Gold fell as low as $1,204 this morning before rebounding and climbing as high as $1,221…as of 7:30 am Pacific, bullion is up $1 an ounce at $1,216 in the face of continued greenback strength…Silver is off 20 cents at $17.26…Copper is down 3 pennies at $3.04…Crude Oil is 82 cents lower at $93.77 while the U.S. Dollar Index continues its surge – off its high of the day (slightly above 86.20) but still up nearly one-third of a point at 85.89…

It seems the Dollar Index is determined to test the 88 Fib. measured resistance level, as John’s chart yesterday indicated, before a possible correction sets in, so a sustained turnaround in Gold and commodities may not come until then – this could occur in as little as a matter of days or sometime during October…but that’s a key area (88) to watch…it’s important to point out as well that 89 acted as strong resistance in 2008, 2009 and 2010 – so that “band” between 88 and 89 is where this Dollar Index surge can be expected to meet very stiff resistance and reverse…a turning point in the greenback could come as early as Friday if non-farm payrolls for September disappoint…on the other hand, Thursday’s ECB meeting and Friday’s U.S. jobs report could further demonstrate the widening gulf between the euro zone and U.S. economies, and push the Dollar Index even higher…but again, the 88-89 area should be the short-term high – that’s a logical target…

It seems the Dollar Index is determined to test the 88 Fib. measured resistance level, as John’s chart yesterday indicated, before a possible correction sets in, so a sustained turnaround in Gold and commodities may not come until then – this could occur in as little as a matter of days or sometime during October…but that’s a key area (88) to watch…it’s important to point out as well that 89 acted as strong resistance in 2008, 2009 and 2010 – so that “band” between 88 and 89 is where this Dollar Index surge can be expected to meet very stiff resistance and reverse…a turning point in the greenback could come as early as Friday if non-farm payrolls for September disappoint…on the other hand, Thursday’s ECB meeting and Friday’s U.S. jobs report could further demonstrate the widening gulf between the euro zone and U.S. economies, and push the Dollar Index even higher…but again, the 88-89 area should be the short-term high – that’s a logical target…

It has been encouraging that Gold has held up as well as it has – bullion may survive this current huge move in the Dollar Index potentially without hitting a new low…that remains to be seen…Gold, however, is still set to post its sharpest monthly loss since June 2013 and its first quarterly loss (about 9%) this year…overall short positions in Gold are at their highest since last year – perfect set-up for a major short-covering rally in the near future – while it’s also important to note that smart-money commercial traders have been significantly scaling back their net-short positions in recent weeks…

One imminent factor not in Gold’s favor is the the Chinese Golden Week holiday which begins tomorrow…some market participants say the absence of Chinese buyers may be felt in the Gold market via lower prices. “We have seen moderate demand from them in the $1,210-20 region over the last week and they have been an instrumental factor in the market not testing fresh cycle lows,” says MKS (Switzerland) of Chinese buyers. “The absence of their demand combined with a strong expected NFP (non-farm payrolls report) and general bear bias, we could be testing $1,180-$1,200 in the coming days. Another factor that may come into play is the riots in HK (Hong Kong), which could dramatically deplete domestic demand in that market, a prominent source of physical demand.”

Today’s Equity Markets

Asia

China’s Shanghai Composite gained 6 points overnight to close at 2364, its 6th straight daily advance and a 19-month peak to finish the quarter…HSBC’s China final manufacturing report for September came in at 50.2, unchanged form August…Japan’s Nikkei average slipped 137 points…a slew of Japanese economic data for August was mixed with household spending and industrial output coming in worse than expected, while retail sales beat forecasts…the Hang Seng Index hit a fresh 3-month low amid the largest civil unrest in that country since the 1960’s…

Europe

European markets are mixed in late trading overseas…today’s data dump included inflation, a key metric used by the ECB to gauge the strength of its economy…euro zone inflation slowed to 0.3% in September, largely as expected…it comes amid growing concerns that the region could be heading towards a long-term period of weak consumer price growth or even deflation…euro zone unemployment was unchanged from last month at 11.5%, also in line with expectations…

North America

The Dow is off 14 points as of 7:30 am Pacific…U.S. consumer confidence dropped in September after holding near a 7-year high for the last two months, the U.S. Conference Board reported this morning…the board said that its monthly Consumer Confidence Index fell to 86.0 from August’s revised reading of 93.4…

The TSX is down 17 points as of 7:30 am Pacific while the Venture, which has fallen in 17 out of the last 20 sessions, is off a point at 912…

U.S. Dollar Index vs. Venture

This long-term monthly chart shows how critical the performance of the U.S. Dollar Index is to the Venture trend…a surge in the greenback is typically problematic for the Venture, as we’ve witnessed over the last month, while a retreat in the Dollar Index (2006, 2007, much of 2009, the last half of 2010 into early 2011, mid-2012 and the last half of 2013 into 2014) is bullish…

After 11 straight weekly advances, the Dollar Index is getting “stretched” technically and a cleansing of overbought conditions – likely to begin sometime in October after a possible test of the 88-89 area – will certainly take some pressure off the Venture and create conditions for a potential strong rally…

U.S. Dollar Index vs. S&P 500

While the Venture under-performs when the greenback is hot, the S&P 500 typically enjoys riding the wave of a higher Dollar Index…a significant correction in the broader markets is not likely to occur until the Dollar Index cools off…

TSX Gold Index

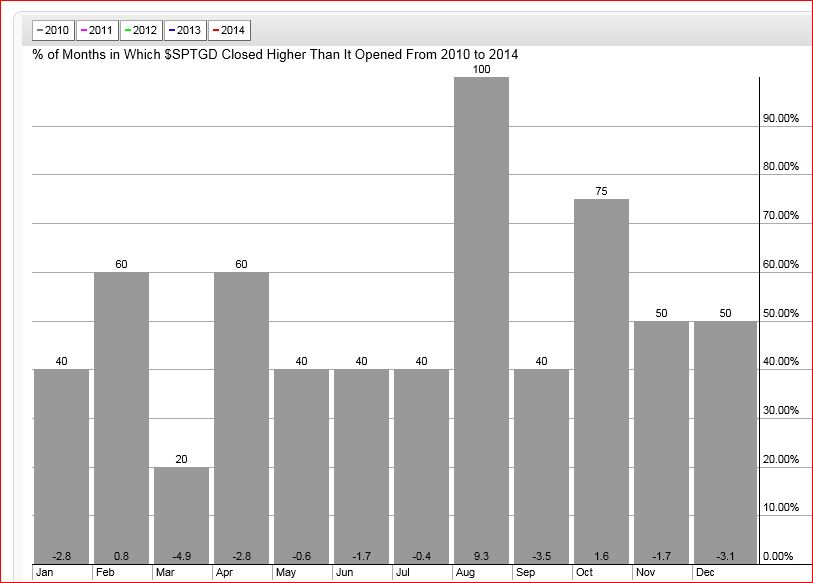

Historically, the TSX Gold Index has shown the propensity to reverse sharply in October after a large September decline…interestingly, since 2010, October has also been the second-best month (behind August) for the Gold Index as you can see in this chart below…

The TSX Gold Index for September was down a whopping 16.3% through yesterday, and it’s off slightly again this morning on this final trading day of the month and quarter…so the producers have been hit even harder than the juniors in September…

Given the current extent of oversold conditions, the likelihood of a sharp turnaround at some point in October is high in our view…the very strong bearish trend has started to decline and a consolidation is now occurring on declining volume…note also the large gap that has opened up with the still-rising 200-day moving average (SMA)…

Newstrike Capital Inc. (NES, TSX-V) Update

Newstrike Capital (NES, TSX-V) is actually UP for the month of September and a bullish trend is clearly in place, so an October rally in Gold and Gold stocks could produce a significant breakout in NES above neckline resistance as shown below…recently, the company released a very robust Preliminary Economic Assessment for its Ana Paula Project in Mexico’s prolific Guerrero Gold belt…we urge readers to check it out as part of their due diligence…

NES is down 3 cents at $1.02 through the first hour of trading…

Blackbird Energy Inc. (BBI, TSX-V) Update

As we noted at the time (late August), Blackbird Energy (BBI, TSX-V) staged an important confirmed breakout through resistance at 30 cents, and BBI has held steady this month on strong volume…the company announced the acquisition of more ground in the Alberta Montney along with a transformational $35.5 million bought deal financing (Sept. 22)…

BBI is unchanged at 35 cents as of 7:30 am Pacific…below is an updated 2+ year weekly chart…

Note: John, Terry and Jon do not hold share positions in NES or BBI.

32 Comments

DBV taking a big hit today…RBC seller came out of the gates hot and was hitting the bid all the way down to .125. Let’s hope for a correction as the day continues. Disappointing to see, especially on the cusp of (hopefully) good news.

DBV recovered more of the same games as yesterday, now at .15, pgx on the other hand is not doing well, anon hammering it down to .085.

The bleeding just wont stop for pgx, million shares traded and sitting at .075 yikes!

So um, do you guys like PGX down here at 0.07 cents? Ouch!

Unnecessary and unfortunate that PGX is trading where it is.

Unnecessary and unfortunate that PGX is trading where it is. Looks like some panic-selling, capitulation.

Ripleys’ believe it or not, i managed to get some PGX at 0.075.

I would suggest the boy’s pots’ & pans’ are worth 0.075/share. Anyway,

time will tell.

BMR – Your site is very slow today, maybe it needs an oil change.

GGI getting dragged down as well some news from Mexico might help I hope/pray.

Jon look at who’s selling, anon, with many shares, has the signs of brokerages. I know anyone can sell under anon but it sounds like Peter has upset some big players.Will be interesting how PGX plays out, would ahte to ahve been the guy involved in the pp at .50

GGI down again today. What is the support level and is it broken? We need some good news from GGI.

GGI touched a Fib. support level (18c) and the rising 300-day SMA this morning, Dan…normal and healthy retracement, plus oversold conditions have certainly emerged. With all that GGI has going on, it’s a great candidate to bounce back very strongly in October as this overall market mayhem subsides. And they don’t have a share structure problem like other companies.

No Jon they don’t have a share structure problem like other companies I agree. What they do have is a ball and chain that is being pulled on by PGX results and possibly DBV results if the results are a bust. Hope DBV results are decent to stop the downdraft. IMO, Sheslay area is the reason right now. Mexico – if it proves to be a monster at Rodadero may be GGI’s only saviour short term. When the heck will GGI drill the Grizzly? Did GGI change their minds on drilling?

I respectfully, disagree, Dan. They have a share structure problem because 14 million shares were issued over the last 12 months and not enough volume was created in the market to absorb that since January. So that IS a share structure problem, plain and simple, even though they have only 30 million or so outstanding. This goes back to my original point last week. And, I repeat, the issue is not the results from the Star target (other than the fact there was no “glory” hole), because those results were good and fully support the Star deposit model. Strangely, in the first 19 holes (perhaps not at all) they didn’t step out from the confines of the Star deposit – that fact, more than the actual results from the Star, is a major source of the market’s disappointment. So you have to understand the underlying problem(s) here. A whole range of factors – completely independent from the numbers they reported – are at play. This isn’t about “bad results”. The Sheslay district is as prolific as ever, and DBV and GGI should be able to demonstrate that.

Jon, you lost me on the share structure problem. I agreed with you in my previous post that GGI doesn’t have a share structure problem. With regards to GGI share price, I believe Rodadero is GGI’s best hope right now, unless they pull a surprise whopper of a hole on it’s first try at the Grizzly. My issue right now is why won’t GGI disclose the drill date for the Grizzly? Could the drill already be turning up there?

The share structure issue was in reference to PGX and understanding what’s happening in that market, Dan, sorry if I misread your post. I’m sure we’ll hear from both GGI (Mexico and Grizzly) and DBV (Hat) soon enough. September is done with and that’s good. Awful market month but likely a turnaround at some point in October.

I don’t claim to know a lot, but i feel the problem today is the flow through

shares, issued earlier. I doubt if anyone part of a 0.50 p.p.would be selling

at that much of a loss, but the flow through shares are a different matter,

especially since they can be used as a deduction on income from ALL sources.

This is my way of thinking & why i have been buying recently at such low prices.

What do you think of that my buddy !

Bert, you touched on a very valid point. The problem with any stock these days that has completed a financing, 4 months after the fact you’re going to have some investors anxious to sell, even at a minor (or in some cases a larger) loss, and ride the warrant. If there’s flow-through involved, even worse as the real cost of the original investment of course is much less.

My last post should have been addressed to Jon

Corrected copy

Jon

I don’t claim to know a lot, but i feel the problem with PGX today is the flow

through shares, issued earlier. I doubt if anyone taking part of a 0.50 p.p.would be

selling at that much of a loss, but the flow through shares are a different matter,

especially since they can be used as a deduction on income from ALL sources.

This is my way of thinking & why i have been buying recently at such low prices.

What do you think of that my buddy !

Thanks Jon. Hope GGI announces somrthing next week.

Pgx, you just have to love the confidence by insiders who sell while their stock free falls : Symbol Company Name Insider Buys Volume Insider Sells Volume Net Sells Volume

PGX Prosper Gold Corp. 0 1,205,000 1,205,000

Paul, thanks for picking up on that, but in fairness to Prosper, I don’t believe that “insider” selling today came from anyone in management or on the board. That was probably a fund that by virtue of the percentage of its holdings in PGX, had to report the transaction(s). Having said that, fund selling is no fun…

Probably right Jon but sure creates a lack of confidence for the poor guys who are invested in PGX,

Dan, I have a theory about Garibaldi and the Grizzly. GGI are very careful with their cash and are proud of the fact that they have not had to raise cash on the open market for several years. My guess is that they have set aside a smallish sum of spend for a few initial holes at the Grizzly (lots to do in Mexico as well). They probably have several targets lined up but will only drill some of these before winter sets in. They could well be waiting for DBV to announce their results before finally deciding which holes to drill first. This is purely guesswork on my part, but I would really love to see them drill in the immediate future. Good drill results from DBV and GGI here, could well encourage me to buy some PGX shares, probably during tax loss season as there could still be room for them to fall further.

Paul

It’s not all selling going on with PGX

Sep 30/14 Bernier, Peter direct Ownership Common Shares 10 – Acquisition in the public market 300,000 $0.085

Further to my previous post re PGX, just wait until i file my

insider buying report. Full steam ahead or bust. ha !

Good to see Pete stepping up to the plate, Bert. Positive sign.

Jon, did you get any response from Dirk regarding the invitation of an interview? Could PGX salvage something by issuing a PR explaining current and future plans?

Hi Tom, Dirk politely turned down the invitation. I spoke with him briefly following the news; he was very gracious as always – he’s a first-class guy – and we had a good conversation, but he decided against an interview.

Guess there was nothing Dirk said that would motivate you ( Jon ) to buy back in , even at these prices ? Bert, Peter’s buying 300 k looks like damage control on a out of control share price, the guy is ultra rich, he could have filled his pockets with what some suggest are cheap shares, all day long.

Paul

Please be reminded that he is holding a bundle & i mean a bundle

at much higher prices, say 0.50. Whatever, i am gambling & i will

not shy away if i lose & i hate losing. Have a good day.

I understand he’s holding a large position Bert, the 300k he bought, in my opinion, was to stop the bleeding. You’re a brave man and I wish you luck with PGX.