Gold has confounded the pundits by reversing higher today, despite the much stronger than expected U.S. April jobs report from the Labor Department which came in at 288,000, well above the consensus estimate of 210,000…as of 8:00 am Pacific, bullion is up $10 an ounce at $1,295 after dipping as low as $1,276 immediately following the jobs report…escalating tensions in the Ukraine are helping bullion today, but perhaps a segment of the market is also starting to sense a trend toward higher inflation…the vast majority of economic reports over the last several weeks is pointing to an upward shift in growth in the U.S., yet the Fed is committed to maintaining interest rates at historic lows…Silver is up 42 cents at $19.43…Copper is up 4 pennies at $3.07…Crude Oil has gained 36 cents a barrel to $99.78 while the U.S. Dollar Index is relatively unchanged at 79.56, reversing earlier gains…

Go ld exchange-traded funds saw outflows of 641,000 ounces in April, according to UBS. “This marks an altered course from the buying of 261,000 ounces and 462,000 ounces in February and March respectively and the first month of selling since January’s 901,000-ounce outflow,” the firm stated. UBS says selling was “very prevalent” during the first three weeks of April. Small inflows followed, but on Wednesday, 134,000 ounces were sold out of the SPDR Gold Trust ETF (GLD). “This in fact was the largest daily liquidation volume in April and suggests that Gold is vulnerable to further outflows in May if the macro data isn’t supportive.” UBS adds that Silver ETFs saw outflows of 5.15 million ounces, its firstly month of selling since December.

ld exchange-traded funds saw outflows of 641,000 ounces in April, according to UBS. “This marks an altered course from the buying of 261,000 ounces and 462,000 ounces in February and March respectively and the first month of selling since January’s 901,000-ounce outflow,” the firm stated. UBS says selling was “very prevalent” during the first three weeks of April. Small inflows followed, but on Wednesday, 134,000 ounces were sold out of the SPDR Gold Trust ETF (GLD). “This in fact was the largest daily liquidation volume in April and suggests that Gold is vulnerable to further outflows in May if the macro data isn’t supportive.” UBS adds that Silver ETFs saw outflows of 5.15 million ounces, its firstly month of selling since December.

U.S. Mint data show that Gold bullion coin sales in April totaled 56,000 ounces, up 70% from 33,000 in March but down 77% from 246,500 in for the same month last year, according to HSBC. “The pick-up in Gold coin sales in April from the previous month is a sign that retail investors remained upbeat on the yellow metal as prices fell to an average of $1,299/oz in April from an average of 1,335/oz in March,” the bank stated.

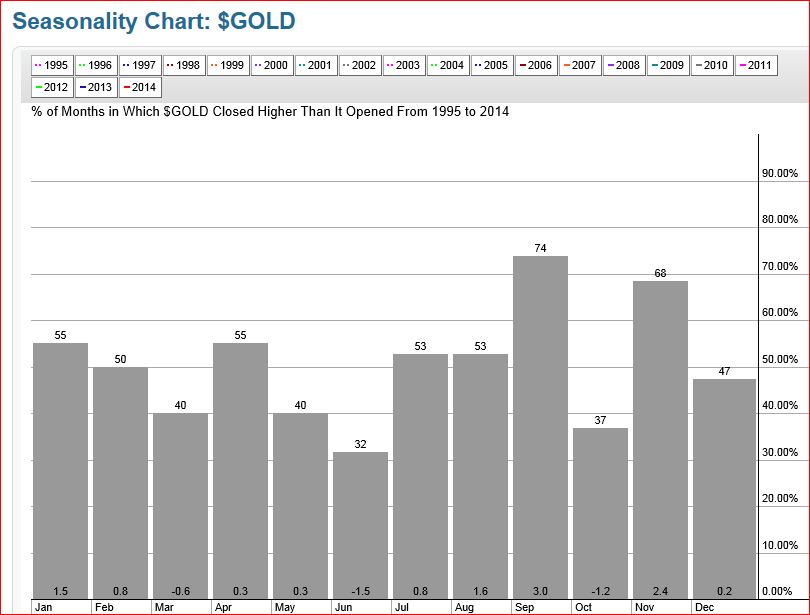

Gold Seasonality Chart

Below is a Gold seasonality chart…combined, May and June historically have been the worst back-to-back months of the year, followed by a sharp summer (third quarter) rebound…Gold’s start this month is highly encouraging…

Ontario In A Mess

Both situations are bad but which addiction is worse? – Toronto Mayor Rob Ford’s substance abuse problem, or a provincial government addicted to spending money it doesn’t have?…the left-wing media gets great pleasure out of reporting on the Ford circus and every sin committed by the beleaguered mayor, who has wisely decided to take a leave of absence, but the sins of the Ontario government – from the Hydro scandal to its red-ink budget yesterday – are conveniently brushed aside…after yesterday’s unbelievable budget, the province’s net debt (at $289-billion, already nearly double what it was when the Liberals took power) is projected to grow by another 18% – $48-billion – over the next three years…debt service costs, even at today’s historically low interest rates, are projected to climb by a third…the debt-to-GDP ratio will hit 42% this year, up from 28% a decade ago…the Liberal government is ramping up the province’s deficit with a big-spending budget which outlines a sweeping Obama-style agenda including a new provincial pension plan, billions of dollars’ worth of new infrastructure and piles of money for social services…the blown budget deficit could quite possibly trigger a downgrade of Ontario’s credit rating, but that’s not important, is it?…both Ontario and Quebec are becoming like the Greece of Canada…not surprisingly, yesterday’s Ontario budget got a major endorsement from Ontario Federation of Labor President Sid Ryan…“I like it – I think it’s an NDP budget, basically.” A continuation of these policies, in our view, cannot be beneficial for the mining sector as they will hurt business in general…and history has often demonstrated that when governments are run poorly and are broke, they often scramble to raise revenue by increasing taxes and royalties – making the situation even worse…

Today’s Equity Markets

Asia

Japan’s Nikkei slipped 28 points overnight in quiet trade as some Asian markets, including China, remained closed for a public holiday…

Europe

European shares were mixed today…

North America

The Dow is down 15 points as of 8:00 am Pacific…the U.S. unemployment rate dropped to a surprising 6.3%, from 6.7%, and the number of non-farm payrolls was well above the 210,000 expected as jobs were broadly added in retail, construction, restaurants, and professional and business services…March payrolls were also revised higher to 203,000…however, today’s jobs report also sent mixed signals as a disturbing number of Americans dropped out of the labor force…

The TSX is up 53 points while the Gold Index is also doing well today…Agnico-Eagle Mines Ltd. (AEM, TSX) has jumped $2.45 to $34.87 as of 8:00 am Pacific…AEM reported late yesterday that Q1 net income rose on the back of higher Gold production and lower production expenses, with net income at $108.9 million, or 63 cents per share…AEM achieved record quarterly Gold production of 366,421 ounces at a cash cost of $537 per ounce, with record quarterly Gold output at its Meadowbank mine in Nunavit of 156,444 ounces at a cash cost of $434 per ounce…

The Venture Exchange has added 6 points to 1013…check out the interesting article by Chris Parry at Stockhouse yesterday on the medical marijuana industry as he interviewed Dev Randhawa, CEO and Chairman of Fission Uranium Corp. (FCU, TSX-V) who also heads up Papuan Precious Metals Corp. (PAU, TSX-V)…click on the link to the article below…PAU is up 3 cents at 13 cents as of 8:00 am Pacific…

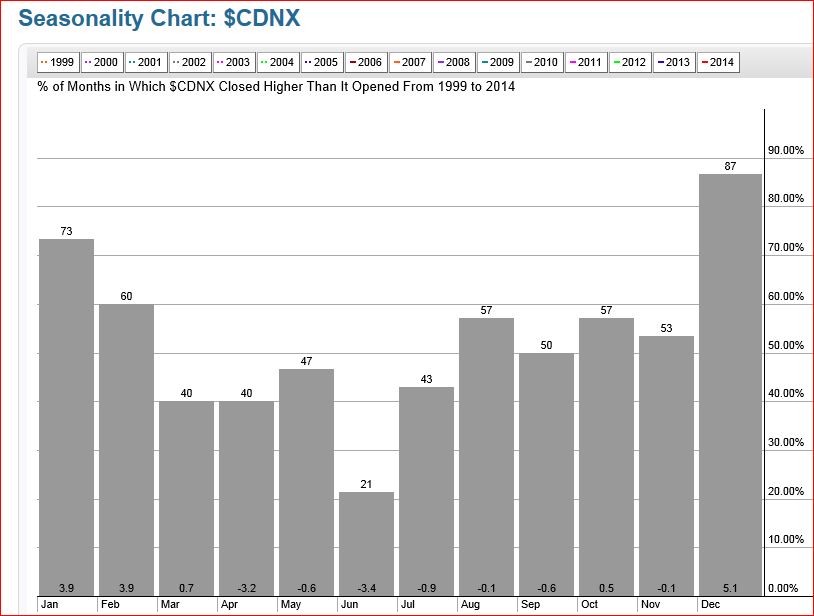

Venture Seasonality Chart

Historically, May has proven to be marginally better than March and April for the Venture, so that’s additional evidence that the current uptrend could accelerate…

Garibaldi Resources Corp. (GGI, TSX-V) Update

The rich get richer in these markets, so to speak…fortunes are born during the bottom of a market cycle…this applies not only to astute individual investors, but well-run companies as well who have strong balance sheets and CEO’s with the vision and the boldness to act and take advantage of unique opportunities that open up at fire-sale prices…this is how Garibaldi Resources (GGI, TSX-V) acquired the La Patilla Gold Property in the spring of last year…President and CEO Steve Regoci had his eye on this gem for quite some time, then smartly pulled the trigger as soon as Gold hit bottom last spring and many people panicked…Regoci is calm, cool and collected and understands market cycles…he also sees how investor interest in northwest B.C. is going to ramp up in a very serious way for a variety of reasons, in part due to the Sheslay Valley and how that rapidly evolving district could very conceivably emerge as a new world class mining camp…it’s in that context that we view yesterday’s announcement from GGI that the company has acquired two additional properties in the Stikine Arch (Red Lion and MSM) as a “strategic leveraged opportunity for the future while we focus immediately and vigorously on unlocking the value of the Grizzly.” GGI has a bright future in northwest B.C., and of course Mexico as well where drilling is currently in progress…

Below is an updated GGI chart (10-year monthly) from John…technically, GGI is acting in textbook fashion…RSI(14) continues to climb an uptrend but still has plenty of room to move higher…there are several bullish aspects to this long-term chart as you can see below…short-term, the 10 and 20-day moving averages (SMA’s) – not shown on this chart – have reversed to the upside this week, suggesting May is shaping up to be a strong month…

Doubleview Capital Corp. (DBV, TSX-V) Update

As investors await assay results from recent drilling at the Hat Property, Doubleview Capital (DBV, TSX-V) continues to inch higher – a positive sign…it, too, has seen a positive reversal with regard to short-term technicals…the next major Fib. resistance levels are 34 cents and 53 cents, respectively (those aren’t price targets, just measured resistance based on Fib. and analysis)…DBV is up a penny at 26.5 cents as of 8:00 am Pacific…

GoldQuest Mining Corp. (GQC, TSX-V) Update

Keep an eye on GoldQuest Mining (GQC, TSX-V) which has a couple of potential near-term triggers – the start of 2014 drilling in the DR, and a PEA on the Romero deposit…GQC is unchanged at 30 cents as of 8:00 am Pacific…

Adventure Gold Inc. (AGE, TSX-V) Update

Exploration is starting to heat up in Quebec and one of our favorite companies there over the last few years has been Adventure Gold (AGE, TSX-V), a well-managed junior with some excellent prospects…yesterday the company announced that it has commenced a 3,000-m drill program at its Val-d’Or East-Pascalis Property with the goal of increasing resources to over 1 million ounces…we’ve been on this property which is adjacent to Richmont Mines‘ (RIC, TSX-V) Beaufor mine…AGE’s project also encompasses the past producing Beliveau mine, a very profitable low-cost operation in the early 1990’s…

Technically, AGE overcame a long-term downtrend line earlier this year and climbed as high as 25 cents before retracing to support at 16 cents (it closed yesterday at 18 cents)…this is a favorable chart and we see good things in store for AGE as the year progresses…

Note: John and Jon both hold share positions in GGI and DBV.

Read more at http://www.stockhouse.com/news/newswire/2014/05/01/fission-uranium-v-fcu-ceo-looks-to-starbucks-up-weed-dispensary-business#ei8c42DIdg54cwWK.99

Read more at http://www.stockhouse.com/news/newswire/2014/05/01/fission-uranium-v-fcu-ceo-looks-to-starbucks-up-weed-dispensary-business#ei8c42DIdg54cwWK.99

Read more at http://www.stockhouse.com/news/newswire/2014/05/01/fission-uranium-v-fcu-ceo-looks-to-starbucks-up-weed-dispensary-business#ei8c42DIdg54cwWK.99

Read more at http://www.stockhouse.com/news/newswire/2014/05/01/fission-uranium-v-fcu-ceo-looks-to-starbucks-up-weed-dispensary-business#SfLIRFJqiXUoDQft.99

6 Comments

I hear the Prosper guys will be up at the Sheshlay mid next week. Looking forward to what unfolds up that way this exploration season!

Great day/week for the venture. Up almost 1% today.

A good finish to the week as the Venture was up 8pts today and 5pts yesterday. Nice rebound on Gold to close at 1300!

Strong week for gold, silver and the venture. Hope that it will be the start of an upleg in the sector, but perhaps the manipulators start hamering gold and silver next week! We hope for the best!!

Hi guys

I’m a long & strong shareholder of DBV and muchly appreciate you’re coverage of it.

I noticed you guys are bullish on nickle plays and wondered if you ever looked at another company I have a large position in called First Point Minerals.

They are developing the Decar project by Dease Lake in BC with their JV partner Cliffs Natural Resources.

This play is a monster in the making that will be the first ever in the world deposit to be developed hosting a unique style of nickel mineralization called awaruite. It is neither sulphide nor laterite, but a naturally occurring, metallic Nickel-Iron Alloy. In effect, naturally occurring stainless steel. It represents a potential new, long-life, low-risk source of nickel mine supply, and a possible game changer for the nickel industry that is poised to change the price of nickel across the globe.

On April 22nd they released a marketing study that clearly demonstrates the Market Acceptance and Commercial Potential of Decar Concentrates.

They are cashed up with over $7M in the treasury and the stock has been rising off its 52 week low on this marketing study news and in anticipation of Cliffs announcement of the 2014 work program.

Some confuse the recent transaction by Dr Ron Britten where he transferred over 400K shares over to his and his family’s TFSA’s as selling, but he insists if one looks on Sedar they will see quite the contrary

I think this stock will be well north of $100 a share when Decar goes into production in 2018 that is if FPX has not been acquired by then , Jmho …dyodd

Thanks and keep up the good work guys

PS

Cliffs cancelled Billions of $ worth of projects this year from their Bloom Lake project to the Ring of Fire project.

Decar is the only project they fully intend to develop and what their former CEO in last years conference call , said Decar is their most exciting discovery.