Gold has traded between $1,234 and $1,240 so far today…as of 5:00 am Pacific, bullion is up $1 an ounce at $1,236…Silver is down 9 cents at $18.60…Copper is off a penny at $3.16…Crude Oil is down 43 cents at $94.45 while the U.S. Dollar Index is flat at 84.09…

It’s an important day for equity and commodity markets with the Fed’s policy decision (11:00 am Pacific) and economic forecasts, followed by Janet Yellen’s news conference (11:30 am Pacific)…many market participants have been anticipating a more hawkish tone from the Fed today, hence the recent slump in Gold and commodity prices in general with the greenback going in the opposite direction…markets have been moving closer to a view that the Fed will drop a dovish phrase from its statement which says it would keep rates low for a “considerable time” – whether that occurs at today’s meeting or one in the near future, perhaps, remains to be seen…Wall Street Journal ace reporter Jon Hilsenrath, who is often correct on these matters, argues the Fed won’t announce any major changes today. “Given the economic backdrop, they don’t want to send a signal right now that rate increases are imminent. I think what they do, at the end of the day, is they qualify it.”

It’s an important day for equity and commodity markets with the Fed’s policy decision (11:00 am Pacific) and economic forecasts, followed by Janet Yellen’s news conference (11:30 am Pacific)…many market participants have been anticipating a more hawkish tone from the Fed today, hence the recent slump in Gold and commodity prices in general with the greenback going in the opposite direction…markets have been moving closer to a view that the Fed will drop a dovish phrase from its statement which says it would keep rates low for a “considerable time” – whether that occurs at today’s meeting or one in the near future, perhaps, remains to be seen…Wall Street Journal ace reporter Jon Hilsenrath, who is often correct on these matters, argues the Fed won’t announce any major changes today. “Given the economic backdrop, they don’t want to send a signal right now that rate increases are imminent. I think what they do, at the end of the day, is they qualify it.”

Gold Sector Profitability

Interesting comments from Randgold Resources‘ (GOLD, Nasdaq) CEO Mark Bristow in an interview with Kitco’s Alex Letourneau at the Denver Gold Forum when asked where the blame should be spread as the sector struggles with profitability. “It’s going to be tough, right now we’ve seen the fund managers looking to management to fix it,” he said. “I think, to a large degree, the fund managers are joined in how we got there, culpable like management.

“Perhaps some of the fund managers should practice what they preach, and that is allocation of capital,” Bristow continued. “For Gold mining to be profitable, you have to take out a whole lot of Gold production. If you take out a lot of Gold production, everyone’s going to make more money including the host countries in which we operate.

“I think that’s what the industry needs and I still think the industry’s living in denial,” he added.

China Stimulus?

Gold rebounded modestly yesterday on reports that China’s central bank is injecting 500 billion yuan ($81 billion) into the country’s five major state-owned banks as it moves to counter slower-than-expected growth in the world’s second largest economy…the move also gave the Shanghai Composite a modest lift today but falls short of a more sweeping effort, such as an interest rate cut, to lift the economy, showing that Beijing is continuing to use targeted measures…some Chinese bankers and executives doubt the measure will do much to help rev up economic activity, pointing to sagging demand for loans from businesses due to a lackluster economic outlook…

World’s Billionaire Population Increases By 7% Over 2013

The world’s billionaire population is at an all-time high, despite the sluggish global economy…a new survey shows that 155 new billionaires were minted this year, pushing the total population to a record 2,325 – a 7% increase from 2013…credit goes to the United States – home to the most billionaires globally – where 57 new billionaires were recorded this year, according to the Wealth-X and UBS Billionaire Census 2014 released this morning…

Today’s Equity Markets

Asia

China’s Shanghai Composite, after a rough session yesterday, reversed and posted a 12-point gain overnight to close at 2308…Japan’s Nikkei fell 23 points to finish at 15889…

Europe

European markets are up modestly in late trading overseas…

North America

Stock index futures in New York are pointing toward a slightly positive open on Wall Street…the Dow hit a new record high yesterday as it rallied 101 points to close at 17132, leaving it about 20 points below an important Fib. resistance level…the TSX closed at 15511 yesterday while the Venture was off 6 points to 976, 8 points above the May low…a very strong Venture support band exists between 970 and 980…

Copper Chart Update

“Decision” time for Copper soon…below is an interesting 3-year weekly chart for the metal…note how the RSI(14) has been climbing an encouraging trend line since Copper sank to just below $2.90 a pound in late March…RSI(14) is currently at 50%, testing support at the trend line, but it also faces resistance at 60%…a bullish downsloping flag has formed which would make a close above the $3.20 level significant…plenty of resistance, however, between $3.30 and $3.40…

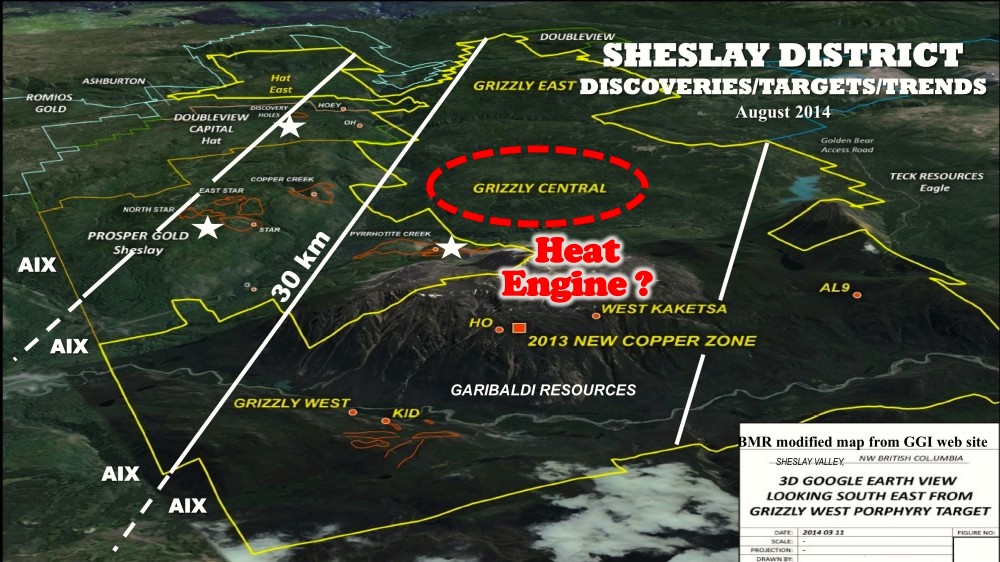

Sheslay District Update and Garibaldi Resources Corp. (GGI, TSX-V)

From the first bold words last year on the Sheslay district from renowned geologist Dr. Dirk Tempelman-Kluit, to the encouraging, passionate words this morning from Garibaldi Resources‘ (GGI, TSX-V) President and CEO Steve Regoci, to the publicly available geological data on the key properties in the area, there’s ample evidence to conclude that this prolific yet under-explored part of northwest British Columbia has an excellent chance of imminently delivering an exciting “triple play” which could also give a boost of confidence to the entire junior exploration sector…

Some of the brightest geological minds in the country are convinced that the Sheslay district is destined to become a major new mining camp in northwest B.C. – a development, if it should occur, that could make investors at this early stage fortunes…the combined market capitalization of the three largest players – Garibaldi, Doubleview Capital (DBV, TSX-V) and Prosper Gold (PGX, TSX-V) – is only $36 million…just one of these companies could potentially be bought out for multiple times that amount if they’re able to prove up a substantial economic resource – no easy task, but this area has the right geology and some of the best people to figure everything out…

It doesn’t take a rocket scientist to understand that a potential avalanche of news from the Sheslay district – including drill results and news of more drilling – is likely just around the corner…all companies in the area have been holding their cards very close to their chests over the last few months, but you don’t even have to “read between the lines” of Regoci’s comments, from an exclusive interview with BMR, to know that there’s a growing sense of confidence…

“We’re enjoying a high success ratio down in Mexico and we expect that will translate to the Grizzly,” Regoci told us as GGI ramps up to first-ever drilling at the 262 sq. km property that has “exceptional high opportunity” targets over an area stretching at least 15 km NW-SE from Grizzly West to Grizzly Central…

“We’ve got up to 17% (Cu) on surface samples (Grizzly West),” stated Regoci, “so there are definitely higher grades to be had here. You see the clustering at Grizzly West, the clustering of these Cu-Au porphyries at the Star, and we’re seeing evidence of that throughout the whole 30 km belt including of course Grizzly Central and Doubleview’s significant discovery. There is certainly going to be more than one deposit found as far as the early evidence indicates. So we’re very, very optimistic that we’re going to be able to leverage this in a very big way for our shareholders. Leverage just isn’t a word. It’s a function of how we operate and how we think.”

A “Heat Engine” and Parallel Trends

Garibaldi, which has the longest history in the area, also has a reputation for knowing where to drill as demonstrated most recently with a high-grade Silver discovery from the first hole drilled at the Silver Eagle target (Rodadero Silver-Gold Project) in central Sonora State.

“We have a road map…we know what we’re looking for,” Regoci stated in reference to drilling at the Grizzly. “It’s certainly a very pregnant system. There has been a huge amount of pressure and fluids forced through this entire region. You can debate about exactly the nature of that, and how it relates to the topographically dominant feature, the Kaketsa pluton – maybe a heat driver, a heat engine – but along the entire 30 km belt, from the northwest boundary to the southeast, you just see massive fracturing and fluids and mineralization of all styles throughout this whole region. It’s going to become a very, very big story. And it’s something we intend to lead in.”

Grand Prairie Energy Services Inc. (GPE, TSX-V) Update

Great Prairie Energy Services (GPE, TSX-V) is another energy play we’ve been tracking closely in recent months…the second quarter and first half of the year are characteristically the company’s weakest due to spring breakup, so investors will be looking for stronger third and fourth quarter performances…as always, perform your own due diligence…

Technically, GPE is showing strong support in the immediate vicinity of the 40-cent Fib. retracement level while the rising 200-day moving average (SMA) currently sits at 35 cents…the share price is now right up against a downtrend line while RSI(14) has already broken above its downtrend line, and buy pressure has replaced sell pressure which has been dominant since June…

Cardiff Energy Services (CRS, TSX-V) Update

Cardiff Energy Services (CRS, TSX-V) pulled back very modestly late last week from chart resistance at 20 cents – not unexpected – but then blasted through that level yesterday on high volume as it closed up a nickel at 22.5 cents…the breakout above 20 cents (now new support) will likely draw in more momentum players…

Highbank Resources Ltd. (HBK, TSX-V) Update

Highbank Resources (HBK, TSX-V) has been a big winner for some of our readers since we first mentioned the company when it was trading in the mid-teens in March…as expected, a consolidation phase set in after the stock climbed to a multi-year high of 38 cents intra-day July 21…Fib. levels are indeed important to watch and support at 26 cents has held on the pullback…HBK closed down half a penny yesterday at 30 cents…the company came out with an update Monday on progress at its Swamp Point North aggregate project near Stewart which is moving closer to production…

A recently overbought RSI(14) condition on this 2-year weekly chart has unwound and a bullish “W” pattern has now formed…note the uptrend support line and the very consistent buy pressure…the overall trend here remains very positive…

Note: John and Jon both hold share positions in GGI and PGX. Jon also holds a share position in DBV.

13 Comments

You’re up early 🙂

PXA dissapoints, taking a major haircut this morning.

Just wondering what you BMR guys make of Prosper’s SP having drifted down to 24c recently. They have results to report very soon and this will be adding to already promising numbers. They should be able to give a decent picture of what they have on their hands in the very near future.

Tom, the market knows little about the Star Project as Prosper has made this sort of the world’s best kept secret for the last 10 months or so – perhaps that was part of their strategy – to keep expectations muted, I don’t really know. So the fact this is trading in the low 20’s at this point keeps the downside to a minimum and provides for plenty of upside in the event they’re able to show the potential for large tonnage and higher grades. They’re a very professional group, they’ve always run a tight ship (previously with Richfield and now Prosper) and that means no “leaks”, good or bad. Hope that helps.

The selling in Pgx has been mostly cannacord in the recent decline. I attribute the drop in share price to low share float and selling of paper possibly from previous financing. Therefore I see this as an opportunity

I would agree, Doublejay. Going back to mid-July, Canaccord has accounted for about 30% of PGX selling. That paper supply must be starting to run low, I would suspect.

Jeff hope you didn’t get soaked too badly with Pxa today, can’t see how they’re going to close a pp at .10 when the stock is trading at the .055 range. Flags galore with this one!

Pgx and DBv be a goid buy in a month at the five cent mark maybe.

Enjoy your site Jon. Been watching Pgx since you mentioned last year.Do you know if they have had several rigs going? They are lean with the info.

Paul, thank u. We should be hearing from PGX shortly in terms of the important drilling they have been carrying out since May. They need to show growing tonnage and grade. The North Star target should be particularly interesting. It sits almost 1 km north of the Star porphyry and has never been previously drilled – lots of encouraging geophysical and geochemical data at the North Star, so that’s certainly a key area to watch in terms of a possible new discovery.

Gold smacked and rebound somewhat tonite….

PaulH, one rig started in May and the plan was that another joined it in June. As you say, news is rather lean. However, someone has spoken to the PGX office a few of weeks ago and was told that results would be out in mid-September i.e. now !!!! The PR a few months ago was that 10,000m would be drilled and they gave a detailed breakdown of where these holes would be. I’m hoping that everything has gone according to plan and that all holes will be reported soon. No news today and from what people say companies avoid releasing good news on a Friday, so it looks like it might be next week by the time we get info. Between DBV and PGX this has felt like the longest summer ever 🙂

Good comments Tom UK