Gold has traded between $1,065 and $1,078 so far today, just over 24 hours from the start of what’s expected to be an historic Federal Open Market Committee meeting…as of 3:30 am Pacific, bullion has shed $7 an ounce to $1,067…Silver is off 18 cents at $13.71…Copper has retreated 2 pennies to $2.11…Crude Oil is down for a 7th straight session, off another 65 cents at $34.97, while the U.S. Dollar Index is relatively unchanged at 97.70…

Multiple indicators – technical and fundamental – are flashing positive for Gold right now, despite this morning’s minor pullback, as the metal recovers out of extreme oversold conditions brought on by the assumption that the Fed will finally act on Wednesday to raise interest rates…read below why a Fed move will likely be bullish for the yellow metal, triggering an even stronger advance in Gold stocks…

Multiple indicators – technical and fundamental – are flashing positive for Gold right now, despite this morning’s minor pullback, as the metal recovers out of extreme oversold conditions brought on by the assumption that the Fed will finally act on Wednesday to raise interest rates…read below why a Fed move will likely be bullish for the yellow metal, triggering an even stronger advance in Gold stocks…

The Venture in this 4th quarter, meanwhile, has been doing the opposite of what it did in Q4 last year when it led commodities to the downside…the Venture is down just 4.5% this quarter, a far cry from a nearly 30% decline during the same period last year, and the Index has interestingly outperformed Gold, Silver, Copper and Oil since October 1…keep in mind, as well, that 80% of the time over the last 15 years, the Venture’s December low has occurred by the 18th of the month…there is no better time than right now to be shopping for pre-Christmas bargains in the junior resource sector, particularly quality opportunities with exposure to Gold…

This is a special early edition of Morning Musings as we’re in preparation meetings this morning for an imminent visit to Grizzly Central and the prolific Sheslay district of northwest British Columbia, an opportunity to fully capture for our readers the excitement and importance of a potential new drilling discovery that could breathe fresh life into the junior resource sector (read more below)…

Gold, The Dollar, & The Fed

The highly anticipated December Fed meeting tomorrow and Wednesday comes on the heels of a fresh spike in volatility, signs of distress in the high-yield market, and falling Oil prices…in addition, the world as a whole is growing increasingly chaotic with hotpots all over the map…however, Fed Fund futures are pricing in a more than 80% chance that the Fed will indeed announce a 25 basis points increase in interest rates on Wednesday – the first hike in nearly a decade…the Fed has been promising, but not delivering on, a rate hike for a year-and-a-half, so Janet Yellen is faced with a credibility problem if she doesn’t act as expected this week…the tone of the central bank’s monetary policy statement will be key, along with Yellen’s subsequent news conference…

Fed-inspired speculation surrounding a rate hike since mid-2014 has been a driving force behind the U.S. dollar’s record run over the last 18 months…the “sell on news” part is now coming into play, and that bodes well for Gold and Gold stocks…the smart-money commercial traders understand this, and that’s why they’ve dramatically reduced their net-short positions in the metal recently while large speculators/money managers became increasingly more bearish toward Gold – a very favorable contrarian sign…the COT structure is incredibly bullish at the moment, so much so that it’s hard to imagine Gold won’t enjoy at least a major bounce in the weeks ahead with gains magnified in Gold stocks…

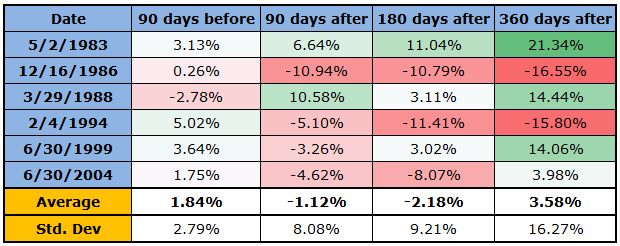

Interestingly, during the last 3 rate hike cycles beginning in 2004, 1999 and 1994, the Dollar Index was down 4.6%, 3.3% and 5% after 90 days…over 180 days, the average decline was even greater – better than 5% as you can see in this chart from www4.dailyfx.com…

Historically, it’s also just not true that Gold gets “slayed” during Fed hike cycles…between June 2004 and June 2006, for example, the Fed more than quintupled its federal funds rate to 5.25% through 17 consecutive hikes totaling 425 basis points…Gold powered 49.6% higher over that exact span…

Redefining The Sheslay District

As far as pure exploration plays go on the Gold side, especially when it comes to high-grade possibilities which the market favors, Garibaldi Resources (GGI, TSX-V) clearly stands out as a compelling immediate opportunity given developments at Grizzly Central in northwest B.C., and in Mexico…GGI, in our view, is about to redefine the Sheslay district as not only prospective for multiple porphyry deposits across a broad corridor, but as an area that is an ideal host for epithermal-style Gold deposits…this would be a serious game-changer for the district, and consistent with Garibaldi’s proven ability to sniff out high-grade deposits across large land packages in Mexico…

“The broad regional NW/SE trend of porphyry deposits and high-grade Gold deposits is very obvious and prolific,” stated Steve Regoci, GGI President and CEO, in an interview following the company’s update last Thursday of its Grizzly Central drill program that has intersected mineralized structures over a broad area (assays pending), apparently trending toward the fertile Kaketsa pluton 2 km to the west…

“You look to the west of Grizzly proper, and just 20 miles away you’ve got the Golden Bear which was a super-rich mine that justified the construction of a 150-km long road that runs through Grizzly Central on the southern border,” Regoci continued. “You have high-grade systems in all directions surrounding the Sheslay district, and within this under-explored district we’re seeing greater opportunities than ever before in terms of discovering different deposit types. There’s an awful lot going on here – we’re seeing it at the Grizzly, at the Hat Property adjoining us, and to the north. Probably the comparable is the Ring of Fire in Ontario. That’s why the AMEBC calls this the #1 greenfield district in the province and one of the best in Canada.”

We’ll have more with Regoci tomorrow regarding the Grizzly and the Sheslay district…

As for Mexico, GGI announced Thursday that it has mobilized its company-owned rig to the Rodadero Project in central Sonora State to follow up on a series of high-grade discoveries from drilling and surface sampling last year that helped push GGI’s share price to a 4-year high…the 2014/early 2015 results from Rodadero speak for themselves…

To date, GGI has only drilled a portion of the western side of Rodadero where the shallow Silver Eagle discovery (15 holes) is confirmed to be structurally linked with the adjoining Reales target to the south to form the “SR” high-grade zone with a potential strike length in excess of 2 km…Rodadero appears to transition, west to east, from a high-grade Silver-Lead-Zinc system to a high-grade Gold-Silver system…Silver Eagle and Reales are just two of a dozen targets defined to date over the nearly 50 sq. km project…this is an emerging new mineral camp in central Sonora that was discovered through the use of GGI’s remote sensing technology and proprietary data collected from deposits across the Sierra Madre – the same technology and data that allowed GGI to cash in big on its Temoris option (San Miguel high-grade deposit) in 2009…

The diversity and richness of deposits in central Sonora is phenomenal…just a few years ago, Bacanora Minerals (BCN, TSX-V) took a few initial samples from a property about 30 miles northeast of Rodadero, and now has a world-class Lithium deposit that has given the company a market cap in excess of $160 million…this has also sparked a great deal of interest in the overall potential for Lithium in this part of Mexico, a point investors should keep in mind regarding GGI given its established presence there…

In today’s Morning Musings…

1. The Oil War – how low can Crude go?…

2. Attractive Gold producers and near-producers…

3. Two non-resource plays ending the year on a strong note…

Plus more…to view the rest of today’s Morning Musings, login with your username and password, or click here to gain full access to this and other exclusive BMR content and features…

21 Comments

Any thoughts on this Jon? clivemaund.com/article.php?art_id=3653

Hi Steven, my thoughts are, if one believes that scenario could unfold, it reinforces the case for holding quality Gold stocks. One encouraging indicator is how the Venture has outperformed commodities over the last 2 months, the opposite of what occurred during this same quarter last year. Fed Day on Wednesday should bring a lot of clarity to the markets.

ABR Halted!!!!!

abr- these guys seem to like halting their stock. hope it’s more good news. really tiny m/c on this one.

good news for sure… but nobody cares… the apathy out here is deafening…

#1…Interesting!!! Thanks, Steven1

Clive’s article – thx for posting ! eek

Venture under 500 … ALL TIME LOW over 25 years this exchange is broken and may not survive the advent of other exchanges. stockcharts only goes back 16 years.. someone said 25 years..

the CRB is at a 40 year low… like holy freakin

No tools are working, no ideas are correct, no vision is accurate, and no forecast is believable… is this Armageddon?? one wonders

I read Clive’s article, there is always someone predicting total doom and gloom, it all depends on who you want to believe. It wouldn’t surprise me if 2016 was a tough year but if technical analysis was a perfect science then a lot more people would be rich. Do the simple things like paying off debt and not investing more than you can afford to lose. There has been so much talk about a .25 increase in the fed rate that it is tiresome. Let’s just get it out of the way, a .25 increase has already been built into the market, the markets will probably move upward once it’s announced.

Jon, have you any idea what else GGI might have found other than gold and copper. Silver is the obvious possibility I guess, but it sounds like they have more than 3 possibilities. Really hope the assays get published this week.

Anything’s possible with Kaketsa, Tom…hole 3 in particular could be quite unusual for the district, beginning with Gold…

Clive Maund is actually bullish on the PM mining shares but is very negative on the general market as the article posted says. Here is his article explaining why the PM sector will be ok when the general markets fall. clivemaund.com/article.php?art_id=3654

Strength in WRR right off the bat this morning.

WRR- Nice to see WRR at the openning !

Jon, when will you release the latest interview with Regoci?

Working on it, Dan1…ASAP.

Great. Thanks Jon.

Jon, what’s going on with Venture?? Gold and Oil as well as the TSE big board are all up but the Venture keeps dropping setting new all time lows in a daily basis. What gives eh?

When it’s ready to start its usual December reversal, Jeff, it will – could be later today, tomorrow, or as late as the 21st as history shows…last year it was the 16th…Venture has really closely correlated with Gold recently, not Oil (note the Venture and Gold Index are both slightly down today), so when Gold starts its move, that could be a trigger…

The December 2013 market can also answer your question, Jeff…the Dow turned on the 11th trading day…the TSX kicked into gear on the 13th day…the Venture didn’t start moving until the 16th trading session that month, but then it went on a record run (consecutive daily advances)…so today’s activity in that context was not unusual…

Current situation – Venture technically oversold going into a seasonally strong period, with a Fed rate hike finally out of the way tomorrow (likely)…bullish.

WRR- Nice volume today !