Gold has traded between $1,170 and $1,181 so far today…as of 9:30 am Pacific, bullion is down $4 an ounce at $1,174…Silver is up 3 cents at $15.87…Copper has retreated 2 pennies to $2.60…Crude Oil is down 83 cents at $60.18 while the U.S. Dollar Index has added nearly one-tenth of a point to 95.42 (see updated Crude and Dollar charts below)…

Reuters reported this morning that China is expected to receive approval from its central bank for a yuan-denominated Gold fix “anytime now”, with more details about the scheme potentially set to emerge at a major industry conference this week…

Reuters reported this morning that China is expected to receive approval from its central bank for a yuan-denominated Gold fix “anytime now”, with more details about the scheme potentially set to emerge at a major industry conference this week…

The world’s top Gold producer and its biggest consumer wants to be a price-setter for bullion and is asserting itself at a time when the global dollar-denominated benchmark, the century-old London fix, is under scrutiny for alleged price-manipulation…

If the yuan fix takes off, China could compel buyers in the mainland and foreign suppliers to pay the local price, making the London fix less relevant in the world’s biggest bullion market…however, given the yuan is not fully convertible, the two fixes could exist side by side globally…

Crude Oil Update

A U.S. government report this morning showed that Crude inventories fell more than expected for an 8th straight week…

Interesting chart for WTIC which continues to perform according to script…there seems to be little doubt, as we speculated in the spring, that Crude put in a double bottom in March just above $42 a barrel…the recovery since then has encountered resistance as expected in the low $60‘s, while the rising 50-day moving average (SMA) – currently $59.01 – has been providing strong support which is also solid in the mid-$50‘s (Fib. and chart)…

As you can see below, key levels to watch are between $62 and $64…WTIC has not been able to sustain a price above $62 since the beginning of May…$63 is the 200-day SMA while $64 is a Fib. level…there’s a real possibility WTIC could surprise many traders and run further to the upside (into the mid-to-upper $70’s) if the $64 level is cleared…this could happen if supply-demand dynamics continue to improve, and if the U.S. Dollar Index comes under renewed pressure…

U.S. Dollar Index

As Crude Oil formed a double bottom in the spring, the U.S. Dollar Index completed a double top along with a head and shoulders reversal pattern (RSI and price)…note how the Dollar Index in late April broke below the uptrend line (now resistance) in place since last summer…

The Dollar Index closed yesterday at its declining 50-day SMA…near-term, it could push modestly above that before encountering stiffer resistance around 97–98…the key “takeaway” is that the 2nd half of this year is not going to be a repeat of last year’s sizzling move to the upside – if anything, the dollar is poised to trend lower over the coming months, and that has favorable implications for commodities and the Venture…

Today’s Equity Markets

Asia

Japan’s stock market rose to its highest level in more than 18 years overnight, buoyed by optimism that Greece is moving closer to a bailout deal with creditors, while China shares continued to gain their footing following a volatile streak…

The Nikkei ended up 0.3% at 20868, its highest close since December 5, 1996…the Shanghai Composite, meanwhile, soared 2.5%…

Differences remain between Greece and its lenders, but progress has been made in talks on an agreement that would stop the country from defaulting and possibly leaving the euro zone…

Europe

European markets were mixed today…

North America

The Dow is down 105 points as of 9:30 am Pacific amid discouraging developments in the Greek debt talks…

The U.S. economy contracted less than previously thought in Q1 while it struggled with bad weather, a strong dollar, spending cuts in the energy sector and disruptions at West Coast ports…the Commerce Department stated this morning that GDP fell at a 0.2% annual rate in the January-March quarter instead of the 0.7% pace of contraction it reported last month…a stronger pace of consumer spending than previously estimated accounted for much of the upward revision…consumer spending, which accounts for more than two-thirds of U.S. economic activity, was revised up to 2.1% from the 1.8% growth rate reported last month…

TSX Chart Update

In Toronto, the TSX has climbed another 66 points to 14971 as of 9:30 am Pacific after triple digit gains Monday and yesterday…as this 6-month daily chart shows, the TSX is threatening again to push above a downsloping channel…15000 is really a key area to watch…a confirmed breakout above 15000 would be encouraging but the TSX would then have to deal with resistance at its declining 50-day SMA which is currently 15100…Fib. support held recently at 14554…

The Venture has added 1 point to 684 through the first 3 hours of trading…

Walker River Resources Corp. (WRR, TSX-V) Update

Accumulation has picked up in Walker River (WRR, TSX-V) in recent sessions, which leads us to believe the company is getting close to commencing drilling at its Lapon Canyon Gold Property in Nevada…the last update from the company was June 9…exploration work began in April and 6 drill targets have been identified, with planned drill hole lengths varying from 150 to 400 m…

Visible Gold has been noted in 2 different locations in the upper adit of the Lapon Rose Zone (1 of at least 4 shear zones at Lapon Canyon), the site of underground development…this shear zone shows a minimum strike length of 4 km, has a width of over 60 m and a vertical extent of at least 650 m…high-grade mineralization is hosted in what appears to be a quartz monzonite intrusive…this is a system that has clearly been under-explored, for a variety of factors, and offers excellent potential for early drilling success, especially down-dip from historic workings…

Below is an updated 2-year weekly WRR chart…this has several very favorable aspects to it including the RSI(14) pattern and a 50-day SMA that is now flattening out just above 3 cents…immediate resistance is 3.5 cents…

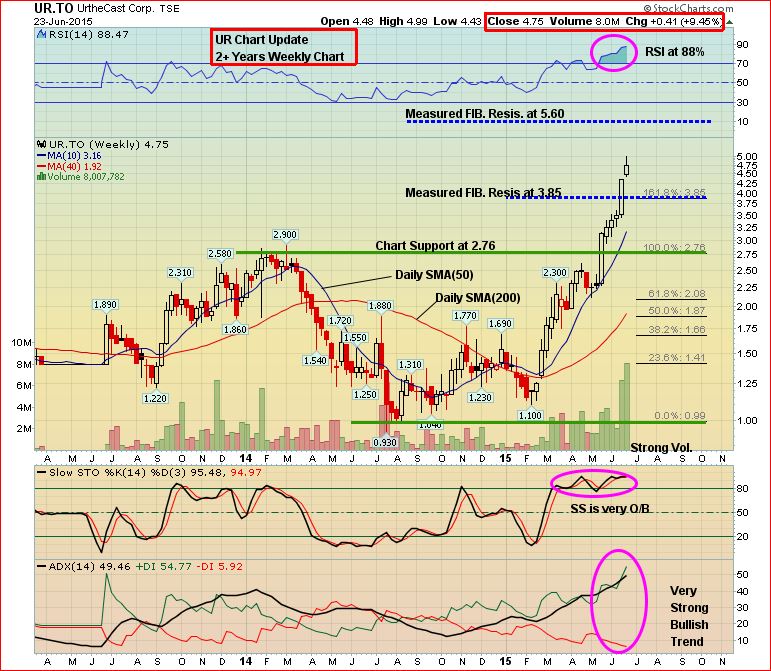

UrtheCast Corp. (UR, TSX) Update

High-flying UrtheCast Corp. (UR, TSX) is smartly capturing the benefit of the masses jumping on the bandwagon with this play as the company announced yesterday an increase in its bought deal offering to $86.5 million (21,625,000 subscription receipts at a price of $4 per subscription receipt)…

Amazing video, satellite imagery, and cool software – certainly the recipe for a hot stock and a potentially very profitable business…if you haven’t visited the company’s web site yet, check it out – Urthecast.com…

Technically, very overbought conditions have emerged in UR – so there’s sure to be a cooling off period in the not-to-distant future…that may not happen, though, until the next measured Fib. resistance level ($5.60) is hit…

UR is off 22 cents at $4.53 as of 9:30 am Pacific…

Macro Enterprises Inc. (MCR, TSX-V) Update

How many Venture companies have posted 15 consecutive profitable quarters, as Macro Enterprises (MCR, TSX-V) has?…if you’re bullish on the Oil and gas sector for the 2nd half of 2015, and British Columbia, then you ought to put MCR on your radar screen…

As John’s recent charts pointed out, the $2.40 to $2.50 area was an ideal accumulation zone for MCR which posted Q1 net income of $1.4 million or 5 cents per share…this was achieved despite a 66% drop in revenue from 2014′s record 1st quarter, which demonstrates how activity has slowed in the Oil and gas industry – particularly in Alberta where there is also now the added uncertainty of a socialist NDP government which is guaranteed to damage business confidence and scare capital away to other jurisdictions…

As part of its overall strategy, MCR is seeking out pipeline and facilities construction contracts in connection with the LNG projects being planned in B.C., an industry that is anticipated to bring substantial economic activity to the province over the next 30 years…Macro has completed bid processes and has entered into discussions with LNG project owners regarding future pipeline and facilities construction…a stronger emphasis on B.C. is a wise move on MCR‘s part…

Note the increasing buy pressure and how the MA(40) – the 200-day SMA on this weekly chart – is flattening out and preparing to reverse to the upside…this bodes well for a strong second half of 2015 for MCR…exceptional support between the Fib. $2.43 level and the rising 50-day SMA at $2.75 ($2.82 on this weekly chart)…

MCR closed at $2.91 yesterday…

Note: John and Jon both hold share positions in WRR.

31 Comments

Jon any time frame as to when we can expect that interview with Dr. Rezique ? This waiting for any news from the area is driving people up the wall including me.

We should be cautious about promising “video flow” (LOL), Les, as we have a lot of material to go through…but by the weekend sometime? Quite possibly, yes. We are aiming for that. We have to get through an ocean of hydrothermal magnetite.

Thanks Jon , everything about good information helps clarify things by removing doubt from people’s minds . Good to hear Frrshad and the drill crew are on site with drilling to commence as soon as the can . I can just imagine Farshad chomping at the bit. ( pun intended ) with all the things he had to overcome over the last six months. Give the man ( Farshad ) a high five .

STILL CAN’T FIGURE OUT WHY SHANGHAI/HONG KONG/DOW/TSX-T/NASDAQ,ETC ALL HAVE GONE UP FOR 4 YEARS YET THE VENTURE IS STUCK AT THE BOTTOM……..? JON?

Les an amazing man a new bread of CEO always on the ground floor working for the shareholders very much focused on expenditure getting value for the $$$. The savings achieved in drilling is commendable and his hard work

in doing the impossible on shoe string budget like drilled 23 holes at the Hat Complex.

Now we wait with bathed breath for drill results of hole 23 and the upcoming drill program put together with a great team of geologists.That will be rewarded handsomely with a substantial discovery that will surprise many and reward the loyal friends and believing and trusting shareholders as they say have faith and you will move mountains we have and its started.

Is BMR following CMB.V (cmc metals)? Looks like interesting chart/story and is being promoted by Chris Vermeullen who, I think, has a pretty good sized following.

Vermeullen here: Sweet Spot for Gold Stock Investors at The gold and oil guy web site (June 23, 2015).

what is everybody’s comment on blo

Steven1. The venture is dead. Why would anyone risk their money on venture companies when they can invest in sound companies that are listed on the exchanges you just mention?

Eddie , I’m not to concerned about hole 23 as it has been the best hole so far and it is on the edge of this huge anomaly. I’m waiting for the next holes picked by the best team among many. I wait for the interview with Dr. Razeque who my in layman terms explain just what they have at the Hat . The best way to end the skepticism is to get some more holes drilled and that is about to begin. Some major mining company’s are also waiting quietly.

DBV and GGI do not look good… going down. Hold on to your buy order….

Hi Jon. Did you meet with Regoci today? I appreciate you taking the time to meet with him as well as other company personal and reporting it here. Yes we can try ourselves as investors to contact management but it is very difficult to reach most company execs at times so I truly appreciate your efforts.

Theodore , it is true Dbv and GGI do not look good but there is an old saying ” buy when there is blood in the street ” . Both of these companies have important news releases coming very soon which will change their circumstances completely . Having the venture exchange wallowing in its lows is not helping but as history has shown that too will change. Good luck to all!?

blo – buzz feed tanked them… while I own a bunch this will not go anywhere til alpha testing news is released and the upfront declaration of the beta system is in testing for 3rd parties…

the C-level morons really did a number on the SP… I wrote to the PR firm and asked them why did they let the C-levels tell the truth.. be like a miner CEO and lie..

sorry for the dig but Martin Delaaire comes to mind.. and that RBW fellow… as well as the CEOs of over 12 companies I bought into

sff, cui, and a bunch more…. gbb is a potential … but come on guys.. who has told the truth so fa

and you think GGI ceo is goin to???? dreaming i think.. but i ahve been surprised before:)

respectfully submitted

Les, probably you are right. Do you know why some people are still selling at this price? If the news are so important and valuable, I will not sell them… Anyway, I wish all of you … have a fortune soon… Good luck… think positive right?

Jon if Farshad is on the site to begin drilling, is this mean that there was agreement with the talhan band!

Met with Regoci this afternoon, details below. Guy, to answer your previous question, what this would mean is that Doubleview is a big step closer to confirming a major discovery at the Hat. As far as actual drilling is concerned, DBV and GGI have the full legal authority to press ahead, but they would be wise to keep communications positive with the Tahltan and attempt to include as many Tahltan workers as possible. As Chad Day said, “It actually makes a lot of sense to partner with us because we have the capacity, we have the work ethic, we have the experience.”

Regoci Meeting

Rest assured, Regoci is not pleased with how GGI’s market cap has been hammered down to a paltry $4 million. I made it clear to him there are frustrated and disgruntled shareholders who want to get some communication from the company. He understands that, and greatly appreciates the loyalty of investors through this unusual period with the FT selling and the Sprott issue. My concern was whether all of this has negatively impacted GGI’s resolve to keep pushing forward in an aggressive way, as that is part of their brand and what helped take this stock from a nickel to 32 cents between mid-2013 and the summer of last year. I can state unequivocally from my discussion with Regoci that GGI is not going to continue to be a punching bag for much longer, and in fact they’re going to come out swinging hard themselves very shortly. That was reassuring to hear.

1. The Sprott issue

Literally dozens of companies have been affected by this recently. Has nothing to do with GGI specifically – they simply got caught up in a wide net which has led to indiscriminate selling as Sprott diversifies. Sprott’s GGI holdings, which were about 10 million shares, are now estimated to be down to about 2 million. So they now have very little of their original position and we can probably assume this last remaining amount will be sold in the very near future. IMHO, this has created an extraordinary opportunity in GGI given how the company IS progressing at the Grizzly and IS progressing in Mexico. Regoci believes it’s also an example of a final capitulation in the junior resource market. On the positive side, Sprott’s move is a liquidity booster for GGI and this could prove helpful over the summer as things ramp up on different fronts. It also removes potential future risk of a large single shareholder dumping into the market.

2. Grizzly

GGI was first on the ground this year in the district and they continue to “narrow down” to final drill targets, as the company has been stating all along. GGI has proven this in Mexico – they know how to cost-effectively get to a drilling discovery. So they are well positioned for a drilling discovery this summer at the Grizzly and doing that within the confines of the budget established by the FT raise in December. Given developments at the Hat, and all the information that has been collected to date at the Grizzly, Regoci is more convinced than ever that this district will become a major new mining camp in NW B.C. Hence the Tahltan now stepping up to the plate. Regoci has spent a great deal of time on this issue over the last number of weeks, and for that, coupled with the demands of planning and carrying out exploration on different fronts, GGI has been more quiet than usual on the news side. That should change shortly.

Hope this helps. As everyone knows, the junior resource market can be extremely volatile. Stocks can move violently in one direction or another. A good example in the Sheslay district is DBV. Went quickly from 4 cents in 2013 to nearly 20 cents, tumbled back down to 4 cents in December 2013, then soared 10-fold on discovery holes 8 and 11 within 4 months.

If GGI hits a discovery hole, this too could easily become a 10-bagger from current levels, thanks to Sprott. It would look good on them, just like the Brown Bottom in Gold 15 years ago.

Ggi another 913,000 shares sold

If it is in fact sprott they held 12 mil shares they sold around 2.5 mil till the end of may

Plus 6 mil FT shares

So we need to clean out 18 mil shares

Since April 1 till close of today

13.4 mil shares have traded

If indeed sprott is selling we have at least 6 to 8 mil shares to go

Theodore , not all that many selling DBV but as it continues day after day the numbers add up , I would have to say the people that are selling have not done their dd and have dissolution due to the time it has taken to proceed with the drill program . Remember Farshad struggled over the winter months to raise Capitol. The new team with Dr. Razeque needed time to go through all the core samples and then ( curve ball ) The Tahltan hit the reset button. All this has added to the delays and many people who aren’t aware just sell their position and move on . Dr. Razeque came to DBV for a reason and that reason being the potential for a world class deposit . Their are major mining company’s that have quietly taken an interest in this area not to mention Antofagasta the company that Dr. Razeque is associated with. DBV has 23 hole with good mineralization and the next holes about to be drilled with Farshad and the Tahltan drill crew on site now. I can’t wait to see that interview with Dr. Razeque.

I have not done much dd on GGI so I won’t comment but they are to close to DBV and appear to be part of the same system to be ignored. Hang in there.

Yes very helpfull, over a mil today so that balance may be less, just a bump in the road, get the ducks in a row and start swinging, thanks Jon .

Are they still drilling roradero? any news from mexico Jon?

I also read,a class action lawsuit against sprott, cleaning house are they!!

Theodore, most likely the people that are selling have not been following the events , they only see what appears to be nothing happening . But on the contrary over the past six months Farshad has raised Capitol, taken on a new team with Dr. Razeque , who have reevaluated all the information available ,then The Tahltan hit the reset button . All of these events have happened without any new cores but Farshad and the Tahltan drill crew are on site now and the drill is about to turn again. Major mining companies have quietly taken an interest in the area not to mention Antofagasta the long time associate of Dr. Razeque. I can’t wait to see the interview with Dr. Razeque. Hang in there , the news is starting to flow .

Jon, I really appreciate your updates. I know there has been a lot of frustration expressed here but at the end of the day we are all big boys who are responsible for our own investment decisions. You provide the best updates you can and your judgement will be wrong sometimes, impossible to have a perfect record in the junior sector. You can’t control selling by Sprott which hopefully will be cleaned up soon. My gut tells me there could be a little more downside here but not much as intelligent investors will start to recognize the opportunity. It will be interesting to watch. I am ready to buy more.

You’re welcome, Danny. Month-end settlement is tomorrow. Could be an interesting day re: Sprott. In any event, there’s not much left now and I anticipate within several sessions it will be all soaked up. Thank you very much because at these levels, given the circumstances at Sheslay and the prospects in Mexico, this could swing violently the other way faster than it took Sprott to fully unload. Indiscriminate selling – complete opposite of the indiscriminate buying witnessed in late 2010. Like Regoci said, capitulation that is further evidence of a cyclical bottom in the market. The big boys aren’t always that smart.

good morning bmr boys I bring you the latest press release from heron resources(HER VEXCH) dated june 24 2015 “KATE LENS EXPANDS WITH SIGNIFICANT SULPHIDE INTERCEPTS” regards walter emond

Thanks for the update Jon, it is reassuring to hear that we should hear some news soon. Is Regoci holding back news until the FT shares and Sprott holdings have been cleared out? Can you tell us how if they have produced any gold from La Patilla yet?

Now is not the time to panic with ggi, now that I know what Is going on with the sp and with sprott getting out, I’m going to be patient,why would I sell and give in to sprott, by next week things will change and with dbv ramping up, this would be a good opportunity to add on.regoci played this one rite, why release anything knowing what’s going on, smart move, patience folks..

I agree tombc. When Pinetree were doing their selling before xmas I picked up shares in Integra and Gold Canyon and doubled my money on both. I have done my DD on GGI and will probably buy some if the selling continues. A SP of 5c would give a market cap of just over $3mil. They have at least $1mil in cash, a holding in another company (name escapes me), stockpiling of ore at La Patilla and they are in the process of firming up a discovery at Rodadero. Those are all in the bag and a good hit at Grizzly would send the price soaring.

correction heron resources should be her texch not vexch walter emond