North Arrow Minerals (NAR, TSX-V) Added To BMR Portfolio

At BullMarketRun we have consistently and significantly outperformed the market by finding companies that the crowd hasn’t discovered yet but will, stocks that are undervalued and offer something truly unique and of value to investors (our average stock gain is over 100% with an 86% success rate). We’re constantly searching for “home run” opportunities – stocks that have the potential to increase by hundreds or even thousands of percent – and today we’re pleased to unveil a company that we have every reason to believe is going to become a grand slam for BullMarketRun readers – North Arrow Minerals (NAR, TSX-V).

North Arrow is a tremendous addition to the BMR portfolio as it has everything going for it – strong exposure to lithium and diamonds along with base metal and gold projects – including a special kind of leadership that has convinced us this company is destined to succeed in a huge way.

“You’ll never see me sell a single share unless of course we get ‘taken out’,” declared Gren Thomas, North Arrow President and CEO, during our interview. “I’m totally committed to this.”

Retirement is the last thing that’s on the mind of the 69 year-old Thomas. He’s a Canadian mining icon who’s itching and striving for another triumph, and to help him in that quest he has reconnected with another industry legend and long-time friend Dr. Chris Jennings (more on that shortly). Both are proven mine finders and company builders – to have two individuals of their stature and expertise in a junior resource company trading with a market cap of less than $9 million is an incredible ground floor opportunity for any investor.

Thomas has carefully aimed this particular “arrow” and we suspect, with Jennings’ help, he’s going to hit the bull’s eye with his aggressive plans to make North Arrow a big winner. Over the last number of months Thomas has strategized and laid the groundwork for a successful 2010 for North Arrow and he’s ready to start executing the plan immediately on all fronts.

Thomas is no stranger of course to major discoveries which is why he won PDAC’s Prospector-of-the-Year Award in 1999 and was inducted into the Canadian Mining Hall of Fame just last year. His mining career began at the age of 16 in the coal mines of his native Wales. In his 20’s he moved to Canada where he started with Falconbridge and then eventually honed his prospecting skills. Over several decades he built up an impressive track record of discoveries, culminating in the early 1990’s discovery with Jennings of diamond deposits ultimately developed into the world class Diavik mine in the Northwest Territories.

Only time will tell if North Arrow becomes Gren Thomas’s next Aber Resources, but one of the smartest strategies when it comes to investing in junior resource stocks is finding a company led by an individual such as Thomas who has major discoveries already under his belt and a burning desire to build on that success.

What really struck me in my conversation with Gren was his energy, passion and determination to make something big happen with North Arrow. He’s in great health – works out at the gym nearly every day – and is clearly focused on the task at hand which is building a junior mining company and shareholder value in the process. Money can’t really be his motivation – he’s already one of the richest men in the country – but having his name attached to another major discovery probably is.

So how exactly is Thomas going to pull things off with North Arrow?

There are many moving parts to the North Arrow story – it has a very diverse portfolio – which is why we’ll be reporting on this company extensively in the weeks ahead as we examine all the individual components that make it so attractive. In this article we’re going to focus on North Arrow’s two immediate goals – defining a substantial lithium deposit in North Carolina and making a world class diamond discovery at Lac de Gras.

Location – North Arrow’s Lithium Success Driver

Approximately one-third of global lithium production is derived from spodumene which is found in pegmatite rocks while the remaining two-thirds comes from brines, salts and clays. We could write 10 pages just on lithium itself, the advantages and disadvantages of the different types of deposits and the demand-supply scenario moving forward, but that information can easily be found elsewhere. The bottom line is that a good lithium stock makes sense in a portfolio right now and North Arrow has a major competitive advantage over many of its peers based on the location of its Beaverdam Project. With lithium, as in real estate, it’s location, location, location.

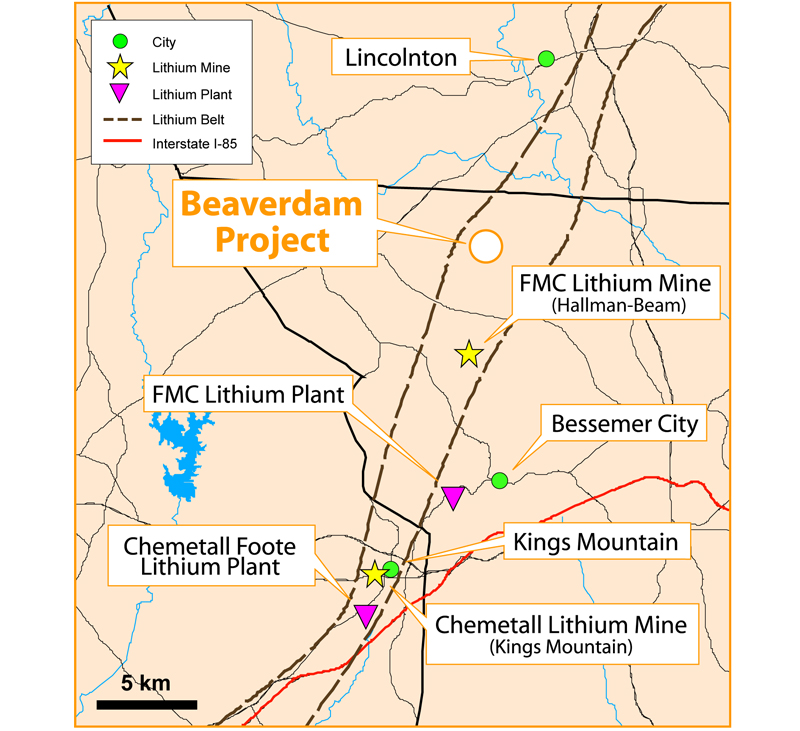

North Arrow’s Beaverdam Project is right in the heart of the 60-kilometre long, 1.6 kilometre wide Tin-Spodumene belt of North Carolina which historically, from just after the Second World War into the 1980’s, was the most important lithium producing region in the world. By the mid-80’s, though, producing lithium from brines became more economically viable than from the aging Foote Mineral and Hallman-Beam spodumene deposits and these mines were forced to close (large reserves still exist but these are deep deposits that would require significantly higher lithium prices and stronger demand for mining to be reactivated).

Thomas’ track record clearly demonstrates he knows where to look when it comes to trying to discover a potential mine. As the lithium market took off last year he saw opportunity around these former producing mines in North Carolina. He tied up a strategic land package that has already returned promising results for North Arrow with an important follow-up 2010 program to begin almost any now day now. The Beaverdam Project is focused on an area where past exploration and evaluation work was completed by the Lithium Corporation of America (predecessor to FMC Lithium) between 1950 and 1996.

“The North Carolina belt probably represents the premier locality in the world to be exploring for lithium pegmatites,” stated Thomas. “The history of lithium production in the area, access to excellent transportation and power infrastructure, and proximity to the existing downstream lithium production plants of FMC Lithium and Chemetall Foote makes this an ideal location to potentially define additional American domestic lithium resources.”

With critical infrastructure including processing already in place, lowering potential production costs, it’s very conceivable that North Arrow could compete financially with most of the lithium brine prospects under development if it’s able to define a significant deposit. In addition, fast-tracking a deposit to the production stage would be easier to do in North Carolina than just about anywhere else.

North Arrow completed a shallow 12 hole (1,235 m) drill program in the fall of 2009 with all holes intersecting spodumene mineralized pegmatite (10 of the holes produced intervals ranging from 4.11 m to 13.20 m). Many of the grades were over 1% Li2O and roughly in line with historical grades of 1.5% at the nearby two past producing mines. North Arrow started work at Beaverdam in the spring of 2009 when 14 of 16 widely spaced grab samples returned more than 1% Li20 including values as high as 4.4%.

Highlights from different drill holes included 13 m @ 1.24% Li2O; 12 m @ 1.18%; 8 m @ 1.04%; 7.89 m @ 1.33%; 7.7 m @ 1.04%; 7.57 m @ 1.16% ; 6 m @ 1.10%; and 4.67 m @ 1.54%.

No less than 37 pegmatite bodies have been mapped at Beaverdam over a 1.7 km by 1 km area. Only nine of the mapped pegmatites were drill tested last year, so the drill program that’s just about set to begin is going to be substantially larger. The drill bit will tell the tale, but the possibility of an open-pit deposit being defined at Beaverdam over the next several months is very real.

The success of Canada Lithium (CLQ, TSX-V) in taking over and developing a former lithium mine in Quebec underscores Beaverdam’s potential viability as the two projects share some similarities. CLQ just came out with a 43-101 pre-feasibility study of its project, also a spodumene deposit, which gave measured and indicated resources of 31.6 million tonnes grading 1.11% Li2O. The company has a market cap of just over $100 million.

Dynamic Duo Reunites In Hunt For Diamonds At Lac De Gras

In November, 1991, Thomas and Dr. Jennings left Yellowknife to start the staking of what is now the Diavik diamond mine. And now the “Dynamic Duo” are back together again in hopes of making another major discovery at Lac de Gras where North Arrow holds 42 claims over 100,000 acres in close proximity to a pair of mines – Diavik and Ekati – that are among the richest diamond deposits in the world. The Diavik trend projects through the centre of North Arrow’s holdings while the Ekati trend projects through the western margin.

Jennings, the former President/Chairman of Southern Era Resources which was taken over for more than $100 million three years ago, really needs no introduction as he’s truly a legend in the diamond industry. He has just completed a half million dollar private placement with North Arrow and has entered into a 50-50 joint exploration deal with the company on its Lac de Gras holdings.

With the aid of proprietary technology, Jennings recently completed a review of detailed airborne geophysical data collected over North Arrow’s extensive holdings and has identified a total of 57 priority kimberlite targets which will be explored this summer. Searching for economic kimberlite pipes can be like trying to find a needle in a haystack, but Jennings and Thomas are in the super elite category of this business and they’ve succeeded at this before. The combination of these two working on North Arrow’s diamond assets is a very powerful dynamic. It’s also going to generate some interesting speculation. Will this renewed partnership between Thomas and Jennings expand in some way with North Arrow in the near future? Could there be something even bigger in the works here?

Share Structure

North Arrow, which closed April 5 at 22.5 cents, currently has 38,564,544 shares outstanding after Jennings recently purchased 2,780,000 shares at 18 cents. The company is in the process of completing an additional $1 million financing, so it is well positioned to aggressively pursue exploration programs at both Beaverdam and Lac de Gras. Thomas is believed to control nearly 20% of the company, based on the current shares outstanding, while Strongbow Exploration (SBW, TSX-V), which Thomas is Chairman of, holds 4.8 million shares or 12.5% of North Arrow.

North Arrow currently has 11,793,250 warrants outstanding (five million at 20 cents expire June 1) at an average weighted price of approximately 18.5 cents. There are also approximately three million options outstanding at prices ranging from 20 cents to 40 cents.

The current market capitalization of only $7.7 million, based on the April 6 closing price of 20 cents, leaves North Arrow with major upside potential (the average market cap in the BMR portfolio prior to the addition of North Arrow was approximately $20 million).

Bottom Line

North Arrow is a perfect fit for the BMR portfolio – it has been flying under the radar screen and its low market cap gives it considerable immediate as well as longer term upside potential. The company is extremely well positioned to deliver shareholder value through high quality properties and superior management/geological expertise. North Arrow is well financed and ready to immediately proceed with its exploration plans beginning with a major drill program at its Beaverdam lithium project. With Gren Thomas at the helm and another mining legend at his side, Dr. Chris Jennings, the blue sky potential of North Arrow is very real and truly exciting.

Technically Speaking

North Arrow is also very attractive from a technical standpoint with the most significant factor being a recent turnaround in its 100-day moving average as shown in the dark blue line on the chart below (the 50-day SMA is in light blue). All of NAR’s moving averages (10, 20, 50, 100 and 200) are in bullish alignment and Stochastics and RSI are essentially neutral, showing the stock is neither overbought or oversold. NAR should gain momentum as it crosses and stays above its 200-day SMA which is 21.5 cents. The stock could really start to fly once it clears resistance in the upper 30’s where it got ahead of itself and shot up to last August and September.