Gold is firmer this morning…as of 5:30 am Pacific, the yellow metal is up $13 an ounce at $1,747…Silver has gained 26 cents to $33.87…Copper is up 4 pennies to $3.78…Crude Oil continues to surge, adding $1.35 a barrel to $104.59 while the U.S. Dollar Index is flat at 79.11…

The euro zone has once again successfully kicked the Greece debt can down farther down the road…euro zone finance ministers sealed a 130 billion euro ($172 billion) deal for Greece early today to avert a chaotic default next month after persuading private bondholders to take greater losses and Athens to commit to deep cuts…how Greece addresses its growth deficit, however, remains to be seen…ultimately Greece will cave in and default but right now it’s not an issue to lose any sleep over…central banks are printing money faster than rabbits can make bunnies, so as investors that’s all we need to know…Gold is going higher and so are the markets in general…

Keep focused on the big picture…the recent growth in global money supply is very bullish for the markets…the euro zone, U.S. and Chinese economies will fare better than most were fearing last year…and the European Central Bank’s long-term refinancing operations (LTRO), which flooded the markets with $644 billion in cheap cash last December, marked a turning point in propping up the region’s battered banks and improved liquidity tremendously…it was a liquidity crunch in Europe last fall that temporarily drove Gold lower…

Have you ever heard of the Office of the Extractive Sector Corporate Social Responsibility Counsellor?…that’s indeed a mouthful, and at first glance one might think it’s a government department in Ecuador or in some other left-wing, screwed-up regime…in reality, it’s a federal agency created by the Stephen Harper Conservatives to mediate complaints about Canadian mining operations abroad…it has spent more than $1.1 million in the past two years but has yet to mediate anything, another classic example of Big Government failure and waste of hard-earned taxpayers’ money…the CBC (another waste), to its credit, has uncovered the boondoggle of the Office of the Extractive Sector Corporate Social Responsibility Counsellor (good grief) in a report the other day…the agency has racked of hundreds of thousands of dollars in travel, entertainment, training, meetings, reports and other expenses according to documents obtained by the CBC…its senior official, Marketa Evans, has been flying around the world to conferences, roundtables, workshops and other meetings – in all, 47 trips to Africa, South America, Washington and cities across Canada…she earns up to $170,000 a year…what the agency hasn’t done is mediate a single complaint against a Canadian mining company…the fact this information was uncovered by the CBC is definitely ironic in that the CBC is the embodiment of all that’s wrong with Canada – a taxpayer-subsidized ($1.1 billion a year) state broadcaster with a sense of entitlement and a liberal agenda and created out of a national inferiority complex…a stronger, more confident Canada in the 21st century doesn’t need the money-sucking CBC any more than it needs an Office of the Extractive Sector Corporate Social Responsibility Counsellor…

Today’s Markets

Stock index futures are pointing toward a positive open on Wall Street…with just seven more trading days remaining this month, including today, we are anticipating a breakout in the Venture Exchange through the 1675 resistance area prior to the beginning of March…that will set the table for an explosive move up to at least the 1800 area (the 500-day moving average) where the CDNX will meet some temporary resistance…in fact, after busting through 1675, all it would take is a 19.4% jump from there for the Index to reach the 2000 level and that’s what could be in the cards next month before a 10% haircut correction…that’s just speculation but it’s a very real possibility given the very bullish CDNX chart…there is still plenty of cash sitting on the sidelines to produce that kind of “reverse capitulation” event…that’s when the naysayers and doubters finally cave in and their fear turns to greed as they throw in the towel and embrace the market as it shoots higher, not wanting to lose out on additional gains…

Silver – New All-Time High In 2012?

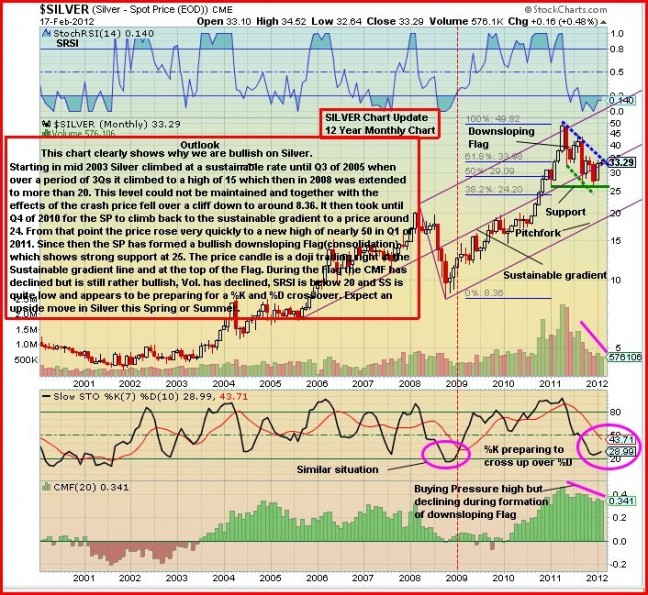

The chart for Silver is looking exceptionally bullish which is why we’ve been putting forward a lot of Silver stocks recently (producers and explorers)…John’s 12-year monthly chart below tells the story – look how the SRSI has bottomed out…this is the best time since late 2008 to be long on Silver and Silver stocks…

Base Metals – Barclays Sees Sharp Demand Pick-Up

Barclays Capital says its leading indicators for base metals demand point to a sharp pick-up in demand momentum toward the end of first quarter and into the second quarter this year…this is certainly consistent with our bullish outlook for the Venture Exchange…analysts cite recent purchasing managers indexes in U.S., China and elsewhere…”This does not discount the cyclical slowdown that EM (emerging markets) and the global economy still face for this year, but it probably encourages market participants to look beyond the downturn and should bode well for metals demand,” Barclays stated…”The latest reading of our leading indicators for base metals demand now points to a clear pick-up in demand growth starting in late in the first quarter…our leading indicator experienced a sharp m/m (month-on-month) increase, the sharpest increase since the start of our series in 2005″…

St. Andrew Goldfields

A company worth performing some due diligence on is St. Andrew Goldfields (SAS, TSX), a profitable Gold producer focused on the Timmins mining district…SAS appears to have broken out of a downtrend that started in the second half of 2010 after the stock climbed just above $1.70…SAS gained 25% last week on a sharp increase in volume, closing Friday at 52 cents…the company has 368 million shares outstanding but enjoyed an impressive fourth quarter (net income of 4 cents per share, record production, earnings and cash flow) and expects to produce 90,000 to 100,000 ounces of Gold this year while reducing cash costs per ounce…John’s chart shows the stock has good upside potential from current levels…

Note: John, Jon and Terry do not hold positions in SAS.

36 Comments

Good day for CQX!

Kalkan – CQX is going to make a new yr high. I had a position in CQX in January but sold – Oops!

I should have checked the insider activity before I sold – Elmer Stewart would likely know the potential of Goldstrike better than anyone.

Why is CQX going up I do not see any news?

Great day for CQX…..they tied up an excellent land package in Utah last year, a former gold-silver camp, as we’ve written about, but Cadillac management had a bad year in 2011 in terms of execution in the market and with their projects…hopefully this will spark a turnaround…we have some readers who have been holding CQX and are quite happy this morning…congratulations! Goes to show that patience can quite often win the day…

For me the deciding factor to increase shares in CQX was to see Elmer Stewart as a director and shareholder. He is the CEO of Copper Fox Metals with a massive Copper/gold deposit in Canada. Gave me quite a confidence vote in CQX also.

I think I am going to throw up, how does this happen, I sold all my CQX on friday to finally get into Rainbow my life story, hide the guns…

Niiiiiice rise in CQX today. Banked profits of over 450%, good luck to anyone else holding on in there.

Dont know if its been mentioned already, but might be of interest to Rainbow holders-

smartstox.com/interviews/rbw/02-19-12?rss

Is this a kind of move we could have with rbw? Hope for you Greg!

25’s on RBW are disappearing…we have found some good properties before…RBW is a gem…

Ouch Greg, feel little bit sorry for you man. I dont own cqx at all. Wish I did…

we will have new all time high today :-), next target 0.35 cent and will still be cheap!!

Greg – CQX had big news this morning:

Cadillac Mining Intersects 1.25 g/t Gold Over 82 Meters; Confirms Significant Mineralization at Goldstrike

Wish there had been a BMR alert! 🙂

There would have been, but this happened so quickly, Andrew….

What this shows, in the bigger context, is how the market has truly shifted from the bear phase to a new bull phase…speculative money is coming back into a lot of deals…March could be absolutely huge…the bears are going to be run over completely and fortunes are about to be made IMHO…

Andrew peux tu m’envoyer L2 si t’as encore mon email please,

L2 sur RBW 🙂

It also shows the folly of jumping from stock to stock just because the share price falls or doesnt move. Patience is a scare commodity these days. Also shows the time to start buying was when BMR turned officially bearish…there were stocks trading at cash value in Nov/Dec. Couldnt really care less (and I said so at the time)what a chart says to do, fundamentally thats giving them away.

Mark – Thanks for the Smartstox link – good interview. 🙂

Oui, Martin!

All time high for RBW 🙂

Thanks Andrew, ca regarde bien!!

Bienvenue, Martin

I think I like the way RBW chart looks – no piercing arrow on the candle, RSI overbought but still room to move up before a pullback. Am I reading it correctly John, Martin , anyone? 🙂

With speculation, 2 news suppose to come, this week and the other, the 43-101 report, silver bullish, cdnx charts strong, I would not trade at these level.

Another former favorite ABI moving nicely also. This has been a long time coming.

Talked with IR via email. News still most likely this week. Looks like the time has come to start averaging UP.

on RBW that is…

Cadillac drills 82m of 1.25 g/t Au…

This same company putting out this same result WOULD NOT have resulted in this same reaction at any point in 2011.

Couldnt agree more with Johns Comment (#14).

I’ve watched the volume on the venture go from an average of 70 million or so through most of last year to 120 million+ over the last 6 weeks or so.

My sense is this is smart money, coming in and picking up on the value weve all been whining about for over a year now.

The fact that so little significant gains have been seen with the pickup in volume being so dramatic is indicative of responsible buying and not that of “the herd”.

GLTAL…

this could be our year.

Thanks Martin and others, I held on to CQX for a long time watched it go down and did not want to take the loss,It was actually last thursday made the decision to sell and put it into RBW, all I can do now is laugh, another lesson learned. GO RBW!!!

JON/BMR

you are right about those small caps and low floats, they can really take off..

RBW now looking like it may have a record volume day to go with the all time high.

RBW makes a new record for daily volume on the Venture >720300

760k with over an hr left….

CQX – Jon… the drill results are the only ones they had to report yes????? they arent drilling in Wasamac… and thus no more results from Nevada.. am I accurate on that??

thanks in advacne mate

New interview with RBW

smartstox.com/interviews/rbw/

might have answered my own question.. but it still remains to be seen as to WHEN the other 19 holes may be drilled yes???????

Cadillac’s drilling program comprised three reverse circulation angle holes for a total of 567 meters (1860 ft). Undertaken in part to satisfy obligations pursuant to one of its patented claim lease agreements, the program was designed to provide cross-cutting information that will clarify the geometric relationship between mineralized intersections obtained in vertical drill holes completed 20 years ago.

Mineralized intervals have been sampled and shipped to an accredited laboratory for analysis. Results are expected in mid-January.

Cadillac holds a permit to drill 19 additional drill holes in this area, and has prepared several drill pads for this purpose.