Gold has traded between $1,304 and $1,312 so far today…as of 6:40 am Pacific, bullion is down $1 an ounce at $1,308…Silver is up a nickel at $19.96 (see updated Silver charts below)…Copper is unchanged at $3.18…Crude Oil has added 23 cents a barrel to $97.88 while the U.S. Dollar Index is flat at 81.45…

Gold is coming off its best week in a month-and-a-half as geopolitical tensions fueled demand for the precious metal as a safe haven…Gold traders have also turned the most bullish since January, according to a Bloomberg survey…the recent appetite for Gold is encouraging as it coincides with a strong U.S. dollar, defying the historically negative correlation…the greenback hit a 9-month high last week…at times of rising inflationary expectations, like 1993, the negative correlation doesn’t always hold, however…on that note, the Citicorp Inflation Surprise Index has staged an upturn from a cyclically-low level, which historically bodes well for higher Gold prices even in the face of a firmer U.S. dollar…

Gold is coming off its best week in a month-and-a-half as geopolitical tensions fueled demand for the precious metal as a safe haven…Gold traders have also turned the most bullish since January, according to a Bloomberg survey…the recent appetite for Gold is encouraging as it coincides with a strong U.S. dollar, defying the historically negative correlation…the greenback hit a 9-month high last week…at times of rising inflationary expectations, like 1993, the negative correlation doesn’t always hold, however…on that note, the Citicorp Inflation Surprise Index has staged an upturn from a cyclically-low level, which historically bodes well for higher Gold prices even in the face of a firmer U.S. dollar…

ETF Gold holdings rose by just under 1% in July from a 4-year low in June…the increase was the largest-monthly gain since late 2012, and halted a 3-month decline…Gold ETF holdings are down 1.6% year-to-date as outflows have slowed dramatically this year…

The U.S. and global recoveries have been “disappointing” so far and may point to a permanent downshift in economic potential, U.S. Federal Reserve Vice Chair Stanley Fischer said today…in an overview of the years since the 2007-2009 financial crisis and recession, Fischer said a slowing of U.S. productivity, declining labor force participation and other factors may have hindered the United States’ ability to generate economic growth…the same thing may be happening for different reasons in Europe, major emerging economies like China, and elsewhere, he said, forcing central bankers to reassess their understanding of inflation, employment and growth in general…

Hillary Clinton, President Barack Obama’s first secretary of state, dramatically distanced herself from the President’s approach to foreign policy in an interview published yesterday. “Great nations need organizing principles, and ‘Don’t do stupid stuff’ is not an organizing principle,” Clinton told The Atlantic’s Jeffrey Goldberg, knocking the Obama administration’s foreign policy…

Today’s Equity Markets

Asia

Japan’s Nikkei average snapped a 7-day losing streak overnight to rake in its biggest daily gain in four months…the Nikkei climbed 352 points or 2.4% to close at 15130…China’s Shanghai Composite was also strong today, climbing 30 points to finish at 2225…Chinese consumer price inflation stayed at 2.3% year-on-year in July, according to official data released on Saturday…global investors have been net buyers of Chinese equities for the past nine weeks, with a total $6.6 billion injection…this comes in response to various signs of favorable economic policy and potent political leadership on top of low absolute and relative stock valuations, a distinct reversal from $3.6 billion net redemptions in 2013…

Europe

European markets are up sharply in late trading overseas…

North America

The Dow is 41 points higher through the first 10 minutes of trading today…over 85% of S&P 500 firms have now reported their second-quarter results…so far, the earnings-per-share (EPS) beat:miss ratio is running at a solid rate of around 3:1, according to Deutsche Bank…

The TSX is up 53 points while the Venture has added 2 points to 999 as of 6:40 am Pacific…

Venture 3-Year Weekly Chart

The Venture 3-year weekly chart has been an extremely reliable guide over the past year, and you’ll notice in this update that RSI(14) has touched the uptrend line just like it did in December before the Index blasted off to the upside…

Copper Mountain Mining Corp. (CUM, TSX) Update

Copper Mountain Mining (CUM, TSX) this morning reported net earnings of $9.5 million or 8 cents per share in the second quarter, thanks to record production at the Copper Mountain Mine in B.C. totaling 19.9 million pounds of Copper, 5,000 ounces of Gold and 113,300 ounces of Silver…Q2 production was up 27% over the same period last year, marking the seventh consecutive quarter of increased Copper output…CUM is up a nickel at $2.87 as of 6:40 am Pacific…

Calibre Mining Corp. (CXB, TSX-V) Update

Calibre Mining (CXB, TSX-V) is very active with excellent geological prospects in Nicaragua including the Eastern Borosi Project which was recently optioned by Iamgold Corp. (IMG, TSX)…Eastern Borosi hosts Gold-Silver resources in two deposits and a series of well-defined low-sulphidation epithermal Gold-Silver targets…a 3,400-m drill program is in progress as announced July 14…the series of drill targets represent more than 3 km of potential Gold-Silver-bearing structures within the tens of km’s of potential structures which have been identified within this prolific district…

Early last month, CXB provided an encouraging update with regard to its Minnesota Gold Project JV in Nicaragua with B2Gold Corp. (BTO, TSX)…B2Gold also increased its equity ownership in CXB to approximately 15.2% by exercising common share purchase warrants for proceeds to Calibre of $500,000…

Technically, John noted how CXB broke out above a 2-year downtrend channel near the end of June – a very bullish development…RSI(14) at 65% continues to climb an uptrend line on this weekly chart, and a breakout above 7.5 cents now appears to be unfolding…CXB is up 1.5 cents at 9 cents as of 6:40 am Pacific…

Garibaldi Resources Corp. (GGI, TSX-V) Update

With an early-stage high-grade discovery in Mexico as Phase 2 drilling begins, and exciting possibilities at the Grizzly in northwest B.C., the Garibaldi Resources Corp. (GGI, TSX-V) “engine” is switching into high gear just in time for a traditionally strong period for junior resource stocks…tomorrow, we’ll be posting the first excerpt of our interview with GGI President and CEO Steve Regoci…

Last week’s results from the Silver Eagle target at Rodadero North suggest this project may have some “very long legs”, according to Regoci, especially if targets can be structurally linked…that’s what occurred to the northwest at Yamana Gold Inc.’s (YRI, TSX) producing Mercedes mine (50,000 Gold equivalent ounces through the first half of 2014)…Rodadero is situated strategically between Mercedes, 140 km to the northwest, and two other producers approximately 90 km to the southeast – Agnico Eagle Mines’ (AEM, TSX) La India mine (commercial production began in February) and Alamos Gold’s (AGI, TSX) Mulatos mine…given the prolific nature of Sonora State for both Gold and Silver deposits, it wouldn’t be surprising if some bigger “fish” are keeping a close eye on developments at Rodadero…

Rodadero has scale (45 sq. km) plus shallow high-grade mineralization as demonstrated by the “truth machine” – the drill rig…that’s a recipe for success not only on the ground, but in the market…the Garibaldi team, led in the field by the highly respected Dr. Craig Gibson, has a proven track record in Mexico…the company’s proprietary hyperspectral remote sensing data allowed it to cash in big on a property in early 2009, and it has been very effective in targeting mineralization at Silver Eagle and elsewhere at Rodadero…

Two Fascinating GGI Charts

There are only two measured Fib. resistance levels (upper 30’s and around 60 cents) separating GGI from a powerful technical breakout to a new all-time high, and Rodadero could be like adding gasoline to this year’s continuous fire…Garibaldi surged 47% in Q1 and another 36% in Q2 thanks to positive developments at the Grizzly, La Patilla and Rodadero…there is no cheap paper holding this stock down like other plays – no significant financing has been carried out in more than five years…the share structure is conducive to a healthy and robust market for this company’s shares…

This long-term chart shows a powerful uptrend support line, a bullish trend gaining strength (ADX indicator), and RSI(14) at a modest 63% which allows for plenty of more upside…often in a bullish situation like this, RSI(14) will climb well into overbought territory (above 70%) and remain there for a while as it with GGI back in 2006 when it soared from current levels to 90 cents…

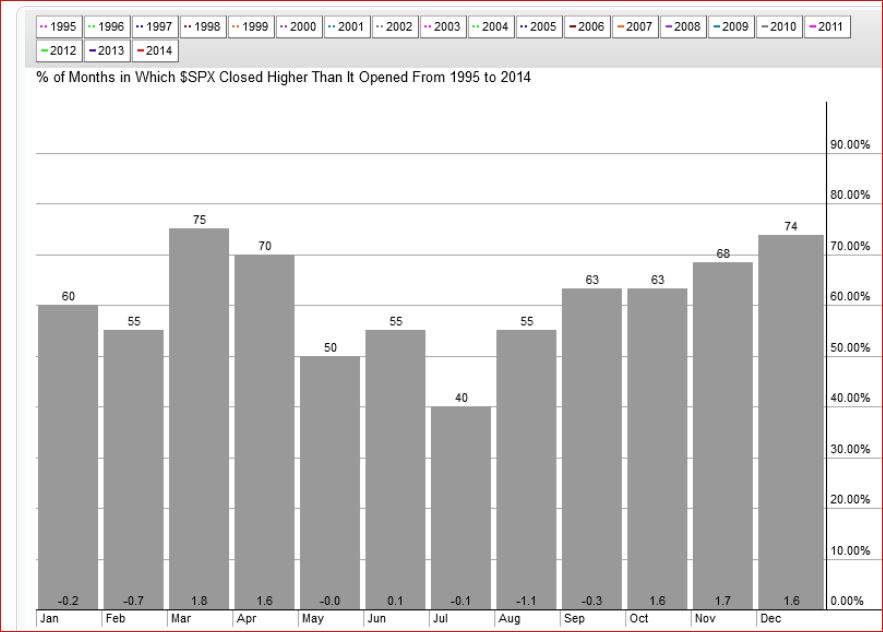

GGI Seasonality Chart

Historically, Garibaldi shows a pattern of stronger second half performance, closing higher in an increasing number of months from August through the end of the year…the current dynamics on the ground suggest we’ll see a continuation of this historical pattern…

Kaminak Gold Corp. (KAM, TSX-V) Update

This is a highly interesting chart, an update of the one we provided last week on Kaminak Gold Corp. (KAM, TSX-V)...KAM staged an important breakout earlier this year above a long-term downtrend line, followed by the completion of an inverted head and shoulders bottom…

Watch for a potential breakout above the neckline which could come at anytime now…if such a scenario were to unfold, KAM could accelerate very quickly to the indicated measured Fib. resistance…

Kaminak recently closed a $13.5 million financing (Ross Beatty was one of two placees) and also commenced a feasibility study for its Coffee Gold Project in the Yukon…results are pending from the 2014 Phase I drill program which has tested some of the greater than 20 kilometres of Gold-in-soil anomalies outside of the current resource area…depending on the numbers from Phase 1, a Phase 2 drill program is possible this quarter…

KAM is unchanged at $1.02 as of 6:40 am Pacific…

Silver Short-Term Chart Update

This 6-month daily chart shows how extreme RSI(2) conditions in Silver persisted for most of June with a healthy unwinding of that overbought situation in recent weeks…in fact, RSI(2) plunged into extreme oversold territory recently at just 4% and now sits at 29%…a strong Fib. support band between $19.50 and $20.00 is expected to hold…a reversal to the upside can’t be far off…

Silver Long-Term Chart Update

Silver has broken out above one important downtrend line which should now provide strong support…RSI(2) closed last week at 38% – notice the higher lows in this indicator over the past year…

Also note how the SS is moving up from a low bullish “W” while the ADX indicator shows the growing potential for a bullish +DI/-DI crossover this quarter…bottom line – Silver looks highly attractive around the $20 level…

Note: John and Jon both hold share positions in GGI.

7 Comments

Jon, any chance of getting an update on a company that BMR was following not too long ago?? I’m referring to DYNASTY GOLD CORP. “DYG”. Thank you..

We’re still following it, Jeff——Dynasty has cash in the bank (about $900,000 at the moment) but the company is obviously in sleep mode, not even a news release for a year. That’s frustrating because they have an excellent property in the Stewart area but like a lot of juniors they’re reluctant to launch any significant exploration until the overall market takes off. In the case of the Stewart district, the window for drilling is very short – 6-8 more weeks, so I doubt they have any intention of carrying out drilling this year. It was disappointing they didn’t drill last year when they indicated they would. This is one of those stocks you accumulate at a penny or at very low levels with a long-term perspective – at some point, hopefully sooner rather than later, an event triggers a significant jump in the share price. The fact they have nearly $1 million in the bank takes the risk away – this will move at some point. Impressive people on the board.

When can we expect that GGI interview you mentioned earlier?

As stated in this morning’s report, Mark, first excerpt of our interview with Regoci will be posted tomorrow morning. There are several excerpts.

Thanks Jon for your update on DYG. I think this is the BEST .01 stock on the Venture since it’s practically trading at cash value. I’ve been accumulating it for the past few months because I know that sooner or later it will have “its day in the sun”!!!

Not sure what happened to my previous message but I would like to know when we may expect the Dbv report you had mentioned in January, thx

We’ll be putting out more on DBV, Paul, at the right time, particularly after more information comes forward regarding the latest drilling by DBV and other district results. While there continues to be intense activity on the ground in the Sheslay district, there has been no hard geological news from any company in the area since DBV three months ago, so that has made our job much more difficult. Clarity should come fairly soon. Results and interpretations from one part of the district can shed light on another, and perhaps in a competitive context that explains the very tight control on news to this point. This leads me to believe we may see some serious fireworks in the not too distant future. I think Regoci was hinting at that big picture in our interview.