Gold has traded between $1,286 and $1,302 so far today…as of 7:50 am Pacific, bullion is up $3 an ounce at $1,299…Silver is off 8 cents at $19.49…Copper is down a penny at $3.06…Crude Oil is up $1.20 a barrel to $102.04 while the U.S. Dollar Index has gained nearly one-tenth of a point and is trading at 79.77…

Holdings in the SPDR Gold Trust, the largest bullion-backed ETP, were unchanged for a fifth day yesterday at a 12-week low of 792.14 metric tons…in China, volumes for the benchmark spot contract in Shanghai shrank for a second day yesterday after reaching a two-month high on April 24…markets across Asia including those in China and India, the world’s largest bullion consumers, are closed for the Labor Day holiday on May 1…

Holdings in the SPDR Gold Trust, the largest bullion-backed ETP, were unchanged for a fifth day yesterday at a 12-week low of 792.14 metric tons…in China, volumes for the benchmark spot contract in Shanghai shrank for a second day yesterday after reaching a two-month high on April 24…markets across Asia including those in China and India, the world’s largest bullion consumers, are closed for the Labor Day holiday on May 1…

The tense situation in the Ukraine should limit Gold’s downside…the U.S. imposed additional sanctions on Russia yesterday but how effective these measures might be is highly questionable…the latest measures target seven Russian officials and 17 companies the U.S. says are linked to President Vladimir Putin’s inner circle…

Fed Starts 2-Day Meeting Today

The FMOC is expected to largely stand pat when a two-day policy meeting wraps up tomorrow…if so, this could mean a limited reaction in the Gold and equity markets…

a post-meeting statement is scheduled for release at 11:00 am Pacific tomorrow…

Stock Tied To Football Star’s Earning Potential

At least a few investors are rooting for San Francisco 49er tight end Vernon Davis to have a very lucrative career…an unusual stock tied to Davis’ earning potential gained $1, hitting the $11 mark in its trading debut in the U.S. yesterday…San Francisco startup Fantex Inc. sold 421,000 shares in the IPO…this marks the first time a stock has been linked to the performance of a professional athlete, an intriguing, albeit risky, concept that highlights the confluence of sports and business. “We think it’s historic, not just from a sports perspective, but from a finance perspective, too,” Fantex CEO Buck French stated in an interview…skeptics ridicule the Davis tracking stock as a ploy that preys upon the passions of sports fans. “If you are a serious investor, you can’t be putting a lot of money in this,” said Ron Heller, a former NFL tight end who now runs his own investment firm, Peritus Asset Management. “You are probably not going to get much money out of it, unless you can sell it to someone dumber than you.”

Today’s Equity Markets

Asia

China’s Shanghai Composite rebounded overnight on upbeat earnings, gaining 17 points to close at 2020…Japanese markets were closed for a public holiday…

Europe

European shares were up significantly today as a slew of corporate earnings managed to offset weaker-than-expected U.K. economic figures…

North America

The Dow is up 79 points as of 7:50 am Pacific…economic reports this morning had a measure of consumer confidence coming in just below expectations in April…separately, the price of a single-family home rose in February, slightly beating expectations, according to a closely watched survey…coming up is the GDP report tomorrow and the Labor Department’s jobs report Friday…corporate earnings continue to exceed expectations…with 54% of the S&P 500 having reported first-quarter results through this morning, overall earnings per share are now seen rising 0.6% from year-ago levels, according to FactSet, versus expectations of a 1.2% decline at the end of March…revenue is seen growing 2.3% from last year, according to FactSet…

The TSX is up 48 points as of 7:50 am Pacific while the Venture is off 9 points at 1001…

Updated TSX Gold Chart

The TSX Gold Index has been trapped in a tight range between support at 180 (the rising 200-day SMA) and resistance at 190 (just below the slightly declining 50-day SMA) for the last 25 trading sessions…how this battle ultimately plays out we’ll see, but the Venture is outperforming the Gold Index at the moment as it did late last year prior to a major advance in the latter…the Gold Index is up a point at 185 as of 7:50 am Pacific…

U.S. Dollar Index Updated Chart

We’ve stated this consistently for more than six months – the U.S. Dollar Index looks technically vulnerable, and that’s a supporting factor for both Gold and the Venture Exchange – main trends in both often run counter to the primary direction of the greenback…below is a 24-year monthly chart for the U.S. Dollar Index…declining highs in the RSI(14) are bearish along with declining 100 and 200-day moving averages (SMA’s)…at the very least, we expect a vigorous test of the key 79 support…should that fail, the Dollar Index could plunge swiftly to the bottom of the symmetrical triangle in the mid-70’s…the ADX indicator still has a slightly bullish bias but the gap between +DI and -DI has narrowed significantly in recent months, raising the possibility of a bearish -DI crossover within the next 2-3 months unless the current trend reverses…

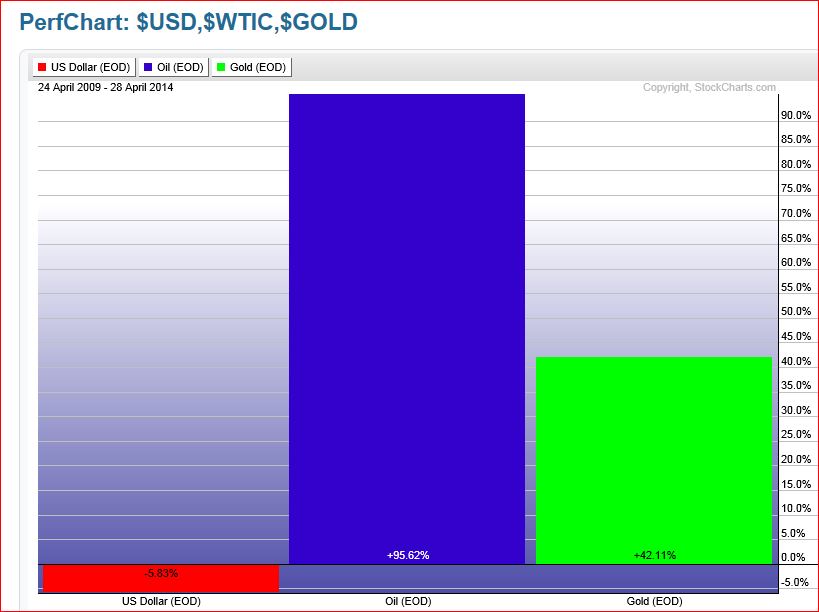

5-Year Performance Chart – U.S. Dollar, Crude Oil (WTIC), & Gold

Below is an interesting performance chart going back five years comparing the U.S. Dollar (down 6%) vs. Crude Oil (up 96%) and Gold (up 42%)…reinforces how currencies are weakening…

Madalena Energy Inc. (MVN, TSX-V)

Energy plays are performing well and Madalena Energy (MVN, TSX-V), one of the few companies in this space that we’ve been tracking since last year, continues an impressive uptrend with remarkable support at its rising 100-day SMA (currently 67 cents) since late July last year…as reported by MVN this morning, the company’s Q4 2013 production averaged 1,271 boe/d (56% oil and liquids), an increase of 101% from Q4 2012…

MVN has a strong balance sheet (zero debt) after raising $23 million at 70 cents in February…it has unutilized credit facilities of $13 million and funds from operations throughout 2014 which will allow the company to meets its commitments and execute its business plan…Madalena has a large land base of approximately 200 gross (>150 net) sections of land (100,000+ acres, 78% average W.I.) encompassing multiple light oil and liquids-rich gas resource plays in the Paddle River area of west-central Alberta with increasing production and reserves on three horizontal plays…MVN also has very attractive assets in Argentina (albeit not our favorite jurisdiction) where it’s focused on the multi-billion barrel potential of large blocks within the “sweet spot” of that country’s prolific Neuquen basin…

Below is a 2.5-year weekly MVN chart from John…very strong support in the high ’60’s…the next Fib. resistance levels are at 81 and 95 cents…buy pressure has declined recently and accumulation has started to flatten…that raises the possibility of a potential correction to secondary support in the mid’50’s, in the immediate vicinity of the rising 200-day SMA…overall, however, MVN’s primary trend clearly remains bullish based on this long-term chart…as of 7:50 am Pacific, MVN is off 3 pennies at 72 cents…

Canadian Mining Company Inc. (CNG, TSX-V)

We urge readers to perform their due diligence on Canadian Mining Company Inc. (CNG, TSX-V) and the mineral Zeolite which is not plentiful in Canada but Canadian Mining Company (CNG, TSX-V) appears to have major supplies of it in the ground in B.C. near Princeton…Zeolite is particularly valuable in holding and slowing releasing valuable nutrients to plants…it promotes more efficient use of fertilizers, generating faster growth and increased yields…CNG’s Zeolite has caught the attention of some segments of the medical marijuana industry, hence the deal (MOI at this point) announced recently between CNG and Thelon Capital Ltd. (THC, TSX-V)…

CNG President Ray Paquette is working hard to gain traction with his company’s Zeolite story which appears to have potential…at the moment, CNG faces stiff resistance at 3 cents based on this 6-year weekly chart but rising 100 and 200-day SMA’s around 1.5 cents are encouraging…speculators may have a good chance on this one, looking out over the next several months, with accumulation on any weakness…CNG is unchanged at 2.5 cents as of 7:50 am Pacific…

Note: John, Jon and Terry do not hold share positions in MVN or CNG.