Gold has traded between $1,129 and $1,141 so far today…as of 8:00 am Pacific, bullion is down $8 an ounce at $1,132…Silver is up a nickel at $15.23…Copper has added 2 pennies to $2.39…Crude Oil has jumped $1.24 a barrel to $45.92 while the U.S. Dollar Index has gained two-thirds of a point to 95.90…

China remains an aggressive buyer of bullion as Gold deliveries from the Shanghai Gold Exchange continue to set record highs…SGE volumes were up 14.2% in August vs. the same month in 2014, and are on pace to reach almost 2,600 metric tons this year…the planned establishment of a yuan-based Gold fix by the SGE by the end of December further demonstrates that China wants to have its say in the global pricing of the metal…

China remains an aggressive buyer of bullion as Gold deliveries from the Shanghai Gold Exchange continue to set record highs…SGE volumes were up 14.2% in August vs. the same month in 2014, and are on pace to reach almost 2,600 metric tons this year…the planned establishment of a yuan-based Gold fix by the SGE by the end of December further demonstrates that China wants to have its say in the global pricing of the metal…

U.S. Commodity Futures Trading Commission data showed on Friday that hedge funds and money managers slashed their net long positions in COMEX Gold to a 5-week low in the week ended September 15, just before the Fed policy meeting, while increasing their short positions (these groups are usually reliable contrarian indicators)…

New research from JP Morgan shows an uptick in confidence in bullion and Gold equities based on investors polled in its latest Gold and Precious Metals Survey…JP Morgan itself has turned more bullish on the sector…

Silver is clearly finding support from China again, Commerzbank stated in a note today, adding that last month’s imports of 353 tonnes “constituted the highest imports since February 2014“…

China’s imports of refined Nickel dropped to the lowest level in 4 months in August, underscoring flagging demand as the stainless-steel industry slowed…Nickel is one of China’s most important metals with that country comprising just over 50% of global demand according to a report today from Credit Suisse…

BNP Paribas believes the U.S. dollar will have especially strong sensitivity to upcoming comments from Federal Reserve officials after the central bank left interest rates unchanged last week…over the weekend, 3 regional Fed presidents reiterated their expectation to raise rates this year, including San Francisco Fed President John Williams (2015 voter), Richmond Fed President Jeffrey Lacker (2015 voter) and St. Louis Fed President James Bullard (2016 voter)…focus will now shift to the other Fed speakers this week, starting with Atlanta Fed President Dennis Lockhart (2015 voter) later today and leading up to Chair Janet Yellen on Thursday…

Oil Update

WTIC has strengthened today after data showed U.S. drilling slowed and a report said $1.5 trillion worth of planned production was uneconomic at current prices…Goldman Sachs said in a report that rig data pointed to a decline in U.S. Oil production between the 2nd and 4th quarters of this year of more than 250,000 barrels per day (bpd)…meanwhile, the head of commodities research at Commerzbank said reductions in U.S. production should, eventually, reverse Oil market fundamentals, giving prices a lift…

Today’s Equity Markets

Asia

China’s Shanghai Composite gained 59 points or 2% overnight to close at 3157…Japan’s Nikkei went in the opposite direction, however, losing 2% to finish near support at 18070…

China’s top economic planner has announced the implementation of mixed ownership reforms in electricity, Oil, rail and airlines sectors as part of Beijing’s overhaul of its inefficient state-owned enterprises, Reuters cited state media reports today…meanwhile, current market perceptions of China are “thoroughly divorced” from the reality on the ground, according to the latest China Beige Book (CCB) Survey, which has found that while the economy slowed in Q3, there are no signs of an impending growth collapse…

Europe

European markets are up moderately in late trading overseas…Alexis Tsipras is once again Greek prime minister after a decisive victory in yesterday’s snap election in that country…he’ll return to power in a coalition government…speaking to cheering crowds in a central Athens square, Tspiras promised a period of stability and said he “felt vindicated” after quitting in August to start on a clean slate with voters…if Tsipras and Ontario’s Kathleen Wynne can get their respective shaky governments re-elected, Stephen Harper more than deserves another majority in October…

North America

The Dow is up 174 points as of 8:00 am Pacific…after 3 consecutive months of positive gains, the U.S. housing market cooled last month, with sales of existing homes falling more than expected, according to latest data from the National Association of Realtors…

In Toronto, the TSX has added 176 points while the Venture is up 2 points at 552..the Venture is trading above its 20-day moving average (SMA) for the 5th session in a row, the longest such streak since May…

Why Garibaldi Resources’ (GGI, TSX-V) Grizzly Central Could Soon Draw Major Attention

In January 2014, Doubleview Capital (DBV, TSX-V) confirmed a Cu-Au porphyry discovery at its grassroots Hat Project – never previously drilled – on just its 8th drill hole…as low as 4 cents in late December 2013, DBV became a 10-bagger within 4 months…the discovery – critically the second in the district, 10 km southeast and on trend from the Star porphyries – sparked a major staking rush, and helped breathe fresh life into the struggling junior resource sector…each round of subsequent drilling at the Hat has delivered even better results, and now the Association for Mineral Exploration for British Columbia refers to the Sheslay district as “the #1 greenfield project in B.C.”…

This district packs enormous geological punch, and some veteran observers believe it has the potential to literally change the economic landscape of northwest British Columbia…hence, the political gamesmanship we’ve seen from Tahltan Central Government President Chad Day…investors, however, can take comfort in the fact that almost the entire Sheslay district is backstopped by the 2011 Atlin Taku Land Use Plan, a landmark agreement that involved multiple stakeholders and was co-managed by a First Nations group (Taku River Tlingits) and the provincial government…Premier Christy Clark heralded the deal, stating it “will bring certainty for economic development”…

Fast-forward to today, and Garibaldi Resources (GGI, TSX-V) has an even greater opportunity than DBV had in 2013 as first-ever drilling rapidly approaches at Grizzly Central…we say “greater” because the knowledge of the district has literally increased exponentially over the last 2 years after 50 new drill holes – even over the last 6 months given the incredible work that DBV chief geoscientist Dr. Abdul Razique has done to put together the “puzzle” of the Hat…in fact, it wouldn’t be an exaggeration to state that Dr. Razique has written “The Dictionary” for the Sheslay district…

Garibaldi has not only learned from the success and mistakes of others in the district, but they’ve also applied their own impressive expertise to uncover some mysteries surrounding Grizzly Central…led by a team featuring C.J. Greig & Associates (Charlie Greig, M.Sc. P.Geo., is highly regarded in B.C. geological circles and is also a senior geologist for Pretium Resources‘ Brucejack Project (PVG, TSX), Garibaldi has identified a large area of “intense interest” and high geological merit at Grizzly Central that has been “hidden” for decades by a relatively thin but widespread (95%) overburden cover…

Click on the arrow below for the first excerpt of Jon’s interview the other day with GGI President and CEO Steve Regoci:

Last Thursday’s news from Garibaldi regarding Grizzly Central tells us the following:

1. It shares similar geological, geophysical and geochemical signatures as those observed at the adjoining Hat and Star properties;

2. Classic discovery set-up – the drill targets at Grizzly Central are defined by NNE striking signatures producing a series of magnetic highs and geochemical anomalies that run parallel to sizeable magnetic lows…significantly, these features appear to cross-cut the dominant NW-SE striking regional fabric;

3. Soil samples at Grizzly Central show a strong correlation between copper and other pathfinder elements including Silver.

Two other critical observations on our part:

a) The drill hole “hit” ratio in the district is remarkable, better than 70% (approximately 90 holes altogether, historically and over the last 2 years);

b) Once a second discovery is made in a district – the Hat system is nearly 10 km on trend from the Star deposit – this really helps validate the “multiple” deposit theory…some of Canada’s best geologists are looking at the Sheslay district and they’re saying it’s “pregnant” with mineralization from one end to the other…while anything’s possible and there are never any guarantees in this business, it’s almost unimaginable that with deposits on the Hat and the Star, there would be none on the Grizzly which is nearly 3 times the size of those properties combined and has the same rock types, geophysical and geochemical signatures…

The Grizzly is also host to the Kaketsa “heat engine”, a dominant topographical feature that has obviously played some sort of a key role to help form this geological paradise…while each property in the district shares certain common features with its neighbors, no deposits are expected to be exactly the same in terms of character or size…different “domains” appear to exist in the district…new discoveries could be made in this region for many years to come…

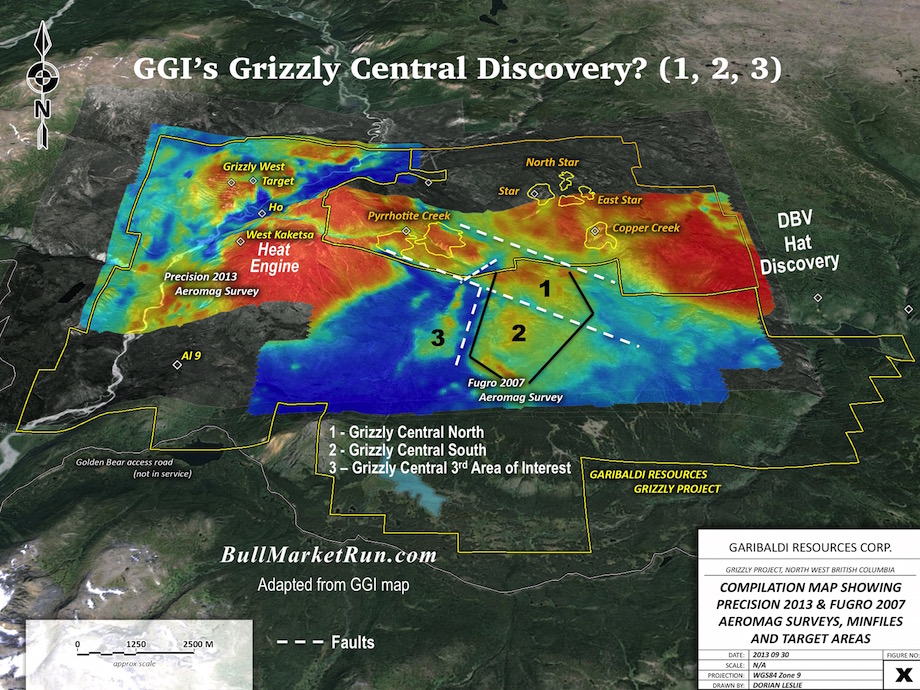

This Map Says It All

Below is a map showing airborne magnetic data from the Grizzly and part of the Star (available on the GGI web site)…in consultation with geologists, we’ve added the fault structures around Grizzly Central in dashed white lines, and divided Grizzly Central into 3 major “hot spots” which roughly cover the 25 sq. km Garibaldi defined in its news last Thursday…

The dashed lines represent interpreted fault structures around Grizzly Central…given what’s known about the Sheslay district, the areas bounded by the faults at Grizzly Central are exceptionally high value targets for Cu-Au porphyry deposits…

Our guess is that GGI will drill initially somewhere within “Area 1” (far left corner near cross-cutting fault structures?), just off from a mag high and into a strong geochemical anomaly…

Pure Energy Minerals Ltd. (PE, TSX-V) Update

Pure Energy Minerals (PE, TSX-V) announced this morning that it has initiated the permit applications for fall and winter exploration drill programs on the company’s Clayton Valley South Lithium Brine Project in Nevada…

Robert Mintak, Pure Energy’s CEO, commented: “Priority target areas have been defined for the next phase of drilling that will target expected depths of approximately 500 metres, subject to approval by the BLM. With the recent exercise of warrants, the company is well funded for this next phase of exploration drilling to further delineate and expand upon our recently published inferred resource report, completed in accordance with National Instrument 43-101.”

Technically, PE remains in a consolidation phase following the rapid run-up to a multi-year high of $1.03 last week which added to already technically overbought conditions in the RSI(14) and other indicators…the rising 20-day SMA, not shown in this 2.5-year weekly chart, provides support in the mid-60’s…even stronger support exists around the 50-cent level which was important previous resistance…

PE is off 2 cents at 68 cents as of 8:00 am Pacific…

Sernova Corp. (SVA, TSX-V) Update

Last month (August 7), we suggested readers take a close look at Sernova Corp. (SVA, TSX-V), a speculative non-resource play in the health sector…SVA is a clinical-stage company developing products for the treatment of chronic diseases using therapeutic cells transplanted into an implanted medical device to replace missing proteins or hormones…last week, the company announced the signing of a licence agreement with the University Health Network (UHN) of Toronto to gain exclusive worldwide rights to certain patent-pending technologies that relate to the development of stem cells into glucose-responsive therapeutic cells for the treatment of patients with insulin-dependent diabetes…

John’s first chart on Sernova August 7 showed a strong Fib. support band between 20 and 23 cents that coincided with rising 200 and 300-day SMA’s, an ideal “entry point”…SVA has made a significant climb since then and is now threatening to break out from chart resistance at 31 cents…it’s up 2 cents at 33 cents as of 8:00 am Pacific after touching a high of 37 cents in early trading…as always, perform your own due diligence…

Silver Short-Term Chart Update

Silver has been quite volatile since the beginning of last month, swinging between strong Fib. resistance just below $16 and solid support around $14…the band of Fib. resistance between $15.30 and $16.60 has proven to be very stubborn since early June, certainly due to the reality of a slowing global economy with Silver having a lot of industrial uses…

Silver’s immediate challenges are to overcome Fib. resistance at $15.29 and $15.79…RSI(14) continues to trend higher which is encouraging…

Silver Long-Term Chart Update

An explosive push higher (eventually) – is this actually a scenario that could unfold in Silver over the next couple of years?…quite possibly, given the look of this 34-year monthly chart, though at the moment it’s hard to understand all the factors that could come into play to generate the kind of “Wave 5” move that could develop…

Have we seen the bottom of “Wave 4”?…that’s quite possible, but still too early to tell…encouragingly, RSI(14) has so far managed to hold support which goes back to 2001…

Sell pressure continues to remain very strong, however, as shown by the CMF – amazingly, at levels not seen in nearly 25 years since the low of $3.51…this intense sell pressure at the moment, which started modestly in early 2013, could continue for a while yet…this should be viewed in a larger context as a bullish contrarian indicator given historical patterns…it doesn’t necessarily mean, however, that Silver has found a bottom just yet…

Note: John and Jon both hold share positions in GGI. Jon also holds a share position in DBV.

45 Comments

Im hoping EQT closes 2nd financing this week as well as some additional news. Would be nice to break above 0.23

I am hearing EQT 2nd PP closed by end of week. But you know how that goes. What I do know is is drilling is near, and thats the spark to start the fire.

With the DBV court hearing assumed to be three weeks from the Sept .8th. application , that should put at at this months end . Does anyone have a date for that hearing ? If there was I missed it .

GGI announcing a drill turning on the grizzly will give everyone in the area a great uplift and all that should happen shortly . Some of those profits taken in PE will be looking for other opportunities and both GGI and DBV could be candidates. IMHO

Dan – I forgot to comment on your post the other day on EQT. If it is halted AFTER the drilling starts and BEFORE assays, it will be one of those very,very good halts, and not one of those very bad halts. They do not have to report any ground work results prior to drilling, but I have just received word that they WILL. This could get interesting before the drill starts turning.

BMR , great article on the grizzly and area. Thanks

Thanks, Les…did you notice Regoci mentioned “bornite”? Hello, everyone, wake up…

I caught that Jon. Bornite!!!

Dan1, any evidence of bornite in the Sheslay district has always proven critical, as bornite was observed in DBV hole 6 which was a key hole in vectoring to discovery holes 8 and 11. At Grizzly Central, there’s also strong correlation between copper and pathfinder elements (including silver) in the soils, so if it looks like a duck and quacks like a duck, it’s probably a duck. This is not some “shot in the dark” as Regoci explained. They’re about to drill into the same signatures that have produced outstanding results and discoveries elsewhere in the district. Think of this district as one exceptionally large property – the mineralization and the systems don’t respect any property boundaries you see on the map. There are different “domains” on this “large property”, some differences along the “continuum” of alkalic systems, but the common features over a very broad area are absolutely stunning.

If you put your hand in front of your face, your fingers are like intrusives and stocks and dykes that are carrying mineralization in this district. The frequency of these structures is what gives you volume and grade for deposits. When drilling, you just want to ensure you avoid those “gaps” that do exist (like in any porphyry system).

Ah mama mia, GGI has “Cuivre Panache” on their land.

Ah, follow the Bornite! Great as it is formed at higher temperatures within a core area I understand. And typically found in larger, higher-grade copper deposits. Seabridge Gold’s KSM project in Western BC is a good example of this (high grade gold and copper).

Thanks for the exert of the interview, Regoci is very positive and confident. Lots of good things said, I liked this one:”we have hit the intrusive 4 or 5 feet down”

Yes Jon , another key indication GGI is part of the same system . This is good news putting the Sheslay area on track to being a world class deposit. The sooner Regoci gets that drill turning the better.

Is it the case that GGI will announce drilling before EQT and there should have a run sooner and speculation that they might hit?

02charoc – I posted that the other day about who drills first. A guessing game on that one.

Once the DBV court decision is handed down DBV will be the front runner with 25 minerized holes and more to be drilled imeadiatly picked by a highly experienced team . IMHO

Jon

thanks for that great interview with Regoci, the delay in GGI getting to this stage is a blessing in disguise… I have thought all along that they would learn much from Prosper and then DBV, even though I and everyone was frustrated with the delays and lack of news, if they hit the mother lode here at Grizzly central then the wait will be worth it… I think Regoci was trying to hold back in that interview but he couldn’t. I think he thinks Grizzly central may be the monster or key to the entire area…

thanks Jon again for preaching patience…

Gents, what your take now on PE? At a glance it seems as though most of the profits have been taken, or at least very close to it. What do the charts say? Time to get back in or wait a bit yet?

Thanks guys!

That is, after today… is resistance still at .75 and support around .50?

You can appreciate the size of this system with DBV second property east of grizzly east, this is huge, Jon did you spoke about Roradero with Regoci last week, any advance there?

Athabasca nuclear corporation becomes the largest claim holder in the garland exploration camp. the corporation now holds 805 claims parcels atenure position which exceeds any other claim position held private or public company in the garland camp,including being larger then the camp holder of equtas resources corp who acquiring their tenure under an option deal in the same vicinity.

This could revive PGX if they hit in area one.

PGX-Nothing since February 24 ????

WRR…anyone know if they actually start drilling their 6 target high grade gold property this week??

Thanks

I remember 2 or 3 years ago Regoci talked about drilling in this very same area. He seemed to suggest that Pyrotite (sp?) creek area just below PGX was the area. He also, at that time mentioned the far western area as having potential. It seems what goes around comes around. I have to assume that GGI field work must have confirmed this northern area. We shall soon see. Good luck to all stake holders. Richard l

even if PGX is revived many will not touch it though

I agree DDD$

WRR- drilling start this morning !

Regoci is going to put a positive spin on anything he says which is understandable. A year ago Rodadero was the hot property. Since then, next to nothing. What gets me is that he never updates shareholders on what they are doing. A positive spin in an interview, then off to somewhere else for a year.

Copper:

ICBC and Citibank reckon an annualised 1.5 million tonnes has already been lost this year due to power outages, strikes, floods and drought, as well as lower grade source material from producers in various places, from Zambia to Chile.

Fresh cuts and stabilizing demand could propel prices towards $5,700 per tonne in the fourth quarter, Citi’s Wilson said.

Any other unexpected supply shocks or signs that Beijing is preparing to boost spending further on industries that use copper intensively could trigger a more significant rally into next year.

The ONLY reason I got into GGI is because of its Sheslay Valley property and its definitely not because of Regoci……too much hype and no action imo….typical Vancouver stock broker. Luckily for shareholders, GGI must drill or it loses the FT money otherwise I think there would be more disappointment again with “broken promises/expecations.”

Always take what a CEO says with a grain of salt until they have proven that they can turn words into action and deliver…..

Since May 2013 Regoci to prove that he was a great talker …. no more!

Interesting, Guy. Let me present you with mostly FACTS, not opinion. Since May 2013, the time you’re referring to, the Venture is down 35% and more than 3/4 of Venture companies are trading at lower levels than they were then. GGI has almost doubled in price since that time, and completed a $1.2 million financing at 21 cents when most Venture companies have had trouble raising a nickel, or have had to raise under a nickel for incredible dilution. Since then, GGI has also made an important discovery at Rodadero which they will be returning to in a big way at the most strategic time. In 2014, GGI was one of the best performing stocks on the Venture, and jumped 6-fold from its May 2013 low. Next, Regoci has put GGI shareholders in a highly favorable/leveraged position in the Sheslay district with an opportunity for a drill hole discovery imminently. That could make GGI one of the best performing stocks on the Venture in 2015 as well.

And, by the way, Guy, if you’re not a great talker in this business, you’re in the WRONG business. Would you prefer a CEO who can’t promote and get the word out? I know lots of those and I wouldn’t put a nickel into those companies. Regoci has some important accomplishments on the ground for GGI, including a big deal with Paramount, to back up his talk.

Any updates on the Chad Day court injunction?

DBV- we are still in wait mode but I expect that we should in the “zone” to hear from the court injunction by months end.

Thanks DDD4

I secretly hope a poacher mistakes Chad Day for a rare species of owl

With RED CHRIS it took two weeks and this is now two weeks in the case of DBV

Lets just hope for the old Rogoci magic in that he can pump the Grizzly like he did Rodadero and we see a 6-fold increase in share price. just don’t forget to dump after the pump.

GGI

The story has been the same on ggi for along time. Regoci tells a good story but that’s about it. Investors have been waiting for along time for an “intense, action packed” summer which never seems to materialize. I know ggi has a lot of fans here but my feeling is you won’t see drilling any time soon. Gmho

What do we think of the chart on VID. V. Recent name change and news today?

Jon, what happened to the “archive/search” button that was located at the top right of your home page??

Thanks

It’s at the bottom left corner for now, Jeff, as other buttons needed to be added up top.

Anyone know the date set for the court hearing for DVB ?.

I don’t suspect it will be a closed hearing so it should be public knowledge , someone in the area could attend just to hear what Chief Day has to say foe himself or if he even attends .

I doubt that Day will attend after what he has caused….

DDD4 , do you happen to know the court date ?