Gold has traded between $1,298 and $1,310 so far today…as of 7:15 am Pacific, bullion is up $3 an ounce at $1,303…Silver is up a penny at $20.80…Copper is off a penny at $3.19…Crude Oil has recovered another $1.35 a barrel to $102.55…the rise comes on news that the U.S. used more of its backup Oil than at any time in the past half year…the “hefty” draw in Crude Oil inventories, which fell by 7.5 million barrels according to data from the Energy Information Administration, was the largest weekly drop in six months…the U.S. Dollar Index is up slightly at 80.54…a new round of U.S. sanctions on Russia, which weighed on stocks with exposure to the country, helped send Palladium to 13-1/2-year highs…the metal is chiefly sourced from Russia…Russian stocks (the market there is down over 4% this week) and the ruble came under sharp pressure today…

Gold is trading around its 100-day moving average (SMA) but a test of strong chart and Fib. support in the $1,280’s, coinciding with the 200-day SMA, can’t be ruled out as John has shown…two attempts at a major smack down of bullion prices have occurred this week – a $1.4 billion sale Monday and another $2.3 billion dump Tuesday, but Gold hasn’t been knocked out by those two separate hard blows…geopolitical hotspots are perhaps helping to put a floor underneath bullion prices…SPDR Gold Trust said its holdings fell 2.7 tonnes to 806.03 tonnes yesterday, while physical demand in Asian markets has failed to pick up in any meaningful way despite the recent price drop…but buyers are out there somewhere and absorbing any selling pressure…

Gold is trading around its 100-day moving average (SMA) but a test of strong chart and Fib. support in the $1,280’s, coinciding with the 200-day SMA, can’t be ruled out as John has shown…two attempts at a major smack down of bullion prices have occurred this week – a $1.4 billion sale Monday and another $2.3 billion dump Tuesday, but Gold hasn’t been knocked out by those two separate hard blows…geopolitical hotspots are perhaps helping to put a floor underneath bullion prices…SPDR Gold Trust said its holdings fell 2.7 tonnes to 806.03 tonnes yesterday, while physical demand in Asian markets has failed to pick up in any meaningful way despite the recent price drop…but buyers are out there somewhere and absorbing any selling pressure…

A jump in India’s Gold imports during June could deter the government from lifting import restrictions, some analysts say…government data show Gold imports rose 65% year-on-year last month to $3.12 billion…while the government doesn’t publish tonnage data, UBS estimates this to be around 74 metric tons, based on the average Gold price for the month…this would be the highest monthly inflow for the year so far, the bank says…the country’s trade deficit, meanwhile, hit an 11-month high…

Gold prices slumped to their lowest level in more than three weeks on Tuesday after Federal Reserve Chair Janet Yellen said interest rates could rise sooner than expected if the U.S. labor market continues its robust recovery pace…Yellen’s comments reignited concerns among many traders – and they could be wrong on this – that demand for a zero-yielding asset like Gold would erode when interest rates turn higher as returns from bonds and equities will lure away investors…

China’s Appetite For U.S. Debt Continues

Investors wrestling with what is driving the surprise U.S. bond rally of 2014 got a clue yesterday, fingering a familiar suspect: China…the world’s most populous nation boosted its official holdings of Treasury debt maturing in more than a year by $107.2 billion for the first five months of 2014, according to U.S. data released yesterday…according to a report in the Wall Street Journal, that’s the biggest first-five-month increase since record keeping began in 1977 and surpasses the $81 billion bought by China for all of 2013…the scale of Chinese buying helps explain why the yield on the benchmark 10-year Treasury note has tumbled this year to nearly 2.5% from 3% at the end of 2013…yields fall as prices rise…

Today’s Equity Markets

Asia

China’s Shanghai Composite fell 12 points overnight to close at 2056…June home price data for China will be released tomorrow…Japan’s Nikkei slipped 9 points…Australia’s benchmark S&P ASX 200 hit a six-year intra-day high and also ended at its highest level since May 28…

Europe

European markets are down modestly in late trading overseas…

North America

The Dow is down 12 points through the first 45 minutes of trading…U.S. housing starts and building permits unexpectedly fell in June, suggesting the housing market recovery is still struggling to get back on track after stalling in late 2013…

The Dow posted its 15th record-high close of the year yesterday, thanks to a rally in tech shares after Intel posted strong third-quarter guidance…meanwhile, economic data also helped to boost sentiment…the Federal Reserve’s Beige Book found the economy expanding at a modest to moderate pace with consumer spending up in all of the Fed’s districts…another report had U.S. factory output increasing for a fifth month in June…

The U.S. economy is “stronger than people think,” Wells Fargo Chairman and CEO John Stumpf told CNBC today. “We were all surprised by the first-quarter GDP,” he said in a “Squawk Box” interview. “Who knows what second quarter will be, but I think it will surprise on the upside.” GDP contracted at a 2.9% annual rate the first quarter, the economy’s worst performance in five years…economists expect GDP to grow around 3% in the second quarter. If you exclude housing, the Wells Fargo CEO said, the economy is better now than it was during the boom years of 2000 to 2008. “Energy is booming, way better than it was then…autos, they might sell 17 million new vehicles this year.” He also said U.S. manufacturing is coming back and so is agriculture.

The TSX is up 22 points while the Venture is unchanged at 1009 as of 7:15 am Pacific…

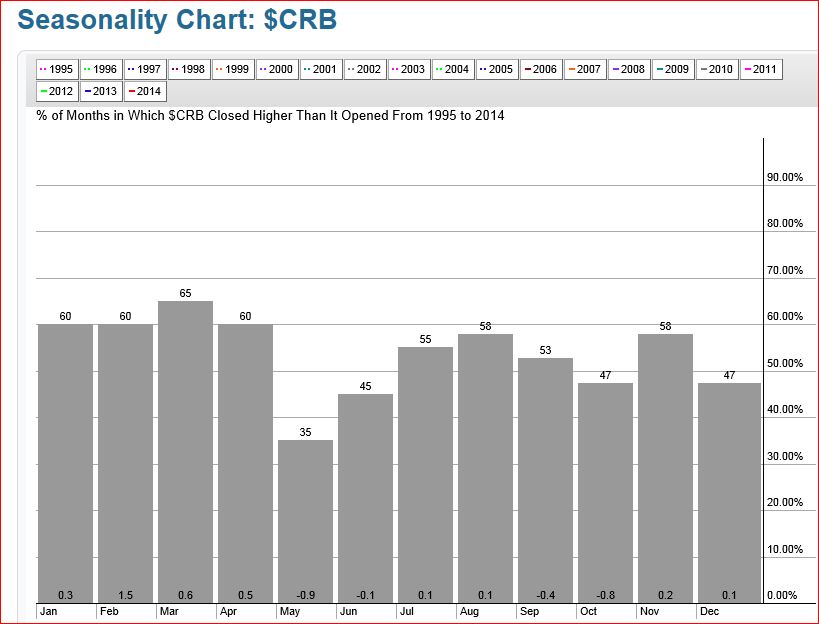

CRB Seasonality Chart

Further to our very revealing CRB charts yesterday, July and August are typically strong months for commodity prices – hence a near-term turnaround should be expected given this “seasonality” effect and the fact that the CRB Index has been driven into oversold territory in recent weeks…

Canadian Dollar Chart Update

Encouraging a weaker loonie clearly appears to be a deliberate strategy of Canada’s central bank (they’re “talking” the currency down) as this will have benefits in terms of increased exports, slightly higher inflation and stronger corporate earnings in some cases (which should help the TSX)…a lower dollar is also positive for Canadian Gold producers…

This 2.5-year weekly chart shows a loonie with major chart and Fib. resistance at 94 cents and the retreat from this level has started with the currency now trading at 93 cents…declining 200-day and 300-day SMA’s at 94 cents and 92.5 cents, respectively, are also putting downward pressure on the loonie…the biggest threat to the Bank of Canada’s dollar strategy during the second half of this year would be a potential major breakout in Oil prices above $110 a barrel…

Shanghai Composite Updated Chart

Very interesting long-term chart on the Shanghai Composite which is showing clear signs of an upside reversal – the question is, what will be the catalyst for that?…also intriguing (a fact we’ve pointed out before) is that the Shanghai and the Venture have correlated quite closely since the beginning of 2006 (they both peaked in 2007 and bottomed in mid-2013), so any indication that the Shanghai is about to power higher has to be considered bullish for the Venture…

Highbank Resources Ltd. (HBK, TSX-V) Update

What a performer Highbank Resources (HBK, TSX-V) has been since we introduced it to our readers in the spring in the mid-teens…HBK captured our attention as soon as it overcame long-term resistance at 15 cents, and recently a confirmed breakout occurred above Fib. resistance at 20 cents…yesterday, HBK hit an intra-day multi-year high of 30 cents…next major long-term resistance sits at 35 cents but keep in mind that HBK may have to digest its recent gains after jumping nearly 50% over just the last five trading sessions…

Highbank has been climbing higher as it moves closer to the production stage at its Swamp Point North aggregate project along tidewater near Stewart…

HBK is unchanged at 29.5 cents as of 7:15 am Pacific after opening down a penny at 28.5 cents…

North American Nickel Inc. (NAN, TSX-V) Update

North American Nickel (NAN, TSX-V) announced the start of drilling about a month ago at its highly promising Maniitsoq Nickel-Copper-PGE sulphide project in southwest Greenland…the opportunity for an exciting new discovery at Maniitsoq clearly exists, and the company is well-funded to carry out its extensive exploration plans this summer…

Technically, NAN has been performing to script and our last chart (June 27) warned of temporarily overbought conditions that could unwind to support around 50 cents…NAN climbed as high as 65 cents but has since retraced to the 50-cent level, just a couple pennies above its rising 50-day SMA which has provided rock-solid support since the beginning of the year…

NAN is up 2 cents at 52 cents on very light volume as of 7:15 am Pacific…

Note: John, Terry and Jon do not hold share positions in HBK or NAN.

16 Comments

Weeks ago Garibaldi posted Some photos of

very encouraging looking drillholes.

I Cannot imagine that the results are not in yet.

Perhaps the grades are so high that they

Are checking them twice 🙂

Not much of a Summer Rally yet as the weather appears to have everyone on Holidays!

If you look at historical patterns, Steven, Venture summer rallies typically begin during the last part of July/or first half of August…the Venture pattern this year has also been to test strong support but with higher lows, so it’s following the right path…

THANKS! Maybe next week things pick up again! It is nice to see this holding/basing pattern, however, it would be nice to see TSX Venture at record highs like i keep hearing every night on the news regarding the Toronto market/DOW!

Gold up $16? $1315!……back up and strong despite those big dumps on Monday/Tuesday!

Speaking of historical patterns, does the venture suffer during November and December due to tax loss season?

Jon

no mention of Global Met Coal for quite some time, any idea what the heck is going on there? Looks like they changed their name to Minecorp Energy.

thanks

Good question, Greg, looks like low coal prices convinced them to turn their attention to Oil, at least for now, which is probably not a bad strategy…we’ll see what comes of it…in the meantime, the coal asset remains….what bothered me months ago was when George Heard (Chairman, CEO and Pres.) took over the reigns at Dolly Varden…running one company well is hard enough; two is challenging to say the least…anyway, Dolly Varden recently announced they’ve arranged a $6 million financing (not completed yet), so George seems to be able to make some things happen…

Jon, you and Terry don’t own shares in NAN. You have your reasons and I respect that but just wondering why you wouldn’t invest in a company that has as much or more potential than a company like GGI. NAN has already hit high grade Nickel and copper at Imiak Hill complex with 3 Norite bodies within a 2km radius, plus other discoveries and interesting targets. Not one but two drills turning. In my opinion, this stock has the potential to be life changing if they hit a Voisey’s type hole, which is very possible given the geology and the team NAN has assembled. Not too many Juniors can boast that they have 13 million dollars in the bank in this market. One of the most mining friendly and pro-mining governments in the world. Ice free ports year round and the project is only 25km from the ocean.

DaMan, you don’t have to convince me that NAN is a great opportunity – we’ve been mentioning it regularly, and it’s quite possible I will take a personal position in the near future (can’t speak for Terry or John). NAN stands on its own merits and at current levels I like it even more than I did when it was in the 60’s, but if they hit a Voisey’s Bay type hole a dime or two won’t matter. It’s not accurate in my view to say it has more potential than GGI – they’re very different animals, but similar in the sense that they are both extremely well-run companies that offer shareholders tremendous exploration upside. Is NAN a potential financial “game-changer” for someone as you say – absolutely, and there are some other companies like that out there as well in that top 10% field.

Sorry I entered the incorrect name – corrected now.

9.Jon, you and Terry don’t own shares in NAN. You have your reasons and I respect that but just wondering why you wouldn’t invest in a company that has as much or more potential than a company like GGI. NAN has already hit high grade Nickel and copper at Imiak Hill complex with 3 Norite bodies within a 2km radius, plus other discoveries and interesting targets. Not one but two drills turning. In my opinion, this stock has the potential to be life changing if they hit a Voisey’s type hole, which is very possible given the geology and the team NAN has assembled. Not too many Juniors can boast that they have 13 million dollars in the bank in this market. One of the most mining friendly and pro-mining governments in the world. Ice free ports year round and the project is only 25km from the ocean.

What a come back for R! Go above $1 ? Quite likely…. obviously I have portfolio in this one.

Hi Jon, could we get a update on Pgx, alot of selling pressure yesterday,, where they nersous nellies, by the way what is a nervous nellies? A idiot lol :-). Have a great week end!

Hi Martin, we’ll be updating PGX in the near future…our position on PGX is the same now as it always has been – they have an incredible property and an incredible team, and they will deliver big-time this summer…a nervous nellie is an investor who sees a market or a stock price go down and gets scared and sells when in fact, for good reasons, they should be reacting in the opposite way…by the way, do a little homework——the selling you’re seeing in PGX has nothing to do with anything on the ground, but much of it is 35-cent flow through paper coming out (Dundee being a good example of that)…classic case of stock moving from weak hands into strong hands, that paper keeps getting soaked up…if you want to dump at 40 cents, you can—–but you’ll be kicking yourself in the not too distant future IMHO…

Hey thanks for that Jon, I will not ack as a nervous nellies 🙂

Its not that i simply want to get off PGX, butt i was looking at other opportunity this week goldquest being a good exemple of that, GGI with the retracement this week to, at the moment i am all in PGX,