11:15 am Pacific, Oct. 14, 2024

B.C.’s Moment of Decision:

A Chance To “Take Back Our Province”

In a classic example of the woke culture that is destroying British Columbia after 7 years of NDP rule, an Indigenous man who stabbed a senior to death in Vancouver’s Biltmore Hotel building in 2020 will not go to jail for the crime in a mind-boggling decision released online by a judge last Friday just ahead of the Thanksgiving long weekend (someone was hoping this wouldn’t get noticed). Yes, in a province where the NDP government enthusiastically became a drug dealer and further endangered public safety by allowing repeat offenders to get back on the streets, a person – especially if they’re Indigenous – can literally commit murder and essentially get away with it (read the shocking details here).

Judge Reginald Harris determined in the case of 31 year-old Anthony Warren Woods, “I find as a fact that his level of culpability was substantially reduced. My conclusion is based on the following collective factors: Mr. Woods’s direct and indirect experiences as an Indigenous person; his significant cognitive deficits; his ADHD; and to a lesser extent his state of intoxication. Mr. Woods’s impairments must not be considered in isolation from his experiences as an Indigenous person, that is they must be viewed collectively and in doing so it is inescapable that his impairments directly contributed to his offence.”

Woods pleaded guilty to manslaughter in the stabbing death of 72-year-old Alex Gortmaker who died of a single knife wound to the chest on the floor of the former hotel on December 15, 2020. Judge Harris gave Woods a 2-year conditional sentence. He must stay in his residence at a recovery home in the B.C. Interior for 24 hours a day for the 1st year, followed by a year of overnight curfew before he is released on probation. He must not possess any weapons or use drugs or alcohol, and he must keep the peace and be on good behaviour.

The above story is just the tip of the iceberg, yet another example of how British Columbia under the woke and socialist NDP is rapidly turning into a cesspool like many parts of California which are now suffering immensely from disastrous far left “progressive” policies and insane judicial decisions.

On Saturday, October 19, British Columbia voters will have a clear choice – remain on the current path and watch their province blow up, creating a mass exodus of human and financial capital to other more favorable jurisdictions like Alberta and Saskatchewan, or choose common sense change to get back on track and reclaim B.C.’s competitive advantage.

Saturday’s decision in B.C. – a new direction with a Conservative government or 4 more years of NDP – will reverberate across Canada and impact investors from coast to coast.

Approximately 1,000 publicly listed mining and mineral exploration and development companies are headquartered in B.C., so resource and economic policies in this province are critical to the health of the broader Canadian mining/resource sector.

Some other facts to consider:

The NDP’s focus is on bigger government and redistribution of wealth, not creation of wealth, meaning the province is not realizing its full economic potential. B.C.’s private sector should be firing on all cylinders but it’s not due to excessive regulation and over-taxation of individuals and businesses;

B.C. now has the 4th-highest top combined (federal/provincial) personal income tax rate in all of North America at 53.5%, according to the Fraser Institute;

The B.C. NDP has raised one tax after another to feed its spending addiction including a hike in the general corporate income tax from 11% to 12% in 2018, deterring badly needed investment in the province;

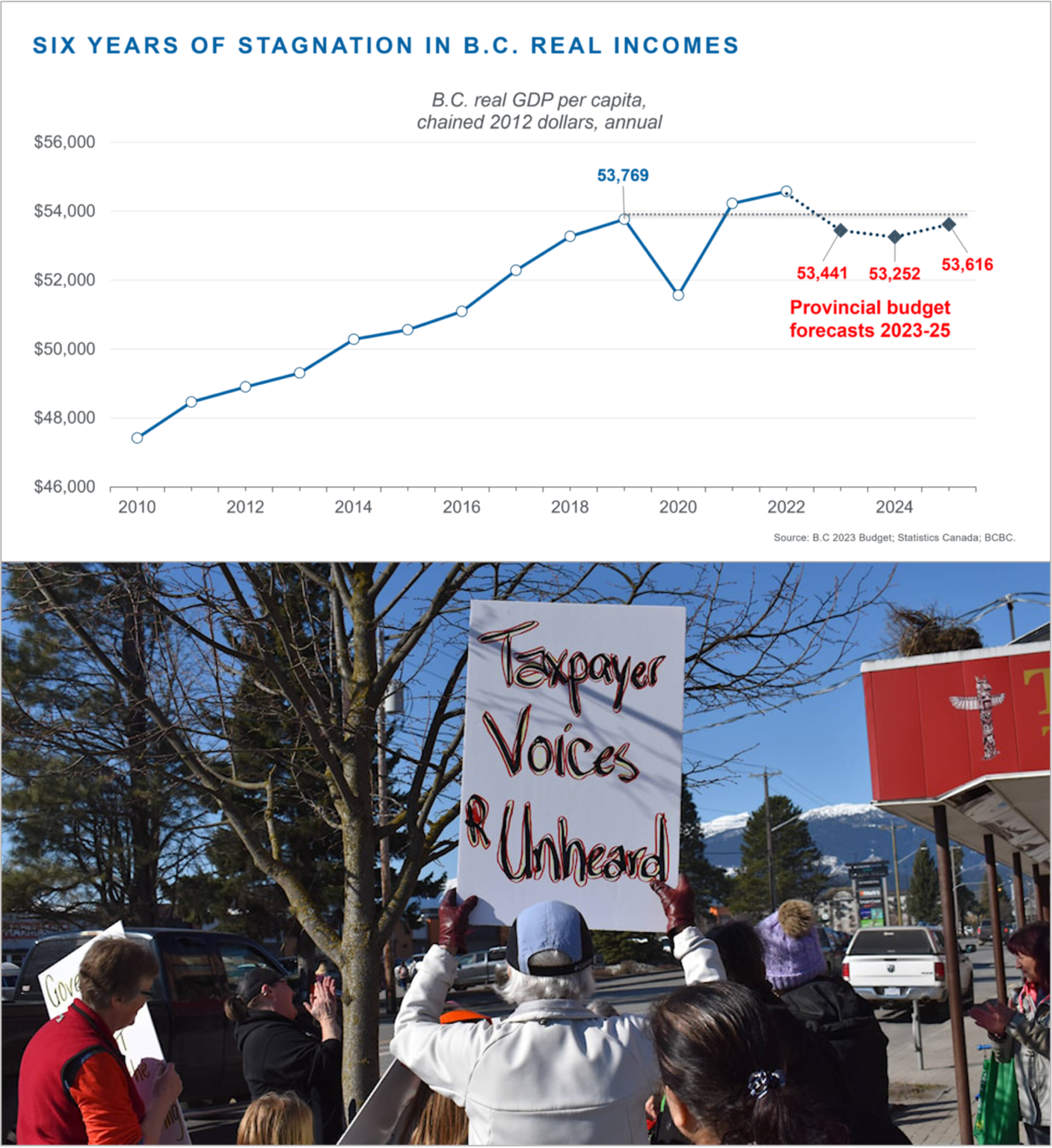

B.C.’s economic growth per person is expected to be lower this year than in 2018 (the 1st full year of the NDP);

Average GDP growth in the pre-NDP era (Campbell, Christy Clark) was double the rate achieved under NDP Premiers Horgan and Eby;

The NDP has spent like drunken sailors the last 7 years, with total debt projected at a staggering $165 billion by 2027 (currently increasing by $53 million a week), but the outcomes in health care, public safety and education just keep getting worse;

B.C.’s credit rating has been cut 3 times in recent years, falling from triple-A to double-A negative. This makes lenders less willing to lend and leads them to impose a higher interest rate. The B.C. government is now spending $4 billion a year just to pay the interest on its debt. And that will undoubtedly rise because the government intends to borrow much more as annual spending rises further;

B.C.’s health care system is in crisis (bureaucratic costs have zoomed, 40% of nurses now work in administration), the streets are less safe, and we’ve become the most unaffordable province in the country in part because of wacky “climate change” policies and a failed housing strategy;

The NDP government are horrendous economic managers who tolerate massive cost overruns in their capital projects – the Richmond Hospital redevelopment has more than doubled in cost, while the Pattullo Bridge replacement is a year behind schedule, which the province euphemistically admits will lead to “budget pressures”;

The NDP funds free public transit for children under 12, free menstrual products in schools, free naloxone kits, and subsidizes purchases of electric vehicles and heat pumps in the name of “saving the planet” as it also attempts to pick winners and losers in the economy;

Vancouver drivers by far pay the highest fuel taxes in the country at a whopping 60 cents per litre, according to data from the B.C. Utilities Commission;

The NDP’s CleanBC Roadmap to “expand and accelerate climate action” will only make matters worse and further negatively impact the province’s resource sector (B.C. has 17 operating mines and 2 smelters, and enormous untapped potential on the energy side including nuclear energy which Conservative leader John Rustad wants to explore as a potential new option);

Political (left-wing) indoctrination has become ingrained in the B.C. education system – schools are being used by DEI progressives to churn out as many “social justice” and “climate change” warriors as possible, and SOGI 123 (“helps educators make schools safer and more inclusive for students of all sexual orientations and gender identities”) is an abomination with a much bigger agenda at play;

British Columbia is a province run by woke progressives and “climate change” nutbars who believe forcing everyone to drink from paper straws (as opposed to plastic) will somehow help “save the planet”;

David Eby, Justin Trudeau, Jagmeet Singh, Comrade Harris – they’re all cut from the same cloth. They are wealth destroyers, not wealth creators, who instinctively and wrongly believe that bigger and more intrusive government is better government.

The chart below says everything – real incomes in B.C. have stalled under the horrendous policies of the NDP.

Venture Update

The way the broader markets have been behaving, it seems investors are betting that Trump will knock off Harris, Rustad will knock off Eby, Moe will knock off Beck (SK election Oct. 28), and Poilievre will ultimately destroy Trudeau.

At no point since 2020 has the TSX Venture looked so bullish from a technical perspective – the potential for explosive gains over the next 3 months is very real.

On Friday the Index closed above 600 for the 1st time since early June. The final big hurdle is the 640 area which has served as stiff resistance for the past couple of years and is also defined by the 1,000-day EMA.

With technical momentum returning to this market, it wouldn’t be surprising to see the Venture challenge the 800 level by year-end. In that kind of environment, there will be many multi-baggers.

We’ll review a couple of longer-term charts tomorrow to better explain what’s unfolding, with suggestions on some situations that could really sparkle and deliver massive returns for investors.

15 Comments

a shot in the arm for the natural hydrogen space with Mitsubishi Heavy Industries announcing this morning its investment in Koloma. time to get the MAXX show on the road.

One thing for sure, QIMC is eating MAXX’s lunch. Time for a CEO change?

Like the tortoise (MAXX) and the hare (QIMC) fable Dan1, it is early in the race. Slow and steady…

My son left for the energy sector in Alberta 8 months ago, my real estate agent is on standby if the communists continue to destroy BC.

Laddy, you can sell your house in Vancouver, buy a mansion in Edmonton and still have some money left over to go on some nice winter holidays.

I couldn’t agree more Dan1, QIMC -wow talk about a company doing what every

shareholder dreams about and actually having skin in the game as well. I keep

hearing it’s in the works for MAXX, but just crickets……

David

QIMC management = a wolf in sheep’s clothing. Can’t trust them, based on past experience. It has been a good trader for sure, but not parking $ there long term.

Sun Summit Drills 57.95 metres of 2.69 g/t Gold Including 19.50 metres of 7.31 g/t Gold at the Creek Zone, JD Project, Toodoggone District, B.C.

2024-10-16 07:01 ET – News Release

Vancouver, British Columbia–(Newsfile Corp. – October 16, 2024) – Sun Summit Minerals Corp. (TSXV: SMN) (OTCQB: SMREF) announces drill results from its fifth hole drilled during its inaugural exploration program at the JD Project in the Toodoggone District, north-central B.C.

Hole CZ-24-005 returned one of the longest cumulative intervals of gold mineralization drilled to date at the Creek Zone, as well as intersected high-grade gold-bearing veins: 362 g/t gold over 0.25 metres, 53.60 g/t gold over 0.58 metres, and 21.60 g/t gold over 0.50 metres. This hole represents a 100 metre step out to the east from hole CZ-24-004, and continues to demonstrate that high-grade mineralization at the Creek Zone is open in most directions.

Highlights:

Hole CZ-24-005 intersected multiple broad zones of continuous gold mineralization punctuated with high-grade veins:

– 64.16 metres of 0.69 g/t gold from 46.84 metres including 10.16 metres of 1.93 g/t gold, and;

– 57.95 metres of 2.69 g/t gold from 145.05 metres including 19.50 metres of 7.31 g/t gold, and including discrete veins that returned:

– 362 g/t gold over 0.25 metres

– 53.60 g/t gold over 0.58 metres

– 21.60 g/t gold over 0.50 metres

– High-grade gold associated with strong silver and base metal mineralization: The 362 g/t gold interval also contains associated strong silver (121 g/t), copper (2.23%) and zinc (18.15%) mineralization which further supports the high-prospectivity for high-grade polymetallic mineralization at the Creek zone.

– Assay results build on previously announced drill results from the Creek Zone: These results further demonstrate the presence of significant high-grade gold mineralization as well as near-surface disseminated mineralization previously unrecognized due to selective sampling in historical drill programs.

High-grade, vein-hosted mineralization remains open: Results from CZ-24-005 demonstrate that high-grade mineralization is open in most directions.

– Additional assay results pending: Assays from the remaining seven drill holes (1,405 metres) from other target areas are pending.

– Final results pending from numerous project-wide surveys: Results from soil and rock geochemical surveys together with final data products from an Induced Polarization (IP) geophysical survey and reprocessing of historic geophysical data are pending.

Sharyn Alexander, President of Sun Summit Minerals, stated: “The 2024 drill program continues to deliver significant results as shown by hole CZ-24-005, our fifth hole of this year’s program. The high-grade, vein-hosted interval of 362 g/t gold over 0.25 metres is the highest-grade interval drilled to date at the Creek Zone. This zone is open in most directions, which presents significant opportunities for step-out drilling to identify the extent of high-grade gold mineralization. Results from this hole, especially the upper 64 metre interval of disseminated mineralization, also confirms our initial thesis that selective sampling by previous operators missed the bulk-tonnage potential of the Creek Zone. We will continue to release additional results from our summer program as they become available.”

Full News Release

Foz, at least QIMC’s management is stepping up and buying a lot of stock on the open market rather than just taking cheap options. That shows faith in the company.

Another company enters the Natural Hydrogen space…

Alaska Energy Metals to Explore Natural Hydrogen Resource Potential at the Angliers-Belleterre Project, Quebec, Canada

2024-10-16 07:30 ET – News Release

Highlights:

– Alaska Energy Metals owns claims adjacent to hydrogen soil gas anomalies recently discovered by Quebec Innovative Materials Corporation; these anomalies indicate potential for discovery of natural hydrogen (also known as white hydrogen) accumulations.

– White hydrogen is a naturally occurring, geologically created type of hydrogen that is gaining prominence as a low-cost, low emission, and renewable clean energy source.

– Alaska Energy Metals’ claims cover source rocks, possible gas migration pathways, and potential reservoir rocks that can trap accumulations of hydrogen gas.

– Hydrogen detected by testing gases in soil could lead to the discovery of hydrogen gas accumulations trapped in rocks below surface.

– Alaska Energy Metals plans to carry out soil gas sampling as an initial step in evaluating the potential for white hydrogen accumulations on its Angliers–Belleterre claims.

VANCOUVER, British Columbia, Oct. 16, 2024 (GLOBE NEWSWIRE) — Alaska Energy Metals Corporation (TSX-V: AEMC, OTCQB: AKEMF) (“Alaska Energy Metals,” ”AEMC,” or the “Company”) today announced its plans to carry out a hydrogen soil gas survey over a portion of its Angliers-Belleterre Project (“Angliers”) in Quebec to determine if the project holds potential for natural, white hydrogen accumulations. Recent soil gas sample data released by adjacent claim owner Quebec Innovative Materials Corporation illustrates the potential for hydrogen accumulations to occur within the Lake Timiskaming Basin of western Quebec, which intersects with various parts of the Baby Greenstone Belt on AEMC’s Angliers claim block (Figure 1). The accumulation of hydrogen in the basin is likely to occur from the serpentinization of iron-rich basement rocks of the Baby Greenstone Belt, which consist of serpentinite, komatiite, basalt, peridotite, and iron formation.

“AEMC acquired the Angliers project for its nickel-copper potential and has been doing exploration aimed at those commodities. We will continue to advance the nickel-copper targets that we’ve identified. However, we are excited to learn of the hydrogen soil gas anomaly discovery in the Lake Timiskaming Basin made by our claim neighbors, Quebec Innovative Materials Corporation,” said Alaska Energy Metals Chief Geoscientist Gabe Graf.

“Natural hydrogen has gained prominence as a potential contributor to the low carbon energy landscape. Both the industry and governments worldwide have shown a growing interest in natural hydrogen exploration, which may form an important part of the future energy mix.The formation of white hydrogen requires the correct rock types and geologic processes to create the hydrogen gas, gas migration pathways, and geologic traps or reservoirs at which the gas may accumulate. It appears we may have these features on our claims. Our planned work will help determine if there is indeed potential for white hydrogen gas on our claims.”

The company plans to collect approximately 400 soil gas samples across six lines on its claim block. Five of these lines will be collected near the interpreted contact of the Lake Timiskaming Basin with the Baby Greenstone Belt, where the company believes the fracture density and deep-seated faulting may be sufficient to allow a pathway for hydrogen, created during serpentinization to reach the surface. Hydrogen detected in soil may be indicative of hydrogen gas trapped below surface. In addition, one line of samples will be collected over in-situ serpentinite, komatiite, iron formation, and basaltic rocks to analyze the potential for hydrogen creation outside of the basin.

Danny, I do see that as a positive for companies when insiders have skin in the game. Not knocking that aspect. Would like to see that type of activity in MAXX for sure.

HIVE looking very strong again today; 50-day EMA threatening to cross above the 200-day EMA for first time since most recent move to $6+ in July.

Fox1971 – That’s why I believe it’s time for RAV to step aside and let someone else take the reigns in MAXX

Oh yes Danny, I’m well aware, looking more at the southern part and not a fan of a big city but we shall see this coming weekend …

Dan1, I tend to agree, he seems to be one of those Howe street guys who shows up as a director of different companies but has he really accomplished anything in his career? Has he ever brought a company to a point where it has been taken over? Perhaps he has had some good ideas but not sure if he has the kind of pedigree to open doors and get this company to the next level.