Gold has traded between $1,191 and $1,205 so far today…as of 7:40 am Pacific, bullion is unchanged at $1,202 an ounce…Silver is up a dime at $16.42…Copper has jumped 6 cents to $2.64…Crude Oil is 49 cents higher at $49.94 while the U.S. Dollar Index is flat at 94.58…

This is a slightly abbreviated version of Morning Musings as we travel east for a visit later this week to northwest Quebec’s Cadillac Trend, specifically the Granada Gold Property which has the attention of IAMGOLD Corp. (IMG, TSX) (and some other major players no doubt) given its status as a near-term producer with a robust Preliminary Feasibility Study and a substantial and growing resource…

This is a slightly abbreviated version of Morning Musings as we travel east for a visit later this week to northwest Quebec’s Cadillac Trend, specifically the Granada Gold Property which has the attention of IAMGOLD Corp. (IMG, TSX) (and some other major players no doubt) given its status as a near-term producer with a robust Preliminary Feasibility Study and a substantial and growing resource…

For comparative purposes, a short distance down the road along the “Golden Highway” is the Malartic CHL Project…yesterday, Abitibi Royalties (RZZ, TSX-V) announced it has sold its 30% free-carried interest in the project to Agnico Eagle Mines (AEM, TSX) and Yamana Gold (YRI, TSX) for $35 million in shares plus a 3% NSR royalty…Malartic CHL includes several early discoveries and 2 small deposits that have been drilled out and placed into a reserve category…Granada is much more advanced, features low start-up costs and has a valuation of only $13.5 million (“ridiculously low” in the words of 1 CEO of a producing company we spoke with yesterday) based on Gold Bullion Development Corp.’s (GBB, TSX-V) current market cap with GBB holding 100% of the project…the way properties are increasingly being scooped up these days, it wouldn’t surprise us if Granada is on a ‘target’ list and that’s 1 reason for our visit…

Gold & Central Banks

Kazakhstan increased Gold reserves for the 28th straight month in January while Ukraine added to holdings for the first time since August, according to the International Monetary Fund said…Russia, meanwhile, trimmed assets for the first time since March (but also sold a whack of U.S. Treasuries)…

Central banks have raised Gold reserves for the past 5 years, a reversal from 2 decades of selling since the late 1980’s…governments added 477.2 tons in 2014, the second-biggest increase in half a century, and purchases will be at least 400 tons this year, according to the London-based World Gold Council…bullion enjoyed its biggest monthly advance in 3 years in January but is trying to hold support at $1,200 as February draws to a close…

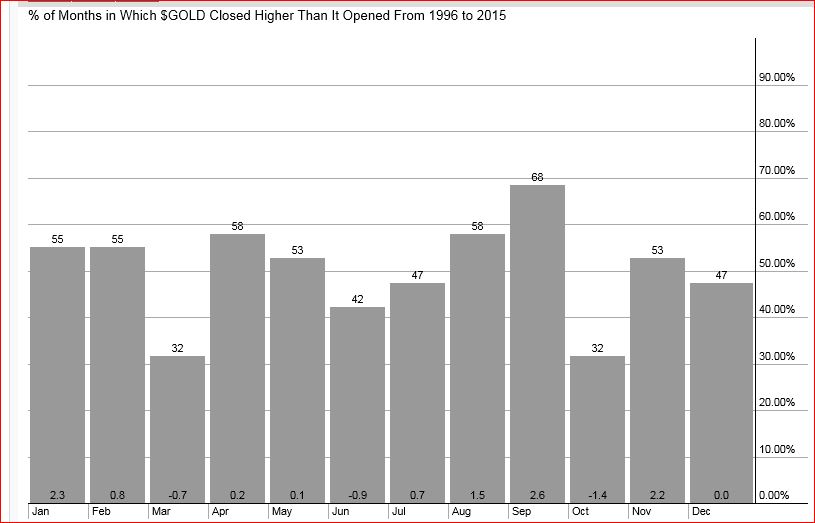

Gold Seasonality Chart

The pullback in Gold this month should not be surprising considering how strong January was…over the last 2 decades, bullion has posted an average gain of 3.1% during the first 2 months of the year…2015 is shaping up to be quite normal in that respect…

Below is a 20-year Gold seasonality chart from John…the weakest months for bullion are March, June and October…September, November and January are the strongest…

Oil Update

Nigeria will call an extraordinary meeting of OPEC if Crude Oil prices slip any further, the country’s Oil minister said in an interview with the Financial Times, in a sign of growing alarm over the impact of Oil’s collapse on Oil producing economies…

“We’re already talking with member countries,” said Diezani Alison-Madueke in the interview published yesterday…if the price “slips any further it is highly likely that I will have to call an extraordinary meeting of OPEC in the next six weeks or so,” she stated…almost all OPEC countries, except perhaps the Arab bloc, are “very uncomfortable”, she added…as OPEC President, she is responsible for liaising with member countries and the producer group’s secretary-general in the event of an emergency meeting…

Copper Update

“There is much debate about how much of the recent Copper move lower has been fundamental,” Goldman Sachs analysts said in a recent note. “We are strongly in the camp that it is fundamental, driven by sluggish demand growth, above-trend refined supply growth, and cost deflation.”

For Goldman, a key sign that Copper’s weakness is justified is the rising levels of inventories of the refined metal in Chile, the world’s largest Copper producer…Copper stocks there rose by as much as 170,000 tons in the second half of 2014 to their highest level in more than a decade, apart from a brief period in 2013, Goldman estimates…factoring in stocks held elsewhere in the world, that implies Copper output is running around 500,000 tons above demand on an annualized basis, the bank says…that is equivalent to around 2% of annual refined Copper production…

Goldman isn’t alone in forecasting an excess of Copper in 2015…the International Copper Study Group, comprising Copper-producing and consuming countries, forecasts that demand for the metal will grow this year, but only by 1.1%…production will rise 4.3%, the group expects, led by output increases in Africa, Asia and North America, leaving a surplus of 393,000 tons by the end of the year, the first positive annual balance since 2009…Copper supply estimates have been off before, however…

U.S. Dollar Index Updated Chart

Will Janet Yellen say anything during her 2 days of Congressional testimony (today and tomorrow) that may put a “cap” on the greenback?…the Dollar Index has been consolidating recently but remains in a powerful uptrend that will clearly accelerate if it breaks above resistance at 96…the Fed is walking a tightrope…the more it attempts to prepare the market for the first interest rate hike in nearly a decade, the higher the dollar goes…a runaway dollar, however, directly competes against the Fed’s goal of boosting inflation while it’s also starting to negatively impact the bottom line of many U.S. corporations…Home Depot (HD, NYSE) this morning, for example, warned that it expects currency headwinds will impact 2015 earnings by about 6 cents per share…

Below is an updated 20-year monthly Dollar Index chart…note the massive breakout from the symmetrical triangle…if the 96 level is overcome, the next Fib. resistance is 101…RSI(14) at 78% is in overbought territory but can certainly remain there for a while yet before beginning to unwind…

One-Third Of Americans Living At Risk Of A Financial Crisis

According to a newly released report from Bankrate, 24% of Americans have more credit card debt than emergency savings, and 13% are not much better off – they don’t have credit card debt but they don’t have emergency savings either…put another way, more than a third of Americans are living at risk of a financial crisis (the same is probably true of Canadians)…

“Americans are woefully under-saved for emergencies,” said Greg McBride, chief financial analyst at Bankrate. “By not having emergency savings and using some of your available credit, your options in the event of unplanned expenses are much more limited.”

Today’s Equity Markets

Asia

Japan’s Nikkei average climbed to another new record high overnight, gaining 137 points…China reopens tomorrow after the week-long Lunar New Year holiday…

Europe

European markets are higher in late trading overseas…

In Ukraine, the government accused pro-Russian rebels of opening fire with rockets and artillery at villages in southeastern Ukraine yesterday, Reuters reported, dashing hopes that a ceasefire agreed last weekend would be held…despite the conflict with Russia, President Vladimir Putin told a reporter with Russian State TV company said Monday that war between the countries was unlikely (so count on it)…

North America

The Dow is up 59 points as of 7:40 am Pacific as investors have responded favorably to Janet Yellen’s comments so far this morning. “The FOMC’s assessment that it can be patient in beginning to normalize policy means that the Committee considers it unlikely that economic conditions will warrant an increase in the target range for the federal funds rate for at least the next couple of FOMC meetings,” Yellen said in prepared remarks before the Senate Banking Committee…

The TSX has gained 66 points while the Venture is off 2 points at 690 as of 7:40 am Pacific…

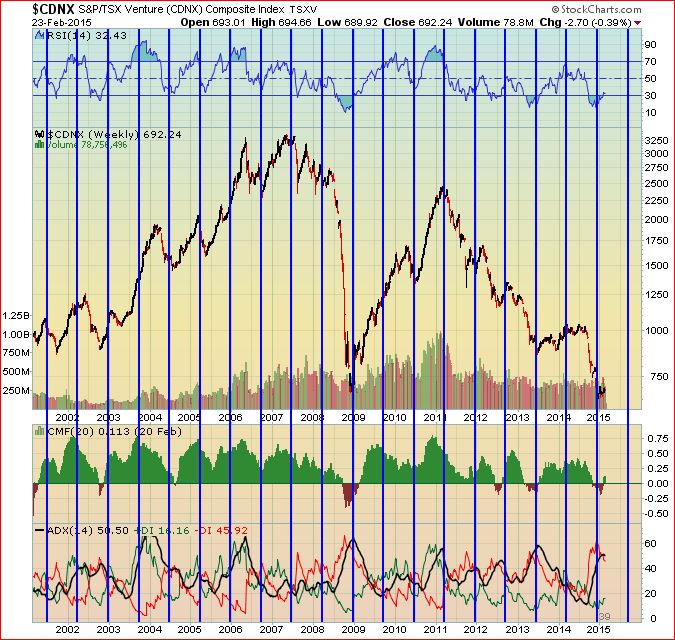

The Venture’s 39-Week Cycle

This is an update to an amazing chart we’ve posted before that shows how the Venture, for some unknown reason, tends to trade in 39-week cycles…in other words, approximately every 39 weeks or 9 months, the Index experiences an important “swing” in direction…and it’s happening again…this indicator points to a better 2015…

Critical Elements Corp. (CRE, TSX-V) Update

We’ve been tracking Critical Elements Corp. (CRE, TSX-V) since late spring last year when it was trading below 20 cents while the company continues to develop its Rose Tantalum-Lithium Project in the James Bay area of Quebec…last August, CRE hit a multi-year high of 40 cents which was the Fib. measured resistance level…after a healthy correction that brought it back below 20 cents, CRE is once again on the rise which could mark the early stages of a significant “Wave 5” move as shown in John’s 2+ year weekly chart…

CRE closed at 24.5 cents yesterday…buy pressure has increased significantly this month…

Calibre Mining Corp. (CXB, TSX-V) Update

Calibre Mining Corp. (CXB, TSX-V) has clearly been one of the top Venture exploration stories since the spring of last year with the stock significantly outperforming the Index…the company is working strategically with strong partners in the prolific northeastern part of Nicaragua, and has some 100%-owned ground…

Overbought technical conditions in CXB last September/early October unwound during November and December…Fib. support between 9 and 12 cents has proven to be exceptionally strong, and that was demonstrated again just recently when CXB was knocked down as low as 12.5 cents on drill results from the Minnesota Gold Project (JV with B2Gold) that fell short of expectations…however, there are a number of targets in and around that project, and elsewhere on the joint venture concessions, that will be explored this year…

Meanwhile, on January 21, Calibre announced final assay results from Phase 1 drilling at the Eastern Borosi Gold-Silver Project being financed by IAMGOLD Corp. (IMG, TSX) under an option agreement…5 Gold-Silver vein systems were tested over a combined strike length of 3 km through 40 drill holes (5,500 m), and drilling encountered high-grade zones on each of the structures…results included 5.07 m grading 13.44 g/t Au (GP14–028) and 2.76 m @ 26.48 g/t Au (GP14–030), testing the down dip portion of the Guapinol and Vancouver structures…

IAMGOLD was encouraged enough by the results to decide to launch a 5,500-m Phase 2 program to commence shortly…

Investors who have embraced any weakness in CXB over the last 8 months have done well…below is a 2.5-year weekly chart…CXB is off half a penny at 14 cents as of 7:40 am Pacific…

Note: John, Terry and Jon hold share positions in GBB.

13 Comments

rpt.some u.s.banks are being probed over possible metals price fixing.lets keep an eye on this one folks.could bmr enlighten us as this unfolds in the days ahead?

GGI – I can only call it where it is right now. 2 inverted hammers back to back didn’t hold. 15 is its only support level left. If it breaks below .15, it could possibly free fall. She turned bearish intermediate term. Lets she if we have a surprise coming.

It’s getting harder and harder to justify holding precious metals stocks for the long term. The central bankers have everything under control. Who knows how long this will last. There have been numerous black swans that could have derailed the system but central bankers came in and patched things up. This is the reason why I dumped my precious metals stock…this can go on for a loooong time… and frankly there are other sectors you can make good money. I’ll be back in the gold/silver stocks once the Fed announces QE4… there is a chance some of these stocks will be much higher but at least the momentum would be on my side. Now, there is still money to be made in gold/silver up here in Canada, and probably in the U.S. … but it involves selling physical gold/silver in the secondary market…which has been on fire as of late.

BMR – According to a newly released report from Bankrate, 24% of Americans have more credit card debt

than emergency savings, and 13% are not much better off – they don’t have credit card debt but they

don’t have emergency savings either…put another way, more than a third of Americans are living at risk

of a financial crisis (the same is probably true of Canadians)…

Bert – Interesting ! The banks caused the problem from day one, as they fought for the almighty dollar.

They issued cards to anyone & everyone. I can’t move without being offered a card, there’s

Mastercard, Visa, American express, Walmart, Canadian Tire, Home Hardware, Birthday card, Xmas

card, Easter card, Valentine card, etc. etc. Now the Banks are realizing that people are not using

their services, no savings they say, where are we going to get cash to satisfy our shareholders ? It

looks good on them…

The latest news

It’s being investigated that the Banks, at least 10 of the loose fingers, have been manipulating

Precious Metals. For goodness sake ! it can’t be ! what ! the Banks ! Impossible !

V.CCK — Canada Coal ..halted since Nov. company merging with a solar panel production innovator Suntricity …Deal slated to be firmed up end of Feb 15 …Any idea if this is actually happening ??

Dan put your beer on ice till tomorrow.

Mention of a probe and gold is up, mmm I wonder!

Tombc. I think the reason gold is up is because chinese new celebrations ended yesterday. Everyone is back to work today.

Your rite tony t, thx.

Freddy, it is a good thing beer got a long shelf life.

您好

Dan

I got a feeling & when i get a feeling, you can take it to the bank.