Gold has traded between $1,304 and $1,317 so far today…as of 7:30 am Pacific, bullion is up $11 an ounce at $1,312…Silver (see updated charts at the bottom of today’s Morning Musings) is 11 cents higher at $19.57…Copper is up 4 pennies to $3.06…Crude Oil is down 22 cents at $99.54 while the U.S. Dollar Index is down slightly at 79.49…

Bullion is benefiting from heightened tensions in Ukraine where fighting grew more widespread over the weekend and continues to intensify…heavy fighting erupted today in the pro-Russian separatist stronghold of Sloyvansk in eastern Ukraine, with authorities reporting four Ukrainian soldiers dead and a rebel commander telling local media that more than 20 militants had possibly been killed…the confrontation marked the most sustained fighting since Kiev launched an operation to quell the insurgency in the region…Russia has warned Ukraine of “catastrophic consequences” unless it halts its military operation against pro-Russian rebels…

Bullion is benefiting from heightened tensions in Ukraine where fighting grew more widespread over the weekend and continues to intensify…heavy fighting erupted today in the pro-Russian separatist stronghold of Sloyvansk in eastern Ukraine, with authorities reporting four Ukrainian soldiers dead and a rebel commander telling local media that more than 20 militants had possibly been killed…the confrontation marked the most sustained fighting since Kiev launched an operation to quell the insurgency in the region…Russia has warned Ukraine of “catastrophic consequences” unless it halts its military operation against pro-Russian rebels…

Heavy buying occurred in Chinese Gold trade overnight, according to MKS (Switzerland) SA…the market held right around the $1,300 level in early Asia-Pacific trading. “We had a bit of an unexpected surprise when China opened up with some heavy buying going through,” MKS stated. “The SGE (Shanghai Gold Exchange) traded up to a premium of around $3-5 over spot and more importantly, the Shanghai Futures Exchange traded higher than the SGE for the first time in weeks, suggesting that the Chinese general public – non-institutional – investors were in covering shorts.”

The confirmed death toll has risen to 12 persons buried by a rock fall at an illegal Gold mine near the city of Santander de Quilichao in Cauca department in western Colombia…an avalanche of mud, rock and earth fell into an open pit where workers were extracting Gold…Colombia has more than 14,000 mines, more than half of which operate without legal permits…the government has created a special military unit to try to close illegal mines in areas controlled by criminal gangs…

Today’s Equity Markets

Asia

Asian stocks ended mostly higher overnight despite weak Chinese manufacturing data but trading volumes were thin with Japanese and South Korean markets shut for holidays…HSBC’s final reading of manufacturing activity in China came in at 48.1 for April, below the bank’s preliminary reading of 48.3…the figure marked a fourth straight month of contraction, in contrast to the country’s official PMI reading of 50.4…China’s Shanghai Composite finished 1 point higher at 2027…

Europe

European markets are mixed in late trading overseas…

North America

The Dow is down 58 points through the first hour of trading…Fed Chair Janet Yellen’s two appearances before Congress this week will draw plenty of market attention…she testifies before the Joint Economic Committee on the economic outlook Wednesday and before the Senate Budget Committee Thursday…

U.S. Dollar Index Updated Chart

Is the U.S. Dollar Index about to go into a free-fall?…this 2.5-year weekly chart from John doesn’t paint a pretty picture for the beleaguered greenback…the Index is now testing a 2.5-year support line while being pressured by declining 50 and 200-day moving averages (SMA’s)…at 43%, there is certainly room for RSI(14) to plunge considerably lower…what’s also interesting is that the Dollar Index broke down against Gold in February after outperforming the metal on a relative basis throughout 2013…given what the Venture is also telling us, the Dollar Index is likely facing additional weakness – a bullish factor for Gold…

Canadian Markets

The TSX is down 63 points as of 7:30 am Pacific…the Gold Index is up 1 point at 187 while the Venture is off a point at 1013…

Venture 9-Month Updated Daily Chart

The Venture is encountering some resistance at its 50-day SMA, currently at 1014…however, RSI(14) continues to climb an uptrend while buy pressure remains solid…fresh momentum should come into the Venture on a close above 1020, but investor patience is critical…John’s analysis is that the Venture is now in a “Wave 5” pattern, meaning this slow-moving train should start to pick up speed in the near future with the next major stop around 1140 – about 12% above current levels…

Ashburton Ventures Inc. (ABR, TSX-V) – Poised For Action On Two Hot Fronts

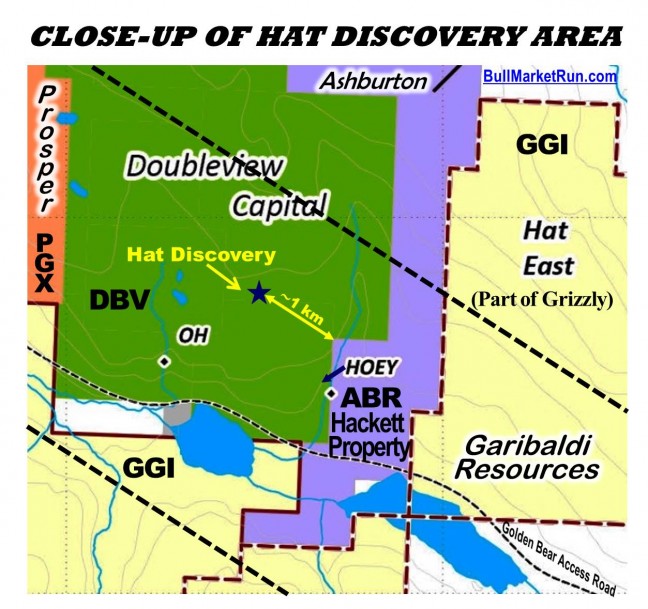

Resting at support at just 4.5 cents, with only 36 million shares outstanding, a speculative but potentially hugely rewarding opportunity in the prolific Sheslay Valley is Ashburton Ventures (ABR, TSX-V) which recently more than doubled the size of its overall land package to 30+ sq. km with the acquisition of the “Grizzly West Extension Project”…this deal (between ABR and Victory Ventures) was approved Friday (May 2) by the Venture Exchange and the Extension covers a 6 km north-south stretch (underlain by Stuhini group, Upper Triassic rocks) contiguous to the western border of Garibaldi Resources’ (GGI, TSX-V) Grizzly Property…in basic geological terms, a potentially robust Cu-Au porphyry system appears to have been fueled by the Kaketsa pluton and is trending west-northwest directly toward ground now held by ABR…we’re sure to be hearing much more about this overall area (Sheslay West) in the coming weeks as exploration heats up from Pyrrhotite Creek (Prosper Gold, PGX, TSX-V) to GGI’s West Kaketsa and Grizzly West targets, to ABR’s new holdings and Alix Resources‘ (AIX, TSX-V) North Cap West…

Hackett Property Work Program Begins, Interesting Gold Showings Along Border With Hat Property

It’s just under 10 sq. km in size, but ABR’s Hackett Property – as you can see on the map below – is highly strategic as mineralization is trending to the east-southeast with the southwestern border of the Hackett just 1,000 m east of Doubleview Capital’s (DBV, TSX-V) Hat Property discovery holes #8 and #11…DBV, as it announced April 30, is within just a few weeks of reporting results from its first round of 2014 drilling following the announcement in late January of a significant Cu-Au porphyry discovery from drilling late last year…another major “hit” (holes HAT-08 and HAT-11 sparked a staking rush in the area) would not only send Doubleview soaring, but could also have a profound impact on Ashburton…

What’s contiguous to the Hackett’s western border is highly intriguing, but not much is known about the Hackett itself – it has never been drilled, nor has any detailed prospecting ever been carried out until now…historical records do show a mag high on the southern portion of the claims and this could hold some significance…time will tell…

Ashburton President Kyler Hardy is excited as he prepares to investigate the Hackett immediately with his own boots on the ground. “We couldn’t be in a better place at a better time. That’s probably the best way to put it,” Hardy told BMR in a recent interview. “Looking at the data, it’s publicly available, we’re very much on trend with Doubleview’s discovery…it’s really interesting. In my opinion we’re into a very, very large regional play rather than simply an isolated deposit (the former Copper Creek Property, now the Star Project) which was looked at previously.”

Much more is going to be known about the Hackett Property in the coming days as the ABR geological and prospecting team descends on the area for some extensive sampling and mapping, the first step prior to planned drilling…this should generate a wealth of new information…the company has already requested permitting for 18 km of line cutting to conduct IP and 2,000 m of diamond drilling from several set-ups…

BMR’s research, which included about one hour on the Hackett during our Sheslay area visit last month, has revealed very interesting Gold values, not only from the well-known Hoey showing just 300 m west of the Hacket boundary, but from other showings significantly further north and northeast of the Hoey on DBV ground along the border with the Hackett (sources: Assessment Report 14802, 1986, and the Hat Property 2012 Technical Report prepared by Erik Ostensoe)…

In the 1960’s, prospector Frank Hoey’s samples returned Gold values as high as 1 oz/ton (subsequent sampling by others returned grades as high as 8.1 g/t Au and 2.2% Cu)…the Hoey area has strongly sheared mafic-rich formations with pyrite, bornite, chalcopyrite, and traces of molybdenite…several areas proximal to the Hoey – including the “D” showing 1.5 km to the north – have assayed several g/t Au from sampling…

It’ll be fascinating to see sampling results for the first time from the Hackett…

Speculatively, the Hackett could certainly be an extension of a Cu-Au porphyry deposit (or cluster of deposits) on the Hat, and Garibaldi’s Hat East claims contiguous to the Hackett may figure into the equation as well…but one also cannot rule out the possibility of a stand-alone Gold deposit that might be hiding somewhere in this general area…

“It’s certainly theoretically possible,” stated Doubleview consulting geologist and geophysicist John Buckle, when asked about the potential for a Gold deposit on this part of the Sheslay mineralized corridor. “Most Gold deposits are related to hydrothermal fluids. And we know we have the heat source,” he stated. “So you have the heat source, you have the metals. If you have the fluids and the trap, yes, you can certainly have a Gold deposit of a different type. Maybe a high sulphidation deposit, maybe a low sulphidation quartz vein system. Possible. They will be distal, or a distance, away from the centre of the volcanic intrusions – maybe two, maybe five kilometres. Yes, definitely possible. We have five top level targets that I picked in 2011. We’ve only just started the first one. These are porphyry targets. One of them has excellent Gold in geochem…we’ll see how the jigsaw puzzle comes together.”

As far as Ashburton is concerned, the pieces of the Hackett puzzle may soon start to come together now that the snow is gone and the geological team can get a clear look at what they hope will be an abundance of clues at surface…

Precipitate Gold Corp. (PRG, TSX-V) Update

Last month, we mentioned that Precipitate Gold (PRG, TSX-V) was gearing up for another potential breakout, and that’s exactly what occurred to begin the month of May…PRG, focused on the Dominican Republic, recently announced that it had received government authorization for diamond drilling at its Ginger Ridge Zone within its Juan de Herrera concession…the host Tireo volcanic rocks are very prospective…multiple targets have been generated at Ginger Ridge through recent geochemical and geophysical programs…an IP survey indicated a strong correlation between a surface Gold-in-soil anomaly and subsurface chargeability and resistivity highs over a measured strike length exceeding 800 m…the geophysical chargeability anomaly remains open in both directions and at depth, and will be the primary target of upcoming drilling…the company, however, hasn’t yet specified when drilling will commence…

Below is an updated 2-year weekly chart for PRG which is quite encouraging…note how in March, the stock broke above a downsloping channel – then it pushed above the top of the “cup” which should now provide important support…PRG should also benefit from any positive news out of GoldQuest Mining Corp. (GQC, TSX-V), our favorite company in the area…there’s only a limited pool of companies to choose from that are operating in the DR, so the law of supply and demand is in the investor’s favor in the event of another discovery…PRG closed Friday at 22.5 cents…

Short-Term Silver Chart

Importantly, Silver found support again last week just below $19 at the top of a downtrend line…this is similar to the Venture pattern during the fourth quarter of last year when it, too, found support at the top of a downtrend line…RSI(2) on this 3-year weekly chart is at 14%, but buy pressure is increasing – a bullish sign…Silver’s support band ranges from $17.50 to $19.50 while the next major chart resistance is $22…

Long-Term Silver Chart

This 11-year monthly chart confirms that the metal has exceptional support just below $20…sell pressure has been dominant since early last year but is weak…if and when Silver breaks above the main downtrend line, watch out (there are two downtrend lines to take note of)…RSI(2) is climbing…

Note: John and Jon both hold share positions in ABR.

9 Comments

the Valley is getting HOT HOT HOT today

Yep and the former “daily coverage darlings” RBW and GBB are sitting at multi year lows. Can’t even shame a comment out of them about the recent MOU that GBB signed. How things change.

Hi John,

Could you draw us how explosive ABR will(could)be in the next couple of weeks!

Thanks!

ABR chart update tomorrow morning, Martin. John has a 2-year weekly for ABR that looks quite extraordinary.

Nice work on ABR! we propably have copper mineralisation at depth, oz/ton of gold from surface, highly fracture area Nord/South, very encouraging ip from DBV telling mineralisation would get wider as it trend east. what do you want more 🙂

Thanks Jon, do you know many geologist will work on the property and went they will actually start?

There is only 26 order from 6 to 8 totalling 1.5 Millions shares on the sellers side, They could get swap in a instant. in fact at still 2.2 M in capitalisation we could get in the 0.20 sooner that we think!

Ditto on the nice work!! Thank-you BMR.

GBB… certified dead… the recent news only boosted with a turnover of 2-3 millions shares and I commented last time, it will go back to 3 cents or lower. There are too many losers in this one and there is a long long line up for dumping. No chance and BMR does not have to comment this.

RBW … still a chance for a rapid jump. At this price, nothing can go wrong if you invest at 2.5 – 3 cents range… Believe it or not!