Gold has traded between $1,288 and $1,300 so far today…as of 7:00 am Pacific, bullion is up $1 an ounce at $1,297…Silver is 2 cents higher at $19.52…Copper is down a penny at $3.13 after a strong advance yesterday…Crude Oil is up 41 cents to $101.00 while the U.S. Dollar Index has added one-tenth of a point to 79.99…

Gold has been building a base between the $1,270’s and $1,280’s, in the immediate vicinity of its rising 100-day moving average (SMA) which has been tested in six out of the last 12 sessions entering today…since the middle of last month, Gold has been caught in a range between $1,285 and $1,315…the stand-off between pro-Russian separatists and government forces in Ukraine has clearly been a major supporting factor for bullion over the past month, preventing a break lower…

Gold has been building a base between the $1,270’s and $1,280’s, in the immediate vicinity of its rising 100-day moving average (SMA) which has been tested in six out of the last 12 sessions entering today…since the middle of last month, Gold has been caught in a range between $1,285 and $1,315…the stand-off between pro-Russian separatists and government forces in Ukraine has clearly been a major supporting factor for bullion over the past month, preventing a break lower…

SPDR Gold Trust, the world’s top Gold-backed ETF, recorded an outflow of 2.39 tonnes to 780.46 tonnes on Monday, the first outflow since May 2…

BNP Paribas gave a fresh Gold forecast yesterday, its first since November…the bank revised up its average 2014 Gold price estimate to $1,255 an ounce from $1,095 previously due to a number of factors that have led to strong technical support around $1,200 an ounce and a range-bound market…BNP Paribas listed incremental buying into ETF’s by fund managers, Asian and Middle Eastern physical demand that was more resilient than expected, and geopolitical tensions in Ukraine as main factors contributing to its higher price forecast…

Meanwhile, UBS lowered its short-term Gold price forecasts today, citing a “host of factors”…the bank cut its one-month Gold forecast to $1,250 an ounce from $1,280 an ounce and reduced its three-month Gold forecast to $1,300 an ounce from $1,350 an ounce…UBS said negative factors include expectations for tame physical demand, the risk of further ETF outflows, a stronger U.S. dollar, positive U.S. economic data and weak investor sentiment…

Today’s Equity Markets

Asia

China’s Shanghai Composite, after a powerful jump Monday, retreated 2 points overnight to close at 2051…a slew of Chinese economic data was released today with April industrial output, retail sales and fixed assessment investment all coming in slightly below Reuters’ forecasts…the numbers follow yesterday’s reports that showed new banking lending and total social financing weakening last month…

Japan’s Nikkei surged 276 points overnight to a one-week high, closing at 14425…

In India, the benchmark Index hit a record high in early trading after major exit polls last night indicated that Narendra Modi – considered a business-friendly candidate – would win the general election and become India’s next prime minister…official results will be announced at the end of the week…

Europe

European markets are up modestly in late trading overseas…the Stoxx Europe 600 Index closed at a more than six-year high yesterday of 340.96… the euro weakened today on another report that the Bundesbank was open to unconventional easing measures by the ECB…The Wall Street Journal reported that the Bundesbank will back a rate cut if upcoming ECB projections for 2016 inflation are lower than expected…

North America

The Dow and S&P 500 hit record closing highs yesterday after M&A activity and a rebound in Internet and biotechnology shares helped brighten Wall Street’s view of the economy…through the first 30 minutes of trading today, the Dow is up another 28 points…

U.S. small business sentiment jumped to its highest level in 6 1/2 years in April, which should bolster hopes of an acceleration in economic activity in the second quarter…the National Federation of Independent Business said today that its Small Business Optimism Index rose 1.8 points to 95.2 last month, the highest reading since October 2007 (ironically, when the economy was on the cusp of its worst recession since the 1930’s)…

The TSX is 16 points higher as of 7:00 am Pacific…

Balmoral Resources (BAR, TSX) Update

Balmoral Resources (BAR, TSX) impressed the market yesterday with high-grade Gold assays from winter drilling at its promising Martiniere Property, 45 km east of the Detour Gold mine…yesterday’s results further demonstrate that Martiniere hosts an expanding, high-grade Gold system…an intercept of 1,138 g/t Au (33 ounces per ton) over 4.87 m (including an eye-popping and property record 9,710 g/t Au or 312 ounces per ton over 0.57 m) was returned from the Bug Lake Footwall Zone which has generated other high-grade results in the past…drilling has successfully extended the Bug Lake and related Gold zones to a vertical depth of 400 metres…

Plans for the summer 2014 drill program at Martiniere are currently being finalized, with drilling expected to resume in late June or early July…the focus will be on additional expansion and infill drilling along the northern segment of the Bug Lake Gold trend, additional testing of the newly identified steep along the southern extension, and testing of several other high-priority targets within the broader Martiniere Gold system…the important Sunday Lake Deformation Zone traverses the southern portion of Martiniere and is largely untested across the property which is centrally located within BAR’s 82 km Detour Gold Trend Project…

Below is a 1-year weekly BAR chart from John…a breakout above Fib. resistance at 91 cents (now new support) occurred yesterday with BAR climbing yesterday to its highest level ($1.09) since early 2013 when it hit nearly $1.30 a share…note that the stock gapped up yesterday…it’s possible, on some consolidation, that the gap could be filled in the near future as a test of fresh support – such an event would certainly present an excellent buying opportunity in our view as the primary trend remains very bullish…the rising 20-day SMA has provided strong support throughout the year – look for a continuation of that…BAR is off 7 cents at 97 cents through the first 30 minutes of trading…

Copper Update

Copper prices jumped to their highest level in two months yesterday after China unveiled a blueprint for overhauling its capital markets, a move that investors hoped will spark economic growth in the metal’s largest consumer…concerns about China’s demand for Copper have whipsawed prices of the industrial metal this year…Copper slid to its lowest level in nearly four years in March and is now up 6.4% from that low…

Production delays in places such as Indonesia and Chile have limited the supply of Copper coming to markets, taking the edge off the expected surplus…Copper stored in warehouses licensed by the London Metal Exchange are at the lowest level since 2008, according to CQG data…

Below is an updated 6-month daily Copper chart from John…extreme oversold RSI(14) conditions emerged in March,, perhaps marking an important low for the year…Copper has been climbing within an upsloping channel since…buy increasing is increasing, and the next resistance level is $3.15…

Venture Exchange

The Venture is unchanged at 988 as of 7:00 am Pacific…

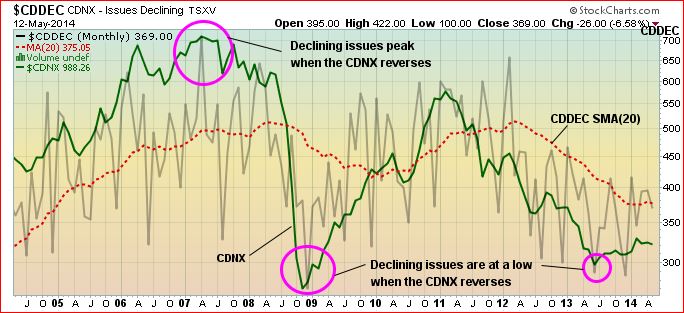

Further to yesterday’s piece, below is another Venture chart (declining issues) that provides additional evidence of a reversal in the primary trend…the SMA-20 for declining issues has reversed to the upside in 2014 as it did in early 2010…

North American Nickel (NAN, TSX-V)

We have high hopes for North American Nickel (NAN, TSX-V) this summer as it gears up to drill its 100%-owned Maniitsoq Nickel sulphide Project in southwestern Greenland…in addition to the robust geological potential of this project, as demonstrated by last year’s results, Nickel has been the best-performing commodity of 2014…NAN is already well-funded but announced last week it has arranged a private placement at 33 cents to raise gross proceeds of up to $9.4-million…Sentient intends to invest its pro rata amount in the financing in order to maintain its 41.3% position in the capital of the company…

On this 2.5-year weekly chart, you’ll see that the CMF indicator is showing the strongest buy pressure in NAN in nearly two years…excellent support in the mid-30’s at the rising 50-day SMA…the next Fib. measured resistance is 51 cents (not a price target, just a resistance level based on Fib. analysis)…NAN is unchanged at 40 cents as of 7:00 am Pacific…

Papuan Precious Metals Corp. (PAU, TSX-V)

One of the higher quality situations dipping its toes into waters of the medical marijuana business, while maintaining its mining assets, is Papuan Precious Metals (PAU, TSX-V) whose CEO and Chairman is Fission Uranium Corp.’s (FCU, TSX-V) Dev Randhawa…PAU made a run to as high as 15.5 cents May 2 but has since pulled back to 9.5 cents, a price that has us more interested as it’s within a band of Fib. support…the rising 20-day SMA is at 9 cents and the company announced April 29 that it intends to undertake a $500,000 non-brokered financing at 10 cents per share…

Below is a 3-month daily PAU chart from John…RSI(14) has been unwinding from overbought conditions…PAU is unchanged at 9.5 cents as of 7:00 am Pacific…

Note: John, Jon and Terry do not hold share positions in BAR, NAN, FCU or PAU…

9 Comments

DBV has been Halted!!

Wow, what an interesting day this is shaping up to be…DBV halted, news just out from GGI as they hit high-grade at Rodadero…DBV stated about 4 weeks for results (end of May)…assuming these are drill results, and coming earlier than expected, who knows…a key thing to look for is a potential discovery at Anomaly C – that would be a real game-changer…

busy day for BMR: DBV/GGI,XME, ETC……..SHOULD I ALSO MENTION GOLD/SILVER!

Keep a close eye on ABR – if DBV reports a stellar hole, it’s off to the races for Ashburton…would be bullish for all the plays, of course, but it will bring new focus on ABR…

anyone what is going on with GGI today??? are we expecting news?

News already came out, Laurie, GGI has hit some stunning Silver numbers at Rodadero…just saw some drill core photos on the GGI website, spectacular stuff…with DBV halted and possibly coming out with more strong numbers, this could be the Perfect Storm indeed…

A very exciting day indeed. Although I sold my remaining GGI last week after making some good money, I still feel this is a great company. The results they released today are phenomenal. People who are holding this will have an exciting summer, no doubt about it. I will be back in this stock in the near future. As for DBV, I am sitting at the edge of my seat; it’s all I can say now. @Steven1: Do you own Xme shares? If so, what do you think of their latest NR. I hold a decent chunk.

thanks for updates guys… not sure why my google alert didn’t pick that up but oh well. looking good!

ps… to the BMR team. congrats on all the fine work you’ve done keeping us in the loop about the developments in northern BC — i’m sure most of your readers are thrilled.