Gold has hit 6-week lows this morning, slightly extending the previous day’s 1.8% drop as it flirts with the $1,200 level…hopes for a successful resolution to Greece’s debt talks have temporarily reduced safe haven demand but $1,200 support should be strong…as of 9:40 Pacific, bullion is down $11 an ounce at $1,199…Silver is off 17 cents at $16.30…Copper is up 2 pennies at $2.60…Crude Oil is off by more than $1 a barrel to $52.35 while the U.S. Dollar Index is up one-third of a point at 94.49…

The Gold market is awaiting further direction from the minutes of the latest FOMC policy meeting later today, but some analysts are saying that Gold is vulnerable to further losses with the absence of Chinese buyers during the Lunar New Year break…however, as we wrote yesterday, Gold actually came out of last year’s week-long Chinese national holiday period at a higher price…

The Gold market is awaiting further direction from the minutes of the latest FOMC policy meeting later today, but some analysts are saying that Gold is vulnerable to further losses with the absence of Chinese buyers during the Lunar New Year break…however, as we wrote yesterday, Gold actually came out of last year’s week-long Chinese national holiday period at a higher price…

In Asia overnight, precious metals house MKS said in a note that Gold trading volumes through Globex had been the lightest it had seen in months, as the Lunar New Year holidays commenced. “The absence of China today certainly made an impact on turnover…and a quiet week is expected,” it said. “Tomorrow and Friday, Hong Kong, Singapore and Malaysia will join them on holiday so things should slow down even further and liquidity will become even more scarce.”

The Gold market in Shanghai has wound down for the annual “Festival” although premiums remained firm in the final hours ahead of the start of the week-long holiday…the premium in Shanghai for Gold for immediate delivery was quoted at $3 over the spot price on kilobars, although some sources reported it at as high as $4 on the Shanghai Gold Exchange’s au9999 contract…withdrawals from the SGE – a useful barometer for wholesale demand – hit 60 tonnes in the week ending February 13 and 59 tonnes in the previous week following withdrawals of 255 tonnes in January…Gold demand is not soft in China, despite what some mainstream media reports suggest…

Billionaire hedge fund manager John Paulson stuck with his holding in the world’s biggest Gold exchange-traded product at a time when other investors were dumping the metal…Paulson & Co., the largest holder of the SPDR Gold Trust, kept its stake at 10.23 million shares in the 3 months ended Dec. 31, a government filing showed…the position was unchanged for a 6th straight quarter…assets in the SPDR fund slumped 11% in 2014, and reached 704.83 metric tons in January, the lowest since September 2008…they have been recovering since…

So Much For The “Peace Deal” With Putin

Vladimir Putin’s thugs continue to be on the rampage in Ukraine despite last week’s very naive European-brokered cease-fire deal…news reports this morning confirmed that Ukraine withdrew troops from the embattled railway hub of Debaltseve early today after pro-Russian rebels overran much of the town…the retreat marks a major setback for Kiev’s forces…steadily losing ground across much of the front line, Ukrainian commanders had vowed to hold this important rail hub which is a vital link between the separatist capitals of Luhansk and Donetsk…

European Union foreign policy chief Federica Mogherini said today that the actions of the Russian-supported rebels in Debaltseve were a “clear violation” of the cease-fire agreement and that the bloc stands ready to take “appropriate action” if such violations continue…as Teddy Roosevelt so effectively demonstrated, and some other American Presidents following him including Ronald Reagan, the key to successful foreign policy is that you “speak softly but carry a big stick”…the West has been doing the opposite with Putin (and others)…

How Gold will ultimately respond to the crisis in the Ukraine, and an expanding ISIS presence in Libya which is of growing concern, not to mention the weakening economic situation in the euro zone, is going to be fascinating to watch over the coming months…

Today’s Equity Markets

Asia

Japan’s Nikkei average surged more than 200 points overnight, thanks to a weaker yen…the Bank of Japan decided to leave its monetary policy unchanged at its 2-day Policy Board meeting that ended today…the central bank will thus continue to aim to increase the country’s monetary base at an annual pace of about ¥80 trillion under its QE program in order to achieve its 2% inflation target…

Europe

European markets were generally modestly higher today…

North America

The Dow is down 44 points as of 9:40 am Pacific…U.S. producer prices posted a record decline in January, weighed down by plunging energy costs, pointing to very benign inflation pressures in the near-term…the Labor Department reported this morning that its Wednesday its PPI index for final demand dropped 0.8% the biggest drop since the revamped series started in November 2009, after falling 0.2% in December…it was the third straight month of decline in the PPI…

The TSX is off 83 points as of 9:40 am Pacific…

Meanwhile, the Venture is down 2 points at 696 through the first 3+ hours of trading…near-term, the Venture faces chart and Fib. resistance at 707…that’s a hurdle the Index needs to overcome in order to pick up fresh momentum…it will “refuel”, so to speak, after successfully clearing 707…GoGold Resources (GGD, TSX-V) was halted just before 9:00 am Pacific and then released a NI-43-101 mineral resource estimate on its newly-acquired Promotora tailings at Parral…another Mexican explorer and producer with some excellent projects on the go…

North Arrow Minerals Inc. (NAR, TSX-V) Update

North Arrow Minerals (NAR, TSX-V) continues to look very strong as drilling continues at its Pikoo Project in Saskatchewan…heavy volume hasn’t kicked in yet, but NAR is nonetheless climbing the ladder after a recent technical breakout…it’s up 2 pennies at 62 cents as of 9:40 am Pacific after a 4-cent jump yesterday…high quality play with very strong management…the emerging Pikoo diamond camp needs to be on one’s radar screen…

Venture-Gold Comparative Chart

Yesterday, we posted a chart comparing the Venture with WTIC which showed an unusually high correlation between the 2 going back to late 2013 – a much stronger correlation than what has existed between the Venture and Gold since early 2011…

It’s reasonable to expect that Gold will have more of a direct influence on the Venture beginning at some point this year, especially if and when bullion can break above key resistance around $1,300…

Gold Bullion Development Corp. (GBB, TSX-V) Update

Gold Bullion Development (GBB, TSX-V) is clearly beginning to regain its “mojo” in the LONG Bars Zone that it had back in 2010 following an important discovery at the Granada Gold Property near Rouyn-Noranda, Quebec…back then we stated that the LONG Bars Zone had multi-million ounce potential, and it has moved in that direction…in just 5 years from the time of that discovery, which in mining terms is really quite short, Granada is on the verge of a high-grade “rolling” production start with only 1 permit remaining out of 26 as the company reiterated in news this morning…last year’s Preliminary Feasibility Study gave robust economics for the rolling start based on proven and probable reserves…

What’s quickly developing now is exceptionally promising, and one doesn’t have to read between the lines of today’s news to appreciate that…despite frigid temperatures in northwest Quebec, the first phase of GBB’s 2015 exploration has now started in the LONG Bars Zone with trenching over strategic areas immediately west of the high-grade starter pit area, and up to 2 km east of there…the trenching should provide some fresh insight and help define new priority drill targets…

More significantly, GBB has reported that it’s in the final stages of updating the resource model for Granada…this has the potential of showing quite a significant increase in ounces given the fact that historical data from over 400 holes (pre-GBB) was not part of the last update in November 2012…

We are also intrigued by the new disclosure this morning that mineralization at Granada “may extend further west than previously thought”…that conclusion was based on 2 factors at least – geochemical water sampling (Gold indicator minerals were obviously picked up in water sampling), and a deformation zone immediately west of the starter pit area…we know the Cadillac fault traverses the northern part of Granada, and there are secondary faults (sort of “off-shoots” from that) as well…the presence of an important structural feature immediately west of the starter pits raises our eyebrows, especially if water sampling is indicating the presence of mineralization…also, we recall previous news from Adventure Gold (AGE, TSX-V) which holds some claims to the west…they reported some high-grade Gold in sampling…this was never followed up on due to market conditions…

We’re convinced that Canadian Gold producers and near-producers are going to enjoy a fabulous year, in part due to the low Canadian dollar and weak Oil prices…Gold Bullion should be part of that wave…

Doubleview Capital Corp. (DBV, TSX-V) Update

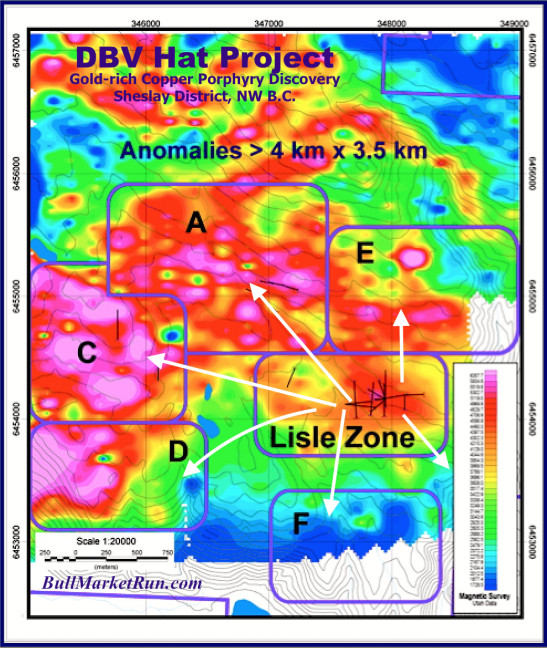

Based on the latest drill results from H-23 and yesterday’s announcement of Dr. Abdul Razique joining the Doubleview Capital (DBV, TSX-V) technical team as a full-time geoscientist, there is little doubt in our view that Doubleview has a rapidly growing and potential world class discovery on its hands at the Hat Project in the Sheslay District of northwest British Columbia…this could prove bigger than we even first imagined after spending 3 days on the property during a site visit in the spring of last year, and the consequences for the entire district should be obvious…

It’s no coincidence that H-23 is the best hole Doubleview has cut into so far at the Hat, with 1 section of 74 meters averaging nearly 1% CuEq, as senior technical adviser Pat McAndless (appointed last summer) is renowned for his ability to find the “sweet spot” in a cooked-up porphyry system such as this…keep in mind that assays are still pending for a third and even wider pyrite-chalcopyrite rich zone in H-23 that continues for at least 120 m (starting at 402 m)…already, a 278-meter section of this hole has averaged 0.53% CuEq, substantially better than the initial discovery holes H-08 and H-11 reported in January, 2014…Gold content is improving considerably at the Hat…in fact, the company is now referring to this as a Gold-Copper porphyry (vs. a Copper-Gold porphyry)…interesting…

Each round of drilling has produced better results at this property, and that’s a trend you look for in an emerging major deposit…Doubleview is indeed inching closer to a potential high-grade core as the company is now stating…those are always very challenging to find, but DBV certainly has the technical expertise to figure it out…

H-23 is the deepest hole ever drilled in the Sheslay District and it’s a game-changer for Doubleview…they are beginning to figure out the puzzle at the Hat, and it’s a massive puzzle that could easily enlarge to at least 2 km x 2 km given the quality of the targets contiguous to the Lisle Zone…as of now, the Lisle Zone has been defined over 1 km by 500 m…

Several Targets = 1 Big System?

Recently, while doing some research and going through DBV’s web site, we noticed something very strange…on a map of the Hat Property there’s a note stating that “assays are pending” from Target “A” which adjoins Target “B” (the Lisle Zone) from the north…

Why would assays be pending from Target “A” when the last 18 holes have all been drilled in the Lisle Zone?…

Our immediate theory is that Target “A” is being revisited, that something perhaps very significant was overlooked in at least some of the 5 holes that were drilled there in mid-2013 (total length of those holes was around 1100 m)…was some of the core simply dismissed and not sent in for assaying?…were the holes not drilled deep enough or in the right direction?…

Keep in mind, Doubleview’s understanding of the Hat has grown immeasurably in just the last 6 months…some of those initial 5 holes – approximately 1500 m north of H-23 – produced some interesting intersections, albeit short, including 1.07% Cu and 0.84 g/t Au in H-4 between 111.5 and 112.6 meters, after a lower grade mineralized zone over 17.8 m at a shallower depth…

H-23 has extended the northern boundary of the Lisle Zone by 110 meters…Pat McAndless and his team may now be of the opinion that the Lisle Zone actually begins much further to the north or northwest over Target “A”, and then of course there’s Target “E” north and northeast of the Lisle Zone.

All together, 5 target areas have been defined at the Hat over a distance covering 4.5 km x 3.5 km, and only 1 of those targets has been drilled in a systematic fashion to date…both “A” and “C” are perhaps a lot better than we initially imagined, and tonnage and grade are building rapidly at “B” in the Lisle Zone…

Updated DBV 3-Year Weekly Chart

Below is John’s latest DBV chart…the takeaway here is the significance of the 16-cent level which represents Fib. resistance and the 200-day moving average (SMA) which is flattening out…directly beneath the 200-day (not shown on this chart) is a now rising 50-day SMA at 13.5 cents…the reversal to the upside in the 50-day is significant…the 200-day could be gearing up to do the same…

Importantly, sell pressure (CMF) which was dominant from late 2013 turned into buy pressure beginning at the end of September last year, and that buy pressure has remained dominant since…this has a lot of bullish tones to it…

Blackbird Energy Inc. (BBI, TSX-V) Update

We followed Blackbird Energy (BBI, TSX-V) fairly closely throughout 2013 as it raised a lot of money and made quite a move in the market (hitting John’s Fib. measured resistance) before a stumble in December took it as low as 18.5 cents…BBI has obviously recovered sharply over the last couple of months, proving to be very resilient to the weakness in Oil prices…

What’s important to note right now, technically, is that BBI has broken above Fib. measured resistance at 43 cents…this is impressive given the current market environment…as always, perform your own due diligence…

Note: John, Jon and Terry hold share positions in GBB. John and Jon also hold share positions in DBV.

25 Comments

Hi BMR,

Could you provide a chart and comments on ABI. Mine development at the Elder gold mine continues and as a producer should we not see the share price be higher or has the last financing stalled this process.

Regards

P.

Paul, ABI should be higher…it’s not higher because there has been little or no effort in the market on the part of ABI. As simple as that. You can have a great asset but if no one knows about it, or you’re not communicating well, that makes it much harder to have success in the market. Ultimately, significantly higher gold-silver prices will naturally move ABI but shareholders shouldn’t have to wait for that. They have some excellent assets.

Jon

You have all the answers, how about considering joining the Ukrainian Armed Forces..

I wondering what Frankie Holmes is considering writing about Gold today & yesterday.

I am all too familiar with John’s charts. I am a member of stockchart and can produce the same charts as John. Please, no offense John to you, not intended that way. I have found thier charts to fail on occasions and I use my super duper site that has been accurate for years. The site I use currently shows 14 resistance price targets for GGI compared to only 3 support targets. You may have a long term defination that could mean years. But my short term definition (6 months) clearly shows that it is not in an uptrend. Now, there is no chart that John can provide to me that can dispute this, cause its just not there. 2 year or 5 year charts I throw out the window, they mean nothing to me. I am just saying that you can take a chart with a longer history to paint a pretty picture that just ain’t there.

Thanks for the quick reply. Any chance of interviewing Mr Renaud Hinse in the near future to perhaps get the message out on their valuable assets?

I like Renaud, Paul, I had planned on touching base with him in the near future as part of our Quebec feature, so will keep u updated. Back in 2011 he gave me an excellent tour of the Elder facility. I will relay your thoughts which are consistent with mine and I’m sure others as well.

Dave, what is this “super duper site” you speak of? I am curious to know. If you don’t want to disclose that information…that’s fine.

Dave

appreciate if you could share your super duper site with us

always looking for a better way

thanks

CT

Chart Reader

Re: Dave’s Super Duper site, a guess would be the BMO Investorline.

Hi Jon/ John big volume on DBV today. Could be news coming soon. Closed above 16 cent resistance should be bullish. Good looking chart.

I met you some years ago at a foot ball game with D mckay & associates in vancouver. I see some posts on your site about blo. As this seems to be the next big movement in the markets you don’t have much to say about this stock. Can you enlighten me more about this stock as to your opinion of where this might be going.AS i have seen some of the news that the press is doing on this item, what would your opinion of all of this be.

Out of respect for John, Jon – I can’t give the site. Sorry guys

Regarding GGI, I think that impending news and activity over the next 6 months will make a mockery of ”resistance levels” on a chart. That is why I have accumulated shares at around the 16.5c level.

“The first casualty of war is the truth.” This quote sums up where we are now in the various conflicts across the globe. Most of them have been instigated by the US/Nato alliance under various different excuses to disguise their real purpose ie. to maintain the supremacy of the petro dollar currency system. BMR should really do some research into the background of the various conflicts across the globe and not simply regurgitate the lies that are being spouted by the bought and paid for mainstream media. Here is an interesting article by Ron Holland which explores the background to these various conflicts and how individuals can protect themselves from our war mongering leaders. It would be good if BMR also read it because their geo political coverage lacks any sort of real research and is just a rehash of what they read.

I can’t quite wrap my head around valuations anymore. It used to be pretty simple math. You have 1M oz in M&I and you are worth X$. Doesn’t seem to work that way anymore. If GBB can get itself to the 5MM oz deposit. What does that mean in terms of $ value in today’s (tomorrows’s) eyes. If they achieve their goal of being a 100oz/yr producer, what does it mean $wise?

I think I need a coffee too early…….

Pete- yes, it used to be simple. Now companies that have millions of oz are selling for ridiculous prices that back 10 years ago one would NEVER believe that they would trade with so low market caps.

The gold sector and in particular, the juniors are not in favour. Luckily for us, the sector is cyclical so the good days will come back at some point…..soon imo. The sector has been dead since 2008. Even at these low market caps majors are not doing a lot of acquisitions either because like us they too don’t know when this will end and gold’s volatility isn’t helping. One thing though, when majors are buying out companies its at a good premium so the majors realize the value even though its not what we have been used to.

I truly believe that those well positioned in this sector will be the next wave of retirees. Its just a matter of time before the sector wakes up again and I am patiently waiting…….

Dave

Your response to Chart Reader regarding your so called super duper site,

appears to be as LAME as Jon’s meeting Regoci, who was tight lipped and

smiling, giving an impression that all shareholders are about to become

rich. (joking)

“Super Duper” charting site brings to mind the tradestation commercials “who cares it offers a free helicopter with every account opening 🙂 cmon Dave fess up u went for the ride… https://vimeo.com/49724465

Tom UK: Ditto. I have done the same re: GGI. It is my firm conviction that the chart described above will get readjusted in a hurry. Good Luck

Hey Patrick, don’t believe everything you read. The West may not be perfect, and I won’t yet compare Putin to Stalin,but my grandpa left Ukraine with his wife and 2 kids in 1925 on one of the last emigrant trains allowed to leave. (by Stalin) If you think the US is causing all the ruckus in the world, you better stop drinking Putin’s KoolAid? I’d rather live here than there.

ANY UPDATES ON WRR?

Probably tomorrow, Steven…looking good.

Steven – if I may add my .02 to Jon’s answer. The asks are big now for a reason. They can’t let it run until the PP gets closed which is any day now. When that happens, you will see the asks become much smaller. Michel said they will be on the property in March. I expect things to get going at that point. As Jon said, its looking good. A stock with this kind of O/S and market cap at current price for what they have does not come along everyday. As Jon knows, I am more noted for my swing (short term) trading, but my WRR shares are locked up in my safe. Again, to find a market cap like this with a monster gold property, you can’t even have good dreams that come close to the reality of this situation. WRR – yeah baby.

Looking forward to the WRR update, bought 90k this morning, got tired of waiting for .035..

yeah, I’m in that .035 bunch too. But I already have a bunch so not worried