Gold has traded between $1,225 and $1,236 so far today as the Fed begins its 2-day policy meeting…as of 8:30 am Pacific, bullion is up $4 an ounce at $1,229 thanks to a weaker-than-expected U.S. durable goods report this morning…in addition, physical demand, particularly from Asia, has been giving underlying support to the metal…volumes for the benchmark spot contract on the Shanghai Gold Exchange are near a 2-week high set October 23…Silver has added 13 cents to $17.24…Copper is up 3 pennies to $3.11…Crude Oil is 21 cents higher at $81.21 while the U.S. Dollar Index is off one-fifth of a point to 85.35…

As usual, tomorrow’s statement from the FOMC will be very closely scrutinized by the market…most analysts believe the Fed will formally end its monthly bond-buying program but may also include some “dovish” language with regard to the future direction of monetary policy given fresh concerns regarding a slowing global economy…Gold will likely take its cue from how the greenback responds…

As usual, tomorrow’s statement from the FOMC will be very closely scrutinized by the market…most analysts believe the Fed will formally end its monthly bond-buying program but may also include some “dovish” language with regard to the future direction of monetary policy given fresh concerns regarding a slowing global economy…Gold will likely take its cue from how the greenback responds…

Gasoline prices have dropped below $3 a gallon at most U.S. gas stations, delivering a welcome lift to American consumers and retailers heading into the holidays…the U.S. economy is set to gain more than it loses from cheaper Oil…lower prices at the pump give drivers more money to spend on discretionary items and they reduce costs for many businesses…but lower Oil prices also threaten to slow the nation’s energy boom which has had a significant impact on the broader economy…

U.S. Durable Goods Orders Unexpectedly Drop

Orders for big-ticket manufactured goods in the U.S. fell for the second consecutive month in September, the latest sign of uneven improvement in the economy…purchases of durable goods – products like airplanes, cars, and heavy machinery that are designed to last at least 3 years – fell by 1.3% in September from the prior month to a seasonally adjusted $241.63 billion, the Commerce Department reported this morning..economists were expecting an increase of about 0.6% in durable goods orders…

Shifting Political Winds In U.S.

Nearly 7 in 10 Americans are “angry” at the direction the country is headed and 53% of Americans disapprove of President Barack Obama’s job performance, troubling signs for Democrats a week before the mid-term elections, according to a new CNN/ORC International Poll…Democrats are in grave danger of losing their Senate majority while Republicans appear set to actually pad their majority in the House, giving them Congressional control which may reshape the U.S. legislative agenda…the potential impact of this, across various markets including of course equities and the U.S. Dollar, will be interesting to see…

Today’s Equity Markets

Asia

A powerful rally in China’s Shanghai Composite overnight as the Index shot up 2%, rebounding from an 8-week low yesterday and snapping a 5-session losing streak…data showed September industrial profits rising 0.4% on year, reversing a 0.6% annual decline in August…Japan’s Nikkei was off 59 points to close at 15330…sentiment was unable to get a boost after Finance Minister Taro Aso said that he will consider an economic package to support the economy after examining third-quarter data…

Europe

European markets were up significantly today…

North America

The Dow is up 66 points as of 8:30 am Pacific…U.S. consumer confidence rose more than expected in October, reversing the weakness seen in September, according to data from the U.S. Conference Board this morning…its Consumer Confidence Index rose to 94.5 from September’s revised reading of 89.0…in its initial reading, last month’s index was at 86.0…

The TSX has added 84 points while the Venture is off 3 points at 787 through the first 2 hours of trading…

Corvus Gold Inc. (KOR, TSX) Update

Corvus Gold (KOR, TSX) released robust drill results this morning from the Yellowjacket deposit at its North Bullfrog Project in Nevada…holes NB-14-400 and NB-14-401 returned broad intercepts of 36 m grading 17 g/t Au and 32 m o@ 5 g/t Au, respectively…(NB-14-400 is the best high-grade broad intercept drilled to date at the project)…these new results continue to fill a gap in the previous drilling in an area targeted for high-grade mineralization related to shoot development…15 other holes have been completed in this area (results pending) with another 10-12 holes planned as part of Phase 2 drilling…mineralization in this target zone occurs in the form of native Gold in quartz veins primarily within the stockwork zone around the main Josh Vein…this new high-grade zone, originally hit in hole NB-14-399, is expanding at depth with grades that are 5 to 15 times the average of the system overall and higher than the main Josh Vein…KOR is up 9 cents at $1.04 as of 8:30 am Pacific…

Kaminak Gold Corp. (KAM, TSX-V) Update

Fresh drill results released this morning from Kaminak Gold’s (KAM, TSX-V) new Kona North Gold discovery at the Coffee Project in the Yukon…highlights included 3.12 g/t Au over 28.95 m from 64 m downhole…mineralization at Kona North has now been traced over a minimum strike length of 240 m with 10 holes completed to date…all holes have intercepted mineralization with estimated true widths ranging from 5 m to 25 m…Kona North appears to represent a broadly east-west striking, moderate to steeply south dipping mineralized envelope, which exhibits pinch and swell as observed at other Gold zones at Coffee…KAM is up 4 pennies at 71 cents as of 8:30 am Pacific…

Garibaldi Resources Corp. (GGI, TSX-V) Update

Encouraged by a new surface discovery 150 m north of Silver Eagle discovery hole SE-14-01, and Phase 2 drill core that’s visually similar to Phase 1, Garibaldi Resources (GGI, TSX-V) definitely appears to have a “tiger by the tail” at its Rodadero Project in central Sonora State – especially with interest in Rodadero shown by at least 2 companies, 1 of them a leading international Silver and Gold producer as reported by Garibaldi late last week…while GGI also has other “irons in the fire” at the moment, including its La Patilla Gold Property in Sinaloa State and of course the Grizzly Project in northwest B.C., the shallow, high-grade and apparent widespread nature of mineralization at Rodadero clearly presents a unique opportunity for the company – especially considering the fact there are majors to the north and south of Rodadero with operating mines…

The discovery of a new mineral camp at Rodadero, a previously under-explored part of central Sonora State, could have company-changing possibilities for GGI…click on the arrow below for additional comments from GGI President and CEO Steve Regoci (Part 3 of our segment)…

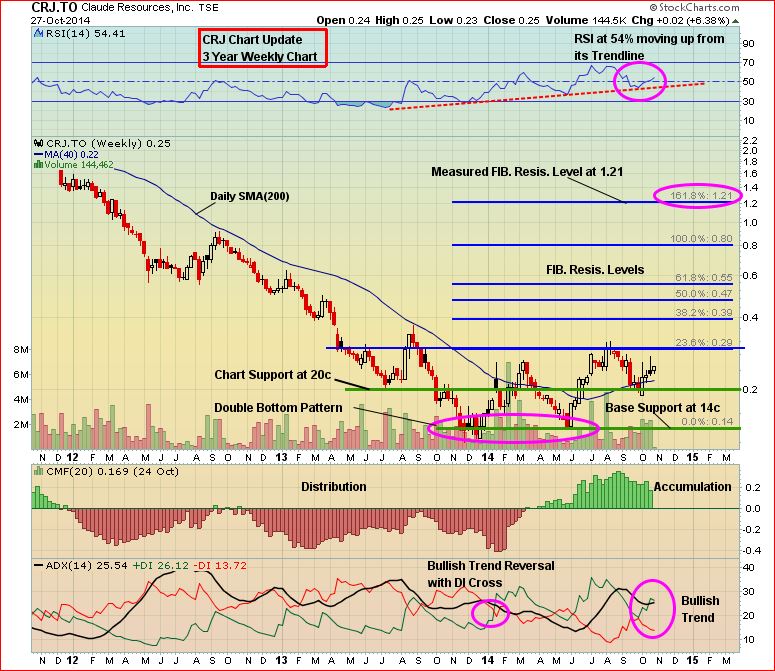

Claude Resources Inc. (CRJ, TSX)

Technical analyst Clive Maund (www.CliveMaund.com) picked up on this one the other day, and John is seeing similar reasons for encouragement…fundamentally, the company achieved record Gold production of 20,614 ounces during Q3 at its 100%-owned Seabee Gold operation in Saskatchewan…the strong third quarter represents a 96% increase in production compared with the third quarter of 2013…year-to-date Gold production of 50,700 ounces is 63% higher than the first 9 months of 2013…on October 7, the company revised its 2014 production guidance upward to 61,000 to 64,000 ounces of Gold from the previous guidance of 50,000 to 54,000 ounces…the company’s strong performance this year has allowed it to continue to focus on generating earnings and reducing debt…Q3 financial results will be released pre-market next Monday…

Below is a 3-year weekly CRJ chart for our readers’ due diligence…note the double bottom pattern, the bullish +DI crossover and the reversal to the upside in the 200-day moving average (SMA), currently at 22 cents, during the summer…

CRJ is off a penny at 24 cents as of 8:30 am Pacific…

Zenyatta Ventures Ltd. (ZEN, TSX-V) Chart Update

Below is an updated 2+ year weekly chart for Zenyatta Ventures (ZEN, TSX-V) which has been showing some encouraging technical signs lately, though it does face some challenges including resistance around $2.25 since early July and a long-term downtrend line that currently intersects just above Fib. resistance in the $2.50‘s…

ZEN is unchanged at $2.20 as of 8:30 am Pacific…

Updated Copper Chart

Copper is at a very important juncture and must soon decide if it’s going to break above a long-term descending triangle or head lower, below important chart support around the $3 level…technically, as strange as it may seem, a substantial drop in Copper prices – as experienced in recent months in Crude Oil – can’t be ruled out – nor can a bullish advance in the event of a breakout above the triangle…these are unpredictable times…

RSI(14) at 42% is at previous support on this 13-year monthly chart…

Updated Crude Oil Chart

Crude Oil can be expected to remain under pressure given its breakdown earlier this month below long-term support…yesterday, Goldman Sachs predicted WTIC prices could fall as low as $70 a barrel by early next year…that possibility certainly exists given a combination of current demand-supply dynamics and the technical deterioration we’ve seen in the Oil chart in recent weeks…”smart money” will likely be selling into any rallies that will likely be capped in the mid-to-upper $80’s…

Below is a 6-month daily chart…sell pressure has been mostly dominant since early July…

Contact Exploration Inc. (CEX, TSX-V) Update

Many energy stocks are suffering, and this has been a major factor in the Venture’s 20%+ plunge since the end of August…we warned about Contact Exploration (CEX, TSX-V) as soon as it confirmed a breakdown into the low 40’s below a long-term upsloping channel…there is likely more pain to come based on the posture of this 2.5-year weekly chart…

CEX is off 1.5 cents at 30.5 cents as of 8:30 am Pacific…

Note: John and Jon both hold share positions in GGI.

24 Comments

Jon, what do you make of this story of the mysterious buyer cornering the copper market…

Zero Hedge website (27/10/2014)…

That’s a very good question, Chris, we mentioned that in yesterday’s Morning Musings when WSJ reported it…it’s darn interesting…who knows what games are going on there, I’m not sure what to make of it actually…maybe some of our readers can chime in on that one with some insight…

Thanks ! That is if it was you who bought the GGI shares

i had for sale.. Gold up 4.00 this a.m., down 0.20 now,so

there you go.

The stock to buy now is AGG. 2.8million ounces and trading at 4 cents. Pinetree is flushing out their stock.

Bert are you leaving GGI??????????

Maybe I am reading too much in to the latest exert of the interview, but it sounds to me as if GGI are in talks with a suitor of some sort.

Just came to mind that if i sell shares of a stock that

we feel so confident about, i should at least elaborate.

I only sold 5500 shares today at 0.225, which i paid

0.165 for, that gave me a 30% profit…I have a core

position, which i intend hanging onto, anything above

that position is for sale, that is, if the price is right.

Sorry about not explaining this earlier. R !

Tom UK, not sure if GGI are in talks with a suitor, but my opinion of Regoci’s comments regarding a suitor is just like the visit by leading silver and gold company – unsolicited. I believe we could see an unsolicited bid for GGI if they prove that the mineralized system is connected and keep hitting high grade. He did say some companies get taken out before a 43-101, just as another company did not that long ago. To me, that speaks volumes to what GGI has uncovered at Rodadero. For Regoci to be this confident in the interviews, it has to be very significant find. This could be a monster discovery!

Not bagging GGI but a few months back he told us people would be surprised at how quickly and aggressively they would be moving on the Grizzly.With this latest NR at least he is trying to keep interest up.

Paul, it would be premature to judge the Grizzly situation IMHO…I suspect they’ve moved the Grizzly forward in ways that may yet surprise us; it has been a continuously evolving situation there…we’ll just have to wait and see what they have to say…at the moment, there’s no question there are important developments regarding Rodadero and the direction things go down there are going to be fascinating…when you have a leading international producer on your property, and drilling and sampling are in progress with high grades already reported, that’s way more than a little fluff to keep interest up…I just have the feeling that this could be a superb situation in the works. The market needs a success story. This could be it, who knows. This part of Mexico is prolific. You drill enough holes, and kaboom. 7 m of 2,100 g/t Ag, very shallow, on one of them. It could get even better than that, and you have a Gold and base metal environment at Rodadero as well. It’s quite accurate and reasonable to state that this is a very compelling scenario that could have some very interesting twists and turns.

Thanks Jon, I agree that at least there is some fluff there! Having two areas of interest is better than a one trick pony like Prosper at this stage.

Be realistic my friends ! Hopefully we have a good find in GGI.,

but having signed a couple of confidential agreements, may not

necessarily mean they will be taken over & may not mean much at

the end, but i will class it as being a good first step. It’s

common practice, for most companies with a discovery, to have

signed confidential agreements. I appreciate Jon & never do i

want to offend him, but i also appreciate my cyber buddies. Jon

is an exceptional writer & i class him as a master of words, which

may be leaving some of us, unable to sleep at night, thinking of

ways to spend money we don’t have. I may not be forgiven for this

but as a cyber friend, i invite you back to earth & remind you all

about the big shiny rock that the CEO of RBW was carrying around &

his smile, which appeared larger than the rock. I am sure that Jon

et al wants us all to be winners, but i feel confident that he

realizes, that only results will tell the true story & may the true

story continue…Also, i want to remind you that i am a shareholder

& like you, i want to profit.

Jon,some tech stocks have done well lately and I was wondering what your thoughts are on Magor Corp. Are you still following them? They have been in a steady decline the past 6 months. A company that I have been watching the past 2 months in the same space has been ChitrChatr Communications cha.c. Share price has climbed from 20 cents in Sept to 2 bucks today. They announced they want to release an alpha version of their communication platform in December. Seems pretty impressive if they can put this app together.

Roger

Hi Roger, I’m seem some of the Magor technology in action and it’s amazing, but they’re having trouble gaining traction in the market and they’re not generating – to this point at least – the revenue they were initially forecasting. Very successful individuals involved in Magor, we’ll see if they can turn the corner. They have not been aggressive at telling their story and that’s one beef I have. CHA has certainly moved big-time, though on low volume. I’m not familiar with what they have.

Well Bert, there are new drill core pics just posted on the GGI website. This is not just a rock, this is drill core and it looks mighty good.

Garibaldi Resources -> Rodadero Drill Core Samples

Dan

My buddy, i have seen them earlier & they do look good to my

unprofessional eye, but so did that darn RBW rock. Maybe i

shouldn’t have written that post, but it was also meant as a

reminder to myself, as i have been hoodwinked over the

past few years, from inwardly digesting all the hyperboles

directed my way, no wonder buying & holding is becoming a

thing of the past & may i suggest, it appears that i may not

be the only one feeling that way. Now i have that out of the

way, i will state that GGI has been a success story for me,

during the last year or so, as i have bought & sold a few

times, but i do hold a core position now, believing we MAY,

repeat MAY have a winner here..If GGI don’t live up to

expectations i will say to myself, why didn’t you listen

to yourself for a change. By the way, i felt more comfortable

with the market yesterday, than i have for awhile now, let’s

hope it continues.

The drill rig is the truth machine, not pretty pictures, I think is what Bert is saying and he is right. But so far the drill rig hasn’t disappointed at Silver Eagle and has delivered exceptional grades near-surface. 7 m of 2100 g/t Au is spectacular, and other intercepts show the system is widening to the south (plus a new surface discovery at a lower elevation to the north, which may support a feeder zone theory). I’d like to see GGI get to some of these other targets as well, as quickly as possible. This has scale, Silver, Gold, base metals. Keep in mind the people involved here – Dr. Craig Gibson, Peter Megaw, others. The best in the business in Mexico. And GGI was the one that led Paramount to the richest part of San Miguel (Don Ese) through hyperspectral data which has helped outline hot spots throughout Rodadero. So far this is shaping up extremely well, and the approach and second visit of a major speaks volumes. As investors we have a chance – not a guarantee of course – but a legitimate shot at a really significant discovery with Rodadero. And people shouldn’t be forgetting about La Patilla either. 30 m of 3.1 g/t Au earlier this year in another discovery, close to surface.

I could have added to my last post by stating that i

can’t lose on GGI now, having profited enough on the

way along. If the play fails to meet future expectations,

i assume i will be fast enough on the trigger, to protect

what i have already gained. I was talking to a CEO of a

particular company yesterday & we discussed the poor

market conditions & i was prompted to suggest that things

may turn around in November & he reminded me of the tax

selling season, which should kick in soon. I couldn’t

believe what i was hearing, after all, haven’t we

witnessed the tax selling season since Jan 1st..

Please be reminded that the European & Asian markets

are closed today, so everything now depends on what

the Feds. say or what they don’t say.

This will be an important day, for sure, Bert, you’re correct…a negative surprise would be a hawkish tone from the Fed…

Bert … my cyber buddy.. it is so good to have you back!!!:) the voice of reason:)

After the RBW debacle of a few years ago, in which I had a sizable position(for me), I changed my way of buying stocks. If I like a stock I take a core position and then trade the stock as results dictate. After all if a stock turns up really impressive results it is cheap at $1.00. GGI has great potential and I expect that I will be in and out of it if all goes well. Richard l

I mentioned ChroMedX about 3 weeks ago C.CHX when it was around .15 it keeps going up everyday , my sister and I have been buying shares in the open market this stock will soon be a dollar or more, no one has mentioned this?

Gary

Gary

what does CHX do, what business are they in?

thanks