Gold has traded between $1,231 (its rising 50-day moving average) and $1,247 so far today…as of 8:30 am Pacific, bullion is down $2 an ounce at $1,237…Silver is up a nickel at $17.02…Copper is down 2 pennies at $2.54…Crude Oil is $1.76 a barrel lower at $51.10 while the U.S. Dollar Index has added one-tenth of a point to 94.67…

Gold broke below its 200-day moving average (SMA) and $1,240 support Friday, closing at a 3-week low, and has had trouble early this week getting back above that key $1,240 level…last week’s $50 drop has so far not attracted strong buying, so bullion may ultimately have to test $1,200 again before it starts to claw its way back…Gold is still up more than $100 an ounce from its early November low, and is also trading above $1,500 CDN (see updated Gold chart this morning in CDN dollar terms)…

Gold broke below its 200-day moving average (SMA) and $1,240 support Friday, closing at a 3-week low, and has had trouble early this week getting back above that key $1,240 level…last week’s $50 drop has so far not attracted strong buying, so bullion may ultimately have to test $1,200 again before it starts to claw its way back…Gold is still up more than $100 an ounce from its early November low, and is also trading above $1,500 CDN (see updated Gold chart this morning in CDN dollar terms)…

More consolidation in the Gold sector…Tahoe Resources (THO, TSX) and Rio Alto Mining (RIO, TSX) intend to combine in a CDN $1.4 billion deal that will bring together 2 precious metals miners with operations in Central and South America…it will be the “meshing of our two businesses,” said Tahoe President and CEO Kevin McArthur in a conference call yesterday morning…upon completion of the transaction, existing Tahoe and Rio Alto shareholders will own approximately 65% and 35% of the combined company, respectively, which will keep the name Tahoe…

Greece Takes Firm Stance Against Gold Mine

Greece’s new far-left government will legally oppose a Canadian-run Gold mine in the northern part of the country, its energy minister confirmed, promising to “support” workers at the mine which Eldorado Resources (ELD, TSX) was planning to bring into production next year (the communists now running Greece have a strange notion of supporting workers – they certainly aren’t protecting their jobs. “We are against the Gold investment in Skouries and we will use all possible legal means to back our position,” Energy Minister Panagiotis Lafazanis declared in parliament today. “In any case we will support all workers at the mines.” Greece is destined for disaster as the new government, not surprisingly, has already branded itself as hostile to foreign investment, and more importantly has also shown in general terms that it simply doesn’t respect money…one has to wonder how long they can (or should) remain in the euro zone?…

Gold Update In CDN Dollars

Below is another look at Gold in Canadian dollar terms…bullion is experiencing a normal pullback after getting a little overheated in January…what’s encouraging here are the rising 50 and 200-day moving averages (SMA’s), with the 50-day crossing above the 200-day during the last half of January…

Gold has performed exceptionally well in CDN dollar terms since hitting a low of $1,282 in early November…the $1,450 area, where it broke out from early this year, should provide strong support during this current consolidation…

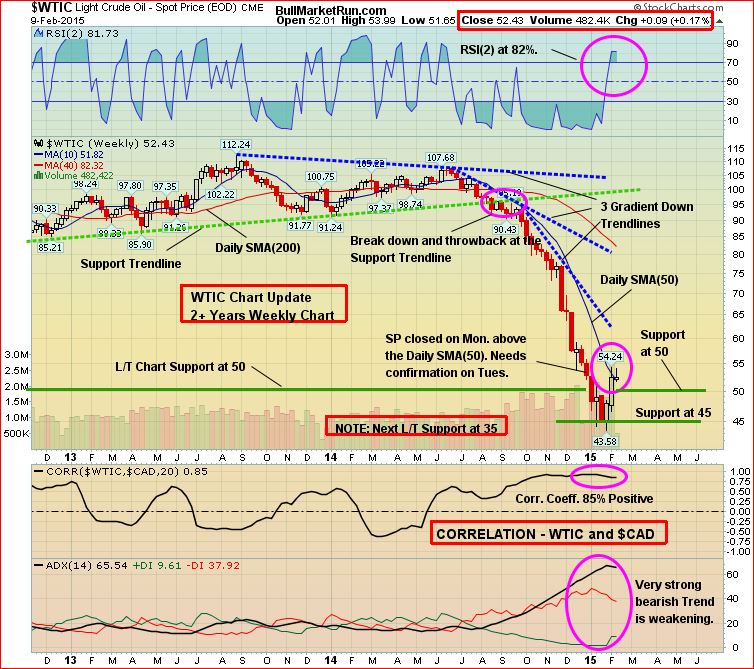

WTIC Chart Update

Oil is trying to re-establish support at the $50 level, but we still view the current rally as a dead-cat bounce…this 2+ year weekly chart shows how RSI(2) conditions were at extreme levels for most of the period from last July to January, so it’s not surprising a rally has occurred…

The 50-day SMA is currently at $52 and still trending lower…at the very least, it’s reasonable to expect another test of the mid-$40’s…

Oil stocks held by countries in the OECD may come close to the all-time high of 2.83 billion barrels in the middle of 2015, the International Energy Agency stated today in its monthly report (the IEA advises the West on energy policy). “Despite expectations of tightening balances by end-2015, downward market pressures may not have run their course just yet,” they concluded.

Today’s Equity Markets

Asia

China’s Shanghai Composite roared ahead overnight, gaining 46 points to close at 3141…China’s CPI rose 0.8% in January from a year ago period, below a Reuters consensus for a 1% gain…wholesale prices, meanwhile, continued their declines…the PPI fell an annual 4.3%, worse than the 3.8% expected decline…

Europe

European markets were mostly higher today…investors are waiting to see if a deal between Greece and the euro zone will be struck when the euro group of finance ministers meets in Brussels tomorrow…Greece’s Finance Minister Yanis Varoufakis is expected to detail new reform proposals at the meeting…

North America

The Dow is up 61 points as of 8:30 am Pacific…the TSX is down 59 points while the Venture has shed 5 points to 691…

Cannabix Technologies Inc. (BLO, CSE) Update

Cannabix Technologies (BLO, CSE, BLOZF, OTC) has been our favorite non-resource stock in the speculative sector since last summer, and its huge run so far this month should come as no surprise as BLO edges closer to unveiling its marijuana breathalyzer prototype as reported February 2…

This is a company that from Day 1 has shown the ability to execute on all fronts which puts it into an elite category as far as CSE or Venture-listed companies are concerned…

From a technical standpoint, overbought conditions are clearly evident at the moment as you can see on this morning’s 4-month daily chart, so at some point near-term there will be a corrective pullback as profit-taking sets in…from exactly what price, it’s hard to say…the stock has advanced for 7 straight sessions (entering today) because demand at current prices is outstripping supply – as simple as that…this is a powerful story, the company has the cash it needs for now, and management knows what it’s doing…they’re very capable and focused, following the game plan they had from the beginning…this all translates into success in the market and in overall business development…

BLO is up another 7.5 cents at 46.5 cents as of 8:30 am Pacific (the chart below is in U.S. dollars from the OTC listing as Stockcharts does not yet provide charts for CSE listed companies)…

Walker River Resources (WRR, TSX-V)

Walker River Resources (WRR, TSX-V), currently trading under a nickel, has caught our attention with a highly favorable chart and a significant uptick in volume recently…the company’s main project is in Nevada where it has received drill permits from the BLM for its Lapon Canyon Gold Property…the initial planned program, which could be just around the corner given the recently announced financing, will target potential high-grade mineralization…

What we like about the Lapon Canyon Property, and we performed some due diligence on this a year ago, is that it features a series of steeply dipping cross-fault structures cutting across the important Walker trend, analagous to other cross-fault structures responsible for many Gold and base metal deposits in the world…these faults are heavily sheared and altered with abundant silica…they vary in width from 60 to 300 m…plenty of opportunity here for some early drill success…high-grade, small-scale mining took place at Lapon Canyon beginning in the early 1900’s…the claims are easily accessible by secondary state roads from the main highway, and a power transmission line passes within 3 km of the property…

In December, Walker River picked up a land package in the James Bay area of northwest Quebec where Visible Gold Mines (VGD, TSX-V) has been enjoying some exploration success…but WRR’s immediate focus is Lapon Canyon and the opportunity to drill into some high-grade Gold…

WRR 2-Year Weekly Chart

What jumps out about this 2-year weekly chart is that WRR has broken above a long-term downtrend line, while RSI(14) continues to climb a trendline…John has seen this pattern in many other situations and it’s a classic signal…a lot of speculative energy could come into this…as always, perform your own due diligence…

WRR is unchanged at 3 cents as of 8:30 am Pacific…

Gold Bullion Development Corp. (GBB, TSX-V) Update

A notable change in a technical indicator on this 6-month Gold Bullion Development (GBB, TSX-V) chart…sell pressure, dominant since the beginning of the year, has transitioned into buy pressure…this is because almost all of the supply from last fall’s flow-through financing has been absorbed by the market in recent weeks…this sets the stage for a near-term resumption of the uptrend with GBB supported by its rising 50-day SMA…note also how GBB broke above a downtrend line in early January…

Doubleview Capital Corp. (DBV, TSX-V) Update

We’ll have more on Doubleview Capital (DBV, TSX-V) as the week progresses, as last week’s results from H-23 are clearly a game-changer for the company in our view, but in the meantime we have an updated chart to give our readers some insight into fresh technical developments…

DBV is showing increasing signs of a confirmed breakout thru Fib. resistance at 16 cents (the next Fib. level is 23 cents), and the “W” pattern and strong up momentum in RSI(14) back that up…in addition, the 50-day SMA (not shown on this chart) is just now beginning to reverse to the upside…

The fundamentals with this play are looking better than ever after DBV reported its best drill hole numbers yet from the Hat Project last week…more assays are pending, specifically from a pyrite-chalcopyrite zone in H-23 that continues for at least 120 m…it’s the thickest zone encountered in this hole…

Note: John and Jon both hold share positions in BLO, GBB and DBV. Jon also holds a share position in WRR.

38 Comments

Last night I was wondering if BLO had something else up their sleeve as well. Yes, we are weeks away from the big reveal,but I was thinking maybe they have been granted the patent or maybe a company is beating on their door wanting a piece of the action. Because the buying to me feels like accumulation rather than a quick flip. I haven’t seen this much desperateness to buy shares in a company for quite some time.

Jon, Wow, funny you should mention WRR. I bought a lode mine very close to WRR property. I spent 3 weeks in Nevada in Sept. of last year sizing it up. I met some very interesting people, one was a Sr. Geologist and the second person was the owner of a processing plant close by. I have a position in WRR.

It’s a small world, Dave. I’m really bullish on this play (WRR), and have taken a position myself. I did some serious due diligence on it last year, and I know that Tom Shuster, a geologist I have a lot of respect for here in Vancouver, has been on the property and loves it. Tookie Angus is also an adviser. I believe these guys have a great shot at hitting some high-grade immediately in the initial holes. That could really give the stock a major lift, opening the door for a bigger raise and more drilling. Some readers wish they loaded up on more BLO under a nickel. Here’s a chance with a 3-cent play that could really rock. Do your DD but don’t wait until everyone else is on the bandwagon. Be a leader instead of a follower, because it’s the leaders who make the big money.

What can u tell us. Dave, about your experiences in the area near WRR’s property? What have you done with your lode mine?

I agree with you 100%. I have a large position at .02. Let anyone tell me that WRR can’t see .15 in a hurry and I will tell them to get a head shake. That will be equal to BLO appreciation from .10 to now. WRR has a market cap of under a mil. I worked very closely with a Sr. Geologist on the area. I was extremely lucky to obtain my lode mine at the price I paid for it. I have worked close with the owner of the new processing plant that has opened upclose by. I am working with him now to help mine my mine as they say. I will be back in Nevada in April.

Thank u, Dave, and good luck with that. If you can send us some pictures on your next visit down there, that would be appreciated.

Jon

I know I keep saying this but the trading in GGI, or I should say the lack of trading in GGI does not look like there is something big about to happen or anything at all happening, no volume today, I just do not believe that if there was another company in talks to JV or buy out that GGI can control the other company too from leaking anything to their friends and family….. You would think that with the properties they have and the speculation of what we do know that you would see some kind of accumulation going on… just hard for me to convince myself that all is ok…. hope I’m proven wrong very soon…..

You know, Greg, there were a lot of people who thought nothing big was about to happen with BLO when it was crashing to 5 cents last fall. Current trading can always be deceptive, especially in these kind of markets. Patience is critical.

No, no buying greg, but no selling either, so I think we should look at that as a positive sign.

Tombc/Jon

thanks, good point on BLO Jon…crazy what is happening now…

Just curious, see it all the time but what do you make of these small trades that bring the sp down on GBB – total 6K shares to know it down. conspiracy or normal?

I make nothing of that, Pete….just normal (silly) trading…what the CMF indicator has picked up (this morning’s chart) is that the flow-through selling pressure is now essentially over…interestingly, National Bank was absent yesterday…we do believe their paper has dried up. That obviously has some implications moving fwd.

BLO: this stock appears to have gone parabolic! Wow.

Jon, I will feed you more of what I know on WRR shortly. There is a mine for sale to the other side of WRR property and I want to wait until that sale is complete which should be any day now.

John .. BLO… what will be the reversing sign for the price stabilizing?? CMF?? MACD?? stochs?? or declining volume?

the US chart is showing a diverging CMF…. just asking… hard to look a gift horse in the mouth right now…..

or is it somewhat of a given that the price will rise to a point, consolidate until the prototype is announced, then the sell on news happens??

any idea on the market ($$wise) of a finished product?? trying to see what the market is for alcohol breathalyser is… in the beginning… but comin up empty..

right now it is a horse breaking out of the barn – agreed???

Dave!!! Take me with you!!

Yes, I wouldn’t mind tagging along as well. We’ll do some sightseeing at Lapon Canyon.

good morning bmr boys I bring to your attention the latest press release from heron resources(her txch) 10 FEB 2015 “woodland zinc copper project—-SUCCESSFUL METALLURGICAL TEST WORK”regards walter emond

I am a stockholder of Garibaldi. I must say that

It is taking them a incredibly long time to get information out

In public.. A major would have made a decision by now won’t

You think. Very arrange situation here because

I can’t believe they drilled Some dry holes with

Their technology. Any guesses what’s going on?

Tom, if you look at the core photos, and read the core descriptions GGI gave, that doesn’t translate into dry holes. So we have no concerns about that. The Silver Eagle deposit certainly appears to be growing. My guess is there are important corp. developments going on behind the scenes, and I can only think that this is positive. It doesn’t pay to be impatient, as those who gave up on BLO discovered.

BLO report from Sept 2014… alcohol device market over 3 billion by 2015 … cannabis detection device??????

Read more at Market Watch website (09/10/2014)…

Greg, Jon, deal.

WRR – Opened strong, bids building, nothing for sale after .07

WRR – I’m hoping with the PP being done at .02 that they drop it back down to .03. – I’m next in line there with another 100k.

Without a desire to offend anyone, i will state that it’s

not fitting to compare BLO with GGI, 2 different plays, 2

different situations & it’s after the fact regarding BLO.

It may also not be fitting for me to compare companies, but

how about comparing GGI to RBW, 2 companies, who have solid

boards, solid properties & RBW had the backing of deep pockets

from the Calgary Flames. I don’t know how the Calgary Flames

are doing today, but i do know how the RBW shareholders are

feeling, that is, mourning their losses, after consolidation…

Jeremy – BLO

Let it run….the price is your best indicator….so much more news to come out.

WRR – BLO 2 in progress. Next sell after .065 is $1

Short note to readers – we’ll be posting slightly later than usual this morning – about 9:30 am Pacific.

Hello Dave, regarding WRR you mention a PP being done at .02. What is your source for that. Thanks in advance.

Check the company’s news releases. Rumor on the streets of Vancouver is that this is wrapping up immediately and it’s all systems go for WRR. The volume is a good clue.

WRR – Volume alert – RBC just lit her up. under 200k shares to a buck

WRR – I was very non-imformative yesterday telling Jon what I was told last summer when I bought my claim in Nevada. Its too long to go into. I will shorten it. They are sitting on a possible motherlode of an extension of the Carlin trend that the majors don’t know about. Take it from there.

WRR – Just as I expected, the $1 dissapeared. Oh well, no stock goes from .04 to a dollar in a day, right. I expect a small correction as the PP is close to closing, this coming from Micheal. They will be on the property shortly. I expect this stock to hit around the .15 mark when drilling begins.

You’re familiar with the area, Dave, so your expertise will help guide everyone on this. We started researching WRR over a year ago, so I’m personally very excited with what could develop here. The fact Vancouver geologist Tom Shuster visted the property and is now on the board speaks volumes. He loves it, so at least consider his view as a very authoritative one. The structures are well understood on this property, so I’m personally confident of early drilling success. Some high-grade right off the bat and this will really kick into gear. As always, do your own DD.

Terry – news release 12-17

Also – talked to micheal on Monday. Its was almost done .

Jon, correct. Minimal money to drill. High grade at shallow depth in the shear zones. I would say more but there is not enough room here.

WRR – good its coming down. I actually hope it gets back to .03 and .035 where I have more bids.

The breakout above the downtrend line as shown in the chart yesterday is significant, Dave, with another breakout today at .04. At this point I would say this wants to challenge chart resistance at .06 before re-testing any chart support, with new support now at .04.