Gold has traded between $1,141 and $1,148 so far today, hitting an 8-month low…as of 10:00 am Pacific, bullion is down $4 an ounce at $1,145…Silver is off 8 cents at $15.01…Copper is up a penny at $2.51…Crude Oil is 29 cents lower at $51.12 while the U.S. Dollar Index has climbed one-third of a point to 97.64…

The Gold market may come to depend on emerging market physical demand even more than usual as other investment demand lags, and this EM demand should pick up in the months ahead, according to HSBC…

The Gold market may come to depend on emerging market physical demand even more than usual as other investment demand lags, and this EM demand should pick up in the months ahead, according to HSBC…

“Indian Gold demand has been weak, as denoted by a steep discount to world prices in Mumbai and other Indian Gold trading centers,” the bank stated…as of yesterday, the discount on Gold had narrowed to $4 from $6, suggesting a mild recovery in demand. “The improved monsoon and better prospects for a good harvest and hence potentially greater demand for Gold from the rural sector may have played a role in the narrowing of the discount,” HSBC stated…

Time for a little humor this morning after all the serious events so far this week…

The “Quote Of The Day” goes to Calgary-born Texas Senator Ted Cruz, running to be the Republican nominee for U.S. President, who was speaking at the Delivering Alpha conference presented by CNBC and Institutional Investor: “You want to sum up this race in one simple meme? It’s one we tweeted out,” Cruz added. “Reaganomics, you start a business in your parents’ garage; Obamanomics, you move into your parents’ garage.”

Meanwhile, a reader with an obvious sense of humor (and perhaps some sort of message regarding situations we see pop up in the mining industry?) sent us this “Toddler Property Laws” declaration this morning (anyone with a young child will especially appreciate this):

Rhodium Roars Back

The best asset over the past week is a metal many people have never even heard of – Rhodium…one of the rarest precious metals, Rhodium has soared 29% in the 5 days through yesterday, beating every single stock in the MSCI World Index, all currencies and major commodities, according to Bloomberg…while the market for rhodium is tiny and doesn’t trade on an exchange, a fund that holds the physical metal rose 23% since July 9, and shares of producers climbed…

Low prices are attracting companies that use Rhodium for catalytic converters in cars, according to Jonathan Butler, a precious-metals strategist at Mitsubishi Corp. in London…the metal plunged to an 11-year low earlier this month on forecasts that South Africa, the biggest producer, is increasing production at the fastest pace in 2 decades…

The 5-day advance in Rhodium was the biggest in 6 years…before this month’s rebound, the metal had fallen almost 50% since August 2014…

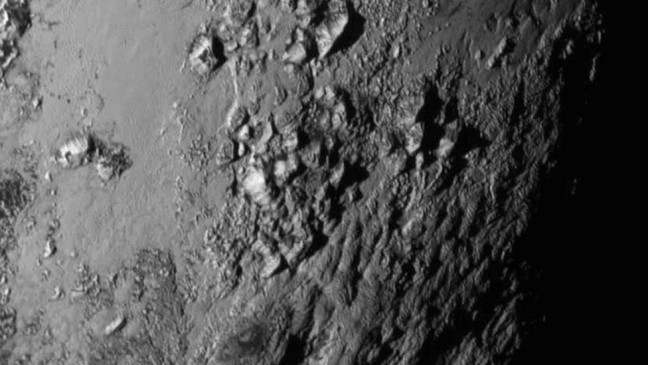

What Minerals Could Be On Pluto?

An important discovery on Pluto as mankind’s 1st close-up look at the far-away planet did not disappoint yesterday…:the pictures showed ice mountains on Pluto about as high as the Rockies and chasms on its big moon Charon that appear 6 times deeper than the Grand Canyon…

Especially astonishing to scientists was the total absence of impact craters in a zoom-in shot of 1 otherwise rugged slice of Pluto…that suggests that Pluto is not the dead ice ball many people think, but is instead geologically active even now, its surface sculpted not by collisions with cosmic debris but by its internal heat, the scientific team reported…

New Horizons’ cameras can see features as small as a city block…this probe will also examine what minerals are present on Pluto and its moon Charon…

Breathtaking in their clarity, as you can see above, the long-awaited images were unveiled in Laurel, Maryland, home to mission operations for NASA’s New Horizons, the unmanned spacecraft that paid a history-making fly-by visit to the dwarf planet on Tuesday after a journey of 9½ years and 3 billion miles…it got as close as 12,500 km and grabbed a huge volume of data…

“I don’t think any one of us could have imagined that it was this good of a toy store,” principal scientist Alan Stern said at a news conference…he marveled, “I think the whole system is amazing…the Pluto system IS something wonderful.”

John Spencer, also a scientist at the Southwest Research Institute, called it “just astonishing” that the 1st close-up picture of Pluto didn’t have a single impact crater….Stern said the findings suggesting a geologically active interior are going to “send a lot of geophysicists back to the drawing boards.”

Spencer told journalists that the first close-up image of Pluto’s surface showed a terrain that had been resurfaced by some geological process – such as volcanism – within the last 100 million years…this active geology needs some source of heat…previously, such activity has only been seen on icy moons, where it can be explained by “tidal heating” caused by gravitational interactions with a large host planet…

“You do not need tidal heating to power geological activity on icy worlds. That’s a really important discovery we just made this morning,” said Dr. Spencer…

U.S. Dollar Index Update

Fed Chair Janet Yellen’s Congressional testimony that started yesterday gave dollar bulls encouragement, and the Dollar Index appears to be gearing up for another test of major resistance in the high 90′s as you can see in John’s updated 9-month daily chart below…the U.S. economy can’t really afford to have another major breakout in the greenback, so it’ll be interesting to watch how this plays out as the quarter progresses…

Meanwhile, Republican Sen. Pat Toomey said today, during an interview on CNBC’s “Squawk Box“, it’s “unbelievable” that interest rates remain so low and it’s time to end the Federal Reserve’s “subjective” moving of the goal post…

“The Fed no longer has credibility, and you can see that. The divergence between the futures markets and the Fed’s own projections about what they’re going to do about interest rates—this is a huge problem,” Toomey stated.

Crude Oil Update

WTIC is desperately trying to hold within a key Fib. support band between $51.72 and $54.08…a now declining 50-day moving average (SMA) is putting fresh pressure on Crude Oil prices, though RSI(14) has recently bounced off previous long-term support…still, a confirmed technical breakdown here below $52 is a real possibility and that would set the stage for a test of the Fib. support at $48.70…below that, next support is $44…

Canadian Dollar-CRB Comparative Chart

The Canadian dollar has fallen below some key support at 78, following the Bank of Canada’s rate cut yesterday, and the prospect of a 70-cent dollar at some point down the road certainly can’t be ruled out given the bearish overall technicals…quite simply, the loonie just hasn’t bottomed yet…

That raises another question – given the close correlation between the Canadian dollar and the CRB Index, will the CRB retest key support at the 200 level (post-Crash low)…it’s currently at 216…

Today’s Equity Markets

Asia

China’s Shanghai Composite gained 18 points overnight to close at 3824 while Japan’s Nikkei rose 137 points to 20600…

Europe

European markets were up strongly today after the Greek parliamentary vote followed by the ECB extending its emergency funding for the stricken country’s banks…Greece’s Parliament last night passed austerity measures needed to secure a fresh bailout, but a rebellion within the ruling Syriza party is testing whether Prime Minister Alexis Tsipras can hold his government together…the measures, which include steep spending cuts and tax increases, were approved by 229 lawmakers in the country’s 300-seat Parliament…Greek anti-establishment protesters threw stones and dozens of petrol bombs at police in front of parliament on Wednesday before a key vote on a bailout deal, in some of the most serious violence in more than 2 years…

North America

The Dow is up 38 points as of 10:00 am Pacific…in Toronto, the TSX has climbed 57 points while the Venture is down 3 points at 640…Walker River Resources (WRR, TSX-V), which has an excellent chance at a discovery in Nevada, is a volume leader this morning, up a penny at 3 cents on total volume (all exchanges) of more than 2 million shares…no announcement yet on the start of actual drilling at Lapon Canyon…Temex Resources (TME, TSX-V) is up sharply this morning on a superior offer from Lake Shore Gold (LSG, TSX) – another sign there is good value out there in the industry…

B.C. Reports Large Budget Surplus

B.C. Finance Minister Mike de Jong announced yesterday that the province’s budget surplus hit $1.68 billion, significantly higher than the original forecast of $184 million…he announced the $1.5 billion surplus increase for the 2014-2015 budget as he released the government’s public accounts numbers for the fiscal year that ended in March…

“We are better positioned than virtually any other jurisdiction in the country,” De Jong said about B.C.’s budget. “No one else is looking at these numbers.”

The province’s economy grew 2.6% in the past year, which is slightly better than the national average of 2.4%, he said…

Total debt has increased to $63 billion, but debt-servicing costs are dropping and saving “hundreds of millions of dollars a year,” de Jong said…B.C.’s debt-ratio costs are 17.5%, with only Newfoundland and Labrador, Saskatchewan and Alberta lower, while Quebec and Ontario are at 49%…

Integra Gold Corp. (ICG, TSX) Update

So far this year, Integra Gold (ICG, TSX-V) has completed 49,650 m of diamond drilling in 113 holes at its Lamaque South Gold Project near Val d’Or with up to 8 drill rigs operating on multiple targets…1 drill rig is currently operating at the Parallel Zone with the plan to ramp things up again with 4 to 5 drills fully operational at Lamaque by September…

Technically, the recent decline in the Venture has sent ICG into a strong area of support in the mid-to-upper 20’s (the rising 200-day SMA is 26.5 cents)…

ICG is unchanged at 28 cents as of 10:00 am Pacific…

Niogold Corp. (NOX, TSX-V) Update

With Sean Roosen and Robert Wares at the helm, it’s hard to believe that Niogold Mining (NOX, TSX-V) won’t remain a leader in this market…drilling continues to uncover high-grade shoots surrounded by lower-grade halos that characterize the wider, mineralized shear zones at Niogold’s 100%-owned Marban deposit in northwest Quebec…10 days ago, the company announced preliminary leach test results showing average recoveries around 88% to 89%, comparable to Canadian Malartic ore under similar leach times and cyanide consumption levels…

Technically, NOX has performed exceptionally well in turbulent markets since the beginning of last year…look at the steady uptrend in the 2+ yearly chart below…consistently, NOX has found strong support at its rising 200-day SMA, currently 34 cents…

Excellent possibilities here for the balance of 2015 and a breakout above key resistance at 44 cents…a more robust resource model for Marban appears to be on track for later this year…

NOX is down a penny at 39 cents as of 10:00 am Pacific…

Note: John and Jon both hold share positions in WRR.

38 Comments

John and Jon. Did Steve Regoci give you any indication as to when the period of accelerated news flow would continue? These words were mentioned in their March 2015 news release. Hopefully, he will give us an update on the discoveries in Mexico as they have been silent for just over 3 months now. Thank you.

I can’t imagine it’ll be much longer before we hear from Garibaldi, Andrew…keep in mind, this Chad Day blockdade obviously has taken up a lot of their time…I don’t know for sure, but I’d be quite shocked if we didn’t hear from GGI by sometime next week…I believe it’s fair to cut them a little slack considering the antics from Chad that are consuming a lot of their time and DBV’s…but hearing from GGI by sometime next week I believe is a fair expectation…

Excellent Jon. Thank you for the clarity and I expected as much because of the Chad Day delay. Cheers.

I have confirmed the email address for the Press Secretary below as she responded to my email. The response was as follows: “Thank you for your email. As I am primary responsibly for media inquiries, I have forwarded your correspondence to the Department. The appropriate personnel will respond in due course.”

If you wish to drop her a line, her email address is:

[email protected]

Emily Hillstrom

Press Secretary for Bernard Valcourt, Minister AANDC,

Office of the Minister of Aboriginal Affairs and Northern Development

819-997-0002

I have elected to pull out of DBV. I have made this decision based on information being sent to me and it in no way reflects the merits of DBV and GGI properties. I wish you the best of luck going forward with both companies.

Dave can you please share the information that was sent to you. Some of us have a lot riding on this.

Yeah Dave. What information? Jon weren’t you supposed to have more on the situation today? There was nothing in the musings today.

We go on facts, Dan, and we’ve accumulated a lot of information that we’re sorting thru at the moment and verifying with different sources. So as soon as we’re ready to post addition info, we will – that will be soon. DBV’s position, and GGI’s for that matter, is stronger than ever IMHO based on a growing mountain of evidence.

Fair enough Jon. Thanks.

Jon based on the information, do you think DBV can get back to drilling next week?

Dave, are you invested in GGI? What have you heard that made you pull out of DBV?

In my opinion, the last news from the Tahltans seems to be another attempt by the kid to pressure DBV to negotiate and give them what they want……a piece of the pie!

To me this is like saying…..Farshad, do you really want another situation like in Sacred Headwaters with Fortune Metals???

Read at The Globe & Mail news… “Tahltan First Nation, Fortune Minerals face off over coal mine project ”

“But she said the Fortune Minerals mine is a no-go because it threatens the headwaters of three important salmon rivers: the Skeena, Nass and Stikine.”

With DBV the kid says its sacred ground which isn’t true! Jon confirmed that DBV property is 20 km from the already protected river! They also say that the Sheslay Valley is an important moose hunting ground…..no worries, the moose will still be there and we can let them hunt them on the property….or they can go chase moose elsewhere as they have a lot of land to hunt on!

The kid doesn’t have much of a case and has lost a lot of credibility.

If the antics of Chad Day end in the removal all drilling equipment and halt all progress in exploration in the areas of DBV and GGI it will be a black eye for Canada. On the world stage Canada will be on its way to being mining unfriendly among global players including Antofagasta. Even if this is just a negotiating tactic and exploration eventually proceeds it is bound to make global players very nervous as to what’s next.

Chad Day keeps changing his story. Tahltan were not consulted on drilling permits (flagrant lie), sacred burial ground (apparently BS, per other Tahltan), it’s close to the river (20 km from the property, river area is already protected), Sheslay Valley is moose hunting territory (is this a joke?).

Thanks in large part to BMR we can see through Chad Day’s silly tactics.

However DBV share price took a hit, let’s hope Farshand and the government act quickly.

remember no reality only perception… and most, like in a divorce, will not consider that there are two sides to the story… they read Day and his chirping and take ot for gospel!!

Les – its not the antics of Chad Day .. it is the response of our elected officials and our legal protectors, along with the kahunas of the mining community that will determine the history here..

I have repeatedly stated that someone somewhere needs to stand up for OUR rights… FN’s already have had theirs tied up with a black velvet band thanks to spineless officials – no disrespect but will someone please just say NO!!????

Jeremy – The response of our elected officials is about to get tested. Best hope it’s soon and fair to all parties . Off topic .Try building a pipeline in BC , according to some people the minute one is put in operation it will leak like a sprinkler hose yet the Trasmountain has been in operation for fifty years without a major incident . I’m surprised the groups of environmentalists aren’t jumping all over this supporting the Tahltan .

Sorry it took me so long to answer, I am extremely busy right now till Sunday. I did not have time to comment in depth on my post #5, had to run out the door. My post #5 clearly states that I sold DBV but not because of its merits with a discovery. I sold to be in all cash for now. It’s not just DBV. I am hearing that the Venture, gold, and silver, along with the Canadian dollar could take a serious hit in August. When you look at the charts to all of them, they are pointing in that direction. When you look at the DBV situation, well, thats just adding fuel to the upcoming fire. Some of you have big positions locked up, so I am going to say the same thing Jon would say. Hold your positions and lets see what happens in August. I would prefer to be in cash, as I have worked my way to that position couple weeks ago simply cause of the summer doldrums. It will be interesting to see if it materializes. It should be hard and fast if it hits, but the positive is afterwards, its going to cause a financial crisis that could rival 2008 and the metals can absolutely soar in 2016. We shall see.

There sure has been a lot of talk about DBV and GGI these past few months and especially the last couple weeks. The way I see it is, as long as there is going to be a native blockade keeping DBV and GGI from drilling there will be NO rise in share price. I don’t like to point out the obvious but say if you sell at 12 cents and rebuy at 10 or 8 cents you are increasing the amount of shares you have in said stock significantly and if it does at some point in a year or so go back up you will profit much more than waiting for 20 or 25 cents to break even. Many shareholders have been doing this. But enough about those two stocks lets talk about WRR!! Good land package, high grade gold , probably one of the most mining friendly districts in the whole world. Drill pads ready, no blockade, other mines in the area. Low float of shares and a terribly low market cap. Get in and recoup your losses. Right now you could get 2 shares of WRR for every share of GGI and 3 1/2 shares for every DBV. Just a suggestion. IMHO do your own due diligence.

With DBV we know what they are about to discover and those that have been following it are well aware of Dr Razique’s model and the potential of it becoming a world class deposit. With the recent drilling, we now have basically confirmed Dr. Razique’s model and we are looking at 3 x 4 km foot print! The issue is that there’s an obstacle in the way but one that isn’t very credible and if the process and people do their jobs, the right outcome will prevail….when it does don’t expect to be able to buy much at low prices now that the 1km step out confirmed Dr Razique’s model! Once this is resolved I think DBV and the SHeslay up trend will start and all eyes will be on DBV drilling! Look forward to hearing from DBV! Flippers beware…..lol.

D4, DBV has the full legal authority to recommence drilling immediately. Obviously they would want some type of assurance they aren’t going to be blockaded again – there are rather quick legal means to ensure that, if they so choose. As Farshad stated, they are reviewing all options. As soon as drilling does resume, this play will get national attention, thanks to Chad’s antics. Another big hit 1 km to the north of the Lisle Zone and this then lights up like a Christmas tree. So that’s the upside. The potential “downside” is probably a massive cash settlement. In many ways, this play has been de-risked.

DBV’s largest shareholder is more optimistic and more upbeat than ever right now with the confirmation of Dr Razique’s model being proven and the outcome of recent drilling. He doesn’t seem stressed out because of the situation……. so I’m not stressing out either. DBV has a few options and will move ahead when they’re ready. The kids case is a futile attempt to get an early deal with DBV for a piece of the pie as he is very aware of what they have. Their own people are doing the drilling and see the core come out of the ground!

Like Jon says, Farshad is a pitbull. He has over come many obstacles over the last few years and has taken the HAT from grass roots to a stage of soon being called a world class deposit. He is a fighter and gets the job done!

On the other side, Chris Day hasn’t said much that is credible and has said so many lies that he is imo no longer credible anymore. I have great respect for the First Nations and I have good friends that are natives and live on their reserves but its non-sense like what Chris Day is doing that give First Nations a very bad reputation! Its unfortunate that his people and all First Nations will get a bad reputation. In this world, one rotten apple spoils the bunch. Its not too late for him to fix this before it makes them look even worse. Lets hope he wakes up and makes the right decision. Sacred Heart was to protect the 3 salmon rivers and I respect that decision but the reasons behind the issue with DBV is totally false and aren’t legit!

Jon do you know if we have concrete evolution of this situation

Guy, it is evolving, no question, from the chatter we’re hearing…however, rumors are just that – rumors. We need to hear directly from DBV, and GGI.

F*** Chad day! We have the legal authority to keep drilling. I say we do so while also keep negotiations ongoing.

Jon, I am going to call you out on your “massive cash settlement” comment. I believe you are being too optimistic. I am going from memory here, so if I am wrong you can correct me. Fortune mineral said they had invested $100 million dollars in their project and got a cash settlement of $18 million. I have a hard time believing DBV will get a massive cash settlement for their troubles. Anyhow, the best thing is for the issue to be resolved because if it doesn’t the shareholders will lose big time.

Jon, I don’t want to be rude here but it’s best to taper expectations until everything is resolved.

You’re not being rude, Chris, you’re just stating the reality – we need to hear from DBV to know exactly where they’re at on this, and what their intentions are, and how quickly this might resolve…we know that much of what Chad Day has stated is simply not consistent with the facts…the evidence keeps piling up…

these companies shouldbe putting out some sort of news…GGI mgmt needs to let shareholders know where they are at by now?….also, DBV 10 offer???

DBV some people are nervous and want to sell….let them sell as I don’t care how low it goes as I will be buying soon!

Chris Day will probably be putting a bid in soon as well…..lol.

The SMC. ( Shaley millionaire club ) is looking pretty bleak this morning with over 4 hundred thousand for sale at 10 cents .

Diplomacy aside We need to hear from Farshad fairly soon .

I have to leave here soon. But I just received some more information that the U.S. Dollar and markets are set to soar which will take down the metals and venture. This will be a short wave and a steady rebound afterwards with 2016 starting the gold rush everyone has been waiting for and talking about. Get your cash ready. Possibilities to look for is the Canadian dollar .60 to .64 – silver 13 to 13.50 – gold 980 to 1020.

Honestly I’m getting a little nervous. The longer this plays out, the lower it will go and the harder it will be to rebound as investor confidence will fade. I’m definitely not selling a single share and waiting to possible buy more but this needs to get resolved and we need to get back to drilling ASAP!

It doesn’t help that we’ve got jittery overall markets, Sam, with commodities remaining under pressure…what DBV needs to do, probably next week I would say, is update everyone on what’s happening and how this situation is unfolding…they have some factors in their favor – a significant discovery, the legal right to drill, plus Chad Day has made inconsistent and non-factual comments since all this erupted May 21…combined with his illegal blockade which he amazingly labels as just a “visit”…wasn’t exactly a neighborly visit as we all know…

Dave, can you give us more details as to where you get this information? Is it from technical analysis?

Tom, just take a look at the Venture 39-week cycle chart this morning…that says a lot, so I don’t believe Dave is off-base here. Could be some stormy weather ahead, for sure, there is that risk, but also the potential for quite a rally or upside move starting as early as September…the long-term Venture chart shows we’re in a bottoming phase which is sort of like the mirror image of the late 2010/early 2011 top, so in that sense this is really the time to be bullish, not bearish, to be a contrarian…many investors’ minds don’t work that way, unfortunately…they strangely feel more comfortable going with the crowd and buying at tops as opposed to the more challenging task of putting fear aside and looking for bargains…

Tom – Not from TA. I follow 2 private clubs of astute analysts, one in Atlanta and one in New York. They have some bizzare tough to understand theories but they are usually pretty accurate. I will be back late tonight. Take care gang

Oh, Jon is right. The quick way to wealth is to buy low, sell high, never chase a stock. If one is overbought, let it go, there is always another train coming.