Gold has traded between $1,223 and $1,135 so far today…as of 10:00 am Pacific, bullion is up $8 an ounce at $1,133…Silver has added 4 cents to $14.81…Copper has slipped to $2.29…Crude Oil is off more than $1 a barrel to $45.08 after a mixed EIA inventory report (Crude inventories fell but gasoline inventories jumped) while the U.S. Dollar Index is down one-tenth of a point at 96.25…

Commerzbank looks for Chinese and Indian demand to support Gold in the coming months…the bank cites Swiss customs data showing that Switzerland exported 173.9 tons of Gold in August, 8% more than in the previous month, with nearly 70% of this shipped to Asia. “Whereas exports to India remained constant month-on-month, 50% more Gold was exported to China,” Commerzbank says. “Exports to Hong Kong were actually more than twice as high as in July, which suggests that China also imported more Gold from Hong Kong last month.”

Commerzbank looks for Chinese and Indian demand to support Gold in the coming months…the bank cites Swiss customs data showing that Switzerland exported 173.9 tons of Gold in August, 8% more than in the previous month, with nearly 70% of this shipped to Asia. “Whereas exports to India remained constant month-on-month, 50% more Gold was exported to China,” Commerzbank says. “Exports to Hong Kong were actually more than twice as high as in July, which suggests that China also imported more Gold from Hong Kong last month.”

Jeffrey Christian, managing director of CPM Group, looks for Gold to rise modestly over the next 2 years but then start to accelerate to the upside more sharply…he told the Denver Gold Forum yesterday that he expects mine production to continue rising into 2017…but then output is likely to start falling, while investors and central bankers will be competing to buy the smaller amount of newly refined mine supply. “In 2018, mine supply starts falling,” Christian said. “It’s a foregone conclusion.”

This will happen, Christian insists, even if Gold prices start rising again, since there is a long lag between when prices climb and producers can ramp up output. “We think the world will get more nasty,” Christian added. “And when they get to the market, they’ll see central banks buying. And the central banks and private investors will compete for increasingly scarce ounces of newly refined Gold.”

High Dollar Helps Keep U.S. Manufacturing Sector In Check

The U.S. manufacturing sector is finding no relief this month, missing expectations, as it continues to hover just above contraction level, according to the latest flash PMI index data…private research firm Markit said its September PMI estimate remained unchanged at 53.0, compared to August’s final reading…according to consensus reports, economists were expecting to see a reading at 53.3…the report noted the index is below its post-financial crisis average at 54.3…

The American Left Is At It Again – Clinton Comes Out Against Keystone XL

Injecting herself into the middle of a Canadian election campaign, which in itself is cause for concern, U.S. Democratic presidential candidate Hillary Clinton announced in a town-hall-style meeting in Iowa yesterday that she has reversed her stance against the Keystone XL Project. “I oppose it,” she proclaimed, “because I don’t think it’s in the best interest of what we need to do to combat climate change.” She was more poignant in a Tweet last night: “Time to invest in a clean energy future – not build a pipeline to carry our continent’s dirtiest fuel across the U.S.,” she wrote…

Keep in mind, 5 years ago, Clinton stated the following about Keystone when she suggested the Obama administration was leaning toward approving the project: “We are inclined to do so and we are for several reasons…we’re either going to be dependent on dirty Oil from the Gulf or dirty oil from Canada.”

So what changed for Clinton?…energy security for her has about as much value as national security (the two are very intertwined), given her email scandal and other actions while she was Secretary of State under Obama, but that’s another story…she’s certainly seeing lots of “green” right now but in the form of money from deep-pocketed activists that have made “climate change” a thriving business down south…Keystone is a Poster Boy for these activists who for some strange reason would rather import Oil from disgusting regimes in the Middle East who are threatening the security of America and the continent, than from America’s closest and most reliable ally…

For its part, TransCanada pointed to a recent American Petroleum Institute poll that showed 68% of U.S. voters support the project, and that 67% said failure to make a decision to approve has hurt the economy…it vowed to keep pressing ahead with seeking U.S. approval…

“The U.S. imports millions of barrels of Oil every day, so where do Americans want their Oil to come from?,” TransCanada spokesman Davis Sheremata stated. “Do they want it from Iran and Venezuela, where American values of freedom and democracy are not shared? Or do they want Canadian and American Crude Oil transported through Keystone XL? We have always believed the answer is clear.”

Of course Keystone has been vetted by the U.S. State Department twice, and got passing grades…the project would be responsible for transporting one-fifth of all of Canada’s Oil exports to the U.S., and findings from the U.S. State Department have indicated that the pipeline is a cleaner alternative to rail, with Keystone creating 28% to 42% lower greenhouse-gas emissions… but none of that makes sense to Clinton or Obama…

Notley Lectures Alberta Business Leaders

The energy industry will be critical to Alberta’s economy for many years to come, but it must “clean up its environmental act,” Premier Rachel Notley told business leaders in her keynote address to the Alberta Chamber of Commerce last night…

Notley said her NDP government will work to promote a healthy business climate (they’re certainly off to a great start, jacking up taxes, spending and regulation), noting she will be travelling to New York next week to sell the province as a “good bet” for investors…she’s not likely to get a warm response as Alberta has quickly gone from being one of the best places in North America to invest to The Land of Uncertainty and Jurisdictional Risk with a government full of social workers, teachers, yoga instructors, university students and environmental radicals imposing their wrong-headed policies on a once-thriving province that is blessed with incredible resources and entrepreneurial spirit…

Governments in Alberta – provincial and municipal – must clean up their act but that won’t come until disaster strikes, unfortunately…the Canadian Federation of Independent Business released a study this week showing that spending by Alberta municipalities grew by 82% between 2003 and 2013…by contrast, the population rose only 24% during that time…provincial governments over the last decade have also been wasteful, and the recently elected NDP has already hiked spending and taxes before even introducing its first budget…this saga will take a couple of years to play out, but the NDP is sure to drive Alberta right off the cliff (then the Great Revolt)…

Today’s Equity Markets

Asia

China”s Shanghai Composite tumbled 69 points or nearly 2% overnight to close at 3117…Japan’s Nikkei re-opens tomorrow after an extended holiday in that country…

When Chinese President Xi Jinping addresses some of the top names in Chinese and American business today in Seattle, they may be most interested in what he says about progress toward a treaty that would provide a framework for broader investment in each nation’s economy…Apple Chief Executive Tim Cook, Microsoft CEO Satya Nadella, Amazon founder Jeff Bezos, billionaire investor Warren Buffett and Jack Ma of Chinese e-commerce giant Alibaba are among the 30 executives attending a closed-door discussion moderated by former U.S. Treasury Secretary Henry Paulson, who has advocated for such a treaty…all of the American CEO’s participating signed a letter to Xi and U.S. President Barack Obama urging them to support an agreement…

Yesterday, Paulson said the U.S. and China need to collaborate to expedite reforms and combat slowing growth in China. “They have an economic model that has run out of steam,” Paulson told CNBC. “They need to place much more reliance on domestic-led growth, domestic consumption.” Paulson also added, “The most troublesome economic issue is corporate and commercial cybertheft. I think it’s the biggest risk when you look at U.S.-China relations. Ultimately, it’s very important for our two countries to come together.”

Meanwhile, the Asian Development Bank yesterday cut its estimate for China’s growth to 6.8% for 2015, down from its previous forecast of 7.2% and below 2014’s 7.3% growth rate…it expects the growth rate of the world’s 2nd largest economy will fall to 6.7% in 2016…separately, Barclays also slashed its growth outlook for China yesterday to 6.6% and 6% for 2015 and 2016, from 6.8% and 6.6% previously…

The slowdown has also prompted market calls for bolder stimulus measures from Beijing and the country’s central bank…economists are hoping for greater clarity about the economy and policy in the context of President Xi Jinping’s U.S. visit…

Europe

European markets were up modestly today…

North America

The Dow climbed as high as 16355 in early trading today but has since backed off…as of 10:00 am Pacific, the Dow is down 88 points…

Below is a 35-year Dow weekly chart that shows how the index has so far been unable to break above a trendline that’s currently cutting through the low-to-mid 18000’s…what’s critical to watch here is the RSI(14), currently 48%…previous significant corrections (even crashes) have occurred when the RSI(14) has fallen below 45% support…in the Dow’s favor is a still-rising 1000-day moving average (SMA), currently 15105…the index came within less than 300 points of that level during the August 24 “Flash Crash”…that long-term SMA represents very important support, and could be re-tested…

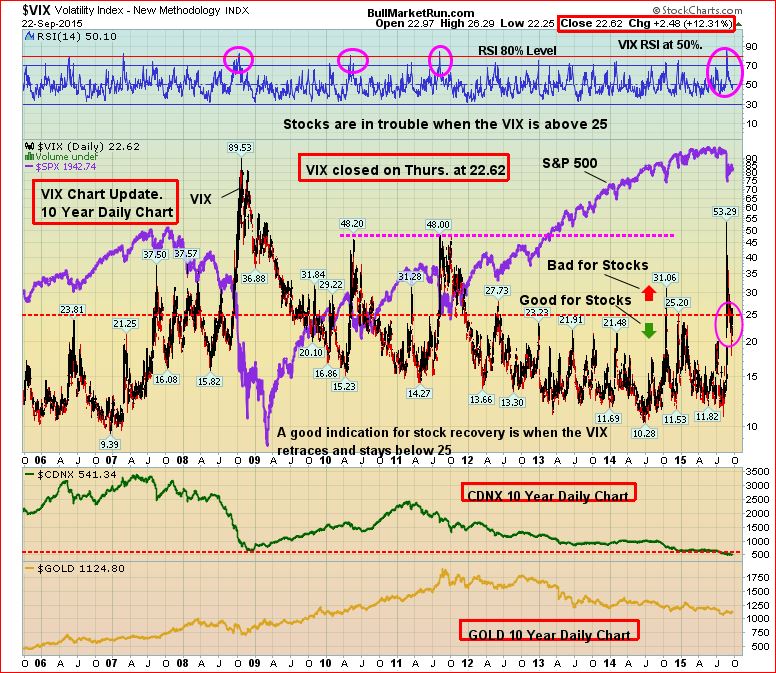

Volatility Index (VIX) Update

The VIX has settled down, for now at least, and that’s positive for stocks – the key will be for the VIX to remain below 25…it closed yesterday at 22.62…

TSX Updated Chart

Like the Dow, the TSX also has strong support at and near its still-rising 1000-day SMA (blue line on this 6-year monthly chart)…RSI(14) is at oversold levels not seen since late 2011, so that makes this a “safer” time than the summer of last year when extreme overbought RSI(14) conditions had persisted for an extended period and needed to be cleansed…hence, a more than 2000-point drop in the index since then…strong band of support between the Fib. 50% retracement level (12831) and where the TSX is now…

As of 10:00 am Pacific, the TSX is off 73 points while the Venture is up 3 points at 544…

B.C. LNG Delays Will Hurt, Says Fraser Institute

Delays in approving and building liquefied natural gas export projects will cost British Columbia $20 billion a year in lost revenue from 2020 onwards, according to a study by the Fraser Institute. “As a result, British Columbians will invariably forgo higher levels of job growth and billions of dollars in tax revenues which could pay for things like health care or public education,” said Ken Green, co-author of the report and senior director of natural resource studies at the Fraser Institute…

Delays in approval from the federal government, provincial authorities and First Nations would likely see the B.C. lose 9.5% of its current GDP, the report said…it argues that “the cost of regulatory delay imposed upon LNG investments in B.C., defined as export revenues forgone. That cost is substantial: $22.5 billion in 2020, rising to $24.8 billion in 2025.”

Biorem Inc. (BRM, TSX-V) Update

Very few companies on the Venture are making money or have attractive share structures…Biormen Inc. (BRM, TSX-V) scores on both those counts…we’ve been very excited about this company for several months given its revenue and earnings momentum, and we first introduced BRM to our readers when it was trading around 30 cents…it more than doubled in value at the end of August/early September after its Q2 financial results were released…that created temporarily overbought conditions with the anticipated pullback showing strong support in the 40’s…

With only about 13.5 million shares currently outstanding, Guelph-based BRM is an environmental biotechnology/engineering company that designs, manufactures and distributes a comprehensive line of high-efficiency air emissions control systems used to eliminate odors, volatile organic compounds and hazardous air pollutants…may not sound glamorous but these guys are making money and that’s what counts…they’re also benefiting from a lower Canadian dollar…much more on this undiscovered gem in the days and weeks ahead as it is clearly a Venture success story…

BRM is up a penny-and-a-half at 43.5 cents as of 10:00 am Pacific…

Kaminak Gold Corp. (KAM, TSX-V) Update

Kaminak Gold (KAM, TSX-V) released an updated mineral resource estimate for its Coffee Project in the Yukon this morning…Coffee now has 52.4 million tonnes at an average grade of 1.68 g/t Au for 2,824,000 oz of contained Gold in the indicated category, and 42.7 million tonnes at a grade of 1.52 g/t Au for 2,088,000 oz of contained Gold in the inferred category…those estimates are based on a cut-off grade of 0.5 g/t Au for Oxide, Upper and Middle Transitional facies mineralization and a 1 g/t Au cut-off for Lower Transitional and Sulphide material….

This new estimate represents an 8% increase in the grade for indicated resources and a 12% increase in grade for inferred resources…indicated resources have increased almost 4-fold to over 52 million tonnes compared to the 2014 estimate…

Additional drilling has provided much better control on the distribution of mineralization in the Coffee deposit…Eira Thomas, CEO, stated, “Resource and conversion drilling has gone very well and most of the assumptions used in the PEA remain relevant and defensible. Coffee remains a strong project and one of the few development track Gold projects located in Canada that can deliver sizeable, high margin production in excess of 160,000 ounce per annum in the current Gold price environment.”

KAM is unchanged at 83 cents as of 10:00 am Pacific…

Updated Charts On Two Profitable High-Grade Producers

Klondex Mines Ltd. (KDX, TSX)

Klondex Mines (KDX, TSX) continues to look very strong, fundamentally and technically…note on this 5-year weekly chart how the RSI(14) is now very close to the 50% support level while the rising 200-day SMA is at $2.95…the 200-day has provided excellent support since it reversed to the upside in the summer of 2013…

KDX is a nickel higher at $3.25 as of 10:00 am Pacific…

Kirkland Lake Gold Inc. (KGI, TSX) Update

Kirkland Lake Gold (KGI, TSX) bounced off the $5 level recently, as expected, as that is exceptional support defined by Fib. analysis and a rising 200-day SMA…Kirkland Lake began to “turn the corner” in late 2013 with its Macassa operation, one of the world’s richest Gold mines by any measure…KGI recently reported net income of 5 cents per share in the first 3 months of its 2015 “stub year” which began May 1…that was the company’s 5th consecutive quarter of positive earnings and free cash flow generation…

KGI is up 2 pennies at $5.46 as of 10:00 am Pacific…next major chart resistance at $6.32…

Note: John, Terry and Jon do not hold share positions in BRM, KAM, KDX or KGI.

30 Comments

biv.com/article/2015/9/lawsuit-week-mining-exploration-firm-claims-first-/

I am hoping this court case with Chad Day is short and sweet with a restraining order for Chad and the granny’s to allow drilling to proceed without further interference.

Les, and hopefully we get a substantial settlement for damages

Respect is a 2-way street…for Chad Day, that also means respecting the laws of the land, other First Nations (he stepped on the Taku), his own people (some lost work because of his actions), and B.C. taxpayers from whom the Tahltan received over $1 million to implement the Shared Decision Making Agreement that he no longer wanted to respect…

Sameer , anything involving a cash settlement will more than likely make this drag on in time . Just a restraining order is all that’s required to get DBV back drilling to prove up this enormous deposit which could be worth $1 billion. Not to worry about financing this project I’m hearing theirs lots of backers with deep pockets that will take this to the finish line. Let’s not forget the connection between Dr. Resique and the mining giant Antofagasta .

Jon , interesting bit of information about the Tahltan receiving $1million for their part in the shared land agreement.

B.C. taxpayers should be more than a little distraught, Les, but we’ll get into that at the right time.

Dave- good call on EQT.

EQT continues to look really powerful…hard not to imagine a breakout above John’s Fib. level on this…bids should build on ASC at 3.5 on the “area play”, that could get interesting…

Equitas Resources Corp. Provides an Update on its Garland Exploration Program

16:25:00 09/23/2015

News out on EQT—

Equitas Resources Corp. Provides an Update on its Garland Exploration Program

Print

Email

September 23rd, 2015 – Equitas Resources Corp. (TSXv: EQT) (FSE: T6UN) (“Equitas” or the “Company”) is pleased to provide an update for its Phase 2 program on the Garland nickel-copper property in Labrador, Canada. Due to initial results from current ground geophysical work Equitas has acquired additional claims to the west adjoining the Garland property. Twelve anomalies have now been identified and the Company has commenced drilling.

The 2015 Phase 2 field program at the Garland project kicked off on August 23rd, with field crews arriving at the recently completed 25-person field camp near the west end of Tasiuluk lake, at the northern end of the property. Despite being hampered by poor weather conditions limiting helicopter operations, significant progress has been made in the evaluation of conductivity anomalies detected by the VTEM survey flown in March.

Further interpretation from final processing of the B-field Tau component of the VTEM data has resulted in three new conductive signatures being identified at O, P and Q (see attached map). Tau anomalies can reflect more conductive bodies with slowly decaying signal, typical of large massive sulphide bodies.

Geological mapping and prospecting have been completed over all of the conductivity target areas except anomaly M. No possible sources for the underlying conductivity have been identified in the outcrops examined to date. This is not unexpected, considering the interpreted depths of the VTEM anomalies, significant overburden cover, and the exploration model that considers favourable target rocks to be overlain by younger ferrodiorite and ferrogranite intrusions.

A total of 39 km of line-cutting has been completed over the anomalies. Large Loop PEM surveying by Crone Geophysics has been completed at anomalies A, B, C and Q. At anomalies A and B, the response signatures have been explained by highly magnetic lithologies coupled with low VTEM bird height, creating an apparent conductivity anomaly termed Super Para-Magnetic effect (SPM). These targets are of no further interest.

At anomaly C, surveying with Crone PEM resulted in the definition of a good quality E-W trending conductor, flat-lying with minimum core dimensions of 15m by 300m, occurring 70m below surface. Definition of this response helps to validate the interpreted Southern Response Trend (SRT, see attached map), an multi-km E-W trending area of conductivity, magnetic and structural features straddling a large E-W offset of the Archean-Proterozoic suture, analogous in scale, morphology and setting to the Voisey’s Bay Intrusive Complex and related mineralization. This sparked the recent staking of license 023365M, consisting of a 132 claim block comprising 3,311 hectares, designed to cover the western extension of the SRT. Interpretation of the PEM data over the large conductive signature at Q is ongoing.

Springdale Forest Products have commenced drilling with borehole GP15-001 (collar at 582975E, 622376N, NAD 27 – UTM Zone 20N, Az. 290, Dip -55). This NQ borehole is designed to test VTEM anomaly D, part of 2 km trend of variable conductivity, coincident with a Ni-Cu-Co lake sediment anomaly, and resident in an E-W structure of the Gardar-Voisey’s Bay Fault set. An update on drilling will be made available once all results have been compiled and interpreted.

Commenting on the results, VP Exploration Everett Makela stated, “I am pleased with the progress of the Phase 2 campaign to date. After initial slow start-up due to poor weather conditions, we are executing our plan to fully test the conductivity responses this year. The three additional anomalies at O, P and Q increase our odds for success, and we are adjusting the program to accommodate exploration of these targets. Recent interpretation of the multi-km Southern Response Trend has led to a shift of exploration focus to this area. We will continue to provide updates on results as they become available”.

NI 43-101 Disclosure

Everett Makela, P. Geo., VP Exploration for Equitas Resources Corp., a Qualified Person as defined by National Instrument 43-101, supervised the preparation of the technical information in this news release.

Jon

your thoughts on the EQT release today?

thanks

At first glance, Greg, I like it a lot. They know what they’re doing, they’ve refined some targets and enhanced their understanding of this package, leading to a 15% expansion of it to the west. And the drill – the truth machine – is now finally starting to turn. Will get more into it later, was tied up on other matters when this crossed the wire. Let the fun begin.

dropped some targets, found some new ones really quickly, and as usual, a drill will tell us if VTEM and EM etc are all we hoped they would be

drill to kill

Looks like eqt started drilling, ok good,hey regoci, your turn now!!!!

Looks like they didn’t find any interesting rocks on top but they didn’t expect to as these anomalies are deeper than the ones at Voisey Bay. They have narrowed down their targets. That’s what I get out of it but I am certainly no geologist. Glad they are finally drilling! As Tombc said, time for GGI to get going now.

EQT – This statement is of the utmost significance.

Tau anomalies can reflect more conductive bodies with slowly decaying signal, typical of large massive sulphide bodies.

Like I said yesterday, last call on EQT. We were scratching our heads when all we got was an update, but were told drilling started. They just waited till the end of the day to put it out.

Drilling begins – I also like the rest of the news release. Based off of “c” they acquired the other property and the way I take it, they have done a preliminary check and find them to be strong targets.

Lets hope for the find of a lifetime.

The most talked about mining play on this board (EQT) finally announces drilling and it gets real quiet here. What is everyone thinking? Or was everyone watching the Jays game tonight.

Thanks Dan and Dave, I didn’t see your comments a few minutes ago when I posted.

Using a baseball analogy, Eqt is rounding third and charging home plate. Looks like there will be a play at the plate. They’ll either or they won’t.

Things are about to get more interesting IMHO. We’ll be doing an EQT update tonight.

Dan – cmon, why so quiet. Are you kidding me, they are making out their Xmas list and adding figures on their calculator.

opps, meant Danny, not Dan

Jon, more interesting is right. Remember where Hardy is right now.

Danny, they did ref the rocks. Remember, that pic of the gossan is on their property, they just did not say where. this is directly out of Hardy’s mouth at the conference in Toronto before he left for Aussie.

Dave

do you know if is Hardy still in Australia

thanks

Thanks dave, glad they are finally drilling, I think tomorrow’s trading will be very interesting. Finished reading the Big Score, a great read. When they drilled Voisey Bay it took a while, not every hole hit sulphides but they have much better technology today. Like you said before, a trading position and a core position.

Greg, it is my understanding that he is still there.

You got it Danny, some of us are in the core at .07