TSX Venture Exchange and Gold

The CDNX went pretty much according to script last week, pulling back to support around 1575 before pushing higher toward the top end of the resistance band that ranges from 1600 to 1700. According to John’s most recent chart, a breakout beyond 1700 appears increasingly possible which would carry the Index to additional resistance at the 1800 level which is also the 500-day moving average (SMA). This is not a move we’re comfortable with for several reasons, however, including poor volume and declining major moving averages, which is why it’s critical to be extremely selective at the moment – more so than usual – in the highly speculative CDNX. At this point we prefer the small to medium-sized producers over the speculative juniors with the exception of those that have substantial NI-43-101 resources or potential major discoveries. This is not 2009 or 2010 or early 2011 when there was intense speculation and a rising tide that was lifting all boats.

Gold

Gold tested support around $1,685 last week and now appears ready to test resistance at $1,800. We’re in a traditionally strong period for both the yellow metal and the TSX Gold Index as the following chart from www.usfunds.com shows:

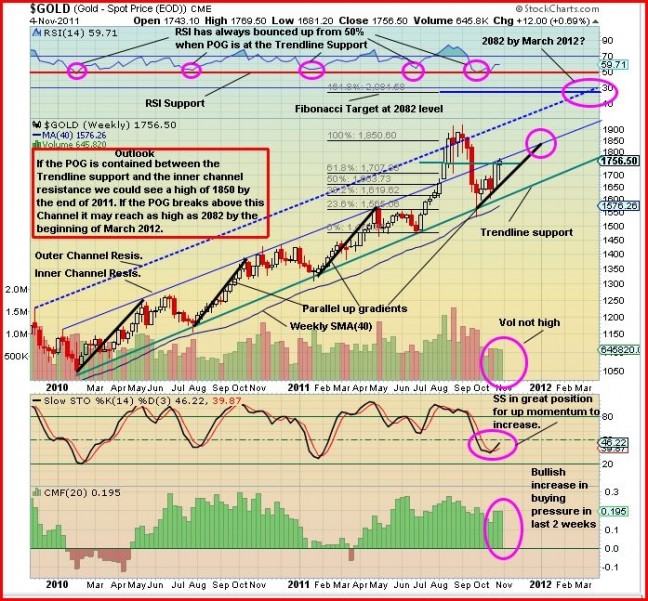

John’s latest Gold chart shows strong potential for a move to a new all-time high during the first quarter of next year:

For the week, Gold was up $11 an ounce after closing Friday at $1,754. Silver, though it’s looking extremely bullish, fell $1.16 to $34.13. Copper lost 9 cents to $3.58, Crude Oil gained 94 cents to $94.26 (its fifth straight weekly advance) while the U.S. Dollar Index jumped to 76.91 from 75.09.

The “Big Picture” View Of Gold

As Frank Holmes so effectively illustrates at www.usfunds.com, Gold is being driven by both the Fear Trade and the Love Trade. The transfer of wealth from west to east, and the accumulation of wealth particularly in China and India, is having a huge impact on Gold.

The fundamental case for Gold remains incredibly strong – currency instability and an overall lack of confidence in fiat currencies, governments and world leaders in general, an environment of historically low interest rates and negative real interest rates (inflation is greater than the nominal interest rate even in parts of the world where rates are increasing), massive government debt from the United States to Europe, central bank buying, flat mine supply, physical demand, investment demand, emerging market growth, geopolitical unrest and conflicts, and inflation concerns…the list goes on. It’s hard to imagine Gold not performing well in this environment. The Middle East is being turned on its head and that could ultimately have major positive consequences for Gold.

What’s also driving Gold is the weakness of the United States, brought on in no small part by one of the most ineffectual Presidents the nation has ever been saddled with. America has lost its way and the recent S&P downgrade is both a real and a symbolic reflection of that. Since the summer of 2009, the U.S. economy has produced a net total of just two million jobs while federal spending has gone through the roof. Throughout its incredible history, the United States has demonstrated an amazing resiliency and the ability to bounce back from major economic, social and political troubles. It will do so again but this will take time and a real Commander-in-Chief in the White House by November, 2012. By then Gold will have climbed another 50% or more.

17 Comments

Once again with “the most ineffectual Presidents the nation has ever been saddled with.” B.S.

I guess you could call the W administration effectual. Ignoring imminent, explicit, warnings that terrorists intended to hijack planes and fly them into buildings. Then starting a disastrous, monstrous, war based on lies. Taking a budget surplus and turning into huge deficits, mainly by giving major tax breaks to the top 1%. Guns and butter for the very wealthy. They were completely asleep at the switch regarding the housing bubble and the malfeasance and swindling done by wallstreet and the big banks. Effecttual? You could say that. Now the Republicans in Congress have pretty well admitted that they will stymy anything in order to make things bad enough that the president can’t succeed.

I don’t know if you’ve noticed but the people the Republicans are putting up for nomination are a bunch of freaks whose main tenet seems to be to transfer even more wealth and power to the elite. Good Grief.

“An imbalance between rich and poor is the oldest and most fatal ailment of all republics.”

–Plutarch 85 A.D.

BMR – Throughout its incredible history, the United States has demonstrated an amazing resiliency and the ability to bounce back from major economic, social and political troubles. It will do so again but this will take time and a real Commander-in-Chief in the White House by November, 2012. By then Gold will have climbed another 50% or more.

Bert – I find it difficult to understand why whomever at BMR, which has American followers,

continue to highlight President Obama, in a negative manner. When he wins in 2012, the majority

of Americans will be sending BMR a message, that he is their real Commander-in-Chief. Failing to

find something positive to write about our neighbour’s President, maybe you can inform us, why

some picks have fallen off the charts.

It would be really nice if we could keep politics out of this site. This site is about discussing and investing in junior gold companies. Politics divide, and who wants that? Thanks BMR and you all.

How can you claim Obama is ineffectual, he got Bin Laden and the number two guy, and cleaned up Libya. I really wish you stop beating up on Obama you make it sound like he is the cause and source of all the bad that is happening in the American economy. George W was in office for eight years compared to Obamas three and yet you lay it all at Obamas feet. Get real. I’m having a hard time taking you guys seriously, please take the blinders off. How about some info on the duds you guys picked. Dan V

Obama is in bed with Wall St. He is a weak hand who can’t undo the shackles of Larry and Timmy!

Dan what do you mean why you say Libya is cleaned up? if rebels in control means cleaned up, then Afghanistan has been running smoothly for the last 40 years and Somalia is in great shape with many more nations in the same boat.

I dont like politics at all because its all a facade.

Honestly who cares about Libya and Afganistan,everyone makes it seem that we are discussing two of the most powerful countries in the world and we hanging on every move both they make both in terms of politics and finance.

Obama got Gaddafi a known terrorist, now maybe Libya will not be a terrorist state, big maybe I know but at least Obama is making headway. I ask what did George W achieve? Nothing in my books just a fruitless search for weapons of mass destruction

Jon, are you still holding VGD? Large dump at the open at .22. 🙁

@Dan – Obama was shaking hands with Gaddafi not so long ago so what does that say about Obama! And now the Libyan people have Sharia law – great, id say the Libyan women are thrilled about that! Now the west gets the oil and the international banking cartel get to crush Gadaffi’s gold backed oil trading ambitions with the African Union – Let me ask you this who is the real winner here? The Libyan people or the West’s business interests? I think you need to learn more about the Libyan situation before applauding Obama and the west.

I didn’t hear or read that it was the U.S.A. (Obama,)who placed an

umbrella over Libya, wasn’t it NATO & may i add, they were supported

by the Arab league. I can still visualize the skeletons, the folks

who believed in demoracy, but fell under Gaddafi’s rule. As for

Libyan oil, the U.S. can have all the oil they want, just a matter

of approving the pipeline from Alberta. I could go on & on, but

my wife is calling, “dinner time” ! R !

A person in charge, be it a nation, state, company or a group of people will always bend everything to where it benefits him/her the most. Selfishness and greed come natural to humans from birth. Looks at babes, they do not like or want to share anything. As we grow older we don not change but are able to mask it better and put different names on it.

Has anyone sold VGD this morning?

Not yet, Alexandre. I was waiting for this morning’s review from BMR and to learn whether Jon was still holding VGD. Doesn’t look good though – I may have no alternative but to dump!

Andrew, I still like the Wasa region. Timing the market, that is the tough part. I hope VGD releases a quarterly report soon. Even RIC has delays opening the Franceur mine. They initially promised it for the beginning of the third quarter.

Placed a bid for some Kinross warrant D at 2.37. Good for a couple of days. My full service broker recommends Kinross. See what happens. A confort is that some pros were recommending Bank of America at $15.

I understand, Alexandre but I’m guessing only the first hole was good and that everything else drilled at Wasa Creek and Wasa East has been insignificant. Joutel is an unknown and with financings like the one they’re doing now, it could be a long time, if ever, before the sp goes back to mid .30s for me to break even!