Gold has traded between $1,069 and $1,088 so far today…as of 9:45 am Pacific, bullion is up $12 an ounce at $1,080…Silver has pushed 11 cents higher to $14.29…Copper is flat at $2.11…Crude Oil has lost 45 cents to $40.30 while the U.S. Dollar Index has slipped half a point to 98.95…

Minutes of the Fed’s last policy meeting, released yesterday, showed most members were ready to sanction the bank’s first rise in rates in almost a decade in December as long as further moves then depended on the economy continuing to perform well…expectations for a rate rise have been a major factor pushing Gold prices down more than 10% since the middle of last month, creating very oversold RSI(14) oversold conditions similar to what occurred in July as we pointed out yesterday…

Minutes of the Fed’s last policy meeting, released yesterday, showed most members were ready to sanction the bank’s first rise in rates in almost a decade in December as long as further moves then depended on the economy continuing to perform well…expectations for a rate rise have been a major factor pushing Gold prices down more than 10% since the middle of last month, creating very oversold RSI(14) oversold conditions similar to what occurred in July as we pointed out yesterday…

“It is possible that the Gold market has largely factored in a rate rise,”HSBC said in a note. “This leads us think Gold is likely to trade sideways to slightly higher, at least in the near term.”

A majority of Canadians oppose the Liberal government’s plan to resettle 25,000 Syrian refugees in the next 6 weeks, and the most common complaint is that there isn’t enough time, a new poll shows…meanwhile, President Obama yesterday vowed to veto a GOP-drafted bill that would suspend the program allowing Syrian and Iraqi refugees into the U.S. until key national security agencies certify they don’t pose a security risk…the refugee issue has emerged as a key political issue in the wake of last week’s terrorist attacks in Paris…more than half of the nation’s governors, mainly Republicans, oppose letting Syrian refugees into their states and most GOP presidential candidates have called for a pause in allowing them into the country…a Bloomberg Politics poll released yesterday found that 53% of Americans do not want Syrian refugees resettled in the United States…

For a variety of factors, the last week has been a defining moment in demonstrating how the Obama and Trudeau administrations are “tone deaf” to the threat of ISIS and radical Islamist extremism in general, which heightens the risk of attacks on this continent…speaking at the Asia-Pacific Economic Co-operation summit in Manilla yesterday, Canadian Foreign Affairs Minister Stephane Dion said “climate change is the worst threat we are facing this century”…meanwhile, U.S. Secretary of State John Kerry actually stated in Paris on Tuesday, while addressing U.S. embassy employees, that there was a “rationale” for the Charlie Hebdo attack earlier this year in France, according to various news media outlets:

“There’s something different about what happened from Charlie Hebdo, and I think everybody would feel that. There was a sort of particularized focus and perhaps even a legitimacy in terms of – not a legitimacy, but a rationale (our emphasis) that you could attach yourself to somehow and say, okay, they’re really angry because of this and that,” Kerry stated. “This Friday was absolutely indiscriminate. It wasn’t to aggrieve one particular sense of wrong. It was to terrorize people.”

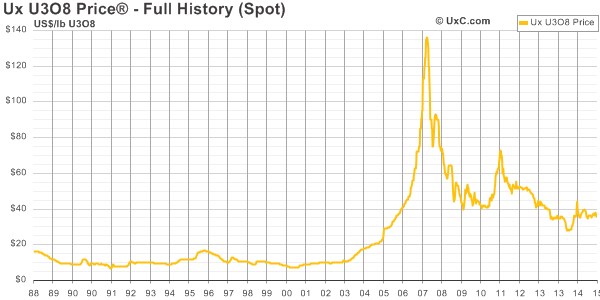

Uranium Price Surge On The Way?

While commodity prices in general are under heavy pressure, Uranium has emerged as an exception…its price has held up relatively well, currently trading at $36 per pound – virtually unchanged from the beginning of the year, though down sharply from the 2011 high of more than $70…

“We believe a violent increase in the price of Uranium will occur within 6-18 months as utilities rush to cover their uranium needs or be forced to operate their reactors below capacity,” said Rob Chang, managing director and head of metals and mining research at Cantor Fitzgerald…in a note, Chang said utilities are expected to have 15-20% of uncovered uranium requirements at the end of next year…

Other positives for Uranium include the gradual restarting of some 30 nuclear reactors in Japan over the next 4 to 5 years, although the country’s post-Fukushima stockpiles are expected to meet initial demand, as well the proliferation of nuclear reactor construction around the globe…data from the World Nuclear Association shows there are currently 438 operable reactors in the world with 65 under construction and a further 489 either proposed or planned…China, already home to 29 operable reactors and 22 under construction, is expected to drive demand for Uranium as it has plans or proposals for a further 179 reactors…

According to Palisade Research, savvy investors are now buying into Uranium-oriented stocks: “As the spot price of U3O8 moves past $45/lb, the herd of the unwashed masses will follow,” it said…one of BMR’s favorites for the longer-term remains NexGen Energy (NXE, TSX-V) which announced a $20 million bought deal financing after yesterday’s close (31.25 million common shares at a price of 64 cents per share)…the offering is expected to conclude around December 9…NXE is down 6 cents at 63 cents as of 9:45 am Pacific…

In today’s Morning Musings…

1. Venture holding at strong support – updated chart…

2. Big volume day for Nemaska Lithium (NMX, TSX-V) on news – updated chart…

3. A new non-resource opportunity with favorable risk-reward ratio…

4. Exploration news from Nevada…

Crude Oil Update

Rising U.S. stockpiles continue to serve as the most visible evidence of oversupply in Oil markets…Goldman Sachs said this morning that there remained a downside risk to prices “as storage utilization continues to climb.”

Technically, the previous support at $44 is now resistance, and we’ll see if WTIC can hold the $40 level…the dotted downtrend line in blue, currently cutting through $50, is WTIC’s biggest obstacle…

Today’s Equity Markets

Asia

Asian markets were strong overnight…China’s Shanghai Composite surged 49 points or nearly 1.4% to close at 3618… China will lower lending rates for loans made under the standing lending facility (SLF), a policy tool to inject cash into the banking system, in the latest step to support the slowing economy…the overnight rate would be cut to 2.75% and the 7-day rate to 3.25%, effective tomorrow, the People’s Bank of China (PBOC) has confirmed…the rates are currently 4.5% and 5.5%, respectively…the fresh move to lower borrowing costs for businesses is in line with recent policy easing to support the slowing economy and as Chinese banks face a surge in troubled loans…

Japan’s Nikkei gained 211 points to close less than 200 points from the 20000 level…

Europe

European markets were solidly in the green today…

The European Central Bank (ECB) considered adding more stimulus to its struggling economy at its last policy meeting and saw “potentially worrisome” downward revisions in consumer price growth…

North America

The Dow is off slightly as of 9:45 am Pacific…in Toronto, the TSX has added 17 points while the Venture has shed 2 points to 519…finally, Walker River Resources (WRR, TSX-V) has announced it will commence a drilling program December 1 at its very prospective Lapon Canyon Project in Nevada…WRR is up half a penny at 3 cents as of 9:45 am Pacific…more in Lapon Canyon in the near future as drilling draws closer…over the weekend, we’ll have important updates for our subscribers on the Sheslay district and how a “Perfect Storm” is indeed brewing for both Garibaldi Resources (GGI, TSX-V), Doubleview Capital (DBV, TSX-V)…

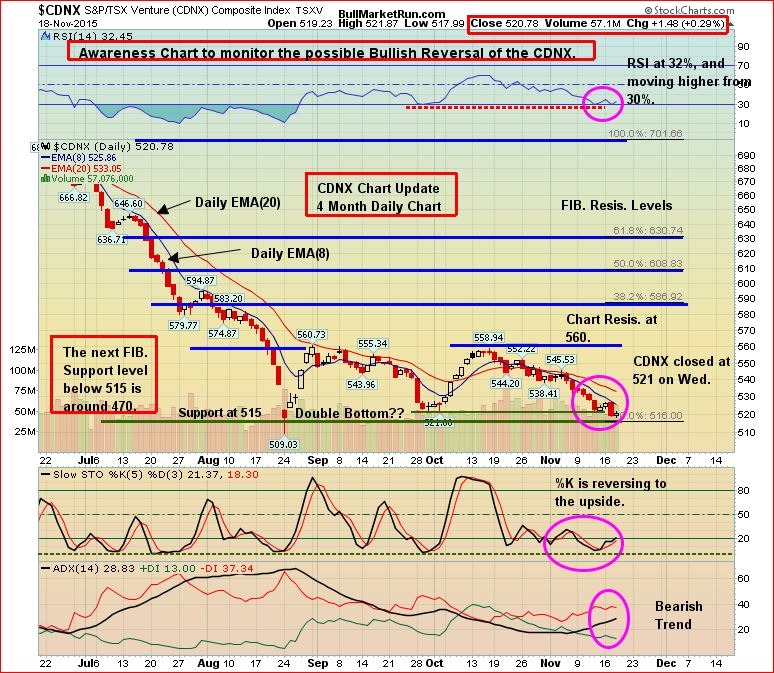

Venture 4-Month Daily Chart

The Venture is bouncing along RSI(14) support at 30% (this was a strong resistance level through July and August)…technically, the Venture’s immediate challenge is to hold this RSI(14) support and Fib support at 515, and push above the declining EMA(8) which has been pressuring the Index for the last month…a solid technical case is building for a potentially powerful move starting just prior to Christmas and leading into the beginning of 2016, so now continues to be an ideal time to be accumulating high-quality issues that are well-positioned to take advantage of a recovery in this oversold market…

Nemaska Lithium Inc. (NMX, TSX-V) Update

On Tuesday, we indicated it was a good time for subscribers to think about locking in profits on Nemaska Lithium (NMX, TSX-V) which we started following a few months ago when it was trading in the mid-to-upper 20’s – keeping in mind the Fib. resistance at 46 cents and temporarily technically overbought conditions…pre-market yesterday, NMX was halted, pending news…as often happens in these situations, the stock gapped up at the open this morning (to 45 cents) but couldn’t maintain momentum…sellers then quickly stepped in and rove NMX down to a morning low of 35.5 cents (support)…as of 9:45 am Pacific, it’s off 2.5 cents at 40 cents…

Nemaska announced this morning that it has signed an MOU with Johnson Matthey Battery Materials Ltd. (JMBM) of Candiac, Quebec, a wholly-owned subsidiary of Johnson Matthey PLC…the MOU contemplates an up-front payment of CDN $12 million by JMBM in exchange for services and products of the same value from the Nemaska Lithium Phase 1 Plant and the subsequent commercial plant to be located in Shawinigan…the MOU also includes provisions for the signing of a long-term supply agreement for Lithium salts (Lithium hydroxide and Lithium carbonate) for future expected demand for JMBM’s battery material products…the Lithium salts will be produced from the commercial hydromet plant which Nemaska Lithium also intends to build in Shawinigan…the collaboration is subject to final due diligence by JMBM and completion of the required final agreements…

The overall bullish trend is expected to continue here, but not without some consolidation that could once again test the rising 50-day SMA (currently 31.5 cents) which the stock has not closed below since early July…RSI(14) finished at 80% yesterday and will have to unwind at some point, either sooner or later, though perhaps not before another challenge of Fib. resistance at 46 cents…

Aphria Inc. (APH, TSX-V)

This marijuana play has performed exceptionally well since just before the Liberal government’s election victory in October, surging from just below $1 to a high of $1.59 November 5…yesterday, the company announced a bought deal financing at $1.30 per unit to raise gross proceeds of $10 million…

After Canopy Growth (CGC, TSX-V) announced its big financing recently, the stock soon surged to the upside…this morning, Alphria headed in the opposite direction and is off 19 cents at $1.28 as of 8:30 am Pacific…Fib. support is at $1.24, so taking that into consideration, plus the bought deal at $1.30, the APH risk-reward ratio at current levels appears very attractive…

Gold Standard Ventures Corp. (GSV, TSX-V) Update

Excellent drill results – a new discovery, actually, half a kilometer north of the Dark Star deposit at the Railroad-Pinion Project in Nevada – have given Gold Standard Ventures (GSV, TSX-V) a nice lift recently…as expected, there has been strong support at the top of the downsloping channel that GSV broke out above at the beginning of this month…the stock is now trading within a Fib. resistance band between 73 and 87 cents…drilling continues and additional success could certainly propel GSV significantly higher, so this is a play to certainly keep on one’s radar screen…

GSV is off 3 pennies at 75 cents as of 9:45 am Pacific…

Discovery Ventures Inc. (DVN, TSX-V)

Strong new management has helped turned Discovery Ventures (DVN, TSX-V) in a more positive direction as the company pushes forward with its high-grade Gold-Copper Willa-MAX Project in southeastern British Columbia…so we see this opportunity as one of the better ones on the Venture going into 2016…

Technically, it’s worth nothing that Discovery’s 200-day SMA has flattened out at 15 cents and should start reversing to the upside over the coming weeks – always a bullish sign…

DVN is unchanged at 16.5 cents as of 9:45 am Pacific…

Note: John and Jon both hold share positions in GGI and WRR. Jon also holds a share position in DBV.

53 Comments

Jon maybe you want to look at GLH and OGI – Two good Weed stocks.

Holly if I was not buying GGI last two days would be no volume 174k yesterday and on the bid again here @ 15cents.

Jon, when are assays expected for ggi? thanks

As a rule of thumb, Treb, from the time a hole is started to when a company could get back some results from the lab, you’re looking at 6 weeks anyway…GGI started drilling around mid-October…even though there aren’t a lot of companies drilling, all labs have cut back significantly on staffing…..you can be sure they are putting pressure on the lab to get some initial #’s back ASAP…with an XRF on site, that’s obviously of some help, but of course it’s the lab #’s that count…

From the Grizzly Central Magnetics Map – The fact that GC-15-04 does not show which direction and how long the hole is yet, tells me they may still be drilling hole 4. This could mean a very long intersection and could be the thickest part of the particular anomaly. Just my thought on it. Either way results of the first 3 holes must be close.

GLH is definitely undervalued. Their financials come out soon, I think next week. The preliminary estimate says 3 mil. I read somewhere where this can be a $3 to $5 stock soon. But you know how that goes too.

PHM broke the 30 degree plane of the downward high’s. It can keep going for a while.

Surprised they never filled the last of the order maybe there getting empty by chance.

Hi Dave, how did you know CXV was going up?

Thank you

Jasi:

1. TA

2. Kinda married to PHM. When PHM moves, cxv will move shortly. When PHM corrects, CXV will shortly.

Thanks on that Dave I sold GLH yesterday at 1.07 but if Jon could find a bottom here would like to re enter some where I picked it up last week at 77- 81 cents so happy on the trade but as I said would like to get it on a dip- OGI that one really gets going also went from 22cents to 1.42 in like two weeks and then they pulled the rug out with a PP maybe we can get a entry on that also if Jon has a min to look at them .

Also:

.59 is resistance for PHM – CXV broke a heavy resistance at .27 but has one more kinda heavy at .30.

They are both there you might say. If they break these tomorrow (expected to), they will make a further run. PHM could see .70 soon and CXV could see.36 soon.

GGI – on hole 5, maybe, maybe not for stuff next week, but as Jon said, labs aren’t busy, but that means they don’t have staff either. bahhh. I think there are a # of eyes waiting for drill results, and the camp has been winterized

Jon, didn’t you have 3 segments of the interview with Regoci? Only 2 were released so I was wondering when the last one would be. Unless I misunderstood.

Thanks for the reply Jon. If that’s the case we’re looking at sometime in December. Maybe Regoci fancies himself as ol’ Saint Nick this year. I wouldn’t mind some high grade in my stocking this year. ..jus sayin.

Dave- do you have any updates on EQT that you can share??

Core out!

Jeff – Not yet.

Vein Breccia at 90 Meters

Looks nice, Martin, also more of that dark pyrite/magnetite unit it appears. I’d be surprised if we don’t hear again from GGI tomorrow. Regoci is on a roll and wearing a smile. This could finish the week with a bang if there’s any indication the big hole 4 step-out has hit favorable rock.

90 meters and 150 meters. What is GGI trying to tell us? I’d say we find out very soon – like Jon said maybe more news tomorrow. My spidey senses are saying we are in for one massive NR!

The “massive NR” will come on assays, Dan1, when they’ve officially confirmed a discovery with the lab numbers, but the next update I’m sure is going to be very interesting. Any indication that they’re onto something in hole 4, a step-out of 500 m at least, would be big.

This is nice Jon, stuff like this at 90 meters, 600m apart from hole 1.

We’re on a massive systems Dan, 4.5km long, forget it 🙂

We need a high res copy of the first new pic posted. Right in the middle of the yellow circled area is a glint of something….? Could it be?

Gold???, you ask….very possible. With the system they’re drilling into, the mineralization is likely very finely disseminated in the rock…you could literally get into multi-grams of Gold or strong copper without ever being able to detect it with the naked eye.

I hesitated to say so but he’s clearly pointing to whatever IS there given the extreme close up and it being circled in yellow marker. Nice…very, very nice.

skarnoid and breccia wil be key word on the next release.

Copper Skarns

Copper skarns are perhaps the worlds most abundant skarn type. They are particularly common in orogenic zones related to subduction, both in oceanic and continental settings. Major reviews of copper skarns include Einaudi et al. (1981) and Einaudi (1982a,b). Most copper skarns are associated with I-type, magnetite series, calc-alkaline, porphyritic plutons, many of which have co-genetic volcanic rocks, stockwork veining, brittle fracturing and brecciation, and intense hydrothermal alteration. These are all features indicative of a relatively shallow environment of formation. Most copper skarns form in close proximity to stock contacts with a relatively oxidized skarn mineralogy dominated by andraditic garnet. Other phases include diopsidic pyroxene, idocrase, wollastonite, actinolite, and epidote. Hematite and magnetite are common in most deposits and the presence of dolomitic wall rocks is coincident with massive magnetite lodes which may be mined on a local scale for iron. As noted by Einaudi et al. (1981), copper skarns commonly are zoned with massive garnetite near the pluton and increasing pyroxene and finally idocrase and/or wollastonite near the marble contact. In addition, garnet may be color zoned from proximal dark reddish-brown to distal green and yellow varieties. sulfide mineralogy and metal ratios may also be systematically zoned relative to the causative pluton. In general, pyrite and chalcopyrite are most abundant near the pluton with increasing chalcopyrite and finally bornite in wollastonite zones near the marble contact. In copper skarns containing monticellite (e.g. Ertsberg, Irian Jaya, Indonesia, Kyle et al., 1991; Maid of Erin, British Columbia, Meinert unpub. data) bornite-chalcocite are the dominant Cu-Fe sulfides rather than pyrite-chalcopyrite (e.g. Big Gossan, Irian Jaya, Meinert et al., 1997). The largest copper skarns are associated with mineralized porphyry copper plutons. These deposits can exceed 1 billion tons of combined porphyry and skarn ore with more than 5 million tons of copper recoverable from skarn. The mineralized plutons exhibit characteristic potassium silicate and sericitic alteration which can be correlated with prograde garnet-pyroxene and retrograde epidote-actinolite, respectively, in the skarn. Intense retrograde alteration is common in copper skarns and in some porphyry-related deposits may destroy most of the prograde garnet and pyroxene (e.g. Ely, Nevada; James, 1976).

I really like the fact that we’re seeing the same vein from hole three and hole four. Roughly same depths and 600m out. Just when I’m getting reading to sell my shares, GGI pumps out cores/news that keeps me from selling. Hope this one is for real :o)

Nice 🙂

Tony don’t sell your share!

Tony T – why would you sell your shares?

I have been in previous plays where I have sold out prior to assays being released. You can learn a lot from a company by the way they handle a drill program and issue news. I have no plans on selling any of my shares of GGI. Really happy in the way this is shaping up and as far as risk/reward I think it is worth it to wait for assays. If assays come back positive then I am tucking this one away for either a buy out or resource estimate. Interesting days ahead.

Tony, SELL???? Now is the time to “backup the truck” and load up ahead of assay results expected soon!!!

Why would I sell? I’ve been following GGI for the last two years and finally bought at 5 cents. I’ve gotten burned for being greedy in the past and seeing the selling the last few trading days, albeit on low volume, makes me a little nervous (especially with them not putting out any core photos of hole #4). BUT GGI did put out core photos tonight and I like what I see, so I will hold onto my shares and hope this puppy hits.

That yellow circled core looks like a flicker of gold to me! I’m not a geologist so just a guess.

GGI: Wow they have hit again in my opinion. I really wish I could buy more. I love the way GGI is sending messages with the pics. Very exciting. This is going to bust through 0.20 and I am hoping for a good end to the week tomorrow. Cheers all.

Foz

Jon, maybe some of your geologist friends can comment on the most recent core. Great post by Martin. The copper skarn description certainly has similarities to the core just posted by GGI.

GGI – what kind of move can we see if the assays are positive and in our favour? What market cap would be fair game?

Perhaps visible gold in the first blurry picture…chalcopyrite present which is brassy, yellow (important copper iron sulphide). really interesting. Want some assays now.

F

Hello Jon,

As a green investor, I wonder if there is something in the past articles of BMR about the way to sell our shares after a rally or a big NR when the shares are going up like crazy….How do we know when it’s time to sell ? Maybe it could be a good topic for an article for all the followers of BMR.

If possible, I would prefer to keep this post private and not in the public comments…you could give me an answer by e-mail if you want ( [email protected] )

THank you very much

Jon

looking at the latest photos of the core, I wonder if they could make me a slab of that for my kitchen counters, now that would be nice, lol have no idea what Im seeing there…

So Jon, any feed back from your friends geologists, quite inpressive, 4 out of 4 so far, at least 60m of this calc-silicate(skarnoid) zone.

There’s no question in my mind, Martin, that they’re into a major system and in fact a new discovery for the district. One geo I did converse with tonight likes the high-temperature aspect of this system which is quite evident from previous core descriptions and photos – the one photo tonight at 150 m is another example of that, includes high-temp. calc-silicate alteration, and epidote. It just looks really solid. Could be an important connection between hole 4 and holes 1 and 3, and that would be very significant given the 500 m or so distance between 4 and 3.

One other observation – there’s something different going on here, certainly compared to the Star porphyries to the north. This is a big district, like a big bowl of stew, and each property is going to feature different parts of that stew, along with certain aspects common to all. There’s a major fault separating Grizzly Central from the Star, for example. That means different geological processes. Regoci did suggest there might be some surprises. One of those could be higher grade Gold at Grizzly Central – we’ll see. That would be very big, and the possibilities seem high given what we’ve seen so far.

WRR UPDATE TODAY TO DRILL AROUND DEC 1ST…IT’S TAKEN MOST OF THE YEAR TO GET HERE, SO, THE STOCK SHOULD START TO FIRM UP SOON? JON?

Yes, for sure, Steven1. The one advantage to the drilling starting later than expected is that hopefully a lot of that cheap PP paper from early in the year has been cleaned up. It has been frustrating waiting for this company to get going with the drilling at Lapon Canyon, but better late than never as they say. Excellent opportunity for a high-grade hit early on in drilling, given the structures there, so WRR should do well…should be a strong finish to 2015 for this stock and a great start to 2016.

GGI NR hole 4:

14.5m of overburden

22m of intense silica chlorite-sericite breccia

103m of finely disseminated chalcopyrite and pyrite stringers in andesitic volcanoclastic rocks consistently chlorite-sericite altered, featuring approximately 5-15% quartz veins

then unknown length (to end of hole) dark, strongly magnetic mafic unit with fine-grained pyrite along shear surfaces similar to that observed in GC-15-03 and GC-15-01.

Regoci does not tell us how long the hole is?

GGI news

“After 14.5 meters of overburden, GC-15-04 immediately entered an intense silica chlorite-sericite breccia for 22 meters. This was followed by a 103-meter interval with sections of finely disseminated chalcopyrite and pyrite stringers in andesitic volcanoclastic rocks consistently chlorite-sericite altered, featuring approximately 5-15% quartz veins.”

Regoci is indeed on a roll. What’s critical also about this 4th hole is that it has hit the same dark, pyrite-magnetite unit as hole 3, 600 meters to the east-northeast, and hole 1, 800 meters away…..from about 140 m right through the end of the hole…….this iron-rich unit could most certainly contain impressive gold values (plus other metals of course) given regional data…so GGI could be showing a lot of volume early on with these widely spaced holes…..the high-grade at the Golden Bear mine to the west was carried mostly in the pyrite….

Camp is now fully winterized as drill program continues…they would not be digging in here unless they knew they were onto something potentially very big.

They winterized the camp!!!

PE.V: anyone has confidence it will hold support at $0.50?

PE – no

Dave: because of the free trading shares?