TSX Venture Exchange and Gold

The CDNX continues to “rock” and posted its seventh straight weekly gain, climbing another 36 points with volume increasing as well. The Index got as high as 1673 Friday (an area of resistance) before closing up 5 points for the day at 1665.

There’s no question in our view that the CDNX is now in the early stages of a powerful bull market phase that should ultimately (by late 2013 or early 2014) take the Index back up above 3000 to test the 2006 and 2007 highs. That’s a double from current levels which means this is a fabulous time to be searching for potential “10-baggers” (Rainbow Resources, the former “shell” that we uncovered in December when it was trading around 14 cents, is a good example of a stock with the right ingredients to become a “10-bagger”) as there will be more than a few serious “home runs” in this kind of bullish environment.

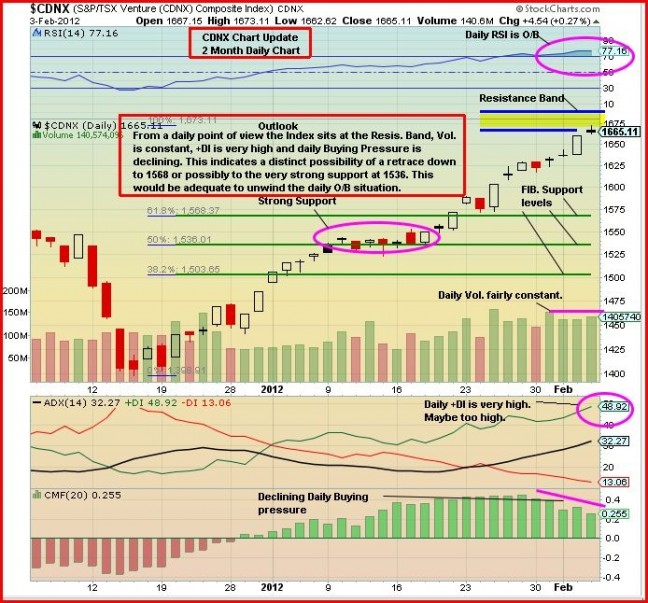

Using 2009 and 2010 as a guide, expect some minor pullbacks (less than 10%) in the CDNX over the coming months but any weakness will present buying opportunities. The 10 and 20-day moving averages (SMA) should provide strong support and they are currently sitting at 1625 and 1585, respectively. Below that, the now-rising 50-day SMA is rock-solid support around 1530. At some point this month, probably sooner rather than later, we expect a minor retracement which would actually be healthy as it would help unwind the current overbought condition on the daily chart as shown below.

The 50-month CDNX weekly chart paints a very bullish overall picture with the Index climbing in a Pitchfork channel. While this market is currently up against resistance, it’s only a matter of when – not if – this resistance will be overcome. It’s reasonable to assume, based on technical analysis, that the CDNX has an excellent chance of testing the 1800 level by sometime in March.

The Venture Exchange put in one of its best January performances of the last decade by posting a gain of 10.28%. History shows that this is an extremely bullish sign for the balance of 2012. Other years that included a strong January were 2002, 2003, 2006 and 2009 – the CDNX gained in each of those years and jumped over 60% in 2003, over 30% in 2006 and a whopping 90% in 2009.

The Dow, meanwhile, roared to a 3.5-year, pre-recession high last week while the Nasdaq hit its best level since 2000.

Encouraging Economic Growth

The United States has just posted its 18th straight week of stronger economic data including Friday’s better-than-expected employment number (just imagine how the U.S. economy could perform under a President focused on wealth creation instead of class warfare and wealth redistribution). Recent upticks in vehicle sales, same store sales, homebuilding and manufacturing data have given the markets plenty of encouragement, while manufacturing data from Europe and China is exceeding most forecasts. The global PMI (Purchasing Managers Index) has jumped considerably since November.

Money Supply Growth = Higher Gold & Stock Prices

The growth in global money supply recently is very bullish for commerce and the markets. According to ISI Group, 78 “easing moves” have been announced around the world in just the past five months as countries (China being hugely important) look to stimulate economic activity. Global money supply rose 8% year-over-year in December, or about $4 trillion, according to ISI.

Gold

Gold’s 2012 weekly winning streak was snapped Friday as the yellow metal fell $32 an ounce to close at $1,726 for a loss of $11 from the previous week. This was a healthy and much-needed pullback. It should also be short-lived with support expected to hold around $1,675.

The Year of the Dragon Lunar New Year holiday in China set a new record for Gold buying. Sales for the two top jewelry sellers reached about 600 million yuan ($95 million), a nearly 50% jump over the prior year. Gold is certainly emerging as one of the preferred investment choices in China.

Silver, which gained over 20% in January, gave up just 29 cents last week to close at $33.99. Copper added 2 cents, closing at $3.89. Crude Oil fell $1.72 a barrel to $97.84 while the U.S. Dollar Index added one-tenth of a point to finish at 78.94.

The “Big Picture” View Of Gold

As Frank Holmes so effectively illustrates at www.usfunds.com, Gold is being driven by both the Fear Trade and the Love Trade. The transfer of wealth from west to east, and the accumulation of wealth particularly in China and India, is having a huge impact on Gold.

The fundamental case for Gold remains incredibly strong – currency instability and an overall lack of confidence in fiat currencies, governments and world leaders in general, an environment of historically low interest rates and negative real interest rates that won’t end anytime soon (inflation is greater than the nominal interest rate even in parts of the world where rates are increasing), massive government debt from the United States to Europe, central bank buying, flat mine supply, physical demand, investment demand, emerging market growth, geopolitical unrest and conflicts, and inflation concerns…the list goes on. It’s hard to imagine Gold not performing well in this environment. The Middle East is being turned on its head and that could ultimately have major positive consequences for Gold.

3 Comments

BMR,

Does anyone know how much cash Isign has?

TIA

Alexandre, this is from the most recent MD&A. I had good success with ISD last year and if the activity continues I will certainly invest again. May as well take advantage of the stocks that are moving in this first quarter rather than holding the ones that don’t have much liquidity nor making gains.

“Currently the Company has cash balances, at October 31, 2011 of $943,153, that the Company anticipates will carry it through February 2012. In

November 2011, the Company has allocated $150,000 to retire the note payable. Additional one time expenditures, relating to professional legal and audit

costs, on the Pinpoint acquisition, will also deplete cash balances over and above the normal level of cash utilized in funding the loss from operations. In

addition, the Company anticipates that its maintenance obligation under the Pinpoint/Couche-Tard Macs Milk deal may require some additional capital.

The Company continues to expend cash to fund its operating losses and is reliant in the short term for working capital funding from equity raises. The

Company is currently actively pursuing a new equity raise that it anticipates closing in early 2012. Additional capital will be required for the contemplated

roll-out of iSIGN’s smart antenna related to the retail advertizing business.”

Thank you Andrew.