Gold is quiet this morning…as of 5:05 am Pacific, the yellow metal is up $1 an ounce at $1,744…Silver is off 16 cents at $33.55…Copper is a nickel lower at $3.80…Crude Oil is off $1.06 at $96.55 while the U.S. Dollar Index has gained over one-quarter of a point to 79.12…

Dow futures as of 5:05 am Pacific are pointing toward a flat open…China is considering increasing its participation in the rescue funds aimed at resolving the European debt crisis, Chinese Premier Wen Jiabao told journalists this morning…but Wen did not made any explicit financial commitments for the European Financial Stability Facility (EFSF) or the upcoming European Stability Mechanism (ESM)…

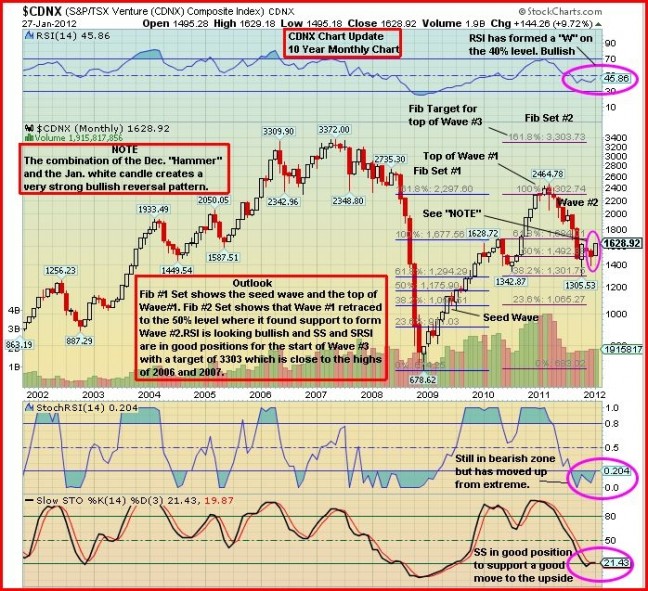

Powerful January For CDNX Bodes Well For 2012

The TSX Venture Exchange put in one of its best January performances of the last decade by posting a gain of 10.28%…history shows that this is an extremely bullish sign for the balance of 2012…other years that included a strong January were 2002, 2003, 2006 and 2009 – the CDNX gained in each of those years and jumped over 60% in 2003, over 30% in 2006 and a whopping 90% in 2009…

Folks, at the risk of sounding repetitive, a major new bull run is underway and some savvy Venture Exchange traders and investors we speak to agree there has been a fundamental shift in sentiment in recent weeks…many investors, however, are still looking through their rear view mirrors and don’t accept that point of view which is just fine – we heard the same denials of a bull run during the first quarter of 2009 and in the summer of 2010…the market needs these “Johnny-come-lately” buyers down the road…

John’s most recent long-term CDNX charts are so important we’re posting them again…look at them closely…a return to the 2006-2007 highs is definitely in the cards and those who catch on to that now could end up with huge pay-days…a likely reversal to the upside in the 1,000-day moving average (SMA) during the second half of this year will be a very important technical event and will add fresh fuel to this market…

CDNX Chart #1

CDNX Chart #2

Here’s another interesting statistic which pertains to the U.S. markets…since 1948 they have gained every single year in which a sitting President was running for re-election…in the 14 elections since 1928 that involved a sitting President, the S&P 500 has jumped an average of 14.6%…

Speaking of the S&P, earnings beat projections at 67 % of the 198 companies that reported quarterly results since January 9, according to data compiled by Bloomberg…analysts forecast profits in the S&P 500 will reach a record $104.58 per share this year after increasing almost 125% since the end of 2009, the fastest expansion in a quarter century, the data show…

We have a few other charts to share this morning…below is a comparative chart for the month of January that features the CDNX, the TSX Gold Index, the U.S. Dollar Index, Gold, Silver and Copper…it was a fabulous month for Silver which looks set to be an out-performer in 2012…

Kaminak Gold Corp. (KAM, TSX-V)

One of our favorite Yukon plays, as readers know, is Kaminak Gold Corp. (KAM, TSX-V) which announced this morning that it will commence a $17 million, 2012 Phase 1 drill program at its Coffee Project consisting of a minimum of 50,000 metres beginning in late March…this will lead to an initial NI-43-101 resource estimate for the project…KAM closed yesterday at $2.37 and its chart is now looking very bullish as John shows below…

Note: John, Jon and Terry do not currently hold positions in KAM.

Armistice Resources (AZ, TSX-V)

Another situation investors should keep on their “radar screens” is Armistice Resources (AZ, TSX-V)…we have mentioned this company before…Armistice is developing the McGarry Project in Virginiatown, Ontario, immediately adjacent to the Kerr Addison Mine which produced over 11 million ounces of Gold…

Note: John holds a position in AZ (Jon and Terry do not)…

Rainbow Resources (RBW, TSX-V) Update

Rainbow continues to look exceptionally strong and any minor weakness, like yesterday, has to be considered a buying opportunity as Rainbow is expected to announce the completion of its private placement at any point now which will open the door to another potential breakout as John’s charts have shown…President David Johnston told us yesterday he is “eagerly anticipating” Moose Mountain’s comprehensive report on the company’s Big Strike Project in the Kootenays…this is due very soon and will include historical data as well as work performed by Braveheart Resources and Rainbow…strong news flow, which is expected according to Johnston, will add a lot of “meat” to the bones of Rainbow and allow RBW to attract a much wider following…with a current market cap of just $5 million, it is our favorite speculative pick for 2012…Part 2 of our Rainbow article is coming next week…

29 Comments

BMR – Many investors, however, are still looking through their rear view mirrors and don’t accept that point of view which is just fine .

Bert – I just have to respond to the above sentence. No wonder, folks

are still looking through their rear view mirrors. One must consider

how much cash some folks may have lost during the last year or so,

either by selling at the lows, or looking at their stocks today at lows.

Folks lose cash in this game of chance anyway, so what chance did they

have, when the market turned against them, kicking in the FEAR factor.

I feel BMR tried their best, but their picks just couldn’t withstand the

force of a negative market & lack of confidence is still surrounding

us. It’s going to take time, although the Venture is showing some strength,

if you can call up 5/6 points as strength, but i will take it. Give me

plus 20 points or so every second day & this site will come alive & tell

me confidence is returning or has returned. R !

BMR brought Ucore (UCU-TSXV) to our attention a few days ago. This morning they had a press release advising of the availabilty of Apps for iPad and smart phones – really useful and innovative!

SGC

Drilling news out on Sunridge this a.m. but i am expecting more—

Sunridge Gold Corp. is exploring and developing the Asmara Project in Eritrea in East Africa. Four NI-43-101-compliant mineral deposits have been successfully defined to date and a feasibility study for the high-grade Debarwa copper, gold and zinc deposit is scheduled for … read morecompletion in 2011. A prefeasibility study on the Asmara North, Emba Derho, Adi Nefas and Gupo Gold (copper, zinc, gold, silver) deposits is scheduled for completion in early 2012. Exploration work continues on the Asmara Project and the Besakoa Project in Madagascar and several high priority volcanogenic massive sulphide targets have been defined

PG on Sunridge.

Technically, the stock is breaking above key downtrend lines while approaching key moving averages. The second chart shows you a classic saucer bottom that I believe is the foundation for the share price to return to much loftier levels on the heels of lots of news flow in the coming weeks and months. It’s been my opinion that their projects are worth a multiple of what the total market cap has been for several months. I’m not alone on my bullish assessment.

Thanks Bert – I’m watching SGC closely. This morning’s news, I think, was just to give investors something before the main course. 🙂 Isn’t there a resource estimate due this week?

Andrew

Yes, but it’s getting late in the week & i wouldn’t expect

it on Friday, but all things are possible.

Thanks, Bert.

I wouldn’t be posting anything on SGC if i thought no one had a

position. Not a very talkative board. As previously mentioned, we

need something very positive to ignite this board. Do you Andrew

have a position in SGC.

Not yet, Bert but I’m working on it – with luck I should have a position before the resource estimate is released.

Anyone been watching NES Newstrike Capital lately, it has broke out the past 2 days from 2.70 to a high of 3.19 today today, over 1 million shares traded yesterday. Would love for BMR to do a chart on this one?

Volume dried up today on RBW?

SSP – Made a year low yesterday following an updated 43-101 and PEA and today it’s making a reversal. I guess it needs another white candle tomorrow to confirm.

Anybody watching NFR northern freegold. interesting play in the Yukon. 3.7 million gold equivalent ounces including silver copper and molybdenum. Fowler has put a target of $1.44 on the stock according to the globe and mail and it is currently trading at 28 cents. they have 110 million shares out or so. might be one to put on the radar.

I currently do not own the stock. I am currently holding AZ and RBW.

Thanks Ed, I’ll check out NFR.

AGE has bounced off the 50 day SMA and touching the 200 day SMA – I hope this is the reversal! 🙂 Note: Andrew holds a position in AGE (Bert does not)

Andrew

Say what you like, it appears that Bert is holding some winners now.

As for SGC, with all the resources they have, they would be dang

fools not to keep the price moving & it’s my guess, they will, thus

should have more news next week & maybe the week after. CEV is

showing some movement, as well as NGD ., & so on.

Yes, Bert – SGC looks like its going to have a strong close. Still hoping that I get a position! 🙂 Strong day for ISD too and a 20 point gain on the Venture; things are looking much better!

Andrew

I hope you didn’t sell CEV. The late move this evening, certainly indicates investors’

were aroused over something. Also, it broke through the always resistant ”even” dollar.

Bert,

No, still have a healthy position in CEV. Thought about it earlier this afternoon and then when AGE started to show some life I thought maybe I’ll be able to reduce my position and trade for SGC. So many juniors had a good day today – seems like the Yukon plays are coming back to life as well. Have a good evening.

A comparsion of Sunridge with Nevsun

Bert — By the way Sunridge is a sidekick of Nevsun

Posted by Raccbannonn on Stockhouse.

Here are some facts regarding the CURRENT deposits of Nevsun and Sunridge:

Both companies deposits are in Eritrea.

Nevsun SP: $6.68 Market Cap: $1.34B Producer since Feb ’11

The Bisha Mine is expected to produce more than 1.14 million ounces of gold, 11.9 million ounces of silver, 821 million pounds of copper, and 1.3 billion pounds of zinc during its initially estimated 13 year mine life. In 2013, the processing plant will be expanded and transition into low cost copper, gold, and silver production.

Sunridge SP: .57 Market Cap: $67M Producing within 3 years?

Total Resource at Sunridge spread over 4 deposits:

• 1.28 billion lbs (580,000 tonnes) copper • 2.5 billion lbs (1,130,000 tonnes) zinc • 1.02 million oz gold • 31.8 million oz silver

BMR, what happened with VGD (Visible Gold)? Will it still be one of the best investments 2012?

Miserable

In case you are not aware, please be advised that the boys at BMR & Bert are now a blood brothers,

thus i have the authority to respond on their behalf. The answer to your question is ”YES”, VGD

will find a way, that’s how the system works, they go nowhere, if they don’t find a way & going

nowhere, will not feed their families or pad their bank accounts… In return, will you answer my

question, that is, do you think Miserable VGN will still be one of the best investments 2012 ?

Miserably yours,

Bert

Keep an eye on GDX. 9 days into drilling the newly discovered El Arco Property in Mexico. There is no evidence of previous exploration on this property which has an extensive vein system visible from surface. Larry Kornze called it the best undrilled property in the Americas. Very reputable management and geological team. High risk/high reward….do your own dd. This is not the only property. El Pato has a non compliant 400,000 ounces of gold and GDX has plans this year to mine the dip slope that has an estimated 20,000 ounces right on surface to generate cash flow. Thoughts anyone?

Poking fun at someone who is hurting is not a nice thing to do…

Dan I am a big GDX fan. El Arco drilling is very interesting and the grades at El Pato were extremely viable. This could be a real mover this year on some decent holes in Mexico.

Bruce – Poking fun at someone who is hurting is not a nice thing to do…

Bert – I feel a finger being pointed my way. If you call it poking fun, it is in a

lighthearted way & that is more than i can say for Johnny, who has left much to be

desired, when directing his comments at the BMR group. As far as hurting, he

certainly has given us the impression in the past, that he has been doing well with

other stocks, so go figure. I would suggest he is not hurting, but just plain mad.

I tell you what Bruce, if it really bothers you, i will quit as of this moment.

Have a good day. R !

WOW !!!!!!!!!!!!!!!

Jobs report very very positive in the U.S., Futures & European stock

prices moving up..Unemployment dropped to 8.3%… The one negative

thing for us is, gold “may” go the other way, we keep our fingers crossed.

Have a good day & that includes you Bruce. R !

50 minutes to market open. Before the jobs report, GOLD went

from being flat to -8., DOW futures went from being flat to + 112.

We have lots of time for further change.

Its an election year, the current administration is going to do everything they can to put a positive spin that the economy is good and all is well, all a bunch of lies, in my opinion.

Thanks again for the blog.Really thank you! Keep writing.