Gold has traded between $1,232 and $1,241 so far today…as of 6:45 am Pacific, bullion is down $5 an ounce at $1,235…Silver is off a dime at $18.57…Copper is flat at $3.11…Crude Oil has slid 22 cents to $92.61 while the U.S. Dollar Index is up one-tenth of a point at 84.38…the greenback continues to hold onto gains from a recent rally that has seen it strengthen by about 5% against a basket of global currencies since July, putting pressure on both Gold and Crude Oil…the Dollar Index is on target for its 9th consecutive weekly gain, its longest winning streak since 1997…it touched a Fib. resistance level of 84.50 this week and is certainly due for a pullback to help unwind temporarily overbought conditions…

Some analysts believe the Gold market is underpricing the possibility of instability flaring up in several hotspots around the globe…one of those hotspots, obviously, is Ukraine, but the cease-fire there continues to hold with Ukrainian officials reporting a pullback of Russian troops from its border…

Some analysts believe the Gold market is underpricing the possibility of instability flaring up in several hotspots around the globe…one of those hotspots, obviously, is Ukraine, but the cease-fire there continues to hold with Ukrainian officials reporting a pullback of Russian troops from its border…

With regard to another hotpot, a CIA assessment puts the number of ISIS fighters at possibly more than three times previous estimates…ISIS, the terror group that calls itself the Islamic State, “can muster between 20,000 and 31,500 fighters across Iraq and Syria,” a CIA spokesman told CNN yesterday…analysts and U.S. officials initially estimated there were as many as 10,000 fighters, including those who were freed from prisons by ISIS, and Sunni loyalists who have joined the fight as the group advanced across Iraq. “This new total reflects an increase in members because of stronger recruitment since June following battlefield successes and the declaration of a caliphate, greater battlefield activity and additional intelligence,” the spokesman said.

Today’s Markets

Asia

China’s Shanghai Composite roared higher overnight, gaining 20 points to finish a positive week at 2332…central bank data showed that mainland banks made $114.55 billion worth of new loans in August, quickening from the previous month and matching expectations…

Japan’s Nikkei average, meanwhile, closed at an 8-month high today with exporters leading gains on a weak yen trading at a 6-year high of 107 against the greenback…

Europe

European stocks are mixed in late trading overseas with investors continuing to monitor developments in Russia and Scotland as well as looking ahead to an important U.S. Federal Reserve meeting next week…

North America

The Dow is off 53 points as of 6:45 am Pacific…the TSX is down 27 points while the Venture is flat at 982…

U.S. retail sales rose in August as Americans bought automobiles and a range of other goods, which should ease some concerns about consumer spending and support expectations for sturdy growth in the third quarter…the Commerce Department reported this morning that retail sales increased 0.6% last month after an upwardly revised 0.3% gain in July…the increase in retail sales, which account for a third of consumer spending, was in line with economists’ expectations…

The measured Fib. resistance level of 17150 has been an important number as the Dow has tried unsuccessfully on a few occasions since July to close above that level as you can see in John’s 6-month daily chart…RSI(7) on this chart has unwound and landed in a support zone with its SMA(25) still rising, so the conditions appear favorable for another attempt at a breakout through 17150…

Doubleview Capital Corp. & Sheslay District (DBV, TSX-V) Update

Doubleview Capital (DBV, TSX-V) roared to life yesterday, jumping a nickel to close at 23 cents – its highest level since mid-May…this wasn’t totally surprising given the improving technical posture of the stock as John showed in a chart Monday, plus the fact it doesn’t take a rocket scientist to figure out that a potential abundance of news from the Sheslay district – including drill results and news of more drilling – is likely just around the corner…all companies in the area have been holding their cards very close to their chests over the last few months – is someone about to lay down a Royal Flush, or does Prosper Gold Corp (PGX, TSX-V) have Four of a Kind at the Star Project?…

Alix Resources (AIX, TSX-V), the largest landholder of all in the Sheslay district, was the Venture’s most active stock yesterday (8.5 million shares, all exchanges) with a massive surge in volume near the end of the day…Ashburton Ventures (ABR, TSX-V), advancing the Hackett Property contiguous to DBV’s discovery, perked up as well…

The entire area has an excellent chance of heating up again in a dramatic way, especially once Prosper and Garibaldi Resources (GGI, TSX-V) – companies with heavy bats – start swinging for the fences…

The exciting thing about a discovery area is that it can easily run counter to the market, just like what occurred in late January/early February when the Venture fell 5% from the mid-980’s to 940 but Doubleview soared on its Hat discovery, a staking rush ensued and all the Sheslay players caught fire…

Below is an updated DBV chart…it’s interesting to note that the 200-day moving average (SMA), once it reversed to the upside in the spring of last year, has dictated the primary trend in this stock through a series of roller coaster rides over the last 17 months…the rising 300-day (not shown on this chart but currently at 14 cents) provided great support for DBV over the challenging last few months…DBV is off 2 pennies at 21 cents in early trading, just above what appears to be new chart support, not unexpected after yesterday’s strong push…

Fairmont Resources Inc. (FMR, TSX-V)

Fairmont Resources (FMR, TSX-V) is worthy of our readers’ due diligence as the company is making headway with its advanced Buttercup Property in Quebec and its game plan of serving the lump titano-magnetite market…

What we like about this 5-year weekly chart is the confirmed breakout above a long-term downtrend line and the RSI(14) momentum and uptrend…measured Fib. support and resistance levels are indicated below…FMR is up 2 cents at 30 cents as of 6:45 am Pacific…

GoGold Resources Ltd. (GGD, TSX)

We suggest investors check out the Preliminary Economic Assessment GoGold Resources (GGD, TSX) released Wednesday for its Santa Gertrudis Gold mine in Sonora State, Mexico – quite robust numbers including a 1.7-year payback and an after-tax IRR of 58%…the proposed project is a 7,500-tonne-per-day heap leaching facility fed by several open pits, resulting in a projected 12-year mine life with total metal production of 671,000 ounces of Gold…start-up capital costs with a a 20% contingency are estimated at $32-million (U.S.)…this includes the development of a centrally located heap leach pad, CIL plant and ADR plant required for the start of mining operations…sustaining capital costs over the project’s life are projected to be an additional $16-million and total life-of-mine capital costs are estimated at $48-million…

Santa Gertrudis has an updated mineral resource of 23.3 million tonnes in the indicated category at 1.08 g/t Au, and 7.7 million tonnes of inferred at 1.02 g/t Au…production is estimated at an average of 56,000 ounces of Au per year (keep in mind that these are mineral resources and not mineral reserves)…

This 3-year weekly chart looks strong and shows RSI(14) moving up from a bullish “W”…rock-solid support around $1.40 which includes the rising 200-day SMA and a Fib. retracement level…GGD is up a nickel in early trading at $1.55…

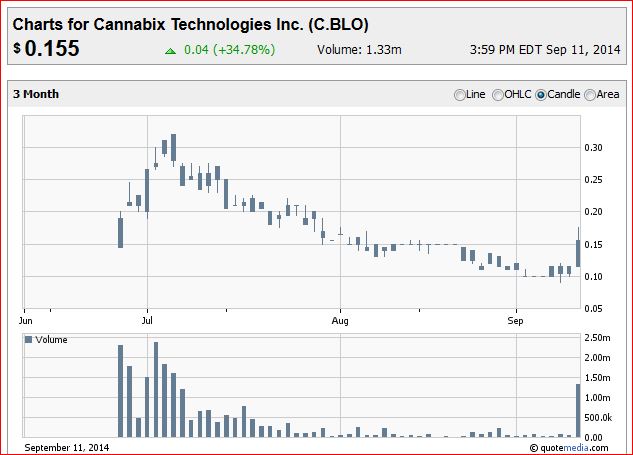

Cannabix Technologies Inc. (BLO, CSE) Update

Cannabix Technologies (BLO, CSE) released some encouraging news this week and broke out of its 2-month downtrend with a powerful move yesterday…the 4-cent jump on high volume (1.3 million shares) is a strong technical sign that a new stage is underway in this promising opportunity…as we stated earlier this week, Cannabix is at the leading edge of the marijuana breathalyzer market which has massive growth potential…this is primarily a U.S. story, so when American eyes and media catch on to this – look out…

Cardiff Energy Corp. (CRS, TSX-V)

We’ve had a few requests for a chart on Cardiff Energy (CRS, TSX-V), an emerging oil and gas play that has performed remarkably well since the spring (Jack Ball took over as President late last year)…

Technically at the moment, Cardiff is up against chart resistance with an overbought RSI(14) at 87% on this 3-year weekly – so a note of caution as far as the near-term is concerned…we’ll keep a close eye on this one for a potential pullback to more attractive levels…

Note: John and Jon both hold share positions in BLO, GGI, PGX and AIX. Jon also holds positions in DBV and ABR.

9 Comments

Looks good for the Sheslea for next week! DBV has good bidding at this new level. PGX up 5 today?! JON: with Tesla moving into Nevada, is PE ripe for a move (like WLC)?

heads up. Prosper heating up. Looks like we could be up. up and away. Richard l

Jon appreciate your comments on RG.v

are they worthy of our attention?

thanks

Do you think we are heading for the December lows in Gold? Clearly this September seems a write off and short of a black swan event the fundamentals are not doing much it seems to support it. At this point I do think it is technical selling, but I also think the price was controlled and manipulated to bring it to the point were the technical could take over and sell it down the rest of the way.

Jon

What is your analysis if CRS were ever to break .20?

Mark, I have a friend who uses the Elliott Wave Theory and he’s been telling since late May that gold will be going to $1224 before rocketing higher. So far he’s nailed the downtrend; now I am waiting for gold to reach his target and to see how it reacts. I don’t use the E.W.T so I can’t tell you how accurate it is.

Can I ask why John does not hold DBV shares at the moment? Has he taken some profits for the time being? Thanks.

Tom UK

I sold my DBV earlier in the year in the 33 – 35c range(from memory) and then invested in other stocks primarily GGI. With GGI, PGX and AXI I feel I dont have to get back into DBV…..it is just a personal choice…..nothing wrong with DBV.

Thanks John, I remember that and the reason you did it was because the SP failed to break through a fib resistance if IIRC. I assumed that you had bought back in at the recent lower share price and had again sold for maybe technical reasons. I buy shares for fundamental reasons but always keep my eye on what the technical savvy guys are doing. I think next week will be the time when we find out if DBV have hit anything good. If the glory hole has not been hit yet, then hopefully there is enough cash for Patrick to drill a few more holes and we get another bite of the cherry.