Gold has traded between $1,277 and $1,292 so far today on this first day of May…as of 7:45 am Pacific, the yellow metal is down $11 an ounce at $1,280…Silver is off 25 cents at $18.90…Copper is flat at $3.03…Crude Oil is off 58 cents to $98.16 while the U.S. Dollar Index is unchanged at 79.52…Mexico’s government outlined a raft of relatively market-friendly proposals yesterday to implement its drive to open up the country’s oil and gas industry to competition…the proposed laws were closely watched by the oil industry as a sign of how far the country might be willing to go to attract private investment, and The Wall Street Journal reported this morning that the bills appeared to be aimed at drawing a large amount of investment quickly…

The 86 year-old Peter Munk officially retired from Barrick Gold (ABX, TSX) at the company’s AGM yesterday. “You can take, maybe, Munk out of Barrick. You can’t take Barrick out of Munk,” he said as he remains as candid as ever…last week, he told the Financial Post how Barrick found its flagship Gold mine: “[Newmont] were Mr. Nevada and we were this absolute penny stock upstart from Toronto. And we discovered Goldstrike on a property they rejected as not being useful because their geologists were so incompetent and so risk-averse.” As Munk departed from the Barrick board, he predicted yesterday that his greatest investment for the company over the past 32 years will be new Chairman of the Board John Thornton…the market remains to be convinced of that…

The Gold market is awaiting what is perhaps the most important economic report of the month – the April U.S. employment numbers tomorrow from the Labor Department…the government is expected to report that non-farm payrolls increased by 210,000 last month after rising by 192,000 in March, according to a Reuters survey of economists…

Today’s Equity Markets

Asia

Several Asian markets shut for the ‘May 1′ public holiday, including China, South Korea and Hong Kong…focus was on China’s official PMI which rose to 50.4 in April…the reading was slightly better than March’s official figure of 50.3 and HSBC’s preliminary April reading of 48.3…still, it missed analysts’ estimates for a 50.5 reading…

Japan’s Nikkei surged 181 points on positive earnings reports…for the month of April, the Nikkei posted a 2.7% loss in part due to strength in the yen…

Europe

European markets are mixed in late trading overseas…

North America

The Dow is down 13 points through the first 75 minutes of trading this morning…U.S. consumer spending rose in March at its fastest pace in nearly five years, providing fresh evidence that the economy gained strength with the arrival of spring…personal consumption – spending on everything from electricity to sliced bread – surged a seasonally adjusted 0.9% from February, the Commerce Department said this morning…this was its largest gain since August 2009…economists surveyed by The Wall Street Journal had predicted a 0.6% rise in consumer spending…spending on physical goods rose 1.4% in March, including a 2.6% rise in spending on durable goods…spending on services grew by 0.7%..

First-time weekly jobless claims in the U.S. climbed by 14,000 to a seasonally adjusted 344,000 during the week to Saturday, the Labor Department said this morning…the tally was above the range of consensus expectations compiled by various news organizations that was for new claims of somewhere between 310,000 and 330,000…meanwhile, the U.S. manufacturing sector continued to improve in April, according to the latest data from the Institute for Supply Management…the ISM said its PMI showed a reading of 54.9% in April, up from March’s reading of 53.7%…

The TSX is down 2 points while the Venture is up a point at 1002 as of 7:45 am Pacific…

Updated Venture Chart

This short-term (3-month) daily chart shows how an overbought RSI(14) condition on the Venture that had built up in February and March had to unwind in April which it did, resulting in an April 15 intra-day monthly low on the Index of 979…RSI(14), which found support just above 30, has since rebounded and now sits within the bullish range of 40% to 80%…buy pressure has replaced sell pressure which was evident for most of April…minor Fib. resistance at 1008 on this 3-month daily while the 50-day SMA, currently at 1014, also provides some resistance…the longer-term charts remain very bullish, so we could see some more “churning” for a short period but this market’s overall technical posture is such that a major acceleration to the upside appears to be in the works starting sometime this quarter and really kicking into gear over the summer…the rising 200-day SMA at 958 confirms the primary bullish trend while an important reversal to the upside in the 300-day SMA could develop as early as next month…

Venture-Gold Comparative Chart

Interesting chart showing how the Venture has outperformed Gold over the last 12 months…the Venture has proven to be a very reliable leading indicator over the years, so such a pattern tells us that some of the dire predictions of bullion tumbling to $1,000 an ounce simply don’t make sense…

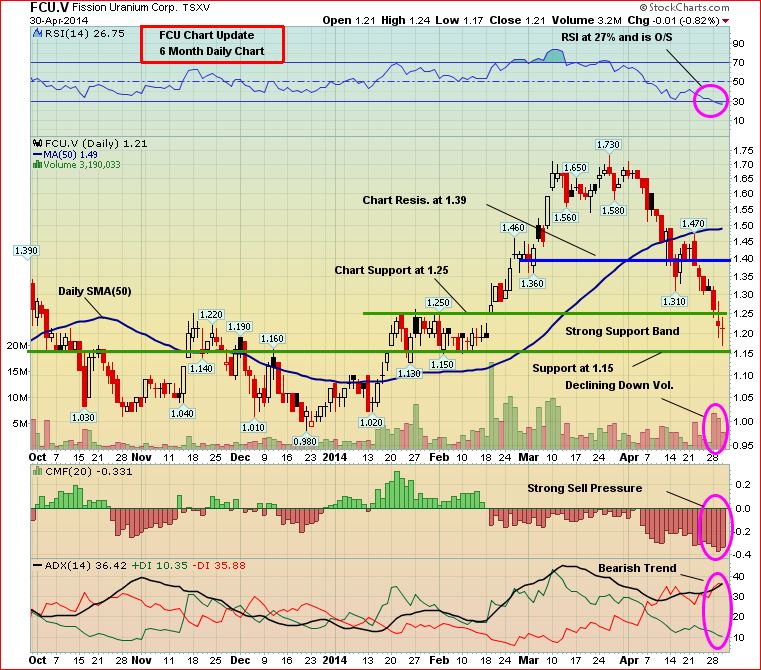

Fission Uranium Corp. (FCU, TSX-V) Updated Chart

Fission Uranium (FCU, TSX-V) came within a whisker of John’s measured Fib. resistance of $1.82 and has since retraced to a strong support band between $1.15 and $1.25…interestingly, overbought RSI(14) conditions in February and March have been replaced by oversold RSI(14) conditions…the support zone appears to be a safe area for bargain-hunters to step in…as of 7:45 am Pacific, FCU is up 4 pennies at $1.25…

North American Nickel (NAN, TSX-V) Update

Nickel prices have been performing extremely well, and that’s just one reason why we like North American Nickel (NAN, TSX-V)…another important reason, of course, is the obvious discovery potential of the company’s Maniitsoq Nickel-Copper-Cobalt-PGM Project located on the southwest coast of Greenland…geophysical work commenced over the Imiak Hill conduit complex last month in preparation for upcoming drilling which will follow up on some significant drill intersections last year including 24.75 m of near massive to massive sulphide grading 3.19% Ni, 1.14% Cu and 0.11% Co…NAN’s financials yesterday showed $6 million in the treasury at the end of December, so they’re in good financial shape…

Technically, NAN has been performing in textbook fashion with outstanding support at the 50-day SMA throughout all of 2014 so far…below is a 2.5-year weekly chart from John…sell pressure has been in decline recently…it would be shocking not to see NAN heat up significantly over the summer, so accumulation around current levels now makes sense as opposed to chasing this at higher prices down the road (as many probably will)…keep in mind that VMS Ventures Inc. (VMS, TSX-V) owns 23.9% of NAN…as of 7:45 am Pacific, NAN is off a penny at 34 cents…

Note: John, Jon and Terry do not hold share positions in FCU or NAN.

9 Comments

Just wondering your thoughts on the fundamentals of the TSX Venture? You do some excellent technical analysis… but to me the fundamentals look extremely week… low cash positions, low commodity prices etc,

Thanks,

James

miningstocksguide.com

You’re right, James, the fundamentals for a good number of companies are very weak. Some of these companies will die and that’s actually part of the overall bullish equation—fewer listings on the Venture and the death of these lifestyle companies would be a very positive development (a healthy cleansing). It’s one of the best times ever to invest in this market because there is plenty of speculative money out there, aiming and targeted toward a reduced pool of quality opportunities. Having said that, I am convinced we are going to see important fresh discoveries this quarter and over the next several months (the Sheslay Valley being but one example) that will restore investor confidence in the junior resource sector and really start to propel the Venture. The technicals are telling us that good things are about to happen, just like the technicals in the spring and summer of 2011 were saying bad things were about to happen in this sector.

Thanks for your comments Jon. I agree the sector needs a good cleansing. I feel we will see further downside to the TSX V as this happens maybe sub 900. Investors really need to focus on being selective and finding those high quality names.

All the best,

James

Hello!

This was very good written. It gives us hope! Nice that there are signs that the venture is going to get better, thank you very much!!

Jon, I was reviewing North cap west and found out that it’s really on trend with Grizzly, ho and kid showing about 2 km to the south. This trend that goes east west on the south east portion of Alix for about 2 km. WOW 😉

maybe 3 km!

You got it, Martin. Bang-on. There are also ways to spot these trends from the air, which is what I was able to do on my recent visit. At depth, this trend of mineralization is connected with the Kaketsa pluton – how exactly, there is still much to be learned, but a very special plumbing system is at work here for sure.

Hey Jon , looking forward to your thoughts on ggi’s newest aquisitions in today’s nr.

Interesting pick-ups, Tom, we’ll comment more on the bigger meaning of this in the morning. Quickly, though, between the Sheslay Valley, the Red Chris mine start-up, and other very interesting activity in northwest B.C., this part of the country is going to be on fire in the months (and years) ahead. I don’t think these GGI acquisitions were spur-of-the-moment – Regoci is a former broker and understands market cycles and timing. I suspect he has been scouring NW B.C. for the last 6-9 months looking to scoop up the best available land at the best time (the bottom of a cycle) for the best price. He acted smartly and increased the size of the Grizzly by 50% and then negotiated two additional property deals, as we see today. He pulled the trigger on La Patilla last spring exactly when Gold hit bottom. He’s a smart operator.