Gold is pushing higher today…as of 8:15 am Pacific, bullion is up $10 an ounce at $1,254…it dipped as low as $1,240 and has traded as high as $1,259…Silver is up 24 cents to $19.04…Copper is down 2 pennies to $3.09…Crude Oil is off 28 cents to $102.36 while the U.S. Dollar Index has retreated after touching an intra-day high just above 81…it’s currently down slightly on the day at 80.58…

Gold is performing well in the wake of this morning’s European Central Bank announcement (this move by the ECB was already “priced in” by the markets) and bullion could get another lift tomorrow if the U.S. jobs report doesn’t meet market expectations…

Gold is performing well in the wake of this morning’s European Central Bank announcement (this move by the ECB was already “priced in” by the markets) and bullion could get another lift tomorrow if the U.S. jobs report doesn’t meet market expectations…

The ECB reduced interest rates this morning and announced a series of other measures designed to boost bank lending as officials scramble to keep ultra-low inflation from gaining traction and derailing the euro zone’s fragile recovery…speaking at a news conference, ECB President Mario Draghi said he and his colleagues were prepared to take further “unconventional” measures if necessary…

The ECB cut its main refinancing rate to a fresh record low of 0.15%, from 0.25%, and its deposit rate from zero to -0.10%, as it becomes the first major central bank to venture into negative territory…

Banks will now need to pay to park cash with the ECB…the theory is that this will encourage banks to lend their cash to needy households and businesses instead…it’s also possible, though, that banks may respond by passing on the cost to their customers, or the negative deposit rate may actually encourage banks to hoard physical cash in vaults instead…who knows how this may work out…neither the Federal Reserve, the Bank of Japan nor the Bank of England have tried the measure, which the ECB hopes will lift inflation by weakening the euro and spurring lending in the bloc’s more unsettled periphery…

As Bloomberg reported this morning, Draghi stated in March that the euro is “increasingly relevant in our assessment of price stability” and policy makers blamed a strong currency for weakening price pressures…Nick Beecroft, senior market analyst at Saxo Capital Markets in London, said the euro may already reflect expectations for measures such as a 15 basis-point cut in ECB rates…now that Draghi has flagged the Governing Council’s concerns on the currency, a bigger drop may only be possible if officials take more dramatic steps to stoke inflation…

“The market has realized that the ECB is really focused on the euro, and they will want blood,” he said. “They’ll want deeper cuts in the deposit rate or quantitative easing before the euro weakens further.”

The Currency Race To The Bottom

The ECB is hoping to drive down the value of the euro, and of course it’s not the only central bank “talking down” its currency…Japan and others have been doing the same, and one has to wonder what this unprecedented central bank intervention on a global scale (which is distorting the markets) will ultimately lead to…

Canada is in the game, too…read this interesting statement yesterday from the Bank of Canada as it kept its key overnight lending rate at 1% for the 31st consecutive time – a span that stretches back to September, 2010 (the underlined parts are our emphasis)…

“Global economic growth in the first quarter of 2014 was weaker than anticipated…and recent developments give slightly greater weight to downside risks. The U.S. economy is rebounding after a pause in the first quarter, but there could be slightly less underlying momentum than previously expected. Globally, long-term bond yields have continued their decline, reflecting in part growing market anticipation that interest rates will remain low over the long term. This, along with buoyant stock markets and tight credit spreads, indicates that financial conditions remain very stimulative.

“The Canadian economy grew at a modest rate in the first quarter, held back by severe weather and supply constraints. The ingredients for a pickup in exports remain in place, including the lower Canadian dollar and an anticipated strengthening of foreign demand. Improved corporate profits, especially in exchange rate-sensitive sectors, should also support higher business investment in the coming quarters.“

Today’s Equity Markets

Asia

China’s Shanghai Composite reversed earlier losses to jump nearly 1% overnight, snapping a four-day losing streak and bouncing off yesterday’s two-week two-week low…data out in early trade showed growth in the country’s services sector fell to a four-month low in May…Japanese shares managed to end at a near three-month high, extending gains into a fourth straight session…

Europe

European markets were mixed today, finishing well off their highs of the day following the stimulative measures announced by the ECB…

North America

The Dow is up 44 points as of 8:15 am Pacific…the Federal Reserve’s Beige Book of regional business conditions found growth expansion in all of the Fed’s 12 districts while the ISM non-manufacturing index rose to 56.3 in May…that beat estimates and offset May’s ADP Report which saw the creation of 179,000 private jobs, below expectations for 215,000…the Labor Department will reveal May’s non-farm payrolls number tomorrow…expectations are for a gain of 218,000…

The TSX is down 13 points while the Venture is up 2 points at 984…Doubleview Capital Corp. (DBV, TSX-V) has announced that drilling has re-started at the Hat Property as the company further explores the Lisle Zone and the recently recognized Sheslay Red Stock syeno-gabbroic intrusion…

Venture Price-Volume Analysis Chart

More technical evidence of underlying bullish strength in the Venture…this is a 3-year daily price-volume analysis chart from John…volume is such a key indicator, and note how it was at its lowest when the Venture bottomed in June of last year at 859…

In October of last year, of course, the Venture finally broke above its long-term downtrend line…not unexpectedly, it then tested that downtrend line as new support before breaking to the upside at the end of December…the rising 200-day moving average (SMA) at 965 forms part of a huge wall of technical support around the 970 area which was major resistance for most of last year…

Open your eyes, everyone…many investors made the mistake late last year of not “buying the dip” to the downtrend line after the October breakout…they were fearful at a time when they should have been greedy…a similar situation has developed since the March high of 1050…the retracement since then has been perfectly normal and healthy from a technical standpoint with the Index re-testing strong support and putting in another higher low…the Venture is behaving in textbook technical fashion…

Magor Corp. (MCC, TSX-V) Update

Magor Corp. (MCC, TSX-V) continues to show momentum in building its client base…Magor announced this morning that New York-based Brook-Pro has selected Magor’s Aerus service delivery platform to support the delivery of an innovative new line of video-enabled service offerings for the financial services and higher education market segments…this follows two other announcements over the last couple of weeks regarding deals from Dubai to Texas…Magor is a “visual collaboration” company led by an all-star management team that includes some of the same key personnel that were at the helm of Newbridge Networks…MCC climbed as high as 37 cents Monday where it hit a Fib. resistance level, but technically the stock is looking much healthier with a near-term reversal to the upside in the 50-day moving average (SMA) very possible…MCC is up a penny at 31 cents as of 8:15 am Pacific…

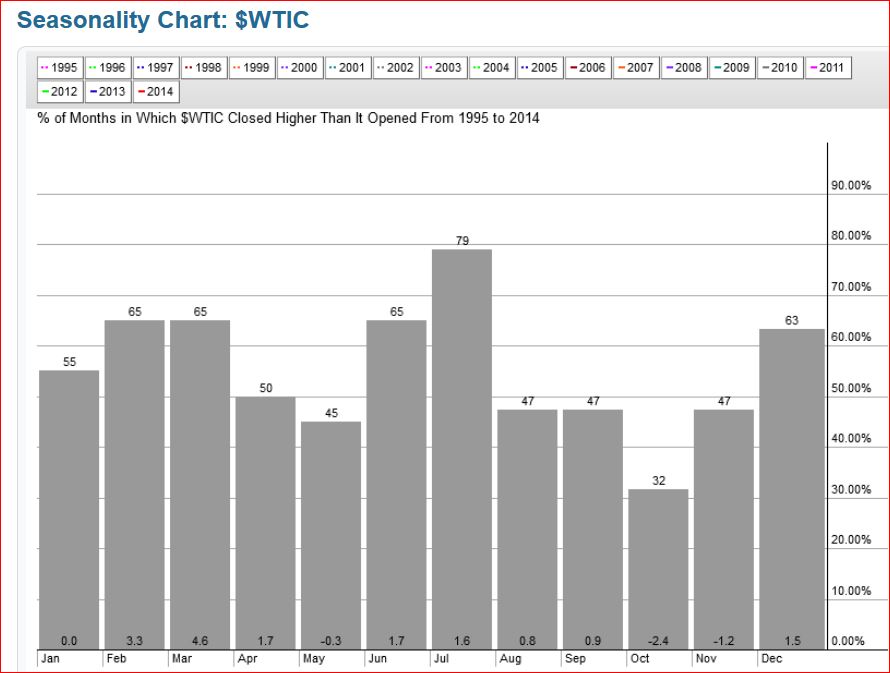

Crude Oil – Seasonality Chart

Historically, at least going back over the last two decades, June and July are the strongest months for Crude Oil (WTIC) prices…below is a seasonality chart from John…

Contact Exploration Inc. (CEX, TSX-V) Update

Calgary-based Contact Exploration (CEX, TSX-V) has been one of our favorite energy plays since it was trading in the 20’s last year…Contact continues to accelerate its key Kakwa Montney play, and is poised for further increases in production as East Kakwa pushes westward…total company reserves (net proved and probable) increased by 43% in the year ended March 31 to 10,643 thousand barrels of oil equivalent (mboe) while total company net present value (net proved and probable reserves discounted at 10%) increased by 69% to $174.4-million…

On May 26, CEX announced it’s proceeding with a non-brokered private placement of flow-through and non-flow-through common shares (at 44.5 cents and 39 cents, respectively) to raise total gross proceeds of up to approximately $10 million…

Technically, Contact has staged a confirmed breakout above Fib. resistance at 38 cents…that level, which also roughly coincides with the rising 50 and 100-day SMA’s, now becomes strong new support…below is a 2.5-year weekly chart…CEX is up 2.5 cents at 44 cents as of 8:15 am Pacific…

Discovery Ventures Inc. (DVN, TSX-V) Update

One of the advantages astute investors have in this current market is that most investors are slow in reacting to positive news – just the opposite, of course, to the situation in late 2010/early 2011…

Discovery Ventures (DVN, TSX-V) is a good example of this…on Tuesday, we alerted our readers to the fact that DVN (trading at 18 cents at the time) had released a very robust Preliminary Economic Assessment for its WillaMAX Gold-Copper-Silver Project in southeast B.C., an area known for high grades with a rich history of mining…the PEA came out last week and has many attractive aspects to it including a very low capex ($12.8) and a rapid payback with a 412% IRR…we encourage our readers to review that document as part of their own due diligence…quite simply, based on this PEA which commands attention as it shows this project has some serious strength to it, the Willa deposit has clear potential to become a major cash cow for DVN…between this higher-grade deposit and the company’s strategic acquisition of the nearby MAX mine and mill facilities, Discovery Ventures is looking more attractive than ever now that it is armed with a powerful PEA that should win the favor of the market in order to enable the Willa to go into production…

DVN is starting to grab increased attention as it jumped 3.5 cents yesterday on over 800,000 shares to close at 21 cents…John’s updated chart shows increasing buy pressure (CMF) and a series of higher lows since the summer of last year which is also very bullish…the 50-day SMA, not shown on this chart, has just reversed to the upside – so a highly favorable technical environment is emerging here to go along with strong fundamentals…DVN is unchanged at 21 cents through the first 90 minutes of trading…

Note: Jon holds share positions in MCC and DVN.

7 Comments

Farshad is very tight lipped. Very little was said in the press release. How much money do they have? How many holes are they going to drill? The market needs to know this. I am sure all will be said once he releases the press release about drilling being done. But he should have said it now to get some buying pressure.

I heard talk that he had enough cash to drill 10 holes. How deep they are was not mentioned. I wonder what his strategy will be? Drill 3 or 4 and release results and review the situation, or drill continuously and release results 1 by 1?

One of the few things that the PR does mention is that they have looked at the previous core samples in order to help them understand better the part that Red Chris might play in the deposit.

What I know is we drill one deeper hole for check the intrusion !

Thanks for the info Tom. Our chances of getting good results this time around are good, seeing that they understand the area better now. If Farshad releases results one by one, they better be monster holes or the market will not take notice. But it’s imperative to get good results so Farshad can get a PP done with little dilution. Also if my memory serves me well, we still have some warrants that can be exercised that will bring in some money.

Let’s hope that Farshad does in fact have a better knowledge of the area in order to provide some stellar numbers. If the current pressure on the share price remains at these levels and DBV doesn’t provide big numbers on the next news release, the share price will be single digits in the blink of an eye. Just my opinion…I have faith in Farshad but a little nervous this time around – based on the poor market support from our last set of results.

Kevin I have the same concerns as you. It is imperative to have solid NRs so you can get some buying pressure. Yesterday’s NR was bare bones; nothing for a speculator/investor to chew on. I think we will move from here going forward but I don’t think we will touch the 30 cent zone this time around. I could be wrong, and we might blast through the 52-week high, which would be nice. I am waiting to see how next week plays out, since I am expecting gold to have a good week. Happy trading/investing.

While PGX as no volume what so ever, maybe not a good sign?, anyway bought some GGI this morning at 0.235$