Gold has traded in a range between $1,748 and $1,761 so far today…as of 5:50 am Pacific, the yellow metal is down $8 an ounce at $1,752…Silver is 32 cents lower at $34.03…Copper is off 4 pennies at $3.79…Crude Oil has backed off 47 cents to $105.78 while the U.S. Dollar Index is up one-quarter of a point to 79.29…

Stock index futures as of 5:50 am Pacific suggest a slightly negative open on Wall Street this morning…China’s manufacturing sector contracted in February for the fourth straight month as new export orders dropped sharply in the face of the euro zone debt crisis, the HSBC flash purchasing managers index showed this morning…nonetheless, the PMI – the earliest indicator of China’s industrial activity – rose to a four-month-high at 49.7 in February from 48.8 in January…the PMI has been below 50, which separates expansion from contraction, for most of the last eight months…

Fitch ratings agency this morning slashed its rating for Greek sovereign debt to “C” from “CCC,” indicating that default is “highly likely in the near term”…not exactly a surprising statement…

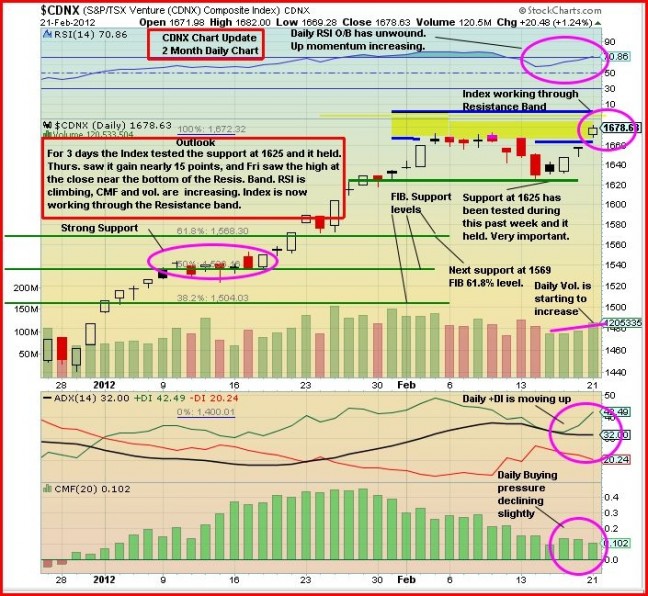

The TSX Venture Exchange enjoyed another robust day yesterday, gaining 21 points to close at 1679…the Index appears poised to bust through a resistance band…once that happens – and we’re certain it will – interest in this market should pick up significantly…below is John’s latest CDNX chart…

Additional evidence that the Venture Exchange is about to explode to the upside comes from analyzing the CRB Index…commodities are looking VERY bullish…

Cadillac’s Surge Confirms The Bullish Market View

One of our old favorites, Cadillac Mining (CQX, TSX-V), enjoyed a spectacular day on drill results out of Utah which really underlines how market sentiment has changed over the last two months…what Cadillac’s jump yesterday should confirm to naysayers is that indeed this market is in another major bull phase…we’ve written about Cadillac’s Goldstrike Project on several occasions over the past year and it does have excellent potential…CEO Victor Erickson and director and geologist Andre Audet worked very hard and skillfully at putting that package together – they tied up an entire former Gold and Silver mining camp – and they have to be commended for that…what they need to do now is capitalize on this opportunity, build momentum and “seize the moment”…this market side of the equation has been Cadillac’s weakness and hopefully this time management will do things right…in this business, execution on the ground is critical but so too is execution in the market…Cadillac needs to raise money with the right people in the right way and at the right price, and keep the momentum going with its Goldstrike Project…

Rainbow Resources (RBW, TSX-V)

A company that is doing well on all fronts is Rainbow Resources (RBW, TSX-V) which hit a new all-time high yesterday (27 cents) on record volume for the stock, just over 800,000 shares…Rainbow recently concluded a $1.1 million financing on almost entirely “hard” dollars, and the company is expected to provide a comprehensive report on its promising West Kootenay “Big Strike” Project in the very near future…just a guess on our part, but we think the odds are good the company will be coming out with news before PDAC…a company’s stock chart is a picture that tells a thousand words…below is John’s updated TA on RBW which closed yesterday at 26.5 cents…the short-term Fibonacci level John has calculated is 37 cents (that’s not a price target, just a theoretical level based on technical analysis and an understanding of the science of Fibonacci)…

Note: John and Jon hold positions in Rainbow Resources with Jon adding to his position again yesterday (Terry does not hold a position).

Arian Silver (AGQ, TSX-V)

We introduced AGQ to our readers about a month ago when it was trading in the mid-to-upper 20’s, and yesterday it broke out to close at 43.5 cents on the best volume since January 19…Arian is a small but growing Silver producer with its flagship San Jose Project in Mexico which still holds strong upside exploration potential…given our bullish outlook for Silver, Arian could do extremely well in the year ahead…below is John’s updated chart on AGQ…

Note: John holds a position in AGQ (Jon and Terry do not).

Adventure Gold (AGE, TSX-V)

Adventure Gold remains one of our favorites and its chart has turned very bullish…the company has started a 15,000 metre drill program at its Pascalis-Colombiere Gold Property near Val-d’Or, a property that encompasses the former producing L.C. Beliveau Mine…drilling and other exploration work up to this point clearly demonstrates that the Pascalis Gold system extends significantly to the north, the south and the west of the former Beliveau Mine…Richmont Mines (RIC, TSX) operates the adjacent Beaufor Mine and is keeping a close eye on results from Pascalis which would appear to be a possible “natural fit” for Richmont…Adventure is well-managed and has an outstanding geological team, so we truly believe this will be a breakout year for the stock…AGE jumped 4 pennies yesterday to close at 46 cents…

Abcourt Mines (ABI, TSX-V)

Abcourt is a company we started following over a year ago and we continue to like its potential given the quality of its Elder-Tagami Gold Property near Rouyn-Noranda and its very prospective Abcourt-Barvue Silver-Zinc Property near Val-d’Or…Abcourt perked up last week on some very nice Silver and Zinc assays…we’ll have more on ABI including a chart from John in the next couple of days…

7 Comments

Gold Standard Ventures hit well on the Carlin trend. GV. I’ve been hepped up on it for a while.

Gold and Silver break out seems imminent!

Encouraging to so little sellers on RBW after three strong trading sessions, Call that easy money 🙂 !

Encouraging to see so little on RBW after three strong trading sessions, Call that easy money 🙂 !

anyway hope you understand my point 🙂

Yes, Martin. RBW seems very controlled. In recent trading sessions I’ve looked at the volume and the number of trades and it’s fewer than I would expect for a penny stock, so I think that’s good. 🙂

i might consider selling some RBW shares at 75c…