Gold continues to look strong…as of 6:40 am Pacific, the yellow metal is up $4 an ounce at $1,749 after running as high as $1,764…Silver has gained 40 cents to $33.13, Copper is 2 pennies higher at $3.55, Crude Oil is up 53 cents to $100.73 while the U.S. Dollar Index is off slightly at 78.21…

Job creation remained weak in the U.S. during November, with just 120,000 new positions created (slightly less than market expectations), though the unemployment rate slid to 8.6%, a government report showed this morning…the rate fell from the previous month’s 9.0% which would reflect a drop in the participation rate among those without jobs…

Markets in New York and Toronto are positive in very early trading…the CDNX has climbed 8 points to 1556 while the TSX is up 78 points…the TSX Gold Index is unchanged at 420…

While Jon remains on special assignment, John has a new chart on the CRB Index this morning that clearly shows what this Index needs to do in order for the current rally in the markets to continue…this Index is approaching the resistance line of a down-sloping chart pattern that has been in place since last spring…if the CRB Index manages to break out of this pattern, then rest assured the outlook for the CDNX will improve dramatically…it’s critical to keep a close eye on the CRB Index over the coming days and weeks…as of 6:40 am Pacific, it’s up 2 points at 315…a strong move through the 320 area on a closing basis in the near future is what to watch for…

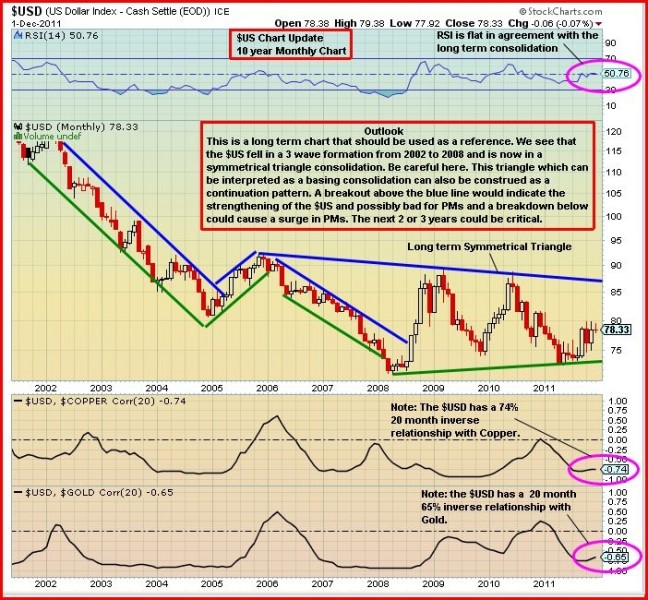

It’s also critical to keep a close eye on the U.S. Dollar which has generally benefited from the nightmare in the euro zone…John’s chart below is a 10-year monthly chart on the Dollar Index which shows there is plenty of room for this Index to move even higher in the coming months (to the top of the long-term symmetrical triangle)…a break below support would be very bullish for Gold as well as the CDNX (previous charts have shown a clear relationship between the CDNX in particular and the Dollar Index with the Venture performing strongly when the Dollar is weak and vice-versa)…

26 Comments

Happy Friday- CJC – Level 2 on the bid is the strongest I have seen in a long time. My guess is that she will break through the .50 resistance next week, trade in the 50’s for a few days and then on to the bigger breakout. Cheers

My wife ask me for christmas a expensive wristwatch…. I am going for the Breitling …. Now I just completed a 100 000 shares buy back of GBB between 15 and 16.5 cents. Now lets get it over the 20 cents mark. Taylor… great post.. very conservative in the number of ounces predicted from you .. My self I see 10 millions. Joakim…. beautiful web site…. do you also see 10 millions ounces… go GBB go.

If you took a position in CJC, you could get her the Porsche to go with the watch. She should break 50’s resistance next week.

The porche…loll From 2000 to 2004 I had a porshe carrera 4. I will be looking at CJC. I don’t know nothing about it. Any other suggestions.

Only 2 I am very familiar with are CEV and CJC, CJC has biggest price gain coming short term. Sorry I have no others

If you have time dave.. CJC One his the best reason or reasons to buy this one. for you.

Hi Andre

If your looking for a stock that may run soon try T.AZ. They are starting gold production this month, no debt, cash cost of 600 to 650 and only trading at a small market cap. of 36 million. I believe this could be a big winner your in time for christmas. But do your own D.D.

T.AZ target 25000 ounces first year and 40000 ounces second year. More drill results pending.

@ Dave!

Thanks alot regarding the cjc. You really made my week!!!

It pushed through resistance, Kalkan. It’s overbought on RSI but may open higher on Monday. There will be an exploration update at some point next week and results starting the week after. May need to unwind but is looking very good! Thanks Dave!

I realize BMR reports it as they see/hear it, but i am a lot more optimistic

tonight than they have been reporting. Things are coming together out there

& will continue to improve with time. Time will also help the Venture as we

see a trickle down affect…

CJC – Some indicators are showing it being overbought & another very very close,

so my money says it will move back the beginning or first part of next week,

barring news, giving those who may be interested, another chance to buy.

CEV – I feel this one has been a traders dream, i have bought & sold it a few

times & today, i have more shares than i had earlier. I was not expecting it to

move up today, instead i felt the market would wait for the financing to close,

but the market showed they felt that shouldn’t be a problem, in particular,

since it was all taken down by Forbes & Manhattan Inc & it’s associates. Another

ten million dollars in the till.. Also, of importance, they now have a deal with the

Natives in the area. I owned SQI & had a strong feeling it would be bought out & it

was, now i have the same feeling about CEV. R !

Hi Bert, there are certainly reasons for concern regarding the CDNX and markets in general, so though we are very cautious overall right now there are definitely individual situations that are bullish and CEV is one of them as we’ve stated. It’s that kind of a market – very selective. In fact, I personally bought some CEV just recently. I share your feelings with regard to this one. The chart looks great as John has pointed out and the fundamentals are powerful – they’re sitting on what is likely a monster (world class) iron ore deposit. I like the odds on CEV.

As I stated earlier CEV is now one to play the chart sort of speak. It is on the road to a buyout in my opinion down the road in late 2012. CJC – to those saying overbought, careful. RSI can and probably will go to 95 and stay a couple days. .50 and .45 are very strong support points. However, you have to look at the end of day action to get a feel on whether or not it will break below .50. My guess is she gaps up Monday and remains in the upper 50’s and with a news release around the corner she will have the biggest break out coming even though it is an update NR. It is important to note that CJC is still under the radar. They have only updated their web page and this is not seen by everyone. The news release will be seen by the bigger audience and smart money will start pouring in with much bigger volume. I am high on both and gave you both when they were .35. I talk more about CJC because of its potential and the speed at which it could pass CEV at the current levels. CEV is iron ore, CJC is rare earth, and if they hit heavies, a 100mil market cap is not out of the question in short order. Worst case scenario they match GMA and move to $1.50. I received information today that if true will accelerate CJC even faster. The Montviel belt with GMA and CJC is now being talked about as the 3rd largest deposit of REE in the world.

I remember reading a post on the boards that CEV was a monster. Well, If CEV is a monster, CJC could be Godzilla. I ask that you keep my posts and information restricted to this board and not re-post on Stockhouse. I would like to think that you have enough respect for my thoughts and all the DD that I have done to stay here where it belongs. Thank you in advance.

CEV was a gift at .35 – CJC was highway robbery at .35, a steal at .50 and a gift at .75. Happy trading and cheers to all.

One more note to anyone positioned in CJC. I caution anyone to try trading this one based on TA. CJC can be halted at anytime and open in the multiple dollar range, RSI all inclusive. This is not a “play the chart for 10 cent moves” scenario here. If you hold a position, do just that “hold”. Happy Trading.

Stop holding back tell us what u really think of CJC

Rick – I have not been holding back and have stated CJC’s possibility of a major heavy REE discovery. Go to their website, read their presentation and look at the drill cores in what they are hitting. I have stated worst case scenario, they match GMA’s results and march upward to the $1.50 range. I have stated that if they hit heavy Ree’s, the sky is the limit. You don’t have to have the crystal ball at this point to understand that at .50 this is a no brainer. CJC’s delay in getting things rolling and the summer market conditions took CJC to a level unheard of after hitting a high of $1.42 in the spring before the first drill was turned. CJC is about to get noticed here very soon. Also, some very astute and intelligent investors have showed up on the boards Friday and took a position. If you read the boards enough, you will know who they are. To those who bought in the 30’s, congrats and enjoy the ride.

Rick, no offense but I really don’t see the point of your question. Dave, however, has been gracious enough to answer it. Dave generously brought CJC to the attention of BMR readers a couple of weeks or so ago, presumably you’ve been following the postings so that’s why I don’t see the point of your question or the way it is put forward. You should do as Dave suggests and read the fact sheet on their website, do your own due diligence and if you have questions ask Chad McMillan – I have found him to be very helpful. Enjoy the weekend and look forward to a successful day on Monday. 🙂

Looking on the lighter side…..perhaps Rick forgot to put LOL at the end of his post.

Now, that would make sense, John! 🙂

I found a funny sounding headline. This is a LOL.

Troymet Director Participates in Gypsy Swap

Jon, have you got any comments on Greencastle’s recent MD&A from Nov25. Sobering reading.

Greencastle doesn’t concern me, Hugh. In fact, it’s a no-brainer buy at 14 cents given that it’s trading below cash value. Rest assured, like always, Roodenburg will pull the trigger on something with VGN and it will surge higher. He has a history of doing this when the overall markets go into a bullish state. So you buy at cash value and sell into the run. That’s what he has taught everyone to do.

On another note, I spent some time in Calgary last week investigating a very intriguing silver-gold play that everyone should perform DD on – Rainbow Resources (RBW, TSX-V). They’ve picked up some really solid silver and gold properties in southeast B.C. through privately-held Braveheart Resources. Check out the people involved in RBW – they include the highly respected Jim Decker of Grande Cache Coal fame, prominent Calgary businessman Robert Libin, and David Johnston who put the land package together – also a very respected figure in Calgary. They have a dream team and some highly attractive exploration targets IMHO, in a rich historical mining district. Current market cap is $4.25 million at 17 cents. I suspect they’re going to raise some money and make things happen with this in a hurry. A nice stocking stuffer.

Yup, I’m pretty sure Rick was tongue-in-cheek there Dave! Anybody follow Aroway (ARW.V)? This thing is climbing on huge volume lately. I’ll leave it to to you folks to peruse as my stock picking ability sucks!

Hello George, I check in on ARW every now and then and have a cyber friend that follows it. I’ll check it out – thanks for the heads up. Would appreciate anyone’s TA on ARW also! 🙂

Actually I do own a few shares of CJC and may buy a few more next week if it don’t go bananas on me . I’m trying not to lose my head though at the thought of a Godzilla in my portfolio. I mean really a person should try not to go ape over these things even though with a market cap of less that 10 mill it would seem to be as you say a no brainer. If this isn’t a no brainer I’ll be a monkey’s uncle