Gold has traded between $1,083 and $1,099 so far today as “safe haven” bids have appeared in the aftermath of Friday’s terrorist attacks in Paris and France’s subsequent bombing of an ISIS stronghold in Syria…as of 9:45 am Pacific, bullion is up $1 an ounce at $1,085…Silver is relatively flat at $14.28…Copper has slipped another 6 cents to $2.14…Crude Oil was lower earlier this morning but is now up 41 cents at $41.15 while the U.S. Dollar Index has added one-tenth of a point to 99.31…

The Canadian government’s response to Friday’s horrific terrorist attacks in Paris, an act of war against one of this country’s staunchest and oldest allies, has been disappointing to say the least given the wishy-washy, dispassionate statement from new Prime Minister Justin Trudeau…even worse, Trudeau and others in his cabinet reiterated that the government will not waver from its resolve to withdraw from the air war against Islamic State terrorists, and that it will fast-track the arrival of 25,000 Syrian refugees in Canada before the end of the year…yes, real change has come to Canada, and Trudeau has already failed his first major test of leadership…

The Canadian government’s response to Friday’s horrific terrorist attacks in Paris, an act of war against one of this country’s staunchest and oldest allies, has been disappointing to say the least given the wishy-washy, dispassionate statement from new Prime Minister Justin Trudeau…even worse, Trudeau and others in his cabinet reiterated that the government will not waver from its resolve to withdraw from the air war against Islamic State terrorists, and that it will fast-track the arrival of 25,000 Syrian refugees in Canada before the end of the year…yes, real change has come to Canada, and Trudeau has already failed his first major test of leadership…

In September 2014, an ISIS spokesman called for attacks, specifically in France, Australia and Canada, releasing an audiotape saying, “If you can kill a disbelieving American or European – especially the spiteful and filthy French – or an Australian, or a Canadian, or any other disbeliever from the disbelievers waging war, including the citizens of the countries that entered into a coalition against the Islamic State, then rely upon Allah, and kill him in any manner or way, however it may be.”

ISIS has not been effectively contained and has expanded its global reach…dangerous times like this on the international stage call for very special leadership from the West…where will that leadership come from, or will Americans find it during the 2016 presidential elections?…

John McCain, R-Ariz., and the Senate Armed Services Committee Chairman, stated over the weekend, “If the administration does not get more serious about combating it (ISIS), our nation and our people will pay a grave price.”

Gold Update

Outflows from U.S. exchange-traded funds backed by precious metals have reached $1.12 billion so far in November, heading for the first monthly loss since July, data compiled by Bloomberg show…until a few weeks ago, investors had poured money into precious-metal ETFs for 3 straight months, the longest stretch since 2012…bulls were anticipating that slowing global economies, especially in China, would deter Fed policy makers from raising rates…signs of resilience in the U.S. labor market have heightened expectations that the Fed will finally deliver a rate hike next month, with the chances of higher borrowing costs in December seen at 66% according to Fed-fund futures…that’s up from 35% just a month ago…Fed-fund futures have fluctuated wildly in recent months, a trend that could certainly continue…

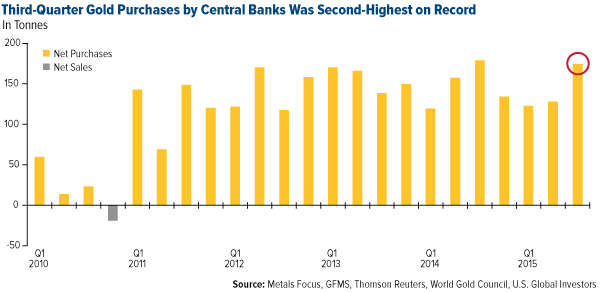

Central banks around the world are obviously absorbing some of the ETF selling as they continue to be strong buyers of Gold…in the 3rd quarter, central bank net purchases rose to 175 tonnes as reported by the World Gold Council last week…that’s the 2nd-highest level ever recorded, nearly equaling the all-time high of 179.5 tonnes in the same period last year…

Russia and China were the top buyers, but we also saw some central banks return to the list of those that hold Gold…the United Arab Emirates (UAE), for instance, reports that it now has 5 tonnes of the yellow metal, after holding none since 2003…the only net-seller for the quarter was Colombia…

In today’s Morning Musings…

1. Our next Gold ETF move after previous gains of 60% and 35%…

2. Updated charts for Silver after 12 straight losing sessions…

3. The overlooked and increasingly profitable Saskatchewan high-grade Gold producer…

4. Confirmed breakouts for both Garibaldi Resources (GGI, TSX-V) and Doubleview Resources (DBV, TSX-V) thanks to the geological power of the Sheslay district…

Plus more…to view the rest of today’s Morning Musings, login with your username and password, or click here to gain full access to this and other exclusive BMR content and features…

28 Comments

It would be nice to stick to 1 year charts. No offense to John or Jon, 10 year charts are only good if you plan on being in the stock for 2 years or more and growing a beard to match Santa. Being in a stock that long is just dead money where otherwise you can move it around and make more in that time frame. but, that’s just me, not meaning to offend anyone.

Desi is the MM for WRR and they really unloaded some today. Makes ya wonder.

Long term charts are key in estabishling trends and patterns both short and long term in technical analysis. iMO

Positive support by DBV shareholders today demonstrating bullish sentiment today that non dilutive financing options for drill program resumption, outweighs reduced warrant strike price.

Good stuff

Long term charts better define the trend which imo is integral in assessing the path of least resistance, support and resistance levels, as well as entry and exit points. Just my opinion but when long, medium and short term charts all trend in the same direction, it provides strong support for placing bets along that line.

Can someone explain to this novice investor why DBV would decrease the warrant price? Thanks.

To me it is a way to finance themselves quickly and do not dilute the company with funding of less than 0.20 but that’s just my opinion

Looks like no actual news today on any fronts

Thanks for pointing that out the book of knowledge Guy.

This novice has only been in the market since 1998

IMHO owning stock where CEO is the largest shareholder usually yields large dividends

Enough said

Thanks David. Yes that was positive news today on KEK. Shows what a tight share structure can easily do. Friday the price was under .40. The high today was .63 with a .56 close. I think there were traders from those that got in mid .30-40’s today. The 3M should just about take care of them now. I see this back to $1.00+ This week.

LTE.C could explode at any time IMO. Can’t wait to hear the next contract….Telus maybe? Or maybe a US company?

Any pro chart readers on here? Would love to hear what the chart is saying on KEK.V. Thanks in advance. I was told resistance at .64 but if it blows thru that .82?

more Alberta… Mayor from Edmonton…

He said so this past week at a city sponsored event – an event that ended up costing the taxpayer over $50,000.

Iveson wants us all to pay more for home heating. Edmonton is a winter city. And staying warm in a winter city is expensive enough.

It’s no surprise to hear Mayor Iveson talk like this. He’s an environmentalist. He likes bike lanes and taxes and he hates plastic bags. In 2007, even he attended the United Nations Climate Change conference in Bali.

Mayor Iveson thinks the most pressing issue happening in Edmonton is climate change. Really. If you’ve driven around Edmonton, the roads are terrible. The potholes can swallow a small car. But roads are a small issue, now.

Alberta is in a major recession. In fact, the jobless rate in Alberta is up to 6.5% . That’s a full two points up from last year at the same time. Statscan says Alberta has dropped almost 11,000 jobs between September 15 and October 15.

Iveson says he cares about poverty reduction. Should he really be advocating ideas that kill Albertans high paying energy sector jobs?

Kek – resistance is at .61, .68, then .73. The strongest resistance is at .82 – Its at the upper bollinger band, but all TA says it still has some room to run before correction.

Old video from FTR, fun to watch. youtube.com/watch?v=YZzkTvvgxdY

I lost my password… can BMR reset my password

Yes, Theodore, no problem…our administrator will send u an email.

EQT – double doji candle bottom at .095 a week apart. Strongest resistance is at .14. Watch her.

No photos of hole 4 from Garibaldi yet. I hope everything is going ok. Assays next week I assume, but I am hoping that hole 1 was sent before the NR and completion of hole 2.

Rumors out here in Vancouver, Tom, that we’ll be hearing from GGI any day now, which I take to be a very good sign…this would be consistent with the fact they’ve updated the market each of the past 2 weeks…

Yes Jon, Tuesday was building up to be NR day from GGI. Maybe we will hear from them with something important later in the week. I’m guessing that Mexico news will start once GGI have attracted attention to themselves with assay results from Grizzly.

I’m sure Regoci doesn’t want to get overly predictable with news every Tuesday, Tom…given the way things are going with the district now, I’m expecting we could hear something quite dramatic from both GGI and DBV this week…

We’ve been ‘expecting’ news from DBV for a few weeks now…sure would like to know what the heck is going on. Excited for what’s to come but had expected something from them by now.

Certain things are worth the wait, Steve. I can’t help but think (and hope) they have something very positive to say.

DBV – when Farshad said news Monday, that’s not what I was looking for ! he didn’t say anything regarding a start other than hopes to get in 4+ holes before Christmas break

Patience wins the day, David. That was probably just an early warning shot, before the big gun goes off.

DBV has had ample time to get all their ducks lined up ,so when they make their move it will be gang busters and they will get their 4 more holes by Christmas break.

Dave re #18, I know little about TA so when you say watch her…do you mean for a break out to the up or downside..LOL? Doji candle is beyond me. Thanks