Gold, trying to snap a 4-session losing skid ahead of tomorrow’s key U.S. jobs report, is relatively flat at $1,115 as of 11:00 am Pacific…Silver is up a penny at $14.52…Copper is off 4 cents at $2.30…Crude Oil has been volatile today due to geopolitical events and a hurricane watch on the U.S. east coast…it’s currently off 11 cents at $44.98 a barrel, as the hurricane fears have subdued, while the U.S. Dollar Index has slipped more than one-tenth of a point to 96.12…

A risk premium could build in Crude over the situation in Syria which may also potentially impact Gold as well…Russia’s launch of airstrikes in Syria yesterday marks its biggest Middle East intervention in decades, thanks to a weak administration in Washington, and reports are that these airstrikes are actually targeting U.S.-backed rebels in an effort to aid the Assad regime…the goal of Putin’s operation appears to be to recapture territory the Syrian government lost to rebels, not specifically to target ISIS, with Reuters reporting that the Russian airstrikes will soon be accompanied by Iranian and Lebanese Hezbollah ground forces…Obama’s “strategy” of defeating ISIS in Syria and promoting the Free Syrian Army has spectacularly failed to bring about its stated aims, and now Putin has jumped in…how this is all going to play out is anyone’s guess, but a world without effective American leadership – and Vladimir Putin allowed to do whatever he wishes – is not a safer place…

A risk premium could build in Crude over the situation in Syria which may also potentially impact Gold as well…Russia’s launch of airstrikes in Syria yesterday marks its biggest Middle East intervention in decades, thanks to a weak administration in Washington, and reports are that these airstrikes are actually targeting U.S.-backed rebels in an effort to aid the Assad regime…the goal of Putin’s operation appears to be to recapture territory the Syrian government lost to rebels, not specifically to target ISIS, with Reuters reporting that the Russian airstrikes will soon be accompanied by Iranian and Lebanese Hezbollah ground forces…Obama’s “strategy” of defeating ISIS in Syria and promoting the Free Syrian Army has spectacularly failed to bring about its stated aims, and now Putin has jumped in…how this is all going to play out is anyone’s guess, but a world without effective American leadership – and Vladimir Putin allowed to do whatever he wishes – is not a safer place…

Silver Coin Market In Supply Squeeze

Reuters reported this morning that the global Silver coin market is in the grips of an unprecedented supply squeeze, forcing some mints to ration sales and step up overtime while sending U.S. buyers racing abroad to fulfill a sudden surge in demand…the U.S. Mint began setting weekly sales quotas for its flagship American Eagle Silver coins in July because it can’t meet demand, and the Canadian mint followed suit after record monthly sales in July…in Australia, the Perth Mint sold a record of more than 2.5 million ounces of Silver this month, nearly 4 times more than in August, and has begun rationing supply of a new line of coins this month, a mint official said…

“Silver (coin) demand is absolutely through the roof,” said Neil Vance, wholesale manager at the Perth Mint. “There seems to be a bit of frenzy as people think there is a shortage of silver. But in fact it is a (crunch in) manufacturing capacity.”

Meanwhile, the American Eagle Gold coin saw total sales of 397,000 ounces last quarter, compared to 127,000 ounces sold in Q2…in addition, the Mint sold 74,000 ounces of its American Buffalo Gold coin in Q3, 82% higher than sales seen from April to June…

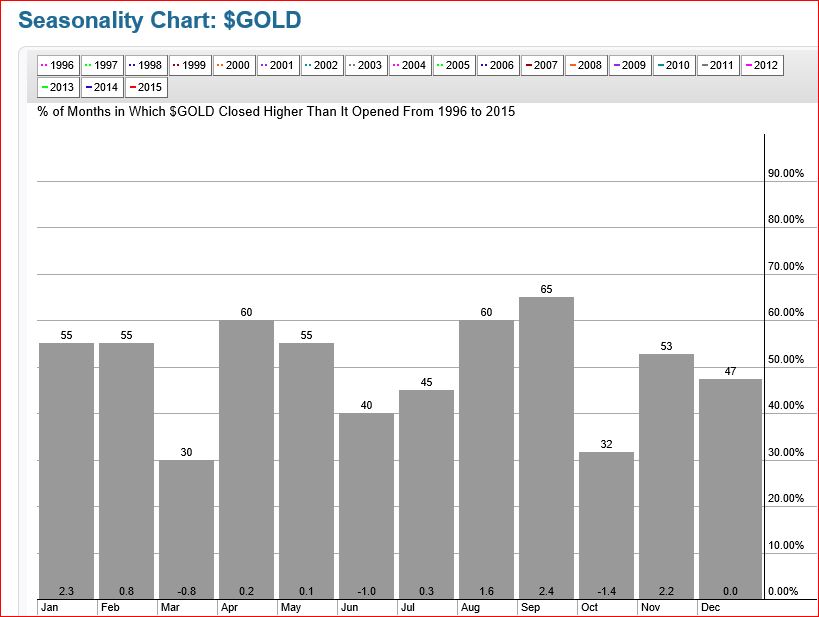

Gold Seasonality Chart

Gold did not enjoy its typical September as bullion declined 1.7% last month vs. its average gain of 2.4% going back to 1996…October should prove interesting…while Gold has risen in most Septembers (two-thirds of the time) over the last 2 decades, it has done just the opposite in October…the best 3-month period for bullion has been July-August-September, but November has had some good kicks to the upside as well…

CRB Index 10-Year Monthly Chart

The CRB Index has so far held on to critical support which is the 180 double bottom low (not shown on this chart) that formed between 1999 and 2002…while it’s impossible to say at this point if the index will ultimately hold that support (the overall trend remains bearish), a significant rally could certainly develop given historically extreme oversold RSI(14) conditions…

The CRB, heavily weighted of course by Crude, is flat at 193 as of 11:00 am Pacific…the 200 level is near-term resistance – a push above that could jump-start a rally…

Today’s Equity Markets

Asia

China’s official manufacturing purchasing managers’ index (PMI) ticked up to 49.8 in September, slightly better than expectations, vs. a reading of 49.7 in August…the final Caixin/Markit PMI, however, fell to a fresh 6-and-a-half-year low of 47.2 in September, vs. an earlier flash estimate of 47…Chinese markets are closed for the week-long National Day holiday starting from today…

In Japan, the Nikkei shot up 334 points or 2% overnight to close at 17722…

Europe

European markets were mixed today…

North America

The Dow is off 113 points as of 11:00 am Pacific…the U.S. Manufacturing sector remains in expansion territory but momentum continues to wane, according to data from the Institute for Supply Management…the ISM’s PMI showed a reading of 50.2% last month, down from the August reading of 51.1% and below expectations…the PMI has been showing a relatively steady decline in the manufacturing sector since October 2014 when the index peaked at 57.9…

In Toronto, the TSX is down 111 points while the Venture is bucking the trend, up 1 point to 525…the Canadian economy is performing better than expected, especially considering the weakness in commodities…yesterday, Stats Canada reported that GDP grew 0.3% in July, close to matching the 0.4% gain of the previous month…

Fission Uranium (FCU, TSX-V) Update

Fission Uranium (FCU, TSX) has proven up a world class Uranium asset in Saskatchewan (Patterson Lake South), but the stock steadily headed lower after the early July announcement of a merger between Fission and Denison Mines (DML, TSX)…while FCU’s tumble from an intra-day high of $1.10 July 7 to the low 60’s now is a reflection of overall market conditions the last few months, it’s also true that investors just aren’t too keen on this merger…one has to wonder right now if it’ll even go ahead…

The way to make money in the market is to acquire quality stocks at a discount, not by chasing the flavor of the day…John’s chart is telling us that Fission is trading in an attractive area at the moment, very close to the bottom of a downsloping flag…directly below that, there’s excellent support at 50 cents (a Fib. level)…

October last year was a great time to be accumulating Fission – it more than doubled from a low of 65 cents…this October likely represents another unusual opportunity, especially considering the very oversold technical conditions and the strong support levels…

FCU is off a penny at 61 cents as of 11:00 am Pacific…

NexGen Energy Ltd. (NXE, TSX-V) Update

Heavy volume in NexGen Energy (NXE, TSX-V) this week with some sell pressure, but the stock has reclaimed the 60-cent support level after Monday’s sharp sell-off on no news…Monday was just a bad day across all market sectors, and free-trading NXE stock from its late May financing at 50 cents has come into play…

As reported Sept. 22, NexGen continues to hit high-grade Uranium mineralization as a major drill program continues at its Rook 1 Project in the Athabasca Basin…the Arrow zone now comprises 4 high-grade shear zones – A1, A2, A3 and A4 – that are subparallel to each other in sequential order from northwest to southeast…this is shaping up to be a tremendous deposit…

NXE is unchanged at 62 cents as of 11:00 am Pacific on total volume (all CDN exchanges) of 3.3 million shares…definitely some heavy fund involvement here as they’re selling the private placement paper and riding the warrants…

Garibaldi Resources Corp. (GGI, TSX-V) Update

Garibaldi Resources (GGI, TSX-V) has developed a very powerful case for a potential new drilling discovery in the Sheslay district, and keep in mind it was Doubleview’s Hat discovery in early 2014 that sparked a staking rush and helped rekindle interest in the junior exploration sector…

Activity at the Grizzly has recently intensified after crews first arrived on the ground in mid-August to carry out final work in advance of first-ever drilling…Garibaldi has a unique advantage at the moment, given the wealth of knowledge regarding the district that it and its neighbors have accumulated over the past 2 years…as GGI reported September 17, and as President and CEO Steve Regoci discusses in this short interview, it’s becoming increasingly evident that the geological, geochemical and geophysical signatures throughout the Grizzly Central area – never previously drilled – are closely matching those observed at the adjoining Hat and Star porphyries…

Click on the arrow below to listen to this interview excerpt…

Technically, GGI is strongly supported by a rising 50-day moving average (SMA), currently 8 cents, with next important resistance at 10 cents following the breakout above the downtrend line…

Note: John and Jon both hold share positions in GGI. Jon also holds a share position in DBV.

37 Comments

athabasca nuclear announce 18000 acre expansion of garland lake property.

One large natural resources investor says the bottom of recent copper cycles has been marked by the closure of US mines, once owned by Phelps Dodge but now controlled by Freeport-McMoRan. Freeport has hinted it is going to take 75,000 tonnes of capacity out of the market, according to analysts.

“That’s nowhere near enough. But once Freeport has raised more equity perhaps it will be more aggressive,” says the investor, who believes the copper price will stabilise once 1m tonnes of production exits the market.

That view is echoed by Bank of America Merrill Lynch, which thinks at least 500,000 tonnes of additional cuts are necessary to rebalance the market. This is unlikely to happen unless prices fall to $4,400 a tonne on the LME, the bank said.

“The protracted four-year bear market in copper will in all likelihood only come to an end when miners align supply growth with more subdued global demand expansions,” Merrill says.

Chinese state factories shrank for a second straight month in September, but the pace of contraction was slower than in August.

“The data may be suggesting China is about to turn a corner, (and) that at some point we will see more robust demand growth rates,” said Bart Melek, head of commodity strategy at TD Securities.

“At the same time, we’re seeing the supply side respond to lower prices. There is a risk the supply/demand balance becomes tighter than the market is expecting.”

Jon, nice interview with Regoci, but did you ask him when they expect to be drilling? I mean October is already here and like you said almost 2 weeks ago, they had 30 days or so to punch a few holes and see what they have before deciding to winterize the camp and keep the drilling going in the event of a major hit. I am confident they will hit big, but time is slipping by.

Peru declared a state of emergency in the area around MMG Ltd. ’s Las Bambas mine after clashes between police and protesters left three people dead. Peru is the world’s third-largest copper producer, after Chile and China, but has struggled to resolve opposition from rural communities to mining in recent years.

Copper prices marched higher in response to the news, which cast doubt on whether this year’s mine supply will match the world’s demand for the industrial metal.

Copper prices also drew strength from China’s decision to halve the tax charged on purchases of vehicles with small engines. The move is expected to boost demand for copper, which is widely used in automotive production.

“This is just one more example of supportive Chinese fiscal policy, which could see commodities’ demand cyclically improve over the coming three to six months,” Macquarie said in a note.

looks like stocks on the venture are picking up steam on higher volume today

Any word on a court date for DBV? It’s already been 3 weeks and are now in October

Sam- we need to be patient for another 2 weeks….

Any guesses on what grades Eqt needs to deliver to please the market?

Agree Dan, time is really running out, they know much more than we think about grizzly central, Jon, why do they wait to the last minute like this, they sure have their drill plan ready at this point, remember me doing homework all night before exam in high school.

Martin, it’s not a case of GGI waiting for the “last minute”. I believe they are truly seeing something very significant at Grizzly Central in terms of G-cubed – geology, geophysics, and geochemical, exceeding even their own expectations given the extensive overburden cover that was “masking” the attractiveness of this area. No doubt some of the best minds in the business are reviewing all data with the goal of pinpointing with precision the best possible location for the first hole in order to make a first-strike hit that could literally change this company, the district and even the market. Those are the stakes. So this is never as easy as it may seem. This is also different than drilling other types of mineral deposits, and GGI has a real opportunity for an immediate hit given what’s known about the surrounding area. Quite simply, they must hit. There is really no margin for error here. Not a question of “time is running out”. Time is endless, actually, if they hit within the first few holes; obviously they have to start drilling shortly but they’re well within what I would call the “comfort zone” at the moment, weather-wise given their current camp set-up. Time runs out only when you don’t hit; hence the significance of getting the target right.

Sam , it may have taken some time to locate Chad Day and serve him, but the process is on track and proceeding. No doubt about it that court date is coming.

I continue to think that Grizzly will not drill as long as DBV will not have an injunction in his hands!

Guy, I guess we’ll continue to agree to disagree – the situation with DBV and the injunction has absolutely NO bearing on GGI going ahead to drill. None whatsoever. I can state that categorically as an absolute FACT. We know. We’ve been on top of this story from the beginning.

I sincerely hope you’re right Jon the start of drilling at Grizzly will surely help DBV to resume drilling rapidly !

Guy, the start of drilling will help DBV and everyone. The real key then becomes GGI hitting. As Regoci stated this morning, they have the roadmap. District drill hole success ratio is about 70%. That’s very high. They want to take those odds even higher and attempt to hit a “sweet zone” right off the bat. I can guarantee, a major such as Antofagasta, if they’re looking curiously at the Hat right now which wouldn’t surprise me, they would jump in with all feet if a third discovery is made on a third property in the district. It will prove beyond a shadow of a doubt that this is a prolific Cu-Au porphyry Corridor with important economies of scale (multiple deposits). And I do believe the odds of finding a stand-along high-grade Gold deposit somewhere in this district are also very real. Just 30 km west of the Grizzly was the past producing high-grade Golden Bear mine, and high-grade gold deposits also follow a NW-SW trend in this area. This is northwest B.C. Geologically, very richly endowed.

Seamus – I don’t think its a question of a particular grade that EQT has to hit initially. With all these strong targets and the staking of that SW corrider, I think if they hit anything, the stock will move up on speculation on all the other targets. How much it moves up will then depend on that so called grade. One commodity that I do not like to trade a lot is oil stocks. They are such high risk/ high reward. I don’t think you can put EQT in such a catagory even without a first hole result. I’m not saying it won’t go down if they find nothing, of coarse it will. But it would not be the type of fall that oil stocks take and it would rebound quickly. The reason of a quick rebound is because of these other strong targets. They are not just drilling into one like Voisey Bay had, they have 12 super targets now. There is a lot of anticipation of a hit somewhere on one of these targets. It may be one they drill 2 weeks from now or a month from now, but I believe they find something big. Because of this and the eyes on this stock, it is risky to be out of this stock entirely.

The same holds true for GGI.

Also, the PP is suppose to close Monday. With this being said, I look for 2 scenarios tomorrow on trading activity. It will open even or red and stay red touching the strong support at .15 and closing at .155 or .16 and completing its down cycle. – or open even or red and stay red throughout the morning and then move up strongly in the afternoon on high volume and close green. This is what I see coming tomorrow.

Note that Athabasca picked up more ground today, Dave. The last time they did that, it was on the heels of EQT extending their package to the west.

We have an updated EQT chart from John. The pennant has not been violated, it continues its formation and remains intact, and also within a broad upsloping channel. The next 2-3 trading days will be quite important. I agree with your scenario for tomorrow.

Jon, are they going for high grade gold somewhere, did you have any discussion about wolverine and why the have acquired those claims. I the release they said that it’s their understanding of the district that made them do this move. They had more that enough porphyry target!?

Yes, our interview included discussion of the Wolverine, Martin (Golden Bear claims). We’re still working thru excerpts. They like what they see there – not only the high-grade gold showing, but reviewing more of the historical data. More than $1 million was spent there in the 90’s. GGI is awaiting results from work that was started there in August but they are very keen on this area which also includes the Golden Bear road access.

One cannot rule out a high-grade Gold hit somewhere at Grizzly Central (could be hiding anywhere). Obviously a Cu-Au porphyry system is the exploration target, but you have to be on the lookout for anything. Keep in mind as well that if there are indeed multiple Cu-Au porphyry deposits in the district (2 already), not each deposit is going to be exactly the same. There will be some differences along the “continuum”. So it will be interesting to see what those differences might be at Grizzly Central.

thanks Jon, one more thing gang. I am not saying this will happen, but with all the shorts out, can you imagine EQT getting halted after the PP closes next Monday (I have been told this) and EQT announcing something good and the stock opening at .30 or .40 or .50 – those shorters are going to look short all right. They are going to look like munchkins.

Few things more exciting than a short squeeze, Dave. At any point along the way here, if EQT drills into massive sulphides, it’s a whole new ball game. That’s what will keep the speculation active. Right now it’s just the first inning. You’ve got some of the best Voisey’s Bay experts watching over this, so Garland is in very capable hands. New technology, experience…it gives EQT a big leg up on those companies who quickly shot into Voisey’s Bay in 1995. Suitable rock package for a discovery.

Dave, what’s the latest short position number that you have? Usually shorts do well but I think this time were going to catch them “with their shorts down”!!

“China is likely to roll out new policies in the fourth quarter,” said Hao Hong, chief China strategist at Bocom International Holdings Co. in Hong Kong. “We are looking for more fiscal stimulus, such as favorable tax treatment and industry-specific policies on property, auto, new energy and environmental protection.”

Copper neared its 200-month moving average. “When you’re looking at price patterns and you look at 2008, we got down to the 200-month moving average and bounced from there,” Mike Dragosits, a senior commodity strategist at TD Securities in Toronto, said in a telephone interview. “You probably have some technical strategists saying potentially there’s a bottom in place, based on that particular indicator.”

Copper steadies; falling stocks offset demand growth worries. Stocks of copper in LME-registered warehouses have fallen about 14 percent to 319,425 tonnes since late August. In China, bonded inventories fell 120,000 tonnes through September, Citi analyst David Wilson said.

“So we’re actually beginning to get a copper market that is beginning to tighten quite significantly,” Wilson said.

The closing of the first tranche of the PP is expected to be announced on Monday, not the complete PP.

U.S. employers slammed the brakes on hiring over the last two months and wages fell in September, raising new doubts the economy is strong enough for the Federal Reserve to raise interest rates by the end of this year.

March?

Wow, I can’t believe that actual real job numbers came out, it’s about time the truth came out on the U.S. They have been fudgeing these numbers for my months now…imo.

Tom, I don’t think those are the real numbers either, it’s really probably even lower

Hey D4…you say we need patience for 2 more weeks with DBV. Is that just your opinion or have you heard something? Cheers.

The probability the Fed will move by its Dec. 15-16 meeting tumbled to 33 percent from 46 percent before the jobs data.

Yeah the numbers are seriously dodgy. China’s numbers, USA’s numbers, …

I agree Sam, if you happen to be listening to trump lately, it’s more like 20% unemployment rate, I tend to agree.

Labor force participation is the lowest in 38 years

No way the Fed will raise rates in 2015…dollar is in trouble.

PE bouncing again off support with good volume

Qe coming soon to a theatre near you…