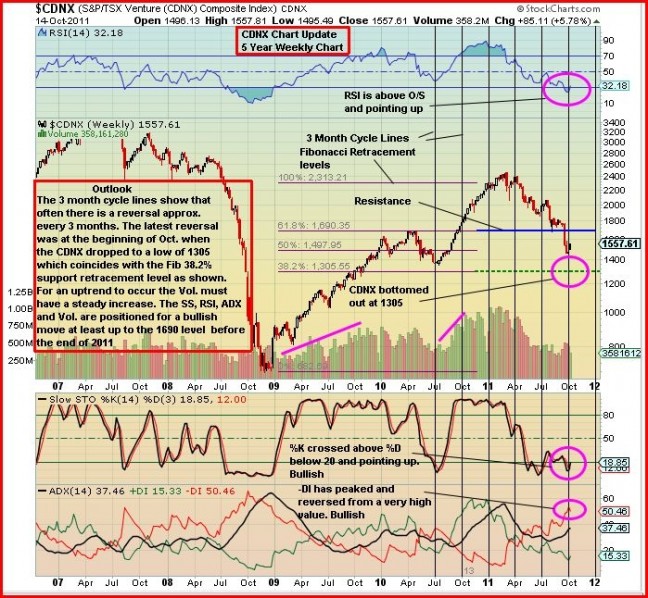

After Friday’s bullish move through the 1530 resistance area, John’s updated CDNX chart this morning shows that we should expect the Index to climb another 10% or so from current levels during this fourth quarter. Such a move should still be viewed within the context of an overall bear market. We’ll have more in our Week In Review later today.

2 Comments

Talk about back and forth.. one minute your bearish as hell the next your saying the opposite. Anyone following your advice in the last 6 months have lost there shirt. You go from junior exploration companies to small producers to larger ones. How is someone positioned in juniors supposed to liquidate and switch in this sequence when theres almost no liquidity in the picks in your portfolio. Your Cdnx leading indicator for other indices is unproven and quite wrong to date, and i find your biblical approach to investing absurd. How can your team gain any credibility with this approach?

I agree jeff. The idea is to try and predict the market, so you can be one step ahead of whats about to happen. Unfortunately BMR has been 3 steps behind and are chasing there tails. On the day they switched from bullish to bearish was the day everyone was panicking, that was the day to start becoming a contrarian, buy companies with good assets and hold for market strength again. There will no doubt be volatility but setting some stink bids to take advantage of that is a much better way to go than following the herd.