Gold is testing support at $1,200 which is not totally unexpected…it has traded between $1,203 and $1,230 so far today…as of 9:30 am Pacific, bullion is down $23 an ounce at $1,205 but Gold stocks are holding up quite well considering the weakness in the metal this morning…Silver is off exactly $1 an ounce at $16.32…Copper has fallen a nickel to $2.56…Crude Oil, up earlier this morning, has reversed and is now down $1 a barrel to $51.76 while the U.S. Dollar Index is weaker, trading at 94.20…

Investors last year who assumed that Gold would weaken immediately following the Chinese Lunar New Year (January 31 in 2014) or during the long holiday break associated with it, were proven wrong…below are comments from UBS going back to February 7, 2014:

Investors last year who assumed that Gold would weaken immediately following the Chinese Lunar New Year (January 31 in 2014) or during the long holiday break associated with it, were proven wrong…below are comments from UBS going back to February 7, 2014:

“This year, Gold is actually over 1% higher than where it was before participants in China left for the New Year break a week ago, and yet demand seems to be very resilient upon their return. This suggests that demand in China is robust.” – UBS, February 7, 2014

The first day of the 2015 New Year in the Chinese calendar is this Thursday, Feb. 19…traders got it wrong last year when they dumped Gold just before the Chinese started their national holiday period – they could be repeating the same mistake now…

Meanwhile, China’s economic growth could slow to between 6.9% and 7.1% this year as the country fends off deflation risks, the head of the Chinese central bank’s research bureau said today according to a Reuters report…in an opinion piece in the China Daily newspaper, Lu Lei said fixed asset investment growth in the world’s second-largest economy is likely to cool further this year, dragged by a sagging property market and a fall-off in state investment. “China’s economic growth rate may remain stable at a relatively lower level in 2015, between 6.9% and 7.1%, restricted by sluggish demand,” Lu wrote. “The biggest medium-term uncertainty for the economy is deflation risk.”

It’s interesting that Bank of England Governor Mark Carney doesn’t see deflation as a serious risk in Britain…last week he warned that U.K. inflation was expected to fall below zero in coming months, but would hit the central bank’s 2% target within 2 years’ time – sooner than earlier forecasts…in an accompanying open letter to U.K. Chancellor of the Exchequer George Osborne, Carney said the current period of falling prices was “temporary” and a “fundamentally distinct phenomenon from deflation.”

This morning, new statistics showed that U.K. inflation has hit its lowest level since records began in 1989…Carney is 1 of the most respected central bankers in the world…will he be proven right or wrong?…

Gold Since 1980

Below is a 34-year monthly chart that puts Gold’s current situation into perspective…

John’s interpretation is that bullion has been consolidating in a “Wave 4” pattern since surging to an all-time high of just over $1,900 U.S. in 2011…it climbed nearly 300% in “Wave 1” and 183% in “Wave 3“…Gold could easily double from current levels in a “Wave 5” move over the next few years…

The current RSI(14) pattern bears watching…it has similar signatures to the one just prior to the beginning of the “Wave 1” push that got the bull market in Gold going in 2001…as bullion has been consolidating since its high in 2011, overbought RSI(14) conditions have gradually unwound and what we’ve seen over the last couple of years are higher highs and higher lows in this indicator…at 44%, it’s at an appropriate level for a possible breakout during 2015…

Sell pressure, as demonstrated by the CMF, appears to be abating – that’s another key indicator to watch…

Today’s Equity Markets

Asia

China’s Shanghai Composite gained 25 points in light trading overnight while Japan’s Nikkei average finished essentially unchanged…

Europe

European markets closed mixed today but there are clearly some concerns over Greece’s debt problems…a bunch of academics and communists are now running the Greek government and they could be on the verge of learning some difficult financial lessons in the real world…

North America

The Dow is down 15 points as of 9:30 am Pacific…the TSX is up 41 points while the Venture has slid 2 points to 695…

Venture-WTIC Comparative

Below is a 15-year monthly chart comparing the Venture with Crude Oil (WTIC)…both have been moving in lockstep since late 2013 – the correlation is extremely high (more so for the Venture and WTIC vs. the Venture and Gold)…

Doubleview Capital Corp. (DBV, TSX-V) Update

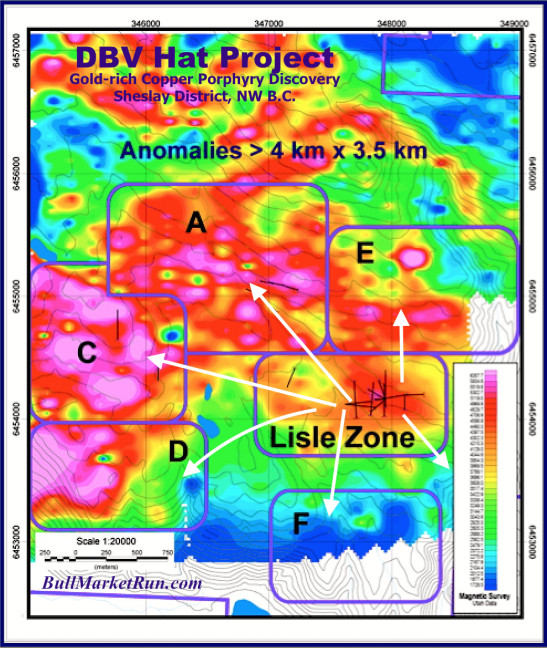

Interesting news from Doubleview Capital (DBV, TSX-V) this morning as the company confirmed that it has retained Dr. Abdul Razique as a full-time geoscientist…Dr. Razique has a highly impressive resume and a proven porphyry discovery track record over the last 2 decades…his gift of being able to assemble the pieces of a major porphyry puzzle could have game-changing consequences for the Hat Project and the Sheslay District in general…

Interestingly, over the last 18 months, Dr. Razique has been evaluating projects in British Columbia, Quebec and the United States on behalf of a “major international mining company and its joint venture partners”…that company wasn’t mentioned in DBV’s news this morning but it’s believed to be Antofagasta Minerals Canada, based on Dr. Razique’s LinkedIn profile…it’s therefore fair to speculate that Antofagasta, which has always shown an appetite for large porphyry deposits and has the ability to turn them into profitable mines, may have the Hat Project on its radar screen and indeed could be conducting some initial “due diligence”…

Why would a major like Antofagasta be interested in the Hat Project?…there’s ample evidence that the Hat has massive volume potential…geophysical signatures and alteration patterns throughout this area strongly suggest that the Lisle Zone is just one part of a very big system that likely begins further to the north and northwest (NW-SE trending), and the limited number of holes drilled into Anomaly “A” and Anomaly “C” back up that theory…more on that tomorrow…

Of course it’s not only volume which is critical, but grade as well…on that note, Doubleview is making progress given what they’ve hit in H-23 – the highest grades yet at the Hat including a 110.9-m section that returned 0.73% CuEq…more assays are pending from this hole – specifically, for the bottom 250 m which is known to include a third, wider chalcopyrite-pyrite zone that was visually observed to extend for at least 120 m beginning at a depth of 402 m…it’s quite possible DBV may continue this hole beyond 650 m where it was halted just prior to the Christmas break…it’s the deepest hole ever drilled in the Sheslay district…Dr. Razique would certainly be able to confirm that these systems often extend to depths of up to 1200 m or more, and there’s an obvious example to the southeast at Red Chris…

What’s amazing about the Hat Project – what underscores the incredible potential here – is that less than 2 years ago, this was just a grassroots project with not a single drill hole ever put into it…and each round of drilling at the Hat since then has produced better results…

What we’ve witnessed since mid-2013 at the Hat is Canadian exploration at its best – and, in our view, it’s about to get even more interesting and significant (not just at the Hat, either, as there’s also a very large Grizzly in the neighborhood that’s about to heard from)…

Gold Bullion Development Corp. (GBB, TSX-V) Update

Where we also see a growing deposit with exceptional potential is in northwest Quebec where Gold Bullion Development (GBB, TSX-V) is on the comeback trail with the Granada Gold Property and the LONG Bars Zone…

What reignited our interest in GBB in December is the fact that this company is drawing closer to the production stage (in this case, a high-grade “rolling start”), and Canadian Gold producers are looking particularly attractive given the strength of the Gold price in Canadian dollar terms and of course the collapse in Oil prices…for open-pit producers in particular, Oil is a major cost factor…Crude is trading at half the level it was a year ago…GBB’s Preliminary Feasibility Study for Granada, released in May of last year, revealed robust economics for the 3-year “rolling start” based on a Gold price of $1,400 CDN (a 90-cent loonie) and fuel costs of $1.30 per liter…

Another factor to consider regarding Granada – the LONG Bars Zone is open for expansion in all directions, and several hundred historical holes have yet to be incorporated into the resource model which was last updated in late 2012…so lots of potential exists here to add ounces…

Technically, the downtrend in the stock that started in early 2011 is over as one can easily see in this 5-year weekly chart…GBB finally broke out above the downtrend line in the summer of last year…in classic technical fashion, there was a “throwback” to the downtrend line in the fourth quarter of last year…sell pressure has been dominant for much of the time since late 2010 but buy pressure is now reappearing…

GBB is unchanged at 4.5 cents as of 9:30 am Pacific…

Silver Short-Term Chart Update

What to make of the volatility in Silver?…RSI(14) “W” patterns are bullish signals and it’s not often they’re wrong, so it’ll be very interesting to see how Silver behaves the rest of this week as today’s activity could simply be a “head fake”…

Silver in December finally staged a definitive breakout above a downtrend line that was in place since the summer on this updated 9-month daily chart (note how the downtrend line became new support in early December)…

The December 1 dramatic move from an intra-day low of $14.15 to a close above $16 was technically highly significant…as expected, superb support was demonstrated around $15…

The metal climbed as high as $18.50 in January, just a few pennies of the the Fib. 50% resistance level…while doing so, RSI(14) edged into overbought territory but has since unwound and was at 54% entering after Friday…

It’ll be very interesting to see if Silver can reassert itself above $17 this week…

Silver Long-Term Chart Update

This 34-year monthly chart continues to give hope that Silver could be in the very early stages of a powerful “Wave 5” move to the upside, though we caution that this could take some time to play out (if indeed this theory is correct)…the reasons for such a move are also not clear…over the past couple of months, Silver jumped by as much as 30% – it led Gold to the upside…

RSI(14) has bounced off previous long-term support which will need to hold along with key price support in the immediate vicinity of $15…

One note of concern on this chart is the sell pressure that has prevailed since the beginning of 2013, after a decade-long period of buy pressure…based on historical patterns, sell pressure could persist for a considerable time yet – though that doesn’t necessarily mean that the price can’t still trend higher…nonetheless, it would be encouraging to see this sell pressure begin to abate…

Note: John and Jon both hold share positions in DBV and GBB while Terry also holds a share position in GBB.

35 Comments

BMR – Below is a 34-year monthly chart that puts Gold’s current situation into perspective…

Bert – I can’t believe it, back to 1971. Talk about predicting

the future, it appears we may be lost in the past… (joking)

tram – I jumped in SNP the other day, just to trade it a few days. Nice little profit.

sorry, typpo, meant spn

John, and Jon, what do you feel is going to be the fuel that ignites WRR to get to the 19 cents you speak of? PP completion? drill program?

Anyone else care to chime in, please feel free. Just a novice investor here trying to get ahead!!

Cheers

Paul, when I look at these speculative situations, there are several boxes that I want to be able to check off to greatly enhance the chances of success…some of these are quite obvious…who’s running the company, are they motivated, capable and credible?…is there something unique about the project that can drive both near-term and longer-term value?…is there money in the bank to do something (that’s obviously a critical question in today’s environment)…is the property in the right jurisdiction?…what’s the share structure like?…what’s the technical health of the stock like, from short-term and longer-term viewpoints…does the company understand the market and can it tell its story, and is there some buying power behind the play (key individuals, brokers, etc.)…is the current market cap “cheap” and what’s the upside, the risk-reward ratio?….in this particular case, Paul, all the boxes check IMHO…the bonus is WRR is going after a very compelling high-grade target…speculation drives markets a great deal…this will move on speculation and obviously on the results…this is not a property or a project that has been quickly thrown together for promo purposes…this has been very well thought out geologically over a considerable period…

Paul, read yesterday’s post

Thanks Jon. I tried calling the Canadian phone number on their website, but it is a shared number with another company and based out of Quebec – all I could do was leave a message. Too bad they don’t have a number to a real person…

Time for GGI to make some noise. This is getting rediculous

Jon, Paul – if I may add my .02 – remember what I told you about the Geologist who sold his mine right by WRR to a set of investors from Australia. This mine has over a Billion dollars of goods in it. Stop and think. Investors from Australia could have bought any mine anywhere else. THEY wanted that mine.

Dan – Time for GGI to make some noise. This is getting ridiculous.

Bert – Dan, i agree with you completely. Just a reminder what they

stated the latter part of November quote The Company eagerly

anticipates receiving the next batch of assay results (drill

holes SE-14-07 through SE-14-12) during the first half of

December. Unquote May i remind Mr Regoci that is almost

3 months ago. If there is a deal, i hope it’s beneficial to

shareholders. With our luck, all things are possible. The

following was part of his Xmas message quote Our shareholders

are highly valued not only as investors but AMBASSADORS for the

company. Your continued support, including telling others about

the exciting direction we’re going, is greatly appreciated

unquote I don’t know about Dan, but Bert is willing to tell

others that GGI appears to be a very tardy company.

I agree with you bert. Jon, Call Regoci, see if he fell asleep.

Dave, LOL…I ran into Regoci today on my travels. Tight-lipped and a smile. That was good enough for me. Guns blazing very soon I suspect, in both Mexico and B.C. There are certain things in life that are simply worth waiting for.

Paul – Ref. WRR – email them. I did and got a reply back the same day from Michal.

Paul – I also wanted to add that its smart business to share office and secretary space with other companies. You have less over head and a smaller burn rate. WRR sharing with other mining companies is not a bad thing.

Maybe it wasn’t Jon who tripped over the gold and silver bar at Rodadero, maybe it was Regoci. Obviously he didn’t get up. Sorry Jon, just having a bit of fun while we wait patiently for GGI to either release assay results or something more significant.

TSX VENTURE: http://energyandgold.com/2015/02/15/the-most-significant-development-in-junior-resource-stocks-in-years/

good morning bmrboys I bring to your attention the latest press release from heron res(her tsx) feb 17 2015 WOODLAWN DRILLING UPDATE A HIGH GRADE RESULTS FROM NEW LISA LENS regards walter emond

Regarding GGI, given that no drilling has taken place at the Grizzly, what will be included in the 43-101 report that is being compiled? How useful will it be.

Tremendously useful, Tom, because a substantial amount of work last year was completed at the Grizzly, with the exception of drilling, which has probably given the company valuable new perspective on the very high discovery potential there. So much has been learned over the last 12 months about the area in general. So it’s the first 43-101 technical report from the district since the staking rush in January 2014 and DBV’s discovery. It will be important for not only GGI but DBV and others as well.

The possibilities in Mexico of course are exciting for GGI; however, as we’ve said repeatedly over the last 18 months, what could ultimately unfold in the Sheslay district, because of the scale there and the widespread mineralization over a 30 km+ corridor, is immense. There are going to be mines here, I am certain of that. The patterns that Doubleview are seeing, they are all over the Grizzly as well and that’s a 260 sq. km property, about 6 x the size. And Farshad is on to something huge. I really want to stress to everyone here that we all need to think big. Ultimately, dollars per share on these companies and take-outs from majors is entirely possible, that’s what a new mining camp delivers. Looks like Antofagasta is already taking a close look at DBV for starters. Ask yourself this—with what’s happening at the Hat, where is GGI’s share price going to be when the first drill hole gets sunk into the Grizzly in the not too distant future? The money is there, the targets are being finalized. And the “code” has now largely been broken on where and how to drill these holes based on the growing drilling success we’re seeing in the district, and the geophysical/geochemical/geological patterns associated with these successful holes.

We encouraged readers to think big on BLO. The same applies with the Sheslay district. If you want to play for pennies, you’re going to kick yourself. Guaranteed.

Looks like a confirmed breakout in the works on DBV today. We’ll have a chart this morning.

Jon – I ran into Regoci today on my travels. Tight-lipped and a smile. That was good enough for me.

Bert – It appears our buddy Jon has moved from charting to facial expressions.

The only problem i have with that is, how do one smile while being tight

lipped. I feel Regoci had to turn up the corners of his lips in order

to smile.

It appears that Jon is enjoying an emotional ride with GGI in the

Sheslay district & that concerns me, especially since they aren’t

concentrating on that area yet. Mexico seems to be fading somewhat

& that concerns me, since we have been waiting months for nothing.

Has he recently learned something ?

Jon, if you saw Regoci, surely you asked him about the drills in mexico. You mean that with your relationship with him, he would not slip you a bone to share with us? – Also, DBV has to break that .18 to break out.

Dave, first off, the resistance on DBV is .16. It requires a confirmed breakout above .16, so we’ll agree to disagree on that. John will have a chart this morning. Second, I can only go on body language, and any words to any investors are always carefully guarded by GGI and most other reputable companies. He certainly didn’t look half asleep, I can tell you that. Anyway, impatient investors make mistakes.

GBB have started their 2015 drill campaign. News release out earlier.

Looking very good. “Final stages” of coming up with a new resource model. This could give quite a boost in the ounces given the historical holes that are being plugged into the model.

Jon, what is your understanding of the financial position of GBB? They need just $7m to get in to production once the final permit is received. I’m guessing and hoping that they have something lined up ready for the off when the time comes.

Once in production, the cash generated will fund drilling, updated reports etc. and also fund capex to get in to the 100k ozs per year production levels in 3 years time. Is this correct?

Tom, once they get the CofA, with the proven and probable reserves they have, that’s what will trigger the necessary financing to put the rolling start into production…that’s when the financiers will step into the picture…that likely won’t be shares but some sort of instrument that would keep further dilution to a minimum and be paid back through revenues…the payback period on the rolling just is start 6-8 months…this is a very valuable asset GBB has, given the stage it’s at, the current resources, and the opportunity for a very significant expansion of those resources…the updated model coming up I think has a chance to really impress the market…

Jon, resistance on DBV is .16-.17-.18-.20- and .24 –

.16 is the strongest confluence number though, I will agree with you on that. However, it ran to .185 earlier, thus the large ask at .18 right now.

There seems to be an iceberg at .165 – it would be nice to get rid of that asap…

Paul – the real iceburg is at .18

Any DBV icebergs are going to get crushed.

BMR had a solid convincing argument that GGI was a buy at $0.285. The price steadily dropped and here we sit at $0.165.

BLO was a long-term buy, too, at 28.5 cents and like GGI had short-term resistance in the low 30’s which John showed on charts…don’t confuse short-term volatility with long-term primary trends, Leslie…all GGI has done is retraced to support…a long-term powerful uptrend remains firmly intact…DBV is no different…hit the Fib. resistance around .40, retraced, and watch what happens as this year plays out…

Jon, you and I see eye to eye a lot, but cmon, GGI is not in a long term powerful uptrend (at the moment).

Again, Dave, we’ll agree to disagree on that one, and I’ll go with John’s chart…he’ll demonstrate that tomorrow again if you wish…