Gold has pushed through Fib. resistance in the $1,280’s this morning…as of 7:00 am Pacific, bullion is up $18 an ounce at $1,295…Silver has added 31 cents to $20.22…Copper is flat at $3.05…Crude Oil is down 51 cents to $105.46 while the U.S. Dollar Index has tumbled one-fifth of a point (helping Gold) at 80.18…

Fed Chair Janet Yellen said yesterday that the central bank, which is cutting bond purchases by another $10 billion to $35 billion, plans to keep its interest rate target low for a considerable time after it ends bond-buying. “The FOMC policy statement did not contain major surprises, although at the margin, the general tone was probably more dovish than expected,” analysts including Edel Tully at UBS AG said in a report. “In effect, the lack of an aggressive Fed is Gold-supportive.”

Fed Chair Janet Yellen said yesterday that the central bank, which is cutting bond purchases by another $10 billion to $35 billion, plans to keep its interest rate target low for a considerable time after it ends bond-buying. “The FOMC policy statement did not contain major surprises, although at the margin, the general tone was probably more dovish than expected,” analysts including Edel Tully at UBS AG said in a report. “In effect, the lack of an aggressive Fed is Gold-supportive.”

Yellen remains fairly optimistic, however, regarding the prospect of a U.S. economic recovery gaining momentum by 2015…when asked if the U.S. will be stuck in a period of lower growth, Yellen said that there are several factors that point to an improving economy: better household balance sheets, rising home prices, an improving labor market and a brighter global economy. “I think there are many reasons why we should see above-trend growth in 2015 and 2016,” she stated.

Today’s Equity Markets

Asia

Japan’s Nikkei surged 245 points overnight to close at its highest level – 15361 – in over four months…China’s Shanghai Composite, however, fell 32 points or 1.5% to finish at 2024…the weakness came despite data showing that profit growth at state firms rose in the first five months of the year and Premier Li Keqiang’s optimistic comments on economic growth…

Europe

European markets are up significantly in late trading overseas, buoyed by yesterday’s Fed announcement and the perception of a dovish tone from Yellen despite her positive outlook regarding the economy…

North America

The Dow is down 5 points as of 7:00 am Pacific…the number of Americans filing new claims for unemployment benefits dipped slightly more than expected last week…initial claims for state unemployment benefits slipped 6,000 to a seasonally adjusted 312,000 for the week ended June 14, the Labor Department reported this morning…

The TSX is off slightly while the Venture has added 6 points to 1015 as of 7:00 am Pacific…

Venture 6-Month Chart Update

It has been a very good week so far for the Venture which continues to gather steam for an eventual assault on the March high of 1050, followed by what we believe will be a fresh 2014 high during Q3…

Buy pressure is rapidly increasing, as shown in this 6-month daily chart…there’s no denying the bullishness of the Venture at the moment, and the likelihood of a strong Q3, but the advance at this stage at least could be a two-steps-forward, one-step-back type scenario…it’ll be interesting to see how the Index handles near-term (temporary) Fib. resistance around 1020…strong new support now exists at 1000…

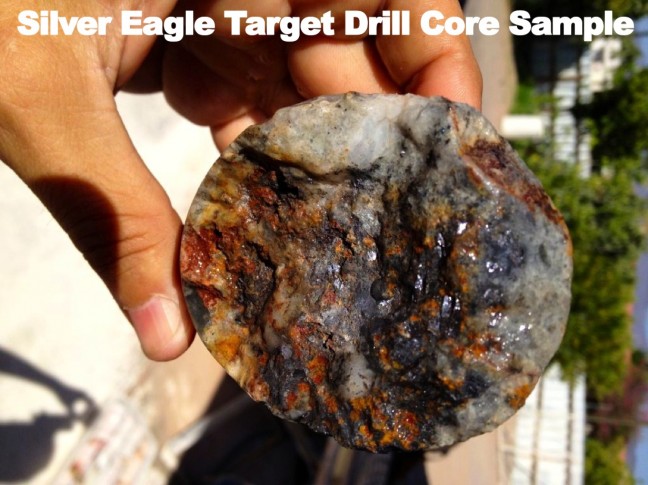

Garibaldi Resources (GGI, TSX-V) Update: High-Grade Structure At Silver Eagle

One doesn’t even have to read between the lines of this morning’s news from Garibaldi Resources (GGI, TSX-V) to know that something very significant appears to be in the works at the company’s Rodadero North Project in central Sonora State, Mexico…the kind of high-grade mineralization at the Silver Eagle target is very distinctive in its look, as shown in drill core photos after the release of assays from discovery hole SE-14-01 (65 oz/ton Ag over 7-m near-surface), and GGI now states that a step-out hole drilled 50 m to the south of SE-14-01 has hit “exceptionally hard mineralized sulphide bearing quartz”…a heavy duty drill rig was brought in to replace GGI’s company-owned test rig, drilling continues and “pending additional assay results are eagerly anticipated.” No one has a crystal ball, but if this hole runs in both grade and width, GGI’s stock price will obviously run with it…a fourth hole is in progress…

GGI is also now talking about potential “geometry and dimensions of a promising high-grade structure” at Silver Eagle, a sign that geologists do like what they see in the core. “Mineralization at Silver Eagle consists of an apparently flat-lying silicified zone or cap of brecciated rock exposed on a hill. Mineralized structures cross this silicified zone and may form a tabular root or feeder zone to the silicification,” GGI reported…

Mineralization at shallow depths, “flat-lying” with feeder structures…in Mexico, the world’s largest Silver producer, this is a winning formula, a recipe for a deposit, so GGI definitely appears to have a tiger by the tail at Silver Eagle…

Hyperspectral remote sensing technology, which GGI used to identify a previous important discovery (the Temoris option) that was sold to Paramount Gold & Silver (PZG, NYSE & TSX), was instrumental in narrowing down targets at Rodadero North (Silver Eagle is just one of 8 prospects) along a 10-km NW-SE trend…hyperspectral, which is flown from miles in the sky and works like a scanner reading a bar code at the grocery store, detected promising mineralogical signatures at Rodadero, and this was followed up by boots on the ground…mapping and sampling confirmed the hyperspectral readings with high-grade numbers at surface…assays from the first drill hole then returned even better numbers within 30 m from surface…

A picture tells a thousand words…below is one of the new Silver Eagle drill core photos taken from the GGI web site…

GGI is up half a penny to 24 cents through the first 30 minutes of trading…

Kiska Metals Corp. (KSK, TSX-V)

We suggest readers perform their due diligence on Kiska Metals Corp. (KSK, TSX-V) which looks interesting from both a technical standpoint (see John’s chart below) and fundamentally as the company has a large portfolio of Gold and Copper projects (advanced and early-stage) in Canada, the U.S. and Australia…after climbing as high as nearly $2 a share in late 2010, KSK appears to have finally bottomed out below a dime (it touched 3 cents last December) and closed yesterday at 9 cents for a market cap of $10 million…

What actually reminded us of Kiska was Garibaldi’s recent news regarding its acquisition of the Red Lion Property (35 sq. km) adjoining Kiska’s Kliyul Project which interestingly was optioned late last year by Teck Resources Ltd. (TCK.B, TSX)…Kliyul is roughly 200 km southeast of the Sheslay district and 70 km southeast of the Kemess mine…Teck is gearing up for a drill program at Kliyul, and this is definitely an area of northwest B.C. that could really garner some attention later this summer…

The most recent drilling at Kliyul, in 2006, yielded very encouraging Copper and Gold intersections from two holes…in KL06-30, a 218-m intersection averaged 0.52 g/t Au and 0.23% Cu…KL06-31 returned a number of intervals of similar tenor, highlighted by 24 m of 0.44 g/t Au and 0.20% Cu, 32 m of 0.62 g/t Au and 0.21% Cu, and 20 m of 1.21 g/t Au and 0.14% Cu…these were the first deep holes drilled on the property and both ended in mineralization…

In 2011, Kiska completed a 30.6 line km IP survey to follow up the 2006 drilling and identified a zone of chargeability measuring 500 m x 1,400 m which underlies mapped pyrite-sericite alteration…the 2006 drill holes are located within this anomaly…the main chargeability high is flanked by zones of moderate chargeability that increase the lateral dimensions of the anomaly to 1,100 m x 1,800 m…

In October of last year, Kiska signed a “participation agreement” with Teck whereby the major can earn a 51% in Kliyul by spending $5.5 million over five years, and subsequently can earn a further 14% by spending an additional $6.5 million…

Technically, KSK finally broke above its 200-day moving average in late December, and that SMA has reversed to the upside and is now acting as strong support at 8 cents…RSI(14) at 51% on this 3-year weekly chart is moving up from a bullish “W, and all signs point toward a test of Fib. resistance levels at higher prices over the summer…

Panoro Minerals Ltd. (PML, TSX-V)

Panoro Minerals (PML, TSX-V) formed a classic double bottom and is certainly worthy of our readers’ immediate attention as it continues to advance important projects within the prolific Andahuaylis-Yauri belt in southeastern Peru…this is the same porphyry Copper belt that hosts the massive Las Bambas Project recently purchased by a Chinese consortium (a unit of state-controlled Minmentals Corp.)…

Panoro, which has just over 200 million shares outstanding, closed yesterday at 40 cents where there is some technical resistance…look for the rising 50-day SMA, currently at 34 cents, to act as a close supporting moving average…the now-rising 100-day SMA is immediately beneath that at 32 cents…below is a 3-year weekly chart from John…as always, perform your own due diligence…

North American Nickel Inc. (NAN, TSX-V)

The sudden resignation of North American Nickel (NAN, TSX-V) CEO and Chairman Richard Mark for personal reasons was a surprise, but that should not distract investors from the major opportunity we continue to see in NAN as the company prepares for the start of 2014 drilling at its potential world class Maniitsoq Ni-Cu-Co-PGE Project in southwest Greenland…

Technically, NAN has been moving along in textbook fashion since announcing its discovery at Maniitsoq last summer…currently, RSI(2) on the 1-year daily chart is at its most oversold level of 2014…the stock recently met resistance at 45 cents and closed yesterday at 42 cents…NAN has remained at or above its rising 100-day SMA, currently at 39.5 cents, throughout the entire year…buy pressure recently replaced sell pressure which was dominant since late 2012…

Note: John and Jon both hold share positions in GGI.

15 Comments

John/Jon …. have we left the starting line???? guys like BTO, SMF, nevsun and the like are all up 25% in weeks…

can it be long before the GBB’s of the world start to bubble?? those who have been talking a pop like Edelson and Savage may be onto something??

the venture being a leading indicator is starting to do its bubbling as well..

will all other indices at record highs and the V at record lows, one wonders where capital will bleed from and into where …

The V has been on life support for 3 years… is it transfusion time???

Getting excited for the recovery…

Jon, that is the kind of update i would have liked to see from pgx!

GBB very quite today

One hell of a short squeeze in the metals market today. I wouldn’t be surprise if we start seeing a rotation out of the stock market and into commodities. There is too much upside. The situation in Iraq is also making traders a little nervous. And inflation cannot be ignored anymore.

NAN just announced that drilling has started…

Regarding GGI’s latest release, am I right in thinking that holes 2 and 3 have been completed and assays are awaited. Have photographs of both these holes been published on their website. Some photographs dated 26th ? May were put on the website but I don’t know if these related to the 1st (already reported) or the 2nd hole. If the latest photos are from the 3rd hole and the 26th May are from the 2nd hole, can we assume that both the step-out holes are successful in enlarging the deposit?

Hi Tom, yes, holes 2 and 3 have been completed, 4 is in progress. The visual description concerning hole 2 is very revealing – “exceptionally hard mineralized sulphide bearing quartz”. So I think it’s a safe assumption – as safe as it gets in this speculative industry – that GGI has “hit” on hole 2. That’s my assumption. And I strongly suspect they would only bring in a commercial rig, to replace their own rig, if they had made a decision to ramp up the program based on visuals. This kind of high-grade mineralization is very obvious to the eye as you can see in the core photos. We don’t know what photos pertain to what hole, but they are darn encouraging.

Things are looking very good!

Silver Eagle is just one of eight targets! Photos look

Massive.

With a possible resource bullmarket on the way this stock could

Be a multi multibagger. Just curious if they used the technology

To pick up Grizzly.

Great day for gold and silver. Most of my precious metals stocks moved to the upside, which tells me that this rally has some legs. Now the test is to hold the 13 handle. DBV ended down on the day- the only disappointment for me today. DBV has lost all of the gains that were made during the previous drilling campaign- unbelievable.

Chris you sholdnt be surprised…. its all about whats hot today… watch the volumes on the sheslay plays and u will see peeps moving in and out of the hot plays.. which there are really not any yet… but the volume suggest that some are trying to create one..

due time mate due time

Awesomeness for the venture today!!!

Chris, I understand your disappointment, in a day like today, Gold up, CDNX up nicely, DBV crossing 200 days moving average to the down side!?

@Martin: The way I see it is the stock is being accumulated. But Anonymous and Canaccord are always there to smash the price down the moment it looks like its about to run. Maybe they have a motive, like forcing Farshad to do a financing at a lower price. But a lot of people start pilling on once momentum starts, but the twosome always kill the momentum. Anyhow, money will slowly trickle in in the near future, that much I am certain. I hope once drilling is done, Farshad releases a strong NR that will grab investors’ attention, since the last one didn’t have much substance to it.

My Gess is next week will be a solid one for Sheslay stocks. First PGX as to come with something substential, Ashburton as something huge untherneath them, they have to deliver to, will at the info DBV as provide over the last few mounth it is not suppose to be that hard to figure out where to sink the rig. Alix as the most dificult game to play where to start and what to do. As far as GGI is concern i am not even worry, tthis is a buy and hold i would be surprise whey would be we biggest winner over there.

Anonymous seller arrives at the end of the day quite often on DBV. Let’s hope that Farshad hits some good grades with the current drilling program.