Gold has traded between $1,104 and $1,116 so far today…as of 9:00 am Pacific, bullion is up $5 an ounce at $1,111…Silver is 10 cents higher at $14.71…Copper is unchanged at $2.44…Crude Oil has added $1.40 a barrel to $45.55 despite data from the U.S. Energy Information Administration that showed Crude inventories rose more than expected last week…U.S. commercial Crude stockpiles increased by 2.6 million barrels, bringing the total in storage to 458 million barrels, near an 80-year high…the U.S. Dollar Index is off one-third of a point to 95.58 as it continues to fight resistance around the 96 level…

Ignore Gold’s weakness yesterday, says one researcher, because August may have marked the beginning of a turnaround for the yellow metal…according to Mike McGlone, head of research for ETF Securities, Gold is showing signs of a potential bottom as many bearish factors dissipate…

Ignore Gold’s weakness yesterday, says one researcher, because August may have marked the beginning of a turnaround for the yellow metal…according to Mike McGlone, head of research for ETF Securities, Gold is showing signs of a potential bottom as many bearish factors dissipate…

“Gold was one of the few positive performing assets in August, gaining 3.6% as prevailing deflationary asset price trends extended into the U.S. stock market,” McGlone stated. However, “the extended period of above average U.S. stock market returns, below average volatility and U.S. dollar strength may have ended,” he added, noting that these are some of the main factors that have been pressuring the bullion.

“Year-to-date, Gold ended August as the best performing precious metal (PM) with a decline of 4.2% on the back of a 6.2% YTD increase in the U.S. Dollar Index and 7.6% decline in Crude Oil. August may mark the initial recovery month following a potential July capitulation bottom in Gold,” he concluded.

Modi Meets Resistance

Indian Prime Minister Narendra Modi, despite a strong parliamentary majority, is running into roadblocks from unions, among others, in his attempt to push through hard-hitting and necessary reforms needed to improve the country’s business climate…since late August, 3 key reform bills intended to make it easier to do business in Asia’s 3rd largest economy have hit snags…earlier this month, 10 major unions – representing a wide range of sectors, from banking to coal mining – called a nationwide strike over the government’s “anti-labor” policies…Modi has been trying to give companies greater flexibility in hiring and firing employees…India currently ranks 142 out of 189 countries in the World Bank’s ease of doing business index, well behind China in the 90th spot…the economy grew by a slower-than-expected 7% in the April-June quarter, down from 7.5% in the previous 3 months…economists stress that India needs to speed up its domestic reform agenda in order to unlock its full growth potential…

Chinese Premier Promises To “Speed Up Structural Reform”

Reuters reported today that Chinese premier Li Keqiang promised to relax restrictions on foreign capital in financial markets and said the country would meet its economic targets. “We are speeding up structural reform,” Li told delegates to the World Economic Forum’s event in Dalian, known as the Summer Davos…China faces a “painful and treacherous” transition from over-reliance on manufacturing toward a “growth model driven by consumption and investment,” Li said.

“It’ s true that the economy has come under downward pressure…but the Chinese economy will not have a hard landing,” he said in a speech on policy direction. “Despite some moderation in speed, growth is stable. We are prepared to undertake preemptive adjustment and fine-tuning as appropriate, and step up targeted macro regulation.”

What China Just Spent $250 Billion (U.S.) On

China keeps throwing money at its stock market problem…the Chinese government has spent 1.5 trillion yuan ($236 billion U.S.) trying to shore up its markets since a rout began 3 months ago, according to Goldman Sachs…

The “rescue team” expended about 600 billion yuan in August alone, with the total now equivalent in value to 9.2% of China’s freely-traded shares, strategists including Kinger Lau (Goldman’s chief China equity specialist) wrote in a report dated Monday…investor concern about what will happen when the government starts to pare these holdings is overdone, they wrote, citing past experiences in the U.S. and Hong Kong…

Today’s Equity Markets

Asia

China’s Shanghai Composite fell 47 points or 1.5% overnight to close at 3196…the country’s consumer price index (CPI) rose 2% in August from a year earlier, beating expectations for a 1.8% gain and up from 1.6% in July…however, disturbingly, the producer price index (PPI) declined 5.9%, compared with an expected 5.5% drop and after a 5.4% decline in the previous month…this marks the 42nd consecutive month of declines…those deflationary pressures simply aren’t letting up…

Japan’s Nikkei average gave back 470 points or 2.5% to close at 18300 after Wednesday’s spectacular gain of nearly 8%…critical support for the Nikkei, as shown in John’s 4-year weekly chart, is 18000…heightened risk of a further 10% drop in this market IF the 18000 support does not hold…after China’s market difficulties, investors don’t need the Nikkei to take a swoon…

Europe

European markets were down modestly today…the Bank of England left its interest rates unchanged at its monetary policy meeting…no change in rates was expected…

North America

After closing with triple digit losses or gains in 13 out of the past 15 trading sessions, the Dow is slightly more subdued so far today…as of 9:00 am Pacific, it’s up 75 points at 16328…with the upcoming Fed meeting, volatility is likely to continue…

Expectations for U.S. consumer spending appear to have dimmed in July, as wholesalers cut their inventories slightly and sales fell…the Commerce Department reported this morning that wholesale stockpiles slipped 0.1% while sales dropped 0.3%…both numbers were below expectations…this follows a solid 0.7% gain in inventories and a 0.4% sales increase in June…

In Toronto, the TSX is up 57 points while the Venture is off 2 points at 548…Sparton Resources Inc. (SRI, TSX-V) is one of the Venture’s volume leaders so far today, doubling in value to 3 cents…SRI came to life this morning after the company announced that, through its majority controlled subsidiary (VanSpar Mining Inc.), “it has executed a contract to finance the commissioning one of the world’s largest vanadium redox flow batteries. This battery is located in Hebei province, China, approximately 60 kilometres north of Beijing, where it was recently installed for the PRC State Grid Company.”

TSX Energy Index – Bigger Roller Coaster Than The Venture

Is it time to consider accumulating beaten-down Oil stocks?…this 16-year monthly chart shows the volatile TSX Energy Index landing in a zone of support between 155 and 172…it closed yesterday at 169…RSI(14) is attempting to bounce off previous support (from its early 2009 low)…

There’s money in volatility which is evident in more than just penny stocks…the energy index climbed 5-fold from late 2000 to its peak of 470 in 2008 when Crude prices topped out at about $150 a barrel…the index lost 63% of its value during the Crash, more than doubled from there in just 2 years, collapsed another 42% during 2011, shot up nearly 50% between early 2013 and mid-2014, and then tumbled another 56% to this year’s low of 151…

Richmont Mines (RIC, TSX) Targets New High-Grade At Island Gold Mine

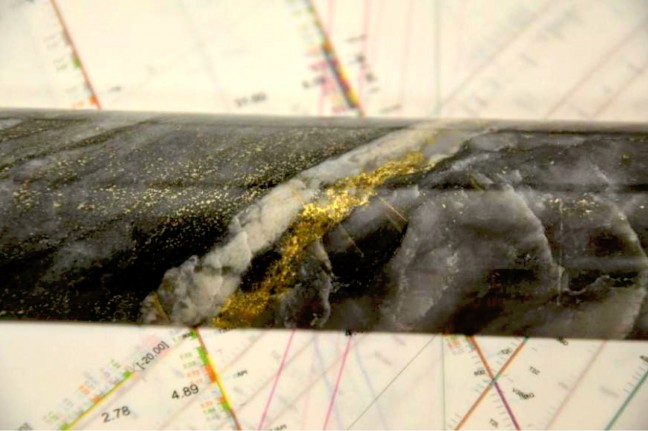

Richmont Mines Inc. (RIC, TSX) announced this morning that it’s initiating a 23,000-meter deep directional drill program at its Island Gold mine in northern Ontario to further expand its resources at depth below its current 1 million ounce global Gold resource…this program, expected to take about 6 months to complete, will follow up on a very encouraging single deep hole from surface last year that intersected 19.87 g/t Au over 3.93 m at a depth of 1,200 m, approximately 280 m down plunge from the existing Island Gold resource…

Three drills will be set up on surface to drill 3 pilot holes from which approximately 10 legs will be done to test different drill targets…the planned array of 30 holes will test an area along the favorable shear zone covering approximately 500 m laterally and 640 m vertically, between depths of 860 m to 1,500 m…

RIC is one of our favorite producers, on track for another very solid year financially…RIC is up a dime at $3.35 as of 9:00 am Pacific…

Targeting High-Grade Nickel Near Voisey’s Bay

The appetite for Equitas Resources (EQT, TSX-V) demonstrates how some “heavy hitters” are stepping up to the plate for a potential home run with this exciting grassroots exploration play…Equitas is getting set to commence an initial 4,000-m drill program (approximately 12–14 holes) at its Garland Nickel Project 20 miles southeast of the Voisey’s Bay mine…yesterday, the company announced it has arranged a $2 million non-flow-through private placement (12.5 cents) on top of the previous financing (mostly flow-through with some hard dollar, up to $1.8 million but probably over-subscribed) that was announced August 18…so EQT will be armed with plenty of cash as it tackles Garland, and that also helps to “de-risk” the play…EQT is racing like a thoroughbred in this market – a nice intersection of massive sulphides would give this horse international attention and perhaps provide the spark to rejuvenate the junior resource sector…

EQT is off a penny-and-a-half at 16.5 cents as of 9:00 am Pacific…a confirmed breakout occurred above Fib. resistance at 15 cents, so that’s where the new support should be…

Pure Energy Minerals (PE, TSX-V) Update

Pure Energy (PE, TSX-V) has met resistance near a Fib. level in the mid-70’s as expected…note how RSI(14) on this 2.5-year weekly chart is at 83%, based on yesterday’s close, so the risk of a modest pullback to unwind temporarily overbought conditions increased as the Fib. level was attained…on the daily chart, the 10 and 20-day moving averages (SMA’s) have provided consistent support since the big climb began in late July…

PE has retreated a nickel to 72 cents as of 9:00 am Pacific…

NexGen Energy Ltd. (NXE, TSX-V) Update

NexGen Energy (NXE, TSX-V) has had a good week after reporting more stellar high-grade results the other day from the Arrow Zone at its Rook 1 Project in the Athabasca basin…the Arrow Zone, which is entirely basement hosted, currently covers an area of 645 m by 215 m with a vertical extent of mineralization commencing from 100 to 920 m, and remains open in all directions and at depth…geochemical results continue to show highly anomalous Gold values and very low deleterious metals content throughout the zone…5 rigs continue to turn as part of NXE‘s 2015 summer drill program recently expanded to 30,000 m…the company has cash on hand of approximately $23 million…

Technically, very strong support for NexGen exists at 60 cents (previous resistance) while the key Fib. level on the upside to watch is 83 cents…NXE’s rising EMA(20), currently 66 cents, is shown in blue on this 2-year weekly chart…it has provided support since early this year…

NXE is off a penny at 69 cents through the first 2-and-a-half hours of trading…

Note: John and Jon both hold share positions in EQT.

74 Comments

EQT – hint: .14 is very strong support.

Jim – So much was posted on Hardy. Trust me, he is a different breed from the rest. Look at his profile pic on the website, then take a week long coarse in kinesic language and give me the words that describe him. Kingsley is on the property for a reason and it starts with Hardy. The addition of Ben Lee is monstrous, not to discount the others. Bnn is coming up soon, along with something in first week of November. Please don’t ask me what. It’s all lined up going forward. Not trying to sound sarcastic here, but with everything put out up to now, it is of my opinion that one would have to have some screws loose in their head to not have at least a small position in EQT. Cheers

Oh, welcome back Jeremy. Love the pic and yes, your wife is beautiful, make her proud.

Nice to see the EQT came back down to touch 0.155 today and bounced. We just need the news of PP closing and drilling starting.

George – remember, it can touch .14 briefly, don’t be disappointed, buy more. I am not saying it will, but it can. Very strong support there and should not drop any lower. Any touch of .14 should be intra day and short lived.

If it dips further I will buy more while I can.

Thanks Dave. I don’t see that happening unless there is a delay in news flow.

ABR.v a left for dead miner seeing some activity since they picked up some Lithium claims in BC (+33% on over 4 million shares) today as she’s battling at the 0.02 level.

Zippy – I looked at ABR this morning as I received another email. One thing that concerns me somewhat is the amount of shares that are up for grabs with such a low O/S base. I think if it can break through the .03’s it may move a little faster. They have acquired the claims, but I think they will have to put things in motion with some exploration before they really start to move. We shall see.

Hey Dave … thx… and yes she is:) not sure why it turns up but it does:) and my goal is to always make her and me mum proud.

Keeping trying everyday…

D4 – me too. Just waiting and watching. I am thinking no later than Monday on the correction.

Dave, you think this will correct more by Monday? This PP really took the steam out of the momentum short term. That being said when we announce drilling people will get excited again.

Jeremy – Just put her in your heart and be real. I envy you as I am single and haven’t found the right one yet. I need to go get me one of those Ecuador women, huh Jon.

02charoc – most of the time a stock will correct for 2 to 3 days after a run up, but it’s not a given. Then again, EQT is that rare breed of horse that could buck any trend. So if you can’t buy till Monday, I hope the best for ya. I made a statement a while back that I believe the drills start turning on the 14th. Well, that is this Monday. Even if the drills are delayed, I am confident the first PP is announced no later than Monday morning. This being the case, it’s $$$$$$$$ time.

Oh Jeremy, it looks like its going to be beer and pizza, and not the beer. (Humor)

CRS – the news the other day finally sparked CRS moving up. By the way, they have not announced yet that they have found oil, they simply announced the re-start of drilling. So it is still a spec play. Get the hint: EQT

Guys. I mentioned CRS.V @.085 last week and this week. Last @.15! Going higher. News coming

GGI is one usual stock. Excitement for a bit yesterday and now today nothing. Most stocks if there is a sign of something coming the increased volume at the end of one day would lead into the next. Not this one.

EQT what a beauty. Could close back @.18+. Great cleanup. Buy folks while they are cheap.

@BigRig_Trader

UMB.c volume

Dan – I have to agree with you on GGI, strange trading for sure. But all it takes is that one NR. I think most Canadians are aware of the story unfolding on EQT and It’s obvious of the money piling in. The shesley area had some good hits by DBV but I don’t think it has caught enough attention yet, but it probably will in time. CRS is getting good attention now cause the re start of drilling, but its oil and those always play with huge extremes. I think they need to get to drilling and find that one massive hole in the system and everything breaks loose up there. I think the eyes are there, but they are not throwing the money on the table.

The old saying is so true. IF you want to make the money, then FOLLOW the money. Where there is volume there is fire.

Check this new map out on GGI Website. It says 2015 Discovery?

garibaldiresources.com/i/maps/Grizzly/Grizzly-Regional-Target-Areas.jpg

Looks like Regoci has his target at grizzly Central. Guessing the drill is probably being set up.

Jon, your analysis of where the first target may be is spot on. Looks like it is Grizzly north Central. Kudos.

A “bull’s eye” at Grizzly Central, Dan, in the northern part of Grizzly Central. Garibaldi is obviously onto something at the Grizzly, in particular it seems Grizzly Central. We’ll have to wait and see what they say, but here’s why this could quickly turn into a remarkable situation:

Our research has shown that up to 95% of Grizzly Central is covered by overburden. Sometimes what CAN’T be seen turns out to be more important than what CAN be seen (Blackwater being a great example). If GGI has strong geophysical and geochemical evidence of mineralization under the overburden, then it’s quite possible a massive porphyry system has been “hidden” in this district for decades at Grizzly Central considering how big this area is. The old-time prospectors were drawn to areas where mineralization was obvious at surface. They completely overlooked Grizzly Central. The fact there are already 2 deposits in this district greatly enhances the chances of more – that’s key. Incredible opportunity for a discovery by GGI. Mount Milligan was also discovered under a lot of overburden.

The map shows 7 regional target areas, Grizzly Central 1 of those 7. Massive scale to this. Farshad made a discovery at the Hat on just the 8th hole (the 6th hole was a technical discovery, the 8th hole really lit it up). Knowledge of the district is exponentially higher now than it was 2 years ago, or even 6 months ago. GGI could easily hit on its first 3 holes.

Yes Dan, what’s encouraging is that it was posted today, should hear something shortly I would think.

Dan, I guess they just have to get that drill rolling on GGI.

I wanted to mention this in case there are some investors that have not been around a long time. Be careful of the bashing going on at SH on EQT, they want in cheaper. If you have been paying attention, they disappear on the green days with good gains and reappear on red days.

Just Grizzly east is a large as DBV, same wall structure.

2015 discovery mean they are pretty confident that drilling will occur.

Martin, I would say there are 2 messages from this map: 1) GGI believes it has a discovery in the making at Grizzly Central; 2) The drill rig is warming up.

Strap yourself in. This could be a rocket ride to the moon.

CRS touched .175 today off my call last week @.085. I’m still holding all my shares. It think we can see .20+ tomorrow. Do some quick dd. Jon any thoughts bud? Thanks.

The area of interest (discovery 2015?) is exactly the picture no.6 on their web site.

Martin, to me it looks like picture no. 6 is actually Grizzly West terrain or part of West Kaketsa…definitely not Grizzly Central.

Dave, I noticed that as well on SH. As soon as the SP starts dropping, the sky is falling – LOL. No worries, they can bash all they want. Not going to shake my shares loose just yet. I have a plan for the core holdings. Put it this way, if EQT hits $5, I will be a millionaire, if it hits $10 I will be a multi-millionaire. I know that’s getting ahead of myself but a major hit at the Garland and the dream will come reality.

As for GGI, hope the drill turns soon at Grizzly Central. One other thing I noticed from the map were the words “Masked” Deposits? So, GGI geologist are indicating not one deposit, but possibly multiple deposits. Interesting.

Yes totally agree Jon. This area coincide with is a mixure of copper creek and pyrrhotite creek.

Dave – she is my heart:) 2nd time round and I have to say that we don’t know much when we are young, and as we age and get more perspective things and outlook changes. THe ‘right one’ is around the corner Davey … problem is we have to be open to all things that confront us which most time we are not since we always seem to be trapped by our old belief structures, and thinking about the past or future so we miss the present.

check out CBS.com .. a 60 minute segment on mindfulness. you need to be introspective for it, but you will get the deal.

Most of us here including Jon/John are focused on the things that we are focused on.. like BMR starting their new biz structure, and us trying to navigate it all, and wondering more about how EQT is going to fair in the future..

and then we miss something that just happened and we cant get it back.

Perspective is everything … and as a christian I believe in things happen for reasons, and there is a plan of sorts… but crap gets in the way..

She has taught me to focus on the present… which is hard for me.. but I keep trying.. and the last 2 weeks I have not done that. Now its better, but it is a struggle each day.

and there are reasons – personal reasons- for why she is the way she is… which I am a grateful receiver for her guidance.

Your time will come mate.. check out the mindfulness thingy… it will raise some eyebrows.. but more importantly bring you into the present, and with any luck it wont let you go:)

Sorry for the dissertation… just how I am feeling this eve… Thx for helping get my perspective back:)

Dan1, DBV, GGI and PGX have multiple deposit potential, one must not overlook what’s hidden under PGX property.

Your welcome Jeremy, and I will check it out. Stay in check.

Just a thought regarding EQT, I saw the PP today and my first thought was. Won’t the first PP cover a lot of the drilling and if they hit which most expect will happen than they can do another financing at a higher price which would be more beneficial for current shareholders?

Are they just trying to raise as much cash as possible while they can in case the first round of drilling doesn’t hit? Are they making sure insiders who I assume are the major part of the PP remain in control?

Thanks for your thoughts. I remain very optimistic.

Jon if the drill rig is warming up for GGI I hope same thing for DBV !

Danny – I am guessing a combination of a few things. The amount of people wanting in and not happy is probably part of it. I don’t have their exact reasons, but I’m not worried about it. If they hit, it’s institutional money from there on.

You sure Jon, AL9 volcano in the back, no sheslay river. taken from copper creek to the s-sw. But you had the helico ride so I won’t argue 🙂

Sorry, Martin, for some reason I was looking at picture #8, not #6. You’re right. #6 is a view from the east, looking west and southwest at Kaketsa and the stratovolcano along the southern border with Teck. So that picture shows parts of Grizzly Central. You can see how forested it is in certain sections. A major forest fire some years ago cleared some of the trees at Grizzly Central but it’s a vast area.

I think Danny raises a good point. If they did have enough to drill their main targets, why dilute further at low prices?

I wonder if there were problems filling the first pp despite their claim of it being oversubscribed. Perhaps originally it was but until the money is in you can’t count on promises alone. If this were the case then it’s possible the second hard dollar pp was a necessity.

The FT pp is still not closed or yet to be announced as is. This is over the standard 21 days from announcement to closing that their previous 4 pp’s have taken.

Treb – the PP is a done deal. Watch tomorrow after close or first thing Monday morning.

JON: it would be nice if you could say something about AIX/ABR as part of the Grizzly area, as well, volume in ABR has been impressive since they started to also get into Lithium in BC based on the last news release. Stocks like EQT/PE/ have definetly caught the market as we enter September! Good to see Millions being raised by EQT,etc too……also, any WRR updates as they will be drilling in less than 2 weeks based on their last news release?

Also, good to see your Forums picking up with over 80 comments yesterday! and over 40 today!

Dave, if that’s the case I wonder why they chose to go ahead and take in the extra 2mm of house money so soon? I know from my conversations with IR that this wasn’t the original plan unless I misunderstood something.

We’ll soon find out.

Ya, why such a large PP when all the touts suggest a hit? sometimes you take the extra cash cause its available and in case that sure thing isn’t so sure, but this does seem to be a LOT of $, its more than the original PP. Why not make the sweeteners, warrants, a little dearer? 1/2 wts? higher pricing? the only other reason I would be keen on a PP like this is if it all went to a single entity, which would then validate the company’s big ideas and visions of riches based on VTEM and some samples, but that doesn’t appear to be the case either from what’s being written

EQT has 40+ mill shares O/S… the last 2 weeks it has traded over that amount in aggregate…

safe to assume that due to the larger volume breaks on stock screeners that the day traders came in to play in that sandbox… and now they are done and moving onto another one??

just thinking out loud…. 15.7K traded in the first 20 min hasnt been the norm …

WRR For a company that will drill in 10 days is pretty quiet !

Doubleview sues Tahltan’s Day over Hat shutdown

2015-09-11 10:30 ET – Street Wire

by Mike Caswell

Doubleview Capital Corp. has filed a lawsuit in the Supreme Court of British Columbia against a group of blockaders the company claims shut down drilling on its Hat property. The company complains that the group wrongfully entered its camp, intimidated workers and caused the complete shutdown of drilling on the site. Doubleview is asking for a permanent injunction.

The problems that Doubleview complains of are described in a notice of claim the company filed at the Vancouver courthouse on Sept. 8, 2015. The only named defendant is Chad Norman Day, the president of an Indian group called the Tahltan Central Government. The company says the names of the other blockaders are unknown to it, and it lists John Doe and Jane Doe as defendants.

Yes, Chad’s in a little hot water…companies have the backing of AME BC and the Ministry of Mines, and the Law of the Land with the Land Use Agreement…

Nice! So how long will this take in court? How much longer before we start drilling?

Courts act quickly on these cases, Sam…often within 3 weeks.

yahoo… something has broken… and good on DBV for standing up to Chad and the FN’s as a whole where most seem to be very tippy toed. They are not beyond the law.. a great message to all.

No disrespect implied to FN’s but the sooner they play in the same sandbox the better off they will be in MHO

I wonder the same thing Sam…definitely great news for DBV, lets just hope this doesn’t sit in the Supreme Court for too long before a ruling is made.

3 weeks I can handle, thanks Jon!

Courts out here in B.C. act quickly on injunctions, as occurred with Red Chris…

HERE IS A MORE IN-DEPTH RELEASE:

Doubleview Capital Corp. has filed a lawsuit in the Supreme Court of British Columbia against a group of blockaders the company claims shut down drilling on its Hat property. The company complains that the group wrongfully entered its camp, intimidated workers and caused the complete shutdown of drilling on the site. Doubleview is asking for a permanent injunction.

The problems that Doubleview complains are described in a notice of claim the company filed at the Vancouver courthouse on Sept. 8, 2015. The only named defendant is Chad Norman Day, the president of an Indian group called the Tahltan Central Government. The company says the names of the other blockaders are unknown to it, and it lists John Doe and Jane Doe as defendants.

The events in question, as described in the lawsuit, occurred at the company’s Hat property on July 7, 2015. On that day, Mr. Day and others arrived at the property via helicopter, with the intention of stopping the company’s drilling, Doubleview says. The blockaders, two men and four women, described themselves as Tahltan representative elders. They occupied the company’s drill camp, which was largely staffed by Tahltan members, and threatened and intimidated the workers into ceasing all activities, according to the suit. Mr. Day and the blockaders camped out at the site until the next day, satisfying themselves that drilling had completely stopped, the suit states.

Doubleview complains that it had to shut down the camp as a result of the actions of Mr. Day and his associates. The situation, as described in lawyerly terms, was one in which the defendants “wrongfully and without lawful excuse” entered the company’s lands and interfered with its work. Doubleview says it had proper permits in place to carry out that work.

As a result of the activities of Mr. Day and the others, the company has lost the opportunity to drill in favourable weather, the suit states. Doubleview also claims to have suffered a decline in its share price, impairing its ability to finance future work. Moreover, it risks breaching the terms of its option agreement for the Hat property, the suit states.

Doubleview is seeking a court order that would prevent any interference with work on the property. It is asking that the injunction specifically prohibit any threats or intimidation. The lawsuit is also seeking appropriate damages, court costs and interest. Vancouver lawyer Maryna O’Neill of Northwest Law Group filed the suit on the company’s behalf.

Mr. Day has not yet responded to the lawsuit in court, but he did issue a news release the day of the shutdown in which he presented his views on the company’s drilling. He said that the Tahltan Central Council had repeatedly asked Doubleview to remove its drill rig. As he saw it, the company was drilling in an area once occupied by Tahltan clans that contained grave sites. He also invoked the often-used complaint that the area had important cultural and spiritual uses.

The case does not yet have a hearing date.

DBV – It will be quicker than a few weeks to get the injunction……I now believe that we will get the injunction and will be driling later this month….

EQT – big buying suddenly started after slow start

DBV – Steve, this is not a news release but a “street wire” news story. Positive to hear something is happening after over two months. We are still to hear from the company.

Wonder how much we are seeking in damages?

Jon do you think Farshad has the consent of the Tuku Band ?

Guy, yes. The Taku have been watching things closely but have had no objections to the exploration programs being carried out.

DBV – IMO National news attention will be brought to the situation more so now. Just a thought, Jon , your opinion?? Perhaps one should post the news story on the Tahltan Facebook page (I’m not a Facebook member) to advise all their members of the situation?

D4 – yeah, I know, I was hoping for .15 to buy more. This is one play right now that you cannot panic in if you see red for a day or two. You could get caught standing on the platform.

Gee Willikers, over a mil now on EQT. I’m smelling a NR after close today or before Monday open.

Oh, great news for DBV too.

If DBV made application Sept.8 th. DBV will be drilling by months end.

Any publicity is good publicity – if it makes the news then Sheslay area will be getting some attention. Could bring in interest from investors if they realise what is at stake here.

I predict we’re going to see a real explosion in the district, Tom…the equivalent of gas being poured all over the place, and now some matches are being tossed in…between what’s developing at Grizzly Central and the Hat, this will draw national attention IMHO…

So what happened to the “meaningful discussions” (GGI PR)?

Repeating myself but Chad Norman Day is imo a terrible Tahltan leader. Illegal blockade, shows up intimidating Tahltan workers with a gun, uncooperative, disrespectful to Taku River Tlingit First Nation, and so on.

Hope everyone not the CRS pull this morning. Headed back up now. Big bids growing @.15

EQT I’m saying .205 close today. Rumours of drill starting Monday morning

UMB.C told you about the volume here yesterday. Look again today. Something’s brewing…..

@BigRig_Trader

Oh ABR .02 looking good to be filled today. Lots of chatter.

just hope that it doesn’t turn into an Ipperwash moment! that went on for years (10+)and is about as messy as it gets with native blockades, govt inaction, police overreaction and then inaction, and is just barely being settled now with the native groups in the area, who are still disputing payments. Lets hope Chad gets enough of what he wants, things resume and then things turn positive

I had mentioned 2 weeks ago for a Sept. 14 drill start day on EQT. Only one red day on the correction, this is a horse in motion.