Gold has traded between $1,104 and $1,143 so far today after a big “miss” in the U.S. jobs report…as of 8:45 am Pacific, bullion is up $26 an ounce at $1,139…Silver has surged 70 cents to $15.22…Copper is flat at $2.32…Crude Oil is off 42 cents at $44.32 while the U.S. Dollar Index has tumbled more than half a point to 95.54…

The U.S. economy posted another month of weak job growth in September, suggesting a high dollar and global economic struggles are sapping momentum from the U.S. expansion…non-farm payrolls increased a seasonally adjusted 142,000 in September (private sector payrolls grew by just 118,000), far below the consensus forecast and the trend over the past 18 months, according to this morning’s report from the Labor Department…

The U.S. economy posted another month of weak job growth in September, suggesting a high dollar and global economic struggles are sapping momentum from the U.S. expansion…non-farm payrolls increased a seasonally adjusted 142,000 in September (private sector payrolls grew by just 118,000), far below the consensus forecast and the trend over the past 18 months, according to this morning’s report from the Labor Department…

Wages also dipped slightly last month while the labor force participation rate, already hovering near the lowest level since the 1970’s under the Obama administration, fell to 62.4% from 62.6%…

Earlier this week it was reported that the manufacturing sector, hit by the strong dollar and weak global demand, expanded at the weakest pace in more than 2 years last month…many economists now estimate that economic growth slowed to an annual pace of between 1% and 2% in the 3rd quarter…

Quite simply, the Fed appears to have missed its window to hike interest rates for the first time in a decade…it now faces a real danger of losing credibility with the market given its “guidance” over the past year…Fed funds futures are now pricing the first rate hike will come no earlier than March 2016…

It appears long-time Fed foe Peter Schiff, CEO of Euro Capital, may have been bang-on when he stated recently in an interview on CNBC that the likelihood of another round of easing is actually greater than a rate hike: “The whole world has been fooled by this Fed con,” said the Euro Pacific Capital CEO. “Most people believe the Fed. They believe the Fed is going to raise rates. I don’t think she (Fed Chair Janet Yellen) ever intended to hike rates. They are in a monetary roach hotel, and they will never be able to raise rates back up.”

An Increasingly Bearish U.S. Dollar Index

We’ve maintained since the spring that the Dollar Index is in trouble, and the technical and the fundamentals are both backing that up…if the Dollar Index were to plunge to base support around 88 in the coming months, this would likely give Gold a strong lift while taking some pressure off the beaten-down commodity sector as a whole…

This chart shows a Dollar Index clearly in a downtrend that should accelerate during this 4th quarter, especially with the unlikely prospect now of a Fed rate hike until sometime in 2016 (maybe?)…the Dollar bulls, who were stampeding from last summer to the spring of this year, were betting on the Fed beginning a tightening cycle by now which just isn’t happening…

Dollar Index-Venture Comparative

The historically extreme relative strength of the greenback vs. the Venture should begin to weaken during this 4th quarter as right now we’re likely at the point where the big gap you see in this chart between the Dollar Index (black line) and the Venture (red line) should begin to narrow…this increases the likelihood of some improvement in the Venture over the next 6 months, giving investors a better overall climate within which to operate than the one we’ve been hampered with over the past year…the Venture typically struggles during a period of U.S. dollar strength, and the dollar’s technical posture will be much weaker entering 2016 than it was coming into 2015…

Mining The Moon

Moon Express, a start-up that plans to mine the lunar surface for rare and precious metals, took one step closer to making its moonshot a reality yesterday, signing a deal with Los Angeles-based Rocket Lab for 3 robotic lunar craft launches starting in 2017…among the moon’s mineral riches: Gold, Cobalt, Iron, Palladium, Platinum, Tungsten and Helium-3, a gas that can be used in future fusion reactors to provide nuclear power without radioactive waste…

Moon Express has won more than $500,000 under NASA’s Innovative Lunar Demonstration Data Program and $1.25 million as a part of Google’s Lunar XPRIZE competition, which will award $30 million to the first company that lands a commercial spacecraft on the moon, travels 500 meters across its surface and sends high-definition images and video back to Earth…

Mining Voisey’s Bay

Equitas Mining (EQT, TSX-V) is on the rebound after weakness at the open this morning as it briefly traded as low as 14.5 cents…Fib. support at 15 cents is superb (this level also represents the bottom of the broad upsloping channel), and the pennant formation is still intact despite the weakness of the last few days…buy pressure (CMF) has remained steady during this bout of profit-taking…

EQT is unchanged at 16 cents as of 8:45 am Pacific…

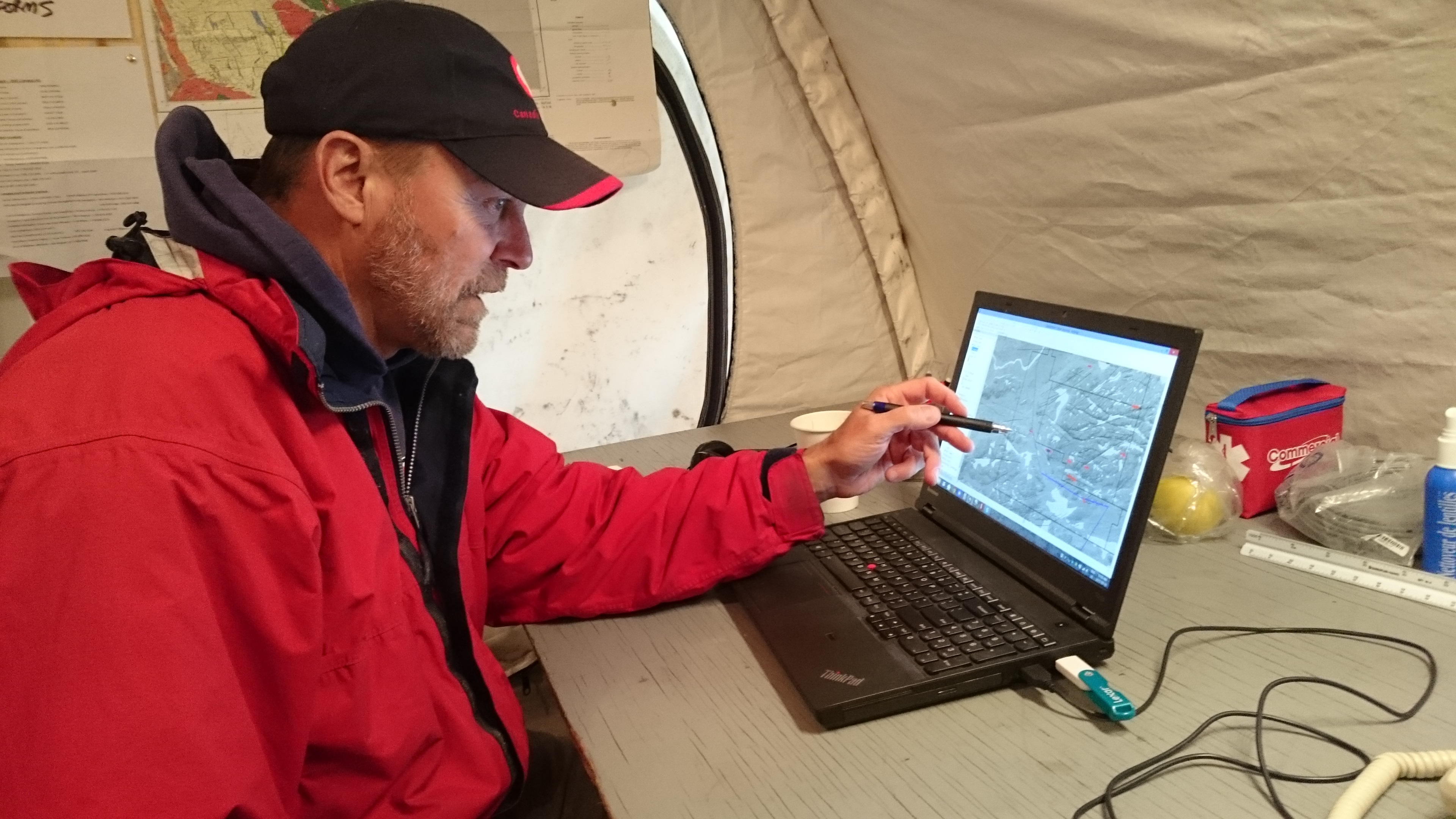

This is still very much the “first inning” of drilling at Equitas‘ Garland Nickel Project 20 miles southeast of the Voisey’s Bay mine…EQT’s technical team, led by Everett Makela (pictured below at the Garland camp) is blessed with intimate knowledge of the Voisey’s Bay discovery and the potential of the surrounding area, so the drilling of this project could not be in better hands…if there are massive sulphides and a deposit to be found at Garland, this group is as capable as any to deliver a discovery hole…

Today’s Equity Markets

Asia

Japan’s Nikkei was relatively unchanged overnight, closing the week at 17725…on the data front, Japanese household spending increased 2.9% in August from a year earlier, beating Reuters‘ estimates for a 0.4% rise…

China’s Shanghai Composite remains closed for the week-long National Holiday…

Europe

European markets were up modestly today…producer prices in the euro zone, however, were down 0.8% in August from July and down 2.6%, year-on-year…the declines were more than forecasters expected and added to the mounting fears of price deflation gripping the European Union…this latest news adds pressure on the ECB to implement further monetary policy easing measures…

North America

The Dow was down sharply earlier this morning but has since recovered most of its losses…it’s down 92 points as of 8:45 am Pacific…

In Toronto, the TSX is off just 64 points, buoyed by a strong move in the TSX Gold Index…meanwhile, the Venture has shed 3 points to 523 as of 8:45 am Pacific…

The surge in Canadian home prices in the 2nd quarter of 2015 ranked among the biggest gains in global real estate markets, according to a Scotiabank study released yesterday…with an 8.2% rise year over year, Canada registered the fourth highest pace of growth in the world…Ireland, with a 13.3% gain in prices, topped the list in the bank’s Global Real Estate Trends…Sweden saw a 10.5% gain while Australia was next at 8.3%…

Gold Stocks

One reason we’re bullish on the TSX Gold Index is the current technical posture of the DUST, the triple-short bear Gold Miners ETF on the NYSE…the DUST has been in a downsloping channel since hitting a high of $83 in the summer of 2013, so momentum on the short side has been waning…the pattern is such that the DUST has been a smart sell when it’s near the top of the downsloping channel (like it has been recently) and a smart buy when it has traded near the bottom of that channel…at some point, it’ll either break above the channel or collapse below it…the latter is the more likely outcome, in our view…

We expect the TSX Gold Index to finish the year on a bullish note – the pummeling of Gold stocks has simply reached the exhaustion point…

Pure Energy Minerals (PE, TSX-V) Update

This fresh 6-month daily chart for Pure Energy Minerals (PE, TSX-V) from John underscores the strong technical support for the stock in a band between between 50 and 55 cents, underpinned by a rising 50-day moving average (SMA) and the previous Fib. resistance level which was 47 cents…

Yesterday, PE announced that it will be holding an investor conference call next Thursday (Oct. 8) at 9:00 am Pacific…during this call, CEO Robert Mintak and other personnel will be commenting on the company’s upcoming fully financed exploration program and discussing recent corporate developments….their last conference call (August 18) was very worthwhile to listen to…

Pure Energy emphasized yesterday that it’s in a strong financial position for the remainder of 2015 and beyond, and is not actively pursuing any equity financing at this point in time…they’re obviously concerned about the fact the stock price dropped in half in just 7 trading sessions, between Sept. 16 and 24, but much of that can be attributed to technical factors as temporarily extreme overbought conditions simply needed to be “cleansed”, and that is what has occurred…

PE is up 4 cents at 55 cents as of 8:45 am Pacific…

Note: John and Jon both hold share positions in EQT. Jon also holds a share position in PE.

46 Comments

Some serious buying in GBB today, must be some value here, as may be starting prod’n in Nov, permits pending. Hydro study has been submitted. Will be shipping

4gm/t material, possibly higher with nugget effect.

Jeff – sorry for delay getting back to you. It’s 12:50 eastern time now and I have been swamped with personal matters. Ok, it is my understanding there are somewhere between 3 and 4 million shorts on EQT. A cover on these could mean a nice move.

John is correct, the big tranche of the PP is suppose to close on Monday. I know that John was calling for .15 as support and I didn’t want to spook anybody, but I really like using stockta.com – This site was showing .14 as very strong support and thats what we hit and then bounced back up as expected.

All is good in Garlandland.

DDD4 – Saw your post on PE. A bounce was definitely coming today. Yesterday’s candle was an “Inverted Hammer”. When a stock opens higher the next day it is a good confirmation. They are pretty reliable when they occur near support or bottom.

As a matter of fact, I don’t think that I ever said this, but this how I suspected GGI was going to .05 when I predicted it. GGI had 3 Inverted Hammers in about a 6 day trading range when it was between .15 and .10 and they all failed to confirm the next day. I then looked at the extended chart and saw that .05 would be a double bottom.

Inverted Hammers with confirmation the next morning opening higher are very reliable.

Actually I stand corrected. GGI – that was a triple bottom on the 10 year chart which also makes it a stronger candidate to break out from there which it did.

75,000 shares of DBV traded at 8 cents this morning , pretty sad state of affairs for having 25 holes of mineralization , but what can one expect when no one knows when the court case will take place or its outcome.

GMP started buying EQT, I am pretty sure my second of the 2 scenarios comes true and we close green.

I think we should start calling this site EQTMarketRun….lol.

I don’t know Chet, the old girlfriend GBB is up on the dancefloor today!! 2nd highest TSX-V volume…..

Dave, thanks!!! With all the PP rush EQT is doing, what will be the fully diluted numbers once “the dust settles”?

I’ve been quietly accumulating ASC, base on being “close neighbour”. When NOT if EQT hits, I’m certain that ASC will move up sharply as they have now surrounded EQT Garland property.

At .035 its really a no brainer.

Your thoughts Sir David?

SACRILEGE..Chet…SACRILEGE….lol

EQT having a great afternoon…meeting a little resist. around 18.5c at the moment. Picked up more today at 15c. Pennant is looking good.

Anyone with any comments on GBB? I have seen volume of more than 4M today with no news. Still holding 100,000 at .045. Maybe there is still some hope for this dog.

what were the 3 sales of 187.500 shrs at .22 about

Does anyone have any thoughts on GBB? Big volume and no news. Still holding this dog from .045. Maybe it is not dead yet. Also holding WRR at .045. It has been a disappointment as it is supposedly drilling right now.

Haha! All in good fun…excited about the future for DBV, GGI and all the EQT holders out there! Have a great weekend.

Wow EQT hit a new high today in the states OTC market at .1669….

Hugh still a little patience with WWR you will be winner soon !

hUGH… only guess would be the permit and the info has been leaked…

Sorry Hugh WRR !

OK, who got chicken feathers and sold EQT at .15, raise your hand. Gotta go for now. I will answer all later tonight.

Sooo…why was my post regarding the short squeeze deleted?

Wow, what a day. I have plenty shares in EQT, but was tempted to pick up more today at 15 cents. Dam, I should have pulled the trigger. Congrats Jon on your pick up today at 15 cents. Smart man.

PE- text book bounce off support and on good volume…….now lets see it is continues on Monday to confirm the up trend! Conference call next week as well which should help add to the momentum.

http://stockcharts.com/c-sc/sc?s=PE.V&p=D&b=5&g=0&i=t18286640603&r=1443827857452

Jeff – EQT will have around 80 million when the dust settles. But that also lowers their market cap a little. Not bad from where I see it.

EQT blew thru that huge .19 wall like a knife cutting soft butter. Love it.

Yes, that move today in EQT Dave was a thing of beauty. Just looking at John’s updated chart which we’ll likely post tomorrow. Looks very explosive going into Monday.

What a turn around on EQT today! Impressive volume was chasing it this afternoon. In fact I think it was the biggest volume day ever for EQT. Volume rarely lies. Now time for GGI to get drilling.

Dave, do you remember when I told you a few days ago that I had a open bid for 50,000 EQT at .145 well I got filled today not bad for picking the bottom.

Keep an eye on ASC as they have surrounded EQT at Garland. Only 58 million out with the CEO owning 25% according to Jon.

Jeff – congrats to you on the .145. You scraped the dried up gravy before the pot got filled.

Jon – yes, looks explosive. Again, a stock does not trade on weakness and be at .155 at 12:39 and wind up putting 3 million up in the last hour and 10 minutes slicing through walls like they were nothing if something somewhere didn’t happen. The retail just doesn’t know it yet.

I like ASC the best of all the area plays. Not high on HHS at all.

Keep it here, keep it real.

First part of the PP was filed with exchange Thursday and will be announced Monday, we are thinking pre-market open. Second part closes later next week.

I am only relaying this and have no way of knowing for sure. There were 4 million shorts out. After today 2.9 remain. So only 1.1 million were covered out of that volume today.

Kyler is back from Aussie. My DD tells me we are going to have a good week next week.

Hi Jeff –

Just to clarify quickly, ASC has 51,643,954 shares outstanding, of which I hold 13,194,000 shares representing 25.55% of ASC’s shares outstanding.

Those interested can see a map of ASC’s royalty-free tenure position in the Garland region through our website:

athabascanuclear.com/wp-content/uploads/2015/10/ASC_Garland_Nickel_Camp_Map_October_2015.jpg

Any questions please send us a message and we’ll do our best to promptly respond:

athabascanuclear.com/contact/

Have a good weekend all,

Ryan Kalt

Chairman & CEO

Athabasca Nuclear Corporation

TSXV:ASC

Hi Hugh. Everyone fixated on EQT so GBB skipped over. Huge volume on GBB suggests to me that the C of A is not far off. Not bad for a Friday! Mondays volume may be a tell tale sign of just how close the C of A is.

EQT has gone very bullish – very bullish – bullish on stockta.com

$$$$$$$$$$$$

Thank you Ryan for your information. I believe you are the best bet if EQT does well.

Dave, I agree – I also believe ASC has strong immediate possibilities, trading at just 4 cents, considering not only the leversge of their Garland package, but the quality of the rest of their portfolio in other high-profile districts in Canada where there is activity by ASC and others. On top of that, the chart with ASC is quite explosive given the breakout above the long-term downtrend line. John’s charts have guided us wisely on numerous plays.

D4 – I see no reason why PE won’t continue on Monday. The RSI just broke above 50. The CCI just bounced off -100, the macd just went west/east and looking to curl up. You have a little resistance at .67

Jeff- you took my .145.. but first come.. first served.. good for you!!!!

Yes, good job, Jeff. John added more at .15. He went right in at the chart support. Even if chart support is exceptionally strong, sometimes you can briefly have a penny or so drop below it on an intra-day basis, and Jeff was able to catch that. Why anyone would want to sell EQT at support at this stage of the game, that doesn’t make sense…and look what happened. You need to closely follow the chart and the fundamental factors at play driving any particular situation.

Factor at play yesterday was the coordinated calling in of shares forcing shorts to cover, as evidenced by yesterday’s forced ‘buy-in’ of 570k shares at 22 cents. Timing is fortuitous. With the 1st tranche rumored to close Monday and possibly news of something even better on the way, there was no better time for KH to put on the rid-the-short campaign.

Jon- Why would anyone want to sell at .15 – Some go for the case of beer, some go for the house on the hill.

Yes, possibly news behind the PP closing. Did I say possibly? Hmmm.

Ryan,ASC..

Thanks for share structure information on ASC. I’ve been quietly accumulating the stock over the past 2-3 weeks.

Are there plans to drill the Garland property after we get amazing drill results from EQT?

Hello Jeff –

Let me extend a personal welcome to you as an ASC shareholder.

To be frank, we have not provided guidance on exploration specifics around our Garland Lake or Orbis projects yet. For reasons of fair disclosure, when we do that it will be something we announce by way of news release. However, if EQT achieves some amazing drill results on their adjacent ground then I do suspect there will be significantly increased interest by the market in what our plans will be. It would not surprise me if ASC looks to exploration work that might be similar to the path that Equitas has taken. We will be sure to keep the market informed on our plans for our Garland Lake property when/if they develop. Most recently, ASC has been focused on becoming the largest tenure holder in the Garland area. We believe that securing a commanding tenure position makes good sense right now from a risk-reward perspective.

It is also worth noting that mineral tenure staking in Newfoundland & Labrador requires a significant portion of the first year’s exploration work requirements to be put on deposit with the Government of Newfoundland & Labrador (approx 1/3 of first year claim work requirements). Companies are of course free to conduct exploration work in any given year well beyond the min. requirements and that work rolls the claim forward for additional time. Regarding the initial deposit put down during the staking process that I mentioned, those funds are refunded to the holder upon completion of the first year’s exploration requirements, so there is certainly an inherent incentive for a large-scale tenure holder to get exploration work done assuming it is justified.

Lastly, I will add that from my personal perspective I believe the route Equitas has taken thus far, which has included prospecting, VTEM, ground mag and drilling seems to be a logical exploration approach and methodology. Like many others, I hope it will prove successful for them in terms of their drilling results. Given the number of targets they have developed it might even take more than one campaign to drill test them all but that is something for Equitas to address.

Thank you again for your continued interest in the Garland area and of course ASC.

Ryan Kalt

Chairman & CEO

Athabasca Nuclear Corporation

TSXV:ASC

Global refined copper production is expected to exceed apparent demand by 365,000 tonnes, compared with a 390,000 tonnes surplus forecast made in October last year, said the International Copper Study Group (ICSG) on Friday April 24.

Meanwhile, the surplus is expected to narrow to 230,000 tonnes in 2016 as demand growth outpaces production growth, said ICSG. The ICSG predicted world mine production to increase by 5% in 2015 to 19.5 million tonnes, with growth for 2016 increasing at the same rate to 20.5 million tonnes.

The Chilean Copper Commission (Cochilco) has cut its forecast for copper prices in 2015 to $2.85/lb. from $3/lb. predicted last October, the government agency said Thursday. Prices will average $2.80/lb. in 2016, Cochilco said, but should recover from 2018.

Cochilco said it expected copper to recover during the second half of 2015 “once the price finds a new equilibrium as doubt about Chinese economic growth dissipates and investors reduce their aversion to risk.”

Glencore Plc surged in London trading.

The shares rose as much as 20 percent to 114.45 pence by 8:07 a.m. local time. The stock surged as much as 72 percent in Hong Kong earlier Monday, the most since its listing in 2011.

Glencore is in the middle of a restructuring to withstand lower commodity prices and bolster its finances. Bloomberg News reported last week that Singapore’s sovereign wealth fund, Japan’s Mitsui & Co. and at least one Canadian pension fund have expressed interest in buying a minority stake in Glencore’s agriculture business

The agricultural business may be worth as much as $10 billion, Sanford C. Bernstein & Co. said in a report on Monday.

Speculation that China may take steps to accelerate growth and that the U.S. Federal Reserve will keep its interest rate hike on hold until at least March 2016 helped underpin the markets. Investors in Chinese equities are feeling confident over the prospect of no Fed rate hike, a chance of QE4 and China stimulus hopes.

Pan Pacific Copper expects copper prices to rise to $6,000 a tonne over the next 18 months, driven by global production cuts and demand growth in Asia, although any upside will be limited in 2015, its president said on Monday.

“Copper prices will continue to languish this year, hovering between the current level and $5,500 a tonne,” President Yoshihiro Nishiyama told a news conference.

Copper prices hit a six-year low of $4,855 a tonne in late August amid fears over a slowing economy in top buyer China. Prices have since recovered to around $5,160 a tonne but are well below recent peaks above $6,300 in May.

Nishiyama said Japan’s biggest copper smelter expected prices to recover from next year, led by a series of production cuts by miners including Glencore and Freeport-McMoRan , as well as solid demand in Southeast Asia and India.

EQT – ir suggested Friday that a partial closing of the 2ndPP should occur today. still waiting for $$ from the Aussie trip though