Gold is holding up well in early trading after yesterday’s big run…as of 5:00 am Pacific, the yellow metal is off $2 an ounce at $1,747 after touching an overnight low of $1,740…Silver is looking good (see John’s new chart below) and has gained 29 cents to $33.12…Copper is down 2 pennies at $3.54…Crude Oil is off slightly at $100.27 while the U.S. Dollar Index has retreated one-fifth of a point to 78.19…

Christmas came early for many investors yesterday as the Dow recorded its biggest one-day gain since March 23, 2009…we were expecting a month-end rally and it came with a bang, and this is now a rally that could have some legs to it…the fact central banks had to step in yesterday, however, shows how dangerous the European situation is…Europe’s already crippling debt crisis is sure to worsen in 2012, despite any assurances to the contrary from political leaders, when many of the region’s governments are forced to refinance huge amounts of debt – and at what yields?…how this European horror movie will unfold in the days, weeks and months to come is anyone’s guess, but one possible outcome – perhaps the only answer – is an even more powerful European Central Bank (ECB) that has the authority to print money like there’s no tomorrow and monetize the debt, an idea that Germany has so far completely rejected…at the end the Germans may have no choice…this would have inflationary implications and would be hugely bullish for Gold…

This is a another pre-market version of Morning Musings as Jon remains on special assignment (through tomorrow)…stock index futures are slightly positive as of 5:00 am Pacific…a slew of U.S. economic data is due out today, including car sales and chain store sales, that could give stocks another lift… non-farm payrolls come out tomorrow and expectations are building for a better-than-expected number after yesterday’s ADP private sector report showed 206,000 jobs were added in November…

Silver is looking interesting and another bullish factor is the continuing very low short position of the commercial traders…this has been the case for a couple of months now, and it’s never wise to bet against the commercials…this is an attractive chart (2.5-year weekly)…

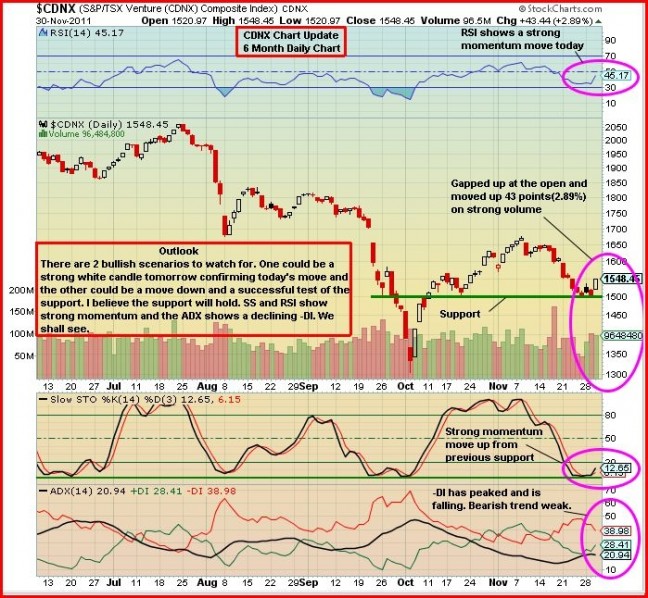

Okay, now for the CDNX…John has an updated chart this morning after yesterday’s bullish action with the Index gaining 43 points to close at 1548…this market faces a lot of challenges, not the least of which now is a declining 300-day moving average (SMA) which in the past has always been a prelude to lower prices…we’re into tax-loss season and the previous support area between 1575 and 1600 was recently broken and will now provide resistance…on the positive side, 1500 has held so far as support and it could be tested again – we’ll see…

10 Comments

Phase 2 drilling at Lapaska (AGE) turning out better results.

Patrick , yesterday you asked me if Osisko bought 7 millions shares … Well no. It was Van Eck funds from New York. This year they bough 4 millions shares from december to before february results. Everyday during that period they had a bid of 250 000 shares between 70 and 76 cents. All there trades were done threw Canaccord. After february results they stop buying. I notice since a month heavy selling threw Canaccord….it could be them reducing there position into GBB.

Thanks for the charts as ever. Silver is quite the enigma.

Thanks for that info Andre. I still believe GBB have a massive deposit and I fully expect 2012 to be a great year for this company. Pity about 2011 but thats the venture.

andre, did you do your own DD or did you get this info from stockhouse?

Seafield???? WOOHOO another 1 of BMR ” picks” has hit ANOTHER, NEW 52 week LOW, congrats to all the longs….Who much are you up on SFF since BMR 1st introduced it to you?? Along with GDX, GBB, CUI, and SD?? VGN came out with MD&A looks like VGN has a LOT on their plate coming up, could be FEAST time!!! Don’t say I didn’t tell you about it, and I will NOT gloat when it sky rockets, not my style

Alec I also though back in January that it was Osisko buying but to be honest someone on stockhouse gave me the lead on Van Eck. Now there is over 50 thousand money managers or fund managers in the US with over 1 billion in assets. It’s almost impossible to know them all. I went out and did my own DD and without any doubts it was Van Eck the only institutional buyer for GBB in 2011. Now I have been saying since February that GBB results are very ordinary to low and sold all my shares at 0.75 cents but still will be a buyer between 10 and 15 cents. In fact yesterday I pick up on my 25 000 bid only 2500 at 0.155 cents. I will be buying between 10 and 15 cents around 200 000 shares. Now GBB must come out with a aggressive drilling programme like Osisko in 2005. Osisko had 11 drills on site including 5 RC drills. This is the only way GBB can prove a multi millions ounce reserve. Not by having 2 drills and flip flopping between projects like they did in 2011. My opinion but have been right all year.

Hi John, have you heard something from Harold (CUI.V)?

thx

Andre, I apologize for those comments to those that might offend. This was just an interpretation on my part. You’re right, we must consider our thoughts before writing!

Unemployment in U.S. now 8.6%, which means they are growing & this should give us another positive

day in the market. R !