Happy Memorial Day to our American friends, as the United States honors the men and women who gave their lives in service to enable this great nation to live freely and fully…this special observance began in the years following the Civil War and was originally known as Decoration Day…it gradually came to be known as Memorial Day…

This important American holiday also marks the unofficial start of summer…about 37.2 million Americans will travel 50 miles or more from home over this long weekend, the most in 10 years according to AAA…

U.S. stock markets of course are closed after hitting new all-time highs last week…Canadian markets are open but volume and news flow are much lighter than normal…

Gold has traded between $1,202 and $1,209 so far today…as of 9:00 am Pacific, bullion is up $2 an ounce at $1,208…Silver has added a nickel to $17.13…Copper is unchanged at $2.79…Crude Oil has gained 34 cents to $60.06 while the U.S. Dollar Index, after rallying 3 points last week, is up slightly at 96.40…the Dollar Index will face very strong resistance at 97 which is the declining 50-day moving average (SMA) in addition to both the uptrend support line and the neckline from where it recently broke down after a double top formation in March-April…

Gold has traded between $1,202 and $1,209 so far today…as of 9:00 am Pacific, bullion is up $2 an ounce at $1,208…Silver has added a nickel to $17.13…Copper is unchanged at $2.79…Crude Oil has gained 34 cents to $60.06 while the U.S. Dollar Index, after rallying 3 points last week, is up slightly at 96.40…the Dollar Index will face very strong resistance at 97 which is the declining 50-day moving average (SMA) in addition to both the uptrend support line and the neckline from where it recently broke down after a double top formation in March-April…

Bernanke Weighs In On Yuan

China needs to create deep and liquid markets to avoid currency risks as it makes the yuan a convertible currency, former Federal Reserve Chairman Ben Bernanke said at a speech in Shanghai today, according to a report from Bloomberg. “China needs to avoid currency mismatch as it opens its capital account,” Bernanke stated. “For a currency to be internationally traded, what you need most is liquid markets. A deep market means people can get their money out.”

China is in the final stages of opening up its capital account, giving global investors greater access to its stock and bond markets while making it easier for citizens to put their money in offshore assets…a freer flow of funds is needed for policy makers to achieve their goal of getting the yuan recognized as a reserve currency when the International Monetary Fund conducts a review in October…

Yellen On Rate Hike – Two Big “Ifs”

Federal Reserve Chair Janet Yellen said Friday she expects to begin raising interest rates later this year – if the job market improves, and if inflation climbs closer toward its target rate which the Fed believes it will…

In her speech Friday to the Greater Providence (Rhode Island) Chamber of Commerce, Yellen described the U.S. economy as “well positioned for continued growth” but at the same time she highlighted a number of headwinds that threaten progress…job wages have been disappointing, and too many people who want full-time jobs are instead working part-time…she also noted a lackluster housing recovery and modest business investment…the Fed has kept its key benchmark rate at a record low near zero since December 2008…

“I think it will be appropriate at some point this year to take the initial step to raise the federal-funds rate target and begin the process of normalizing monetary policy,” Yellen said…however, when the central bank finally begins to raise rates, she emphasized it would proceed cautiously, “which I expect would mean that it will be several years before the federal funds rate would be back to its normal, longer-run level.”

The New Alberta

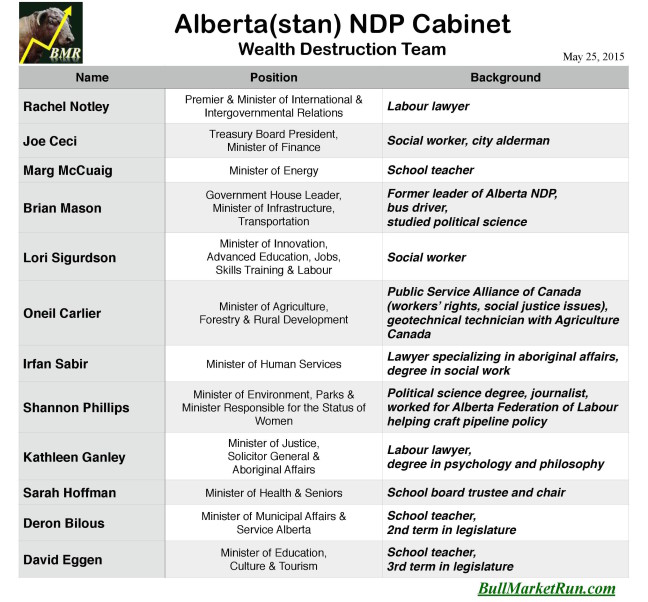

In the entire history of Canadian politics, never – not even during the disastrous Bob Rae days in Ontario – has there ever been a less qualified cabinet in charge of a province as what we see in Alberta after yesterday’s official swearing-in ceremony for the NDP cabinet…

“We have an efficient and lean cabinet to get down to work and to deliver results. This is a cabinet built to work and to get the job done,” Notley blurted out, wearing orange shoes while organizers handed out free popsicles in a carnival-style gathering of thousands of NDP idealists on the grounds of the Alberta legislature in Edmonton…

“My friends, it is spring time in Alberta, and a fresh wind is blowing,” Notley added…

Unfortunately for Alberta, that wind Notley and others feel is actually the beginning of a major storm that’s going to blow away a large amount of wealth the private sector has created in this resource-rich province over the last couple of decades in particular…a massive exodus of investment and human capital is almost certain to occur over the next 4 years (benefiting B.C. and Saskatchewan in particular) given the NDP agenda and the make-up of this cabinet which certainly isn’t representative of what has been Canada’s hotbed of entrepreneurship – Notley’s crew consists entirely of teachers, social workers, union activists, and a few left-wing labour lawyers…the business leaders of Alberta will have no confidence in this ragtag group, and they will act accordingly…it’s “lean” only because the premier had no talent pool to draw from out of more than 50 candidates who were elected, one of whom has already embarrassed the party for posting some outlandish cartoon on social media…

If Alberta were a company, its annual revenue of $44 billion would be $10 billion more than than that of the biggest Canadian corporation, the Royal Bank of Canada…what’s even more scary, this is a cabinet overseeing 173 billion barrels of Oil that this province has been blessed with…

God help Alberta…Kevin O’Leary recent said a “horror movie” is unfolding in this province…that was probably an understatement…

The NDP will raise Oil and gas royalties, increase the corporate tax rate by 20% (from 10% to 12%), stick it to upper-income individuals, raise the minimum wage to $15 an hour from $10.20 within 3 years, withdraw support for essential Oil pipeline projects, eliminate a health levy introduced by the previous government as a deficit control measure, massively expand government funded childcare and other welfare schemes, and…who knows what else…rest assured, at some point they’ll announce they’re “forced” to introduce a provincial sales tax…keep in mind, too, that the Premier’s Chief of Staff is none other than Brian Topp, a long-time NDP hack from eastern Canada with strong union ties who has never been a friend of the Oil industry…that’s a story for another day…

What this means for investors is that, suddenly, Alberta now carries significant “jurisdictional risk“…things will not be “A-OK” in Alberta, as Notley promises, and investors with exposure to that province would be wise to be very cautious…tens of thousands of jobs will be lost and housing prices will decline sharply as capital and people move to friendlier territory…

Copper – Reasons For Optimism

This is an update to a fascinating chart going back 20 years that we first posted a couple of weeks ago…

Copper recently enjoyed its best weekly performance since 2011…during that process, it pushed above an RSI(14) downtrend line that has been in place since shortly after the 2011 all-time high of $4.65 a pound…the metal has now retraced back to the downtrend line – what we need to watch is whether this area now holds as new support…

The long-term uptrend support line from the 2001 low held through the major sell-off that took Copper down to $2.42…notice also the 4 circled RSI(14) lows…they each corresponded with important market bottoms and were followed by powerful upside moves…

Currently, the metal is trading within a bullish downsloping flag on this monthly chart, sell pressure continues to abate significantly, and the -DI indicator has likely peaked…

This is not to say Copper is about to immediately “go through the roof”…what this chart does give us, though, is compelling evidence that a major turnaround is in its early stages, that $2.42 was likely the bottom of a correction that spanned nearly 4 years…a breakout above the downsloping flag would certainly confirm this interpretation…

Today’s Equity Markets

Asia

After last week’s 8.1% advance, the strongest since the week ending December 5, 2014, China’s Shanghai Composite surged another 3.3% overnight to close at 4814…

This is clearly an over-heated market, but John predicted the surge and it’s expected to encounter major resistance at the 5000 level based on this 20-year monthly chart…

Europe

London and German stock markets were closed today, so trading in Europe was quieter than usual…stocks in Greece tumbled (the Athens Index was down more than 3%) as fears of a potential Greek exit from the euro zone remained in the backdrop after the country’s interior minister, Nikos Voutsis, threatened to default on loan repayments due to the International Monetary Fund…

North America

A quiet day on Canadian markets with the U.S. Memorial Day holiday…in Toronto, the TSX is off 9 points while the Venture has given up 2 points to 701 as of 9:00 am Pacific…non-resource plays continue to dominate Venture trading…

Mezzi Holdings (MZI, TSX-V), which has been flashing bullish technical signals recently as John’s latest chart showed, is up 2.5 cents to 24.5 cents as of 9:00 am Pacific…newly-listed BitGold Inc. (XAU, TSX-V) resumes trading at 9:30 am Pacific after announcing that it has entered into an acquisition agreement to purchase the operating and intellectual property assets of GoldMoney Network Ltd., among the world’s largest private managers of precious metal assets…as John Kaiser wrote, “This thing has a technology spin to it, nobody understands what it’s potentially worth, so it can be worth whatever you want it to be.”

Cannabix Technologies Inc. (BLO, CSE, BLOZF, OTC) Update

Keep an eye on Cannabix Technologies (BLO, CSE) this week – “decision time” is drawing near, from a technical standpoint, as the stock is near the apex of a symmetrical triangle (within a broader downsloping flag)…BLO showed some life on Friday, rebounding from a low of 32.5 cents to close at 35 cents…

Silver Short-Term Chart

Silver is digesting recent gains after almost touching Fib. resistance just below $18 as expected…the top of the downtrend line (around $16.50) that it recently broke out above should now provide new support…

Silver Long-Term Chart

An explosive push higher – is this actually a scenario that could unfold in Silver over the next couple of years?…quite possibly, given the look of this 34-year monthly chart, though at the moment it’s hard to understand all the factors that could come into play to generate the kind of “Wave 5” move that appears to be in the works here…

It seems quite possible that the bottom of “Wave 4” came late last year when Silver briefly plunged to just above $14 an ounce…RSI(14) has managed to hold support which goes back to 2001…

Sell pressure continues to remain strong, however, as shown by the CMF – amazingly, at levels not seen in nearly 25 years since the low of $3.51…this intense sell pressure at the moment, which could continue for a while yet, should therefore be viewed in a larger context as a bullish contrarian indicator…

Note: Jon holds a share position in BLO.

6 Comments

Jon, IMO if Regoci doesn’t update it’s shareholders this week it would be irresponsible. You can’t tell me there hasn’t been nothing to report since March 5th. Drill turning at Rodadero (supposedly), drill turning at La Patilla……more than enough time to drill at Grizzly. Why? He stated before 2015, after allocating the 1.5 million for Grizzly that they would dril right into the heart of this thing. What thing was he talking about?

DBV dropped 2.5 cents…. nothing to worry about. It is going to break through 20 cents mark very very soon.

goodmorning bmr boys I bring you the latest press release from heron release(her texch). “appointment of AZURE CAPITAL”as FINANCIAL ADVISOR for the WOODLAWN ZINC-COPPER PROJECT – MAY 25 2015 regards walter emond

Dan, there is also the matter of the LOI at Patilla which should have produced some gold by now. I’m hoping for a NR soon that will update us on all fronts with GBB’s activities. They could spend the $1.5mil drilling at Grizzly within a couple of months. If waiting a few weeks in order to maximise their chances of hitting big with just a few holes succeeds, then I am happy to wait. It is frustrating waiting and the SP is affected by lack of news IMO. Maybe they are waiting for DBV to release their last 250m of hole 23 before finally deciding where to drill.

DBV – What happened to that big bid the other day. I know what happened. It was a fake bid to get you to buy at the ask so they could sell out from under you. Gotta be careful with those. The chart is actually in a downtrend.

Dbv – the longer things drag the lower it goes . But the drill crew is on site and the remainder of hole 23 is long overdue. What we have is people who are fed up that want out and day traders making pennies in this trading range. You have to remember every hole that has been drilled has added to the resource size and I believe every new hole will continue to build this deposit . Eventually it will catch the attention of a lot more investors that will realize the value of this deposit.