It’s “Rock ‘n Roll” time again in northwest British Columbia’s prolific Sheslay district where first-ever drilling at Garibaldi Resources‘ (GGI, TSX-V) Grizzly Project has a realistic chance of producing an exciting new grassroots discovery for the Canadian exploration sector, especially considering the district’s remarkable drill hole success ratio.

Significantly, and this is crucial, if the Grizzly becomes the third straight discovery in this seemingly very rich district, on the third property drilled over the last 2 years, then not only would GGI soar but such an event would trigger a major recalculation of the overall potential value of the Sheslay Corridor with economies of scale tipping in the region’s favor. The more deposits the better, and if a high-grade starter area is also defined among the “cooked-up” Stuhini group rocks (either at Grizzly Central, the Hat or elsewhere), then watch out – early investors will reap fortunes.

Keep in mind that a mid-tier producer with a nearly $2 billion market cap (Centerra Gold, CG) has just joined the Sheslay neighborhood as it searches for more high-grade Gold on the periphery of this massive Cu-Au porphyry corridor that’s actually the size of the entire country of Singapore. In addition, BMR has learned through sources in Dease Lake that officials from a “senior mining company”, believed to be Antofagasta, made two visits in recent months to Doubleview Capital’s (DBV, TSX-V) growing Hat discovery. That project, of course, became a political football over the summer (because, quite simply, it holds value). A temporary “bump”, and certainly nothing that one of the world’s largest Copper producers couldn’t fix.

It should come as no surprise, then, that the Sheslay district is regarded by the Association for Mineral Exploration British Columbia as the province’s premier “greenfield project”, and one of the most prospective areas in the entire country for important new deposits.

Investors are starving for a new discovery somewhere, and an exceptional target area in the central portion of the huge Grizzly Property shares astonishingly similar geological, geophysical and geochemical signatures that guided geologists in the successful drilling of numerous outstanding holes on adjoining properties including the Hat, 10 km east of GGI‘s first-ever drilling. Wide intervals of mineralization comparable to Red Chris grades have been drilled at the Hat, and also at the Star deposit 10 km to the northwest. The last reported hole at the Hat featured the highest grades yet at that property including a 74-m section of nearly 1% CuEq.

Size Matters – The Sheslay District Has Immense Scale

Indeed, just to emphasize its scale, the Sheslay Corridor (about 600 sq. km) is similar in size and shape to the country (island) of Singapore, a global commerce, financial and transportation hub.

The Sheslay Story, Human & Geological:

Hollywood Couldn’t Have Written A Better Script

Just like with other major Canadian discoveries such as Voisey’s Bay and Hemlo, we predict there will be a book written about the emerging world class Sheslay district. There has already been enough drama, including some incredible twists and turns involving a fascinating cast of characters, to fill numerous chapters.

The latest chapter features Garibaldi actually getting to the drilling stage after all odds appeared to be stacked against the company over the summer, related of course to horrible market conditions and a district that was literally taken “hostage” over broader issues concerning the Tahltan and the provincial government.

The Sheslay district, protected for exploration and potential resource development through the all-important Atlin Taku Land Use Plan of 2011, is an issue that has gone to the highest levels of the B.C. government. Government officials are eager to see a mining camp emerge here within the context of the Land Use Plan and all the necessary and appropriate consultation and regulatory steps that led to the development of the Red Chris mine (120 km southeast of the Sheslay district) and the start of construction for Pretium Resources‘ (PVG, TSX) high-grade Brucejack Gold deposit.

Critically, of course, economic deposits have to be proven up in the Sheslay district. Fifty drill holes have been completed over the last 2 years, and about 90 altogether going back several decades, but no resource calculations have yet been carried out on the Hat or Star properties. Privately, geologists are musing about the potential for at least several billion tonnes of Cu-Au porphyry mineralization from multiple deposits, plus the possibility for one or more stand-alone Gold deposits. The drill rig is the truth machine and results will determine if the intuition and interpretations of top-notch geoscientists, geologists, geophysicists and others are correct.

Doubleview Drama

It’s critical to keep in mind, in our view, that the reason the Sheslay district is such a hot topic today, and one of Canada’s premier greenfield projects, goes back to the heroic efforts of Doubleview’s Farshad Shirvani. When the President and CEO of a junior exploration company mortgages his home and overcomes one obstacle after another in order to drill a grassroots property during extremely challenging market conditions, as Shirvani did in late 2013, and makes a significant discovery that sparks one of the few staking rushes Canada has seen in recent years, that qualifies such an individual for “Prospector-of-the-Year”. Doubleview became a 10-bagger – the stock price soared from 4 cents in December 2013 to 40 cents within 5 months. Subsequent rounds of drilling have produced even better results, so DBV’s upside potential remains very robust in our view. The Lisle Zone, measuring 1 km long and 500 m wide, appears to be part of a much larger Gold-rich Copper porphyry system extending in all directions.

Shirvani has shown incredible faith and courage. His efforts have also kept the district alive during the most severe downturn the industry has witnessed. As skilled as Garibaldi’s Steve Regoci has been at putting GGI shareholders in a unique position for possible dramatic events in the coming days and weeks, it has been Farshad’s resolve and steadfast determination that has made this district what it is today.

The Sheslay District “Heat Engine”

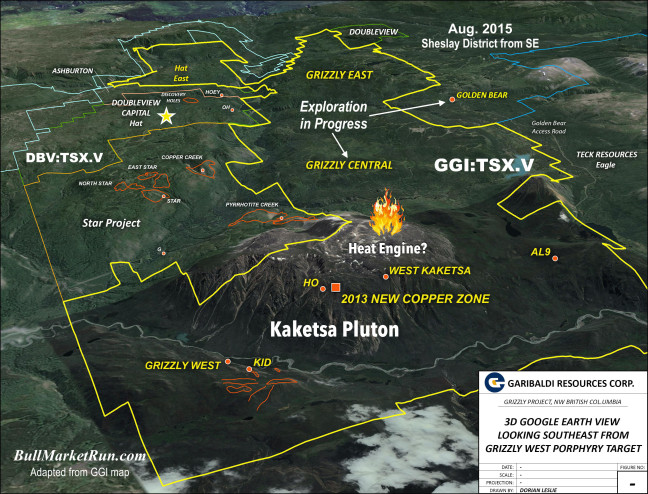

Much remains to be understood about Mount Kaketsa, the district’s most prominent topographical feature and a fertile pluton, and how it may have impacted the Sheslay district. One thing is for certain – around the world, major porphyry systems are known to be adjacent to fertile plutons.

The Sheslay district rests in the prolific Stikine Arch and features the “right” host rocks for Red-Chris style deposits. All the evidence to date from the three main properties (two of which have been drilled) along this Corridor suggests the following:

1. Mineralized systems in the district are powerful, extensive and deep with plenty of fluid throughput;

2. The volcanic and intrusive rocks are highly fractured – they feature classic alteration packages and veining patterns;

3. The consistency of grades (Hat and Star) in holes drilled to date is comparable to other Stikine Arch deposits;

4. Soil geochem, IP and mag data (Grizzly, Hat & Star) all demonstrate excellent potential for multiple deposits throughout the district.

Garibaldi – Initial Drilling On Trend With The “Heat Engine”

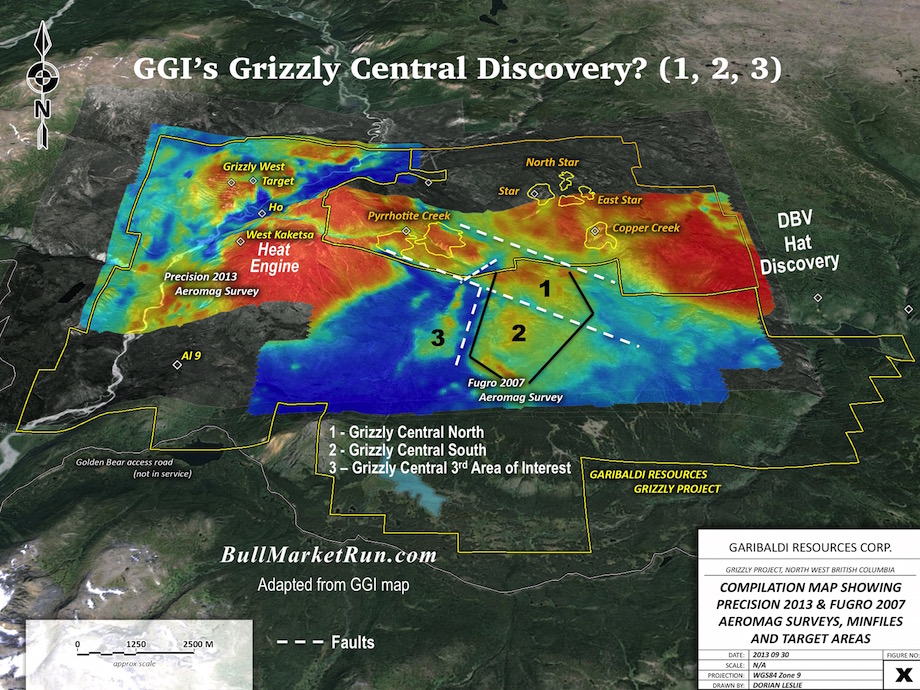

Grizzly Central is fascinating, and keep in mind it’s just one of seven major regional target areas on the property. Grizzly Central is mostly overburden-covered which helps explain why it was overlooked by historical prospectors who were drawn to other parts of the district where mineralization is exposed at surface. Underneath the glacial till at Grizzly Central, however, could exist something spectacular given the geological, geophysical and geochemical evidence collected just recently and over the last number of years since Garibaldi staked its original ground nearly a decade ago. GGI has been very astute in Mexico at using technology to cost-effectively find deposits on large land packages. They’ve been executing a similar strategy at the Grizzly.

Initial drilling at Grizzly Central will occur around the middle of “Area 3” (Grizzly Central Western Grid) as indicated on our modified map below. From the NW to the SE, you’ll note the Kaketsa “heat engine” and then what could be an “island” (Area 3) of geological paradise surrounded by a magnificent “ocean” of blue (mag lows). While that may sound a little dramatic, that’s an entirely appropriate analogy.

The “heat engine” and the mag lows are features that are believed to be highly significant and could be associated with potential mineralized porphyry centers in Area 3. Intriguing north-south trending geophysical anomalies (IP and mag) are flanked by elevated geochemical values in encouraging patterns that have been observed elsewhere in the district. Drill holes on adjoining properties have shown that the best mineralization is usually found adjacent to chargeability highs and mag highs in areas of more moderate or subdued geophysical response, with mag lows nearby. Geochemistry is a critical part of the puzzle.

In short, GGI has a series of outstanding targets. Knowledge of how to find the “sweet zones” of mineralization in the district has increased exponentially over the last couple of years – even over the last 6 months – and that gives Garibaldi geologists the roadmap they need to make an all-important discovery even more quickly than it took Doubleview in 2013 (8 holes).

This prolific district has already demonstrated its ability to flex its muscles, geologically and in the market. The grassroots drilling discovery at the Hat, announced January 20, 2014, breathed fresh life into the junior exploration sector.

Is Garibaldi about to do the same with Grizzly Central? There are sound reasons to believe they will as another Sheslay chapter begins.

Note: John and Jon both hold share positions in GGI. Jon holds a share position in DBV.

21 Comments

Nice, in a interview BMR did with John Buckle (Excerpt IV) DBV geologist, He said that usually high grade gold will occur 2 to 5 km from the heat source, That is exactly where grizzly central is.

Anyone at BMR holding a position of DBV?

Nothing’s changed on that, Les, from last time – just me, not John at this moment, but thanks for pointing that out as I didn’t paste the full text at the bottom. Fixed.

Jon GGI drill soon and DBV follow what is coming with PGX ?

Good question, Guy. Rumors have been floating around for several months that PGX is about to JV the Star to a bigger company. Considering that Centerra just stepped into the region, PGX could be closer to announcing something if indeed those rumors are correct (my hunch is those rumors make sense). The Star is a terrific property – there’s obviously a deposit at the Star target, and what needs to happen here is some aggressive step-out drilling – especially to the north where the North Star target looks very attractive. That’s what will build volume at this project.

Hi Jon, Nice job on the report today. Can you expand on your comment “officials from a “senior mining company”, believed to be Antofagasta, made two visits in recent months to Doubleview Capital’s (DBV, TSX-V) growing Hat discovery.”

Can you advise the readership of what time frame you mean by “recent months”? Is this Aug., Sept. or Oct.? And what dates if you know.

Thanks in advance.

Jon, do you know if Chad Day has filed his defence papers in the DBV upcoming court case??

Go Jays Go…

That I don’t know, Jeff, sorry.

Jon

In your opinion how many shares does one need to own of GGI to become a millionaire assuming of course GGI hits big at Grizzly

Thanks

Greg, let’s do a Blackwater comparison, for fun. Richfield of course made a massive Gold-Silver discovery, previously hidden by overburden, in central B.C. and went from about where GGI is to a $550 million stock buyout at $10.38 a share from New Gold in the spring of 2011. Of course that was at the height of the bull market. But if the Sheslay district becomes as big as some people think it could be, market caps in the hundreds of millions would not be at all surprising for GGI and DBV, for example. Keep in mind as well that GGI controls more than half the Corridor. The Grizzly is very valuable just for its shear size and how it would be a key part of any infrastructure development. Many, many factors involved, and exploration/drilling in the district is still in the early stages—-much to be explored and discovered. The upside is huge. So to answer your original question….200,000 shares, maybe? That would be nice. Keep in mind there will be some dilution along the way.

If GGI hits on a significant find, just for the fun of it I think Regoci should call it the Busang zone….that would draw some attention!

Busang Zone…now that was funny..good one.

Happy election day everyone!

Thanks Jon

I see a strong chance of a approx. 1 year out, complete take-out of GGI & PGX and possibly even ABR by Doubleview.

If so what percentage of a chance of this eventuality would you assign to this scenario playing out?

Thanks

Don I would be curious as to what your reasoning might be for thinking DBV may take out multiple other firms. I see DBV eventually getting taken out entirely themselves and it would be their potential dance partner (a Major) that may look at additional Sheslay land.

Jon,do you knows if drilling have start?

Long line ups at the polls in eastern Canada. Get out and vote , if you don’t, you have no right to bitch.

I suspect DBV is more then a year from signing on with any major.

He got approached by one of the biggest in the world shortly after hitting on holes 7&8, and offered him tens of millions I’ve heard rumoured, and he politely thanked them for stopping by and showed them the door.

Farshad believes he has a tiger by the tail and as BMR eludes, Antofogasta appears to be putting merit in the Hat as well, but just because the wind from the majors is blowing into the Sheslay, don’t think for a moment Farshad is about to relinquish his grip on his Hat without extracting every ounce of value he can, anyone that knows Farshad knows this.

Don’t forget, he is the biggest shareholder of DBV.

So I don’t see him signing any kind of arrangement with a major until he at least has a

initial 43-101 resource report in place.

Why else would he have the kahunas to step out 1 km

He intends to knock the ball out of the park and see DBV’s $tock lit up like a Roman candle.

If he hits like he thinks he will, I could envision DBV stock trading 5-10 million shares a day and the stock spiking 10 to 20 times from current levels.

Of course this is just my opinion

I hope GGI hits too, although I still only hold and acquire DBV shares, but the more the merrier…IMO

I may be wrong, but it seems to me, under current market conditions, there is a high level of risk associated with grizzly, and I prefer to put my money on DBV’s rock star technical team and the their faith getting the backing of majors nipping at their heels, helps solidify this decision.

Sure going to get interesting in Nov. that’s for sure, and hopefully make for a very bright Christmas this year.

Don I would have to agree with you on Farshads tenacity and his goal to maximize value. The fun question will be due to the immense size of this, which seemingly was reinforced by the 1km step out drill being stopped in mineralization, what is the potential size of this ore body and what may a potential buy out price be? Pure speculation at this point with far too may variables but fun none the less.

Don….holding a big position in DBV and having been in it for a few years I fully agree with you and patiently wait the big day. I have said many times here that DBV will be taken out before the end of 2016….

DBV will need fill in holes and at least one 1000m similar to the one at Red Chris before any major steps in . By the looks and the size of what’s at the Hat there will be more than one major taking interest. Farshad and Dr. Razeque believe the Hat has the goods , but they need more holes to prove it.

The audacity of that little twit in pulling the blockade stunt is unbelievable and I hope he gets the book thrown at him. The clock is ticking for Chad Day and he’ll get what’s coming to him by the 30th.