Gold has traded between $1,293 and $1,310 so far today…as of 8:30 am Pacific, bullion is up $10 an ounce at $1,305…Silver is 26 cents higher at $19.79…Copper is up 4 pennies at $3.16…Crude Oil is up another 79 cents at $102.49 after news yesterday that the U.S. government is re-examining its crude-oil export ban in light of growing domestic oil production…the U.S. Dollar Index, meanwhile, has fallen slightly to 80.04…

Official customs data from India show imports there fell 74.1% year-over-year in April, the first month of the fiscal year 2014-15, according to HSBC. “Paradoxically the drop in imports, which shows a decline in demand and is therefore ostensibly bearish, could be viewed as longer-term bullish. This could be case if the drop in Gold imports helps boost the chances of an easing of restrictions that the government imposed last year to cut the current account deficit,” HSBC stated. Currently there is a 10% import tax on Gold, along with administrative controls to reduce the current account deficit. “India’s main opposition Bharatiya Janata Party, which may now form the next government, has mentioned the likelihood that they will ease import restrictions on Gold imports, to combat the jump in smuggling. A revival in Indian demand would be gold-friendly,” HSBC stated. Results of the multi-phase elections in India will be known at the end of the week…

Official customs data from India show imports there fell 74.1% year-over-year in April, the first month of the fiscal year 2014-15, according to HSBC. “Paradoxically the drop in imports, which shows a decline in demand and is therefore ostensibly bearish, could be viewed as longer-term bullish. This could be case if the drop in Gold imports helps boost the chances of an easing of restrictions that the government imposed last year to cut the current account deficit,” HSBC stated. Currently there is a 10% import tax on Gold, along with administrative controls to reduce the current account deficit. “India’s main opposition Bharatiya Janata Party, which may now form the next government, has mentioned the likelihood that they will ease import restrictions on Gold imports, to combat the jump in smuggling. A revival in Indian demand would be gold-friendly,” HSBC stated. Results of the multi-phase elections in India will be known at the end of the week…

Tragedy in Turkey – the Turkish government announced today that so far, 201 miners are known to have lost their lives and at least 80 have been injured in a coal mine explosion and fire yesterday in the western province of Manisa…

Today’s Markets

Asia

Asian markets were relatively quiet overnight…China’s Shanghai Composite slipped 3 points to close at 2048, while Japan’s Nikkei fell 20 points after a 2% rally Tuesday…Japanese wholesale prices rose an annual 4.1% in April – encouraging news given deflationary concerns there…

Europe

European shares were mixed today…industrial production across the 18 countries that share the euro fell in March, a reminder that the currency area’s economic recovery remains modest and vulnerable to setbacks…the EU’s statistics agency reported today that output from factories, energy companies and other utilities was down 0.3% from February, and 0.1% from March 2013…meanwhile, U.K. unemployment fell to its lowest level in over five years, while wage growth in the country rose by more than inflation for the first time since 2010…

North America

The Dow is down 52 points as of 8:30 am Pacific…yesterday, the Dow rose to an intra-day record of 16,736 while the S&P 500 crossed 1,900 for the first time…U.S. producer prices posted their largest increase in 1-1/2 years in April as the cost of food and trade services surged, hinting at some inflation pressures at the factory gate…the Labor Department reported this morning that its seasonally adjusted PPI for final demand rose 0.6%, the biggest gain since September 2012…economists polled by Reuters had forecast prices received by the nation’s farms, factories and refineries rising 0.2 percent…in the 12 months through April, producer prices advanced 2.1%, the biggest gain since March 2012, after rising 1.4% in March…consumer price inflation numbers will be reported tomorrow…

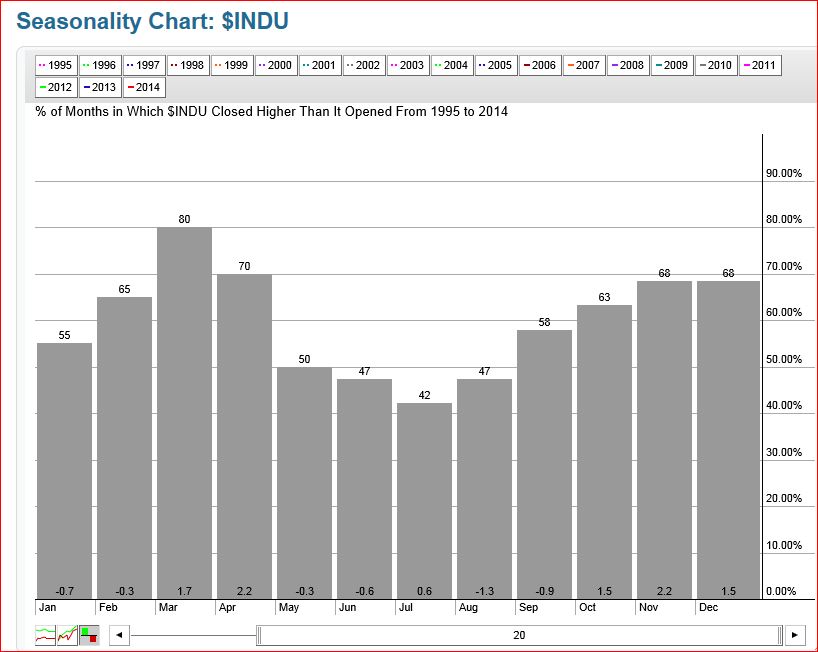

Below is a Dow “seasonality chart” going back two decades. Interestingly, the weakest four months of the year have been May through August…

The TSX is up 13 points while the Venture has gained 6 points to 994 as of 8:30 am Pacific…Doubleview Capital Corp. (DBV, TSX-V) has been halted, pending news, which we assume will be drill results from the Hat Property – perhaps not all of the results considering the most recent drill program didn’t wrap up until near the end of last month…in this business, good news usually travels fast – bad news typically travels by pony express (positive sign)…the Sheslay district could ignite again in a major way if DBV produces one or more stellar holes from April drilling…a “hit” on Anomaly “C”, in particular, would be a game-changer as it’s more than 2 km from discovery holes HAT-11 and HAT-08…

Garibaldi Drills Bonanza Grades At Rodadero – 50-Metre Step-Out Hole Commences

What’s so impressive about Garibaldi Resources‘ (GGI, TSX-V) drill hole reported this morning from its Rodadero Project in Mexico is not only the grade – a whopping 65 oz/ton over 7 metres (23.1 feet) – but the fact that this is from first-ever drilling at the property…it’s not often a company reports a hit like that the first time it sinks a drill bit into the ground…

What was originally a single “test” hole has suddenly morphed into something that could become much bigger with some serious “legs” to it…a second drill hole at the “Silver Eagle” target has now commenced, a 50-metre step-out to the south of SE-14-01…highly interesting, also, is that Garibaldi has reported the discovery of 9 other Silver and Gold targets on its large Rodadero (North & South) package – much more to this story, in all likelihood…

This all comes on the heels of solid first-ever drill results at La Patilla, including 10.4 g/t Au over 8.5 m near-surface, and in advance of follow-up drilling at La Patilla, initial drilling at Iris, and of course the Big Show – first-ever drilling at the Grizzly where Garibaldi controls the largest piece of the pie as far as the Sheslay Cu-Au porphyry mineralized corridor is concerned…

GGI is demonstrating expertise on the ground, and of course it’s also one of the few junior exploration companies with some cash flow as it continues to earn royalty income from a pilot coal program at Tonichi…in addition, GGI hasn’t had to carry out a financing since 2009 – something almost unheard of in a market environment where so many companies have been forced to severely dilute their share structures with cheap financings just to stay alive…

This is truly a special situation (very well managed company) with the opportunity for massive gains over the next few months given an usual “confluence” of events – several potential triggers that offer significant exploration upside from high-grade Gold and Silver opportunities to a dominant land position in what could easily develop into one of the most exciting area plays (Sheslay district) B.C. has witnessed in many years…

Technically, GGI appears poised for a major breakout as you’ll see in an updated chart from John…first, though, a look at a very pretty picture and what seems to be massive sulphides from Silver Eagle drill core posted on the Garibaldi web site this morning…

GGI 10-Year Monthly Chart

Significant progress on the ground by Garibaldi is reflected in this very bullish long-term monthly chart…the pattern is similar to the one that started in early 2009 at under a nickel and peaked in early 2011 at more than 10 x that level…RSI(14) is following a well-established uptrend, accumulation is strong as shown by the CMF, and the bullish trend is gaining strength according to the ADX indicator…given today’s news, the likelihood of a confirmed near-term breakout has increased substantially in our view…indeed, GGI has broken the 24-cent barrier in early trading and is up 3.5 cents at 25.5 cents as of 8:30 am Pacific…the 50-day moving average (not shown on this chart) has reversed to the upside, another bullish sign…

Ashburton Ventures Inc. (ABR, TSX-V)

If the market likes what Doubleview has to report, then it’s likely off to the races for Ashburton Ventures (ABR, TSX-V) which holds very strategic ground within just 1 km of DBV’s original discovery holes (they’re also contiguous to the western border of GGI’s Grizzly, and that will come into play very soon)…the structural trend is NW/SE, going toward the Hackett, and significant Copper-Gold showings run along the western border of the Hackett according to historic reports…the Hackett Property has never been previously drilled or systematically explored, and Ashburton has commenced a work program which is expected to lead to summer drilling…

Not long ago, DBV was trading around a nickel…it has soared…a year ago, Garibaldi was trading at a nickel and it has soared as well…Ashburton could also easily soar along with another low-priced Sheslay play, Alix Resources (AIX, TSX-V)…and of course we’re extremely bullish on Prosper Gold (PGX, TSX-V) which has the most advanced property in the district – the Star Project – with drilling commencing within days…

ABR 2-Year Weekly Chart

Below is an updated 2-year weekly ABR chart…as of 8:30 am Pacific, ABR is up half a penny at 6 cents…technically, what to watch for is a potential close above the horizontal channel on strong volume…this is looking very promising…

Fission Uranium Corp. (FCU, TSX-V) Updated Chart

Fission Uranium (FCU, TSX-V), which reported more solid results from PLS South yesterday, appears to be on the rebound after touching support at $1.04 last Friday during the Venture’s nearly 20-point intra-day slide…below is an updated chart (7-month daily) from John…FCU is unchanged at $1.22 through the first two hours of trading…

Platinum Update

Platinum’s appeal is soaring in India, the world’s second-largest consumer of the precious metal…though Platinum costs more than Gold, demand is increasing elsewhere in Asia, too – a rise that comes at a time when strengthening economies in the West appear likely to soak up more of the metal for industrial uses…output has been curtailed in South Africa, the world’s largest producer…

China remains the heavyweight in terms of Platinum jewelry demand…buyers there account for around 65 metric tons of the near 100 tons sold over retail counters world-wide each year, according to The Wall Street Journal…Chinese demand may rise by 5% in 2014, but India, whose consumers last year took about 158,000 ounces, or a bit less than five tons, is expected to see growth of as much as 35% this year…that’s according to the marketing and promotion organization Platinum Guild International…other sizable consumers are the U.S. and Japan where demand is forecast to increase 11% and 1.2%, respectively…

Below is an 8-month daily Platinum chart from John…the metal is testing resistance – the trend is bullish and a near-term breakout appears quite likely…

Note: John and Jon both hold share positions in GGI, PGX, ABR and AIX. Jon also holds a share position in DBV.

17 Comments

Let’s keep our fingers crossed that DBV’s results are great, not to mention hopefully that they come from Anomoly “C”. Could be some interesting times ahead for the Shareholders, Farshad and Doubleview Capital! Anxiously awaiting these results!

Doubleview Capital Corp. Announces 451m with 0.33% CuEq in Hole H11, and 246m with 0.35% CuEq Including 94m with 0.60% CuEq in Hole H12 at Hat Property

news out

PRESS RELEASE FROM THENEWSWIRE.CA

Doubleview Capital Corp. Announces 451m With 0.33% CuEq In Hole H11, And 246m With 0.35% CuEq Including 94m With 0.60% CuEq In Hole H12 At Hat Property

Wednesday, May 14, 2014

Doubleview Capital Corp. Announces 451m with 0.33% CuEq in Hole H11, and 246m with 0.35% CuEq Including 94m with 0.60% CuEq in Hole H12 at Hat Property

11:41 EDT Wednesday, May 14, 2014

Read more at Stockhouse…

What do you guys think about DBV’s drill?

Jon

what is your opinion of the DBV results reported today?

thanks

I’m still working through them, Greg…on the positive side, DBV is demonstrating very good volume potential in what they’re now calling the “Lisle Zone”, this is a kilometer long and remains open….as they drill more within this zone, and tighten up the spacing, it’s reasonable to expect grades to improve…the gold numbers are interesting…do they have a Gold-Copper porphyry emerging here or a Copper-Gold porphyry? It would have been nice to see a significant hit on Anomaly C but that didn’t occur on this round of drilling…that’s the negative, though they have an interesting sniff in hole 14 that could lead to something….I think they took direct aim at the IP high on Anomaly C, a little off from the high is where they may find the good stuff….so Anomaly C is still very much in play, still early…..if they came up with a Hole 8 or Hole 11 type of hole at Anomaly C, the stock may certainly have gone in the other direction today…they also didn’t continue into high grade on the deepening of hole 11…..hole 12 is nice, and we’ll review this in more detail in the morning but the market seems to have missed the significance of the Red stock…..typical sell on news mentality……Farshad is a bulldog and he still has a tiger by the tail here, he’ll work hard, get back to drilling, and move this forward…system very much remains open and has good length to it…..lots more work to do….importantly, the geological story remains intact….15 holes now drilled at the Hat…keep in mind the most advanced property in the district is Prosper’s Star Project and drilling starts there within days, while GGI, which reported stunning Silver numbers out of Mexico today, is preparing to attack the very large scale Grizzly….it’s going to be an exciting summer in the Sheslay district…

Dbv down 8 cents. Market doesn’t like the news today. Maybe it will have more time to digest and hopefully see a rebound. ( fyi I am not invested in Dbv, just dont like seeing red after results are announced. )

Not the results people were expecting, but I don’t think we’ve seen the end of DBV. Something tells me there is more to come with this play.

For those who are tired of waiting for the initial results of the truth machine and getting burned when results are released may I suggested fancamp fnc.v. This company scoops up properties where initial exploration has already been completed and are worthy of further exploration. Here is a link to a news release from today. Fyi I have shares in this company at 8.5 cents (currently at 7 cents).

http://online.wsj.com/article/PR-CO-20140514-913468.html

I think DBV should bounce back. This is nice long intersection!

Nice GGI numbers today!

Amazing, really, for a first drill hole, Tony…..spectacular. If they can so effectively target a hole like that, then that bodes well for hole 2. These targets, some of them at least, are not just high-grade Silver but high-grade Gold targets as well…Steve Regoci has agreed to a BMR interview tomorrow…..we plan to run the first segment Friday, some interesting questions to ask him given today’s news….

Yes very nice numbers from GGI’s Rodadero project today. Grizzly, La Patilla and now Rodadero. Three very impressive properties, I’ll be doubling down on GGI before its too late

a little overdone on DBV this early morning…back to 24 now…21 low!

Definitely overdone on the DBV selling IMHO——there’s important information we believe was overlooked yesterday that we’ll be expanding on in this morning’s report…

gold just bounced back to over 1300….

Yes there was a lot of over looked info for example he may have found the feeder zone!