

happened. I am somewhat bothered, because it prevents me from being of

assistance to cyber friends. If one loses a freedom, he must act, therefore

i am out of here. Good luck to you all. R !

Wasn’t pulled, Bert, the system just didn’t automatically approve it due to the nature and length of the post….it’s up now…

Viva Bert the freedom fighter 🙂

Thanks Bert, much appreciated. I will spend some time researching DVV, it does seem to have some potential.

Cheers,

Wayne

Nice looking graph. I’m curious to why AGE was promoted since March when this stock started 3-Leg Corrective Phase?

Bruce, we started covering AGE about a year ago and we have been very bullish on the company since then, and for good reason. Keep in mind that no matter how good a company is, or how well the stock is doing overall, there will be times when it will experience a period of technical weakness as AGE has. But that’s the best time to accumulate. We pointed that out in our writings with AGE during the spring and gave the support levels which held.

Thanks Jon. I was think along the similar line. Good fundamental but technical weakness.