A volatile day in Gold with bullion under pressure, trading between a high of $1,322 and a low of $1,289…as of 8:30 am Pacific, bullion is down $26 an ounce at $1,301 (the 200-day SMA is $1,300)…Silver is off 45 cents at $19.52…Copper is off 4 pennies at $2.99…Crude Oil is 27 cents lower at $103.78 while the U.S. Dollar Index is flat at 79.78…

Chinese firms may have locked up as much as 1,000 tonnes of Gold in financing deals, an industry report states, indicating a significant slice of imports has been used to raise funds due to tight credit conditions rather than to meet consumer demand…the financing-related buying in the world’s top Gold consumer means prices could come under pressure if imports are hit by a broader crackdown on using commodities for finance…

Chinese firms may have locked up as much as 1,000 tonnes of Gold in financing deals, an industry report states, indicating a significant slice of imports has been used to raise funds due to tight credit conditions rather than to meet consumer demand…the financing-related buying in the world’s top Gold consumer means prices could come under pressure if imports are hit by a broader crackdown on using commodities for finance…

The report – issued by the World Gold Council (WGC) today – and other sources in China confirm that Gold is not as widely used for raising money as Copper, which saw prices drop to a 3-1/2 year low in March on fears that those deals would unravel. “Imported Gold is being used via Gold loans and letters of credit (LC) to raise low cost funds for business investment and speculation,” the report said. “The use of Gold for purely financial operations is a form of demand that represents a small part of the much wider growth in shadow banking. It is feasible that by the end of 2013 this could have reached a cumulative 1,000 tonnes.” That figure would account for almost a third of annual global production and is worth about $43 billion at current prices…the practice of importing Gold simply to raise funds is being conducted by wealthy individuals and firms for cheap short-term financing either for business or speculation to circumvent capital controls, the WGC report said…

Chinese Gold Demand Expected To Hold Steady In 2014

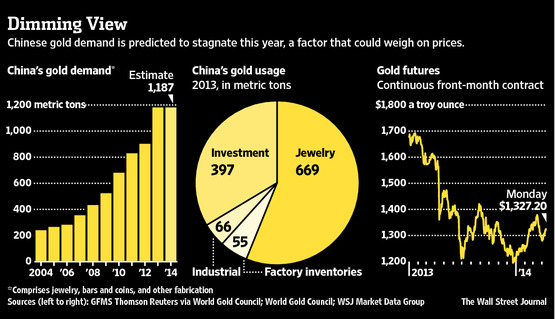

Demand in the world’s biggest Gold consumer is likely to stay flat in 2014, according to the latest estimates from the World Gold Council (demand for bullion in China has expanded every year since 2002, when it declined)…the WGC expects that 2014 will be a year of consolidation for Chinese Gold demand. “We’re looking at best for it to be on par with 2013,” said Albert Cheng, managing director for the Far East at the WGC…Cheng pegs China’s private sector Gold consumption, a category that includes jewelry, bullion and industrial demand, to remain roughly at 2013’s level of 1,187 metric tons…in the longer term, the WGC estimates that China’s appetite will rev up again with demand, excluding factory stockpiles, jumping about 20% by 2017 to 1,350 metric tons…as China’s economy continues to expand and citizens become more affluent, more of them are expected to purchase Gold jewelry or bullion for the first time…

Ukraine Commences “Anti-Terrorist” Operation

A Ukrainian military operation to wrest control of cities in the east from pro-Russian militants has begun, Ukraine’s acting president said today, as Russia’s foreign minister warned use of force could derail international talks on the crisis…Oleksandr Turchynov said that a phased “anti-terrorist” operation began in the early morning hours in the northern Donetsk region, where the majority of the cities commandeered by pro-Russian forces are located…

Today’s Equity Markets

Asia

China’s Shanghai Composite slipped 30 points overnight to close at 2012 as caution set in ahead of tomorrow’s data deluge which includes Q1 GDP, March retail sales, industrial output, and fixed asset investment…meanwhile, it was reported today that money supply in the world’s second largest economy in grew at its weakest pace in March (12.1%) in more than decade…tomorrow’s GDP data is likely to confirm a significant slowdown in the broader economy…some economists, including those at Barclays and Société Générale, expect the Chinese economy to have expanded 7.2% during the quarter, the lowest rate since the financial crisis…

Europe

European markets are down significantly in late trading overseas as Ukraine concerns persist…

North America

The Dow is off 17 points as of 8:30 am Pacific…the Federal Reserve Bank of New York this morning reported that its gauge of manufacturing fell to 1.29 (the weakest reading since November) from 5.61 in March…meanwhile, the consumer price index for March rose 0.2% on the month versus forecasts of a 0.1% rise…excluding good and energy, core CPI also grew o.2%, topping estimates of a 0.1% rise…

Despite the weakness in Gold today, the TSX is up 6 points through the first 2 hours of trading while the Venture is off 10 points at 986…

Sheslay Valley: “We Can Have Several Deposits In This District” – Doubleview Capital Corp. (DBV, TSX-V) President & CEO

While he’s currently focused on his own drill program, following up on discovery holes 8 and 11 at the Hat Property, the bigger picture of what could be unfolding in the Sheslay Valley district of northwest British Columbia is certainly not lost on Doubleview Capital (DBV, TSX-V) President and CEO Farshad Shirvani. “The whole area is really prospective,” Shirvani emphasized in an extensive interview with BMR during our just-completed site visit. “We stand a lot of chances in here with these projects, we can have several deposits. We can see it in the MINFILE records, they’re all lining up. Yes, we stand a chance to have one of the largest mining camps in Canada.”

We’ll have more of our interview with Shirvani later this week. At the moment, Doubleview is attempting to connect some of the dots at Anomaly B and get a handle on the geometry of this potential sizable deposit, about 9 km southeast of Prosper Gold Corp.’s (PGX, TSX-V) advanced Star target (one of several targets on the Sheslay) and 22 km southeast of Garibaldi Resources Corp.’s (GGI, TSX-V) Grizzly West porphyry target (one of several targets on the Grizzly). Many more holes and additional solid results will be required to push the Hat to an initial NI-43-101 resource estimate over the next 12 months or so, but DBV has set those wheels in motion with an early start to 2014 drilling. “We’re going to have a very aggressive year at the Hat,” explained Shirvani. “That’s my plan. For that plan that I have, we need more than one drill. I don’t know how many right now, but we have it in the plan. I’m working on it, setting the blueprint and talking to the government. The goal is to have the Hat at a level where we can have a resource calculation by the end of the year, at least on the four anomalies we’re planning to put into action.”

GoldQuest Mining Corp. (GQC, TSX-V)

GoldQuest Mining (GQC, TSX-V) has commenced its 2014 field exploration program for its Tireo Project in the Dominican Republic, surrounding its Romero Project…ground geophysics including an IP program have been initiated, along with geological and alteration mapping, to follow up on an airborne ZTEM geophysical survey that has identified new trends with numerous targets showing similar properties to that of Romero. “We are identifying exploration targets, and plan to announce the commencement of drilling shortly, to compliment the Romero Project’s Preliminary Economic Assessment (PEA) expected in the coming weeks,” stated CEO Julio Espaillat in a news release this morning…the company has two drill rigs stationed at a field camp next to Romero and will initially mobilize one rig to start drilling by the end of this month…with $11 million in cash, GQC’s 2014 exploration plans are fully funded…GQC is off a penny at 28.5 cents as of 8:30 am Pacific…

Precipitate Gold Corp. (PRG, TSX-V)

Another company in the DR readers should keep on their radar screens is Precipitate Gold (PRG, TSX-V) which is ramping up its activities…PRG has received government authorization for diamond drilling at its Ginger Ridge Zone within its Juan de Herrera concession in the DR…the host Tireo volcanic rocks are very prospective…multiple targets have been generated at Ginger Ridge through recent geochemical and geophysical programs…an IP survey indicated a strong correlation between a surface Gold-in-soil anomaly and subsurface chargeability and resistivity highs over a measured strike length exceeding 800 m…the geophysical chargeability anomaly remains open in both directions and at depth, and will be the primary target of upcoming drilling…the company, however, hasn’t yet specified when drilling will commence…

Below is a 2-year weekly chart for PRG which is quite encouraging…the stock broke above a downsloping channel in early March, and is now threatening to break above a cup-with-handle pattern….the 200-day SMA recently reversed to the upside and provides excellent support just above 12 cents…PRG is off half a penny at 16.5 cents as of 8:30 am Pacific…

Probe Mines Ltd. (PRB, TSX-V) Update

One of the top Gold exploration plays in the country over the past year has been Probe Mines Ltd. (PRB, TSX-V) with its multi-million ounce Borden Lake Project in northwestern Ontario…extensive drilling continues…Probe is taking a hit this morning, selling that is likely technically-driven as support at the $3 level did not hold, at least on an intra-day basis…as of 8:30 am Pacific, PRB is down 34 cents at $2.85 after falling as low as $2.65…

As you can see on John’s 2.5-year weekly chart below, there is major support in the vicinity of $2.60 which is just above the rising 200-day moving average (SMA)…as always, perform your own due diligence, but this looks like nothing more than a healthy correction and an enticing opportunity after a nearly 4-fold increase in the share price over the past year…

Note: John and Jon both hold share positions in GGI and DBV. Jon also holds a share position in GQC.

6 Comments

Hey how’s it going everyone, I’m inquiring about AIX it looks like the have a strategic position in the Sheslay play but I would like to ask since you guys are up there do you think the mineralization reaches the North and East Cap properties and it looks like the South Forks is a little out of the way from the other discoveries.

Is AIX motivated do they have some people on the property poking around looking for samples and places to drill, at .04 do you guys think that AIX will do good in the near future?

Any ideas as to timeline for D(rill) R(esults), will it be a batch of results or a string as they are processed? Also, how many days from today?

TIA,

Bar

Hello Jon!

Does this use of gold for financing deals mean anything for the long term goldprice? The dip today in goldprice was it only a termporary thing? I must confess I dont really understand all that was written above about imported golds use in China, I am from Sweden and not so good in understanding english!!

Sixth sense – RBW news coming soon!

Be great if Jon could get another interview update with Bill Fisher after GQC issues its PEA. I suspect GQC has an 80% chance of a take over if the PEA contains the info the bigger companies are looking for.

Don, I agree, appreciate the reminder, and I think the timing would be excellent. I’m looking forward to seeing the GQC PEA – expected anytime this quarter – and of course a new round of drilling starts within the next couple of weeks. GQC has a history of sudden big moves to the upside and it wouldn’t surprise me if we saw that occur again sometime within the next several months.