Mitek Systems (MITK, NASDAQ) handles more mobile banking transactions than anyone in the world. Roughly 1 of 5 Americans, and virtually all millennials, are using Mitek’s “MiSnap” technology without knowing it.

…what does it do?

It allows individuals and even large corporations to deposit checks remotely. Users simply take a picture of the check with their smartphone, and voila, no need to go to the bank!

“Remote Deposit Capture” (RDC) is the buzzword used to describe the process. Federal Reserve officials and virtually all the Big Banks say it’s the most important development our industry has seen in years. With an estimated user base of 70 million, you or someone you know is likely using RDC – and therefore Mitek.

Banks love this technology, and they’re spending Big Money marketing it…

Bank of America, one of Mitek’s 4,800 financial institution customers, said it closed 900 banks because customers are switching to “mobile banking”.

Banks lower their processing costs and customers save time, so it’s a classic win-win! Over its history, Mitek estimates MiSnap has saved banks billions, and users have saved millions of hours (plus countless headaches) by not waiting in line.

Mitek’s revenue from mobile deposit is driven by two factors…

1) Size of customer base/adoption

The top 10 largest retail banks are using it now – Mitek gets a licensing fee upfront.

2) Number of transactions

Mitek sells “blocks” of transactions, and each block represents millions of MiSnap uses – analysts estimate Mitek collects a few cents (or more?) per transaction.

To date, Mitek has focused on gaining market share. But now that banks and their customers have adopted Mitek’s technology whole-heartedly, I don’t see why they would resist small price increases going forward – especially given the strong return on investment (ROI) realized by the banks.

Arguably, the #1 risk for MiSnap would be a structural decline in check usage – according to The Fed, it has been declining at 9% annually. On the flip side, as of 2013, there were still approximately 18.3 billion checks written, so one shouldn’t expect “the check” to disappear as a payment method anytime soon. Bank of America’s data for 2014 showed Americans (retail customers) were depositing 170,000 checks per day, and mobile deposits grew by 30%.

Capturing the commercial customer…

Mitek’s usage rates going forward will be driven largely by “commercial” customers, and it has just recently tapped into this market – which is adopting quickly. Reportedly, a leading food distributor handling over 7 million invoices per year reduced its processing costs by 29% after converting to Mitek.

During the most recent quarter, new commercial customers included retailers, online gaming, and credit card issuers. This validates Mitek can be successful outside its core retail banking market.

“Mobile Verify” and “Mobile Fill” complement Mitek’s remote deposit applications…

New customer enrollment is the holy-grail for all businesses. Problem is, in today’s busy world few people can find 10 minutes to fill out a form. Here’s an example of how Mitek’s Mobile Fill solution helps an auto insurance company like Geico or Allstate enroll new customers in 2 quick steps:

- Take a photo of drivers license and insurance card

- Get your free auto insurance quote

Two years ago less than 5% of banks and insurers were signing up customers via mobile devices – now its 30%!

Corporations of all types spend billions on television and print ads to steer people to their websites. Unfortunately for them, the lead/customer is lost when the form isn’t filled out completely, huge percentages go abandoned (especially on smartphones because the keyboard is clumsy and webpage is clunky).

Completion rates go up dramatically when offering Mitek’s Mobile Fill because the only barrier between getting a new customer or not is taking a picture.

A few months back, TurboTax’ television ads were promoting how easy it was to file this year – just take a picture of your W2 and your taxes are practically done (I can’t verify TurboTax is using Mitek, but I’m confident you see the blue sky potential). Mitek also announced “a large pharmaceutical company” – read Walgreens or CVS, but eventually both – has embedded Mobile Verify into its mobile prescription management tool/App.

Also, Mitek’s Mobile Verify addresses two “pain points” in the financial industry…

1) Anti-money laundering requirements

2) Know your customer rules

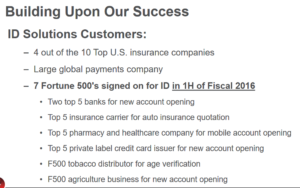

According to Mitek’s CEO Jim DeBello: “Mobile Verify is the digital equivalent of physically showing ID at a bank’s branch office.” Thanks to Mitek, banks of all sizes are streamlining their compliance process (cutting costs) and “verifying identities” in minutes instead of days. As of now, 3 of the 10 largest insurance companies are using Mitek’s Mobile Verify.

When a prospective customer is asked to “show up” physically to complete the enrollment process, abandonment rates skyrocket (up to 90%). Mitek’s suite of software offerings (which have nice margins by the way, over 70%) prove customers prefer a “self-service” environment, and a HUGE number of businesses across many industries are being forced to meet that demand for convenience – or risk losing business to a competitor.

Astute observers occasionally point out, wouldn’t these capabilities be a dream come true for fraudsters?…

Mitek argues losses from fraud in the mobile channel are de minimis compared to physical exchange – apparently desk clerks can be fooled in person (there’s some risk/reward here from the perspective of banks/insurers). However, as an added layer of security in the RDC process, Harland Clarke (the largest check printing company) has created special checks with embedded security features that can only be read by Mitek’s MiSnap (can you say “barriers to entry”, anyone, anyone?). You may have noticed, or will in the future, that almost all checks have an icon reading “Photo Safe” on the backside. With these additional security features banks are beginning to raise deposit limits allowed for RDC – this should drive commercial usage further.

…also worth noting, in the conference call CEO Jim DeBello noted: “Lots of Mobile Fill customers are turning toward Mobile Verify.” There’s somewhat of a symbiotic relationship between the two.

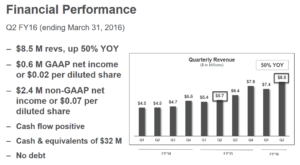

Fiscal year 2016 guidance was recently raised following MITK’s record $8.5M in revenues (up 50% YOY)…

2016 Revenue Est. = $32 – $34 million (judging by past performance below, Mitek’s estimates are conservative)

Non-GAAP earnings growth +20%

Cash on hand as of Q2 = $31.9M

Signed up 10 Fortune 500 companies with Mobile Fill ID (7 signed up in first half)

Analyst coverage and institutional ownership still minimal…

According to Whale Wisdom’s last update, Vanguard and BlackRock are the largest shareholders, but neither owns more than 3%. At this juncture there are only 3 analysts from Benchmark, William Blair, and Northland Securities covering MITK.

Other points worthy of mention regarding Mitek…

a) Consumer habits are changing…millennials demand a mobile, self-service experience

b) The undeniable trend points toward increasing usage rates and applications on mobile, mobile, mobile – using the camera as a keyboard is music to Mitek’s ears

c) Mobile Fill and Mobile Verify address a market upwards of $3 billion in size (not including remote deposit capture/RDC)

d) Large opportunities exist in the “shared economy”…think Uber, AirBNB, etc.

e) Mitek believes “all litigation except for patent trolls is behind them.”

f) Mitek’s core science and technology involves advanced algorithms, computer vision, and machine learning. It would argue with its first mover advantage, patents, and difficulties reproducing, that barriers to entry do exist.

i) Being pulled into other markets (healthcare, telecom, and retail) because of reputation in banking industry. Mitek is a well-known and trusted brand within the executive ranks at Big Banks.

j) Mitek says additional security features such as facial recognition, fingerprint, and iris are biometrics that can be done via camera in the future.

k) What some described as a “hit-piece” from “Street Sweeper [dot] org” recently knocked MITK down from $9.50 into the $7’s. I believe the article presented no new information, and its purpose was to make a quick buck on the short side. In the process it allowed new institutions to get in – Mitek has a tight share structure with just over 32 million outstanding.

MITK market cap as of June 17 = $240M

About the writer: Daniel T. Cook, the newest member of the BMR team, is from the great state of Texas. Daniel has a strong passion for the junior resource sector and has followed the Venture and broader markets with great interest since he bought his first stock 18 years ago at the age of 12. He’s also a licensed investment professional who was a Bright Future’s Scholar at the University of Central Florida, graduating in 2010 with a major in Finance. We know our readers will enjoy his material and benefit from his wisdom and insight. We welcome him aboard!

Note: Dan has a long position in MITK.