Gold has traded between $1,064 and $1,074 so far today…as of 9:15 am Pacific, bullion is flat at $1,065…Silver is up slightly at $14.08…Copper has added 2 pennies to $2.11…Crude Oil is relatively unchanged at $41.51 while the U.S. Dollar Index is off one-quarter of a point at 99.96…

Get ready for a strong finish to the year in Gold…the COT structure has not been this bullish in more than a decade…significantly, the smart money commercial traders have dramatically reduced their net short positions according to the latest available data…this isn’t surprising…money managers, typically the most bearish or the most bullish at precisely the wrong times (at key turning points), are showing extreme levels of bearishness at the moment – and they’re about to be caught with their pants down…this may not happen immediately, but certainly within the next 2 weeks and that’s why we went aggressive on Gold and quality Gold stocks recently which included a bullish call on the double-long HGU…it closed at $15.74 yesterday ($3.15 pre-consolidation)…

Get ready for a strong finish to the year in Gold…the COT structure has not been this bullish in more than a decade…significantly, the smart money commercial traders have dramatically reduced their net short positions according to the latest available data…this isn’t surprising…money managers, typically the most bearish or the most bullish at precisely the wrong times (at key turning points), are showing extreme levels of bearishness at the moment – and they’re about to be caught with their pants down…this may not happen immediately, but certainly within the next 2 weeks and that’s why we went aggressive on Gold and quality Gold stocks recently which included a bullish call on the double-long HGU…it closed at $15.74 yesterday ($3.15 pre-consolidation)…

The U.S. Mint’s sales of American Eagle coins surged in November, with Gold nearly tripling month-over-month and Silver already reaching a new annual record as bullion prices fell to multi-year lows, data released yesterday showed…the mint sold 97,000 ounces of American Eagle Gold coins in November, up 185% from October and 62% higher from a year ago, after selling out of most of the 2015-dated coins as falling bullion prices attracted buyers…

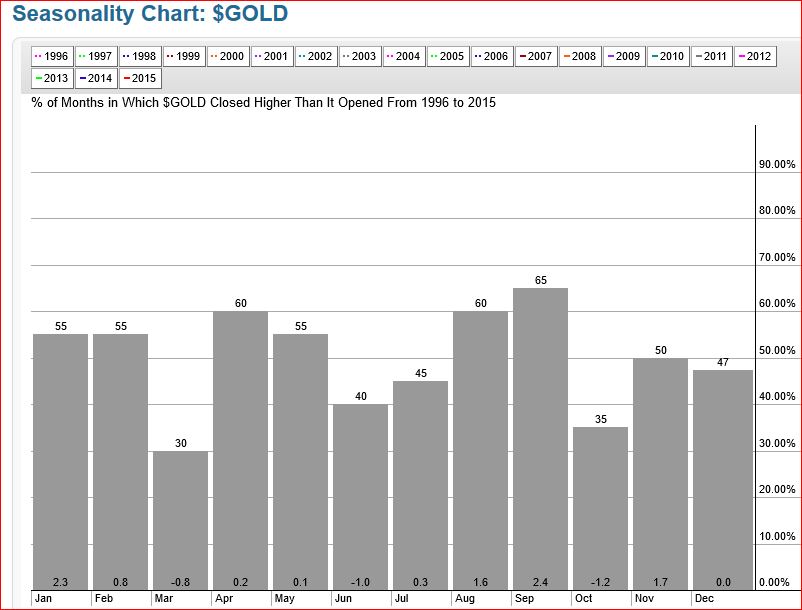

Gold lost a whopping 6.8% in November – highly unusual considering that November has been the 3rd-best month of the year for bullion going back to 1996 with an average gain of 1.7%…last month was unique in the sense that traders dumped Gold on the growing sense that the Fed will initiate its first rate hike in a decade at its upcoming meeting December 15-16…so a hike has already been “baked into” the Gold price, the yellow metal has become quite oversold, and conditions are ideal for a strong December rebound even if the Fed decides to hike rates…

Gold is also approaching one of its best months of the year – January…the 2016 Chinese New Year falls on February 8, 11 days ahead of 2015…expect strong Chinese buying leading up to New Year celebrations…

In today’s Morning Musings…

1. A big volume day in Discovery Ventures (DVN, TSX-V) as the company prepares for a bulk sample test at Willa…

2. A “big picture” update on Equitas Resources (EQT, TSX-V), technically and fundamentally…

3. Tracking the leveraged opportunity in the HGU…

4. The S&P 500‘s interesting December history…

Plus more…to view the rest of today’s Morning Musings, login with your username and password, or click here to gain full access to this and other exclusive BMR content and features…

31 Comments

Jon, will there be any follow-up in relation to DBVs new website and information they recently posted? Curious your thoughts on DBVs near future and the highly anticipated results of the holes yet to be sent to the lab. Thanks.

Yes, ChetBaker, we’re going thru things and of course as soon as we have a chance we’ll highlight what we see are some key points…

I hope GGI can deliver and not be a bust (like 95% of venture companies exploring/drilling) It would be nice to have a real winner!

ABR.v now at 0.025(started the day at 0.01)and more than 9 000 000 volume.

Does anyone know if WRR started their drilling today as scheduled or is this another false start? This stock has been so disappointing. I have been holding it since Feb at .045

WRR- I spoke with Michel last week and he said no problem for drll December 1

Thank you Guy I hope WRR puts out a news release.

GGI; hammer candle today and 200 sma on weekly chart is now flat looking to head upwards. Oh, I hope assays are amazing!!

GGI – bought some more today to average up.

GGI: i hope assays are being re-checked 😉 always a good sign. Quite an interesting first 5 holes – variation yet common “threads” as well between them. I have to remind myself that this is only 1 of 7 regional target areas! will not be much longer. Cheers

You have to think we are really close to results for GGI, we have seen enough core and Regoci has alluded to some interesting readings with the XRF Analyzer, I am cautiously optimistic. Time for some numbers!!

Any feedback from geo Jon on the new cores (4 really differents zone) no pyrite on the 292M black magnetite core. there will be some silver zinc lead value in some of these. i Remenber when Regoci state ” there is mineralisation of all style” think he was right.

2 systems discovered at Grizzly Central, Martin. GGI has found something new in the district. That’s the latest feedback we got this afternoon from some independent geos who have looked at this. So prepare for an exciting ride.

Can you tell us more, low sulphidation epithermal plus the black magnetite pyite gold bearing?

There’s a very high expectation of GGI results here and people are setting themselves up for disappointment imo.

I warned everyone after hole 2 or so to be very careful and sold after what I was hearing about drilling and my gut feeling. Don’t risk more money than you can afford to lose solely based on pictures of small segments of rocks, optimistic interview from CEO and other people’s optimism/expectations. Yes, the CEO sounds very optimistic of things to come but my question is has anyone EVER heard a CEO not optimistic about their property and drill results to come? My number one rule is to NEVER talk to senior management (last time I did was about 11 years ago) as I don’t want my opinion to swayed and want to be able to remain neutral so that I can properly assess things. I consider a CEO like a salesman that is trying to sell you their product (ie buy their shares)…..if they were negative about the potential of a property, drill results, etc they wouldn’t have the job anymore.

My geologist contacts are not giving me a reassuring feeling about GGI. If there is good mineralization it probably won’t be long intercepts of it. As for step outs, they are done for 2 reasons……..if one area isn’t bearing fruit its an attempt to find the sweet spot or its because they are trying to figure out how big the deposit it or the deposit’s limits. GGI did a step out hole very early in the game so which reason is it?? Think about it.

I consider everyone here friends and I hope I’m wrong so that many here are rewarded. I’m not saying that the Grizzly will be a dud……its a very large property and they just started drilling so there could be multiple deposits. The first results will probably not be as good as people expect them to be based on what I’m hearing. Setting expectation high is a dangerous thing…….when set too high the market punishes good results! Until its proven that they are on to something big I would keep expectations low to avoid disappointment and maintain a position in it that won’t hurt you financially if it doesn’t work out.

I know there are a lot of GGI supports here and my post will not make me a popular person but I feel that its my duty to pass on the warning to others in case its correct. If I felt that my info was wrong I wouldn’t be posting this. Hopefully the expectation I heard to anticipate is wrong as there are many shareholders of it here.

Keep expectations low and remember its early in the game and the property is BIG!

DDD4 – I am assuming you prefer that we buy DBV?

A good measuring stick is a CEO’s track record, 02charoc. In the specific case of Regoci, besides of course his astute call on San Miguel that netted the company nearly $20 million, he was very optimistic regarding Rodadero and continued to hit impressive high-grade intercepts there, so he was proven correct. In fact, he was specifically very excited about a particular area north of Silver Eagle and then indeed hit a great step-out hole, 150 m of the discovery hole, and we should expect GGI to soon follow up with the next stage there now that they’re fully set-up at Grizzly Central. In the case of Farshad, he was also very optimistic regarding certain holes at the Hat, and came through. Some CEO’s deliver, but it’s true that many don’t. If you’re an investor in the junior markets, in any company really, it’s necessary to acquaint yourself with management – you need to understand how they think, their strategy, their approach, their strengths and weaknesses. Management is always key.

I think any sort of grade at Grizzly would be acceptable. GGI’s SP does not reflect any sort of expected find. If they do find a reasonable grade (0.7% CuEq) it will help the SP. If it is better grade than that and of a big size, then the SP should go up. Market cap is only around $6mil at time of posting.

DBV won’t do any drilling until Spring is my guess. Will they go there and retrieve the core for assays this winter? I hope so, then they should do a financing at a higher level ready for a new round of drilling.

Did I mention that company? I intentionally didn’t mention it. It’s an honest passing of info that I received and no hidden agenda.

I prefer that people do their DD and not let expecting get out of hand especially when current rumours are not in line with expectations.

Jon- correct….many over promise and under deliver. Yes, GGI seems to have a good track record so let’s hope that the most recent holes deliver now that they have a better understanding of the geology with every hole drilled. My anticipation of not meeting some poster’s expectations is only for the first few holes and I have no idea for the most recent holes though.

GGI – I think the next PR will not only have news on from Grizzly properyy but also news from their excellent Mexico properties. Keep in mind that GGI is not a “one pony” company!!! IMO, the stock is grossly undervalued!!

DDD4 – I never said that you mentioned any company. I’m just remembering previous posts hat you pushed DBV hard and the most potential Short term. That’s all. Doesn’t seem like that will be the case though. I guess management on DBV is also one we have to be careful with.

The assays will be the truth machine. Don’t forget GGI has an XRF analyzer on site. Also they can’t post pics of all the core. That’s what you see most companies do – short sections.

I’m feeling pretty confident on assays. The fact that they rushed assays and also have an XRF on site build some confidence. Looking forward to results ?

DDD4 – any rumors regarding Dbv? Any idea when we will get some news? When will we start drilling?

Its December, you have to be careful with everything. I personally don’t like being in a stock just prior to assays.

George- one must take everything management says with a grain of salt…matter of fact take everything from everyone with a vested interest in something with a grain of salt especially until proven trust worthy….

I watched some youtube videos on XRF and XRF is impressive.I wonder as a new to all these, why company’s like GGI cannot show their XRF results ? Maybe it will help with the sp ?

Sameer- unfortunately DBV needs to get its act together and start delivering on its words. I’m not wasting my time on it for now…..sorry…..not providing any rumours or info even if I have some good opinions/DD/info to pass…. when time comes and things will actually happen I will let you know.

XRF – in specific cases companies, can apply to the exchange and release data, but its very very limited and usually better off to just wait for drill data. the labs are set up as an independent source. XRF in the field is run by management, so there could be a bias on data released.

The most effective way to get lab quality results using XRF is to pulverize the core, screen it, dry it, and then do your reading…that’s a time consuming task, so that often doesn’t occur…regardless, an XRF can be a highly effective tool in obtaining critical real time clues regarding alteration and pathfinder minerals, and guiding the drilling process…