Gold has traded between $1,231 and $1,239 so far today…as of 8:15 am Pacific, bullion is up $5 an ounce at $1,233…Silver is relatively unchanged at $18.60 (see updated charts below)…Copper is off a penny at $3.11…Crude Oil has recovered from negative territory early today and is now up 26 cents at $92.53 while the U.S. Dollar Index is up slightly but off its highs of the day at 84.22…

Gold is facing the prospect of its first quarterly loss of the year, thanks in large part to a surging U.S. Dollar Index that remarkably has risen for 9 straight weeks – its longest winning streak since 1997…near-term Fib. resistance is around 84.50, so it’s possible we could see a cooling off of the temporarily overbought greenback at some point during the last half of this month – perhaps as early as later this week if there’s a “sell-on-news” effect from the Fed meeting…signs of an improving U.S. economy have increased the odds that the Federal Reserve, which begins its two-day policy meeting tomorrow, may begin to raise interest rates sooner than the expected mid-2015…

Gold is facing the prospect of its first quarterly loss of the year, thanks in large part to a surging U.S. Dollar Index that remarkably has risen for 9 straight weeks – its longest winning streak since 1997…near-term Fib. resistance is around 84.50, so it’s possible we could see a cooling off of the temporarily overbought greenback at some point during the last half of this month – perhaps as early as later this week if there’s a “sell-on-news” effect from the Fed meeting…signs of an improving U.S. economy have increased the odds that the Federal Reserve, which begins its two-day policy meeting tomorrow, may begin to raise interest rates sooner than the expected mid-2015…

About a third of Gold production is probably losing money when the price of the metal is below $1,250 an ounce, according to some analysts, so this fact alone should help put a floor on bullion at critical technical support in the immediate vicinity of $1,200…the behavior of the Venture Exchange, underpinned by rising 200 and 300-day moving averages (SMA)’s, suggests that Gold is not about to fall off a cliff…the Venture weakened considerably six months prior to Gold’s peak in 2011 and an important trend reversal has occurred over the last year with the Venture now out-performing the yellow metal…

The Bloomberg Commodity Index of 22 futures has fallen to its lowest level in more than five years since July 2009…in today’s Morning Musings, we have an updated chart on the CRB Index which is approaching a strong support area tested on a few occasions since the spring of last year…

National Mining Association President Hal Quinn says the #1 challenge to the U.S. mining industry is the domestic regulatory bureaucracy…while it typically takes seven to 10 years to permit a mine in the U.S., other countries with similar environmental standards do so within two to three years…bureaucracy in the U.S. continues to weaken the domestic mining industry…

Geopolitics

International support for the U.S.-led military campaign against Islamic State gathered strength over the weekend with the U.K. vowing to “destroy” the group after it killed a British aid worker, Arab states agreeing to participate in airstrikes and Australia pledging forces…

Islamic State militants, who once relied on wealthy Persian Gulf donors for money, have become a self-sustaining financial juggernaut, earning an estimated $100 million per month from Oil smuggling, human trafficking, theft and extortion, according to U.S. intelligence officials and private experts in a report carried by Associated Press…the extremist group’s resources exceed that “of any other terrorist group in history,” said a U.S. intelligence official…this is certainly no “junior varsity squad”, as President Obama referred to them earlier this year…

A report by CNN security analyst Peter Bergen states that, according to information obtained by CNN from the British Office of Security and Counter-Terrorism obtained, British citizens have volunteered to go to Syria to fight for ISIS at 25 times the rate that Americans have done so (500 vs. 100), taking into account the population differences between the two countries…also according to the British government, 700 fighters have traveled to Syria from France; 400 from Germany; between 200 and 500 from Belgium; 130 from the Netherlands; over 100 from Denmark; 100 from Austria; 80 from Sweden, and between 50 and 100 from Spain…

It’s also estimated that 100 Canadians have left Canada to “support or train with terrorist movements abroad…the majority of these are likely to be in Syria”…and it estimates that there are 60 Australians fighting in Syria and Iraq…this brings the total number of Westerners who have fought in Syria to between 2,620 and 2,870, according to the British Office of Security and Counter-Terrorism…

Today’s Equity Markets

Asia

Japan was closed for a holiday but China’s Shanghai Composite gained 7 more points overnight to close at 2339, despite a slew of economic data released over the weekend that raised fresh concerns about a weakening economy…August industrial output rose 6.9% on year, its slowest pace since 2008, while fixed-asset investment and retail sales both missed forecasts…

The options have certainly narrowed for Chinese Premier Li Keqiang: stimulate or miss his 2014 growth target of 7.5%…the weakest industrial-output expansion since the global financial crisis, and moderating investment and retail sales growth, underscore the risks of a deepening economic slowdown in China led by a slumping property market…the PPI has been negative for 30 consecutive months and consumer inflation hasn’t exceeded 2.5% since November…some analysts are now cutting their forecasts for 2014 growth…

Europe

European markets were mixed today…

North America

The Dow is up 19 points as of 8:15 am Pacific…the OECD is lowering its growth forecast for the U.S. to 2.1% this year, down from its May projection of 2.6% growth…for 2015, the group expects the U.S. economy to grow 3.1%, down from earlier estimates of 3.5%…the euro area has also been downgraded, and the stubbornly slow growth in the region is the most “worrying feature” of the OECD’s projections…

The TSX is off 56 points while the Venture has retreated 3 points to 985 as of 8:15 am Pacific…

Venture 3-Year Weekly Chart

It was a bearish sign for both the Venture and Gold when a trend reversed and bullion started out-performing the Venture during the first half of 2011…beginning just over a year ago, that trend reversed again, and the Venture’s out-performance relative to Gold is now accelerating, as you can see in the chart below, which has to be considered a bullish contrarian indicator…

Below is an updated 3-year weekly Venture–Gold comparative chart from John…the 970 to 980 area is such solid support as it was stiff resistance for many months last year and has been tested successfully on numerous occasions since March of this year…it also coincides with the Venture’s rising 300-day SMA…

CRB Index Updated Chart – Turnaround Soon?

Thanks in large part to a surging U.S. dollar, the CRB index has fallen sharply (10%) since mid-June, erasing all of its yearly gains, after it hit a 52-week high of 313.27…RSI(14) is currently at previous support, so we’ll see if that holds…as of 8:15 am Pacific, the CRB is relatively flat at 281.86 (significantly below its rising 200-day SMA) after touching a low of 280.22…the next obvious chart support is 275…a turnaround in the near future appears to be in the cards…

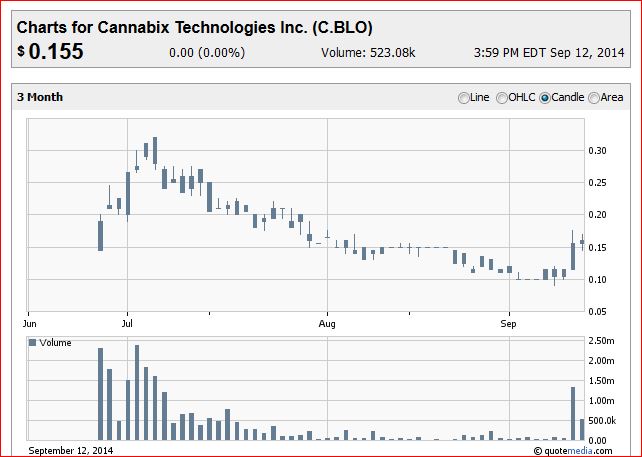

Cannabix Technologies Inc. (BLO, CSE) Update

A confirmed technical turnaround last week in Cannabix Technologies (BLO, CSE) which went into a downward spiral, albeit (importantly) on low volume, after leaping out of the gate once it began trading on the CSE June 26…this chart shows how trading has evolved over nearly three months…BLO is up a penny at 16.5 cents as of 8:15 am Pacific…

Recently we met with BLO CEO Rav Mlait as part of our continued due diligence on this company which we’ve liked from the very beginning several months ago when it was born out of West Point Resources which acquired the exclusive North American license for patent-pending marijuana breathalyzer technology…BLO is a first-mover in developing a roadside handheld breathalyzer which would allow for detection of very recent intake of THC, the principle pyschoactive component in marijuana…

We all know the seemingly unstoppable trend, unfortunate in our view, with regard to marijuana becoming more socially acceptable in North American society, and this has also led to more “drugged drivers” on the roads with no effective tool for law enforcement to combat that problem…

Cannabix’s potential solution has many people excited, and Ken Malhi – the company’s President – is a retired member of the RCMP with a keen awareness of how “disruptive” this technology (initially developed in Sweden several years ago) can be…

A key point which also has us excited: Cannabix has received a lot of Canadian media attention in particular (this is an easy story for people to understand), but just wait until the American media gets to know Cannabix…BLO is primarily a U.S. story and that’s where it’s aiming for market penetration, in terms of both the equity side and the business model…more in that in the near future…

In the meantime, we’ll leave you with this paragraph from the Globe and Mail, written by Jessica Leeder and published on May 20, 2014:

“There seems to be this lax view that smoking a joint and grabbing the car keys is okay. It’s mind-boggling,” said Marc Paris, the executive director of Partnership for a Drug Free Canada, a non-profit advocacy group. In a recent study, one-third of teenage respondents considered smoking marijuana before driving less risky than drinking. “To our surprise, one quarter of parents agreed,” Paris, said, adding: “At the end of the day, impaired is impaired.”

Garibaldi Resources Corp. (GGI, TSX-V) Chart Update

With an important district-scale high-grade Gold and Silver discovery unfolding in central Sonora State (more on that later this week), and first-ever drilling upcoming at the 260 sq. km Grizzly Property in the Sheslay district, there are few companies better positioned on the “discovery curve” at the moment than Garibaldi Resources (GGI, TSX-V), especially considering the fact that this group features the likes of Dr. Peter Megaw, Alain Charest and Dr. Craig Gibson – all are well-known for their contributions to major discoveries in Mexico…

GGI’s drilling hit ratio in Mexico has been remarkable this year (drilling continues at the Rodadero discovery) and the company will be applying that expertise shortly at the Grizzly Property where it has outlined “exceptional high opportunity targets”…GGI has the added benefit of having been able to compare drill results from adjoining properties with a broad array of geological data sets including critical geophysical and geochemical signatures…

In other words, being the third company to drill in the area has put GGI at a huge advantage…given the company’s track record of success in Mexico, combined with the overall known hit ratio in the Sheslay district, one has to consider the odds of a drilling discovery at the Grizzly to be unusually high…Garibaldi has spent several years studying this property intensely…

Below is John’s updated long-term monthly GGI chart…the key “takeaway” from this is that the primary trend is strongly bullish with the most steady accumulation in this stock since just prior to the 2006 explosion to 90 cents…RSI(14) at 58% is following an uptrend line in place since last year with plenty of room to surge higher as it did in 2006 and again in 2011…strong Fib. support at current prices with measured resistance at significantly higher levels as indicated on the chart…

GGI is up 1.5 cents at 25.5 cents as of 8:15 am Pacific…

Pure Gold Mining Inc. (PGM, TSX-V)

Speaking of discoveries, here’s another company quite capable of pulling one off…continue to keep this on your radar screen…

We initially brought Pure Gold Mining (PGM, TSX-V) to our readers’ attention in early July when it trading at 41 cents…since then, PGM has climbed gradually and has a good chance at a very strong finish to the year…

Pure Gold, formerly Laurentian Goldfields, recently consolidated its position in the prolific Red Lake district with the acquisitions of the Madsen Property and the adjacent Newman-Madsen Property…together, these properties make up a 50 sq. km land package of contiguous, primarily patented ground, collectively known as the Madsen Gold Project…Pure Gold now holds the third largest land package in the Red Lake region which includes two past-producing mines, existing mine infrastructure, current mineral resources, and multiple highly prospective exploration targets in a geological setting analogous to other modern high-grade discoveries in the Red Lake region…

PGM, which has just over 100 million shares outstanding, is well-funded and last month commenced a $4 million, 9,000-m drill program at Madsen (check out the August 22 news)…drilling is designed to test and expand the current mineral resource, while concurrently testing high-grade, 8 zone-style mineralization targets developed through continuing consolidation and evaluation of the large historic database…

Technically, as shown in this weekly chart, the trend is encouraging which points to the possibility of an eventual sustained breakout above Fib. measured resistance at 50 cents…the rising 50-day SMA, not shown on this chart, is at 45 cents…

PGM is off half a penny at 47 cents as of 8:15 am Pacific…

Silver Short-Term Updated Chart

Extreme oversold levels (3%) are now showing up in the RSI(2) in this 6-month daily chart…with SS also at low levels, the probability is high that Silver is close to an important low…it’s currently testing a support level around $18.60 which may or may not hold – we’ll have to see…

Silver Long-Term Updated Chart

Silver is still holding support at one downtrend line it broke above during the second quarter as shown in this “Big Picture” 11-year monthly chart…RSI(2) has plunged to 16% which is typically indicative that a turnaround is not far off…the 2013 low was $18.20 while the $17.50 level was strong support in 2010…

Note: John and Jon both hold share positions in GGI and BLO.

9 Comments

Wonder if GGI is started drilling the Grizzly already and the NR will come 4 or 5 days after? Regocci stated three weeks ago that they are going to drill right into the heart of this thing so obviously the drill collar location must be selected already. It has been a long time coming but hopefully we will hear something this week. Also, Rodadero should spread her wings soon as well with hopefully what will be more stellar results. We could be in for a surprise on the next set of results at Rodadero as samples seem to suggest the deposit changes from mostly silver to high grade gold and base metals.

A comment on Cannibix. The recent interest and higher trading volume in BLO is nice to see. How soon will they make this a US story is the question?

Dan, trading volumes on BLO in the U.S. are beginning to increase, even though they don’t have DTC eligibility just yet; some media interest down there has started. Just the beginning, I believe. This should have very long legs.

One that should be looked at is FPC.V falco is moving up. It has very good indications and look at the mangement, excellent. Richard l

We’ve been watching that one closely for a while now, Richard, and we’ll be running a chart on it tomorrow. Pulled back off its highs today.

This from the BLO website:

The current alcohol breathalyzer market is worth is in excess of 3 BILLION DOLLARS in North America….

Hello Jon!

I wonder about whats up with AIX? Expected some drillresults during the summer!Have you heard anything?

Hi Yvonne, I suspect we won’t have to wait much longer to hear plenty from the Sheslay district…

Yvonne I recently spoke to the company and there are no plans to drill this year,they have some soil sampling done and some treanching is scheduled for year end. In my opinion, based on previous Mike England plays, this is a closeology play and they will ride the coatails of the companies who will actually drill.