Gold has traded between $1,083 (just above $1,080 support) and $1,100 so far today…as of 9:30 am Pacific, bullion is down $7 an ounce at $1,087…Silver is off 7 cents at $13.78…Copper is down a penny to $1.98…Crude Oil has fallen another $1.23 a barrel to $30.18 while the U.S. Dollar Index has gained one-quarter of a point to 99.12…

Investors embarked on the biggest 3-day buying spree in Gold-backed exchange traded funds in a year as bullion rallied at the start of 2016 amid a global stock market slump and concerns regarding China…holdings in Gold ETF’s climbed 19.6 metric tons in the 3 days through Monday to 1,477.7 tons, according to data compiled by Bloomberg, the largest increase since January 2015…assets rebounded from the lowest in almost 7 years on January 6…bullion jumped 4.1% last week in its best performance since August amid that global equity rout, also ignited by China…

Investors embarked on the biggest 3-day buying spree in Gold-backed exchange traded funds in a year as bullion rallied at the start of 2016 amid a global stock market slump and concerns regarding China…holdings in Gold ETF’s climbed 19.6 metric tons in the 3 days through Monday to 1,477.7 tons, according to data compiled by Bloomberg, the largest increase since January 2015…assets rebounded from the lowest in almost 7 years on January 6…bullion jumped 4.1% last week in its best performance since August amid that global equity rout, also ignited by China…

Greece Doesn’t Deserve A Single Mining Project

Eldorado Gold Corp. (ELD, TSX) is telling Greece to take a hike, at least for now, and for good reason – Greece doesn’t deserve a single mining project with the way its reckless, socialist government has treated Eldorado…

“Since 2012, we have created approximately 2,000 direct jobs in the country and invested in excess of $700 million (U.S.) towards development of the Skouries and Olympias projects – including tax payments in excess of 120 million euros to the Greek government. In Halkidiki, we have the support of the vast majority of the local stakeholders. Furthermore, we have had numerous decisions of the Council of State, Greece’s Supreme Court on administrative and environmental matters, confirming the integrity of our permits. However, since the beginning of 2015, the ministry has adopted an openly confrontational attitude towards our business and investments, which has had a detrimental impact on our schedule and budget to develop our mineral assets in Halkidiki,” stated President and CEO Paul Wright in a strongly-worded news release yesterday…

Wright and senior management held a news conference this morning in the Athens Hilton Hotel, and below is a link to the text of Wright’s speech at that news conference…got to love the headline on ELD‘s web site – “Amended Investment Plans in Greece“…

http://s2.q4cdn.com/536453762/files/PW-Speech-for-Greek-Press-Conference-Final.pdf

Will this be enough to take up authorities in Greece?…hard to say…ELD stock is taking a hit today – down 82 cents at $3.54 – and jurisdictional risk is a major reason we didn’t include it in our picks of top producers last month…the environmental lunatics across the globe these days are going to be a contributing factor to supply problems in many metals in the years ahead which ultimately of course will drive commodity prices higher…

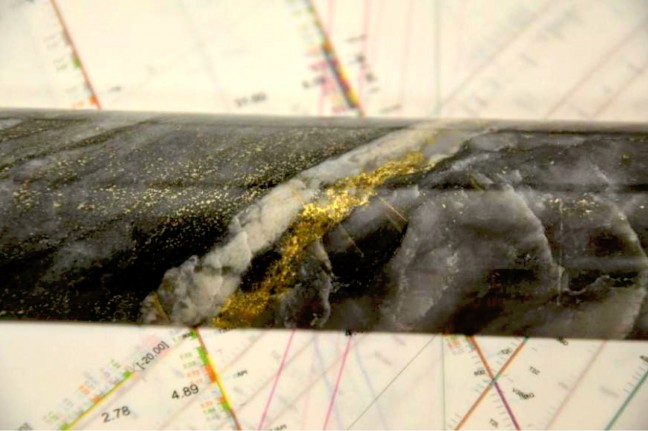

Photo of The Day

In today’s Morning Musings…

1. The technical (chart) pressures on Oil and Copper…

2. The Golden opportunity in the TSX Gold Index (and producers) when Oil prices are weak…

3. Richmont Mines (RIC, TSX) exceeds guidance on 2015 production…

Plus more…to view the rest of today’s Morning Musings, login with your username and password, or click here to gain full access to this and other exclusive BMR content and features…

51 Comments

repost:

when will it be time to just simply admit that the market and all the people in it are toast… never to return.. volumes on the V are anemic, everything is in the tank, no logical reason for things to come out especially after the largest expansion period since WWII..

the glass half empty mindset is that there will never be the level of resource requirements ever again that was needed in the past 20 years..

Some guy last night on CTV news – an economics prof – said that the economy has changed as of now. it isnt the same economy as it was 2 years ago.. it has changed forever..

what that means to me is that our power play due to our resources is over.. we are on the penalty kill now for a very long time..

from one extreme to the other.. comments?????

FWIW- from SH, therefore take with a big grain of salt….

2.5 stars

Kingsley will be at the open of the TSX Wednesday Jan. 13th

posted January 12, 2016 01:19 pm by AndyMan2

2 stars

News will be released tomorrow morning before the TSX opens and Sean Kingsley will be in Toronto tomorrow at the opening bell. We might even see him on BNN. Cheers to Good News. Andyman

WRR- I don’t like this selling !

It’s probably more a reflection of the broader markets, Guy. TSX down 10 straight sessions, doesn’t help. But that’s when the opportunities appear.

WRR

Looks like some know the results of the drilling, not good…

Jon

lots of volume on WRR today… much more than the norm

Yes, higher than normal volume, Greg, the most since July just before the uptrend started. Could be any number of reasons for the volume, but the stock has merely retreated to its 100-day SMA. For every seller there’s a buyer. Personally, I don’t believe the WRR selling has anything whatsoever to do with results (or even the company) which are still probably 2-3 weeks away. Probably just another investor needing to raise cash or giving up on the commodity sector—good sign. Takes just one phone call to find that out.

JOn.. the burning question is that light…….. daylight or train????

WRR – What is going on.

What is going on in these markets.

Look at the canadian dollar, its ready to drop into the 60’s.

This is RIDICULOUS

Make the phone call – find out!

Dave, we did our checking just a short while ago, and the WRR selling has absolutely nothing to do with results or the company, and it’s a source we have 100% trust in (not someone from the company by the way).

GGI – The big bid disappeared at .12, is it next?

Re WRR…don’t forget some investors are buying 100k+, they don’t think there is trouble with this company.

Bob – The way things are going I wouldn’t be surprised to see EQT open at .06

John, no offense, but the ones buying 100+ shares could be retail like us and don’t know or are gambling and hoping.

I hope you’re right Jon !

Dave – sense a bit of panic around… like lots of it.. the sky is falling kind of stuff.. thats the light I speak of.. is it really falling this time?? wheels have fallen off so many resource stocks in the last week alone…

I believe that the wall street bullies are responsible for alot of the precipitating action… they play into the emotion and wonder if they can buy FCX for pennies on the dollar??? the only way they can is if they drive the stock price down so far that they buy a majority stake in the company or something like that.. or froce them into chapter 11 then swoop in…

See post #1…

CDNX has taken a big drop today down th the 500 area .

At some point people begin to realize that all the money printing and QE is a hoax that will not help the world economy. IMO

EQT…rumour is Brazilian gold producer

EQT…I give Kyler H. a lot of credit….he has kept everyone guessing….lets see what happens tomorrow.

Weatheritout…that is certainly an interesting rumour. Looking forward to hearing the details soon.

EQT – I have been saying South America since it was halted. 500+ thousand plus they are talking paying dividends.

Jeremy – good post #17, it’s the end of the world.

By the way, I looked at level 2 on EQT, the bids fell off since the 3rd day of halt and the offers grew. Oh boy.

Dave – thats why we drink… and sometimes we drink a lot:)

EQT – Someone on SH is saying that they bought a producing mine in Colombia, emeralds??!

Dave – I wouldn’t put too much “stock” no pun intended of course, into what’s shown on level 2 during a halt as that will change drastically one way or the other, when a company resumes trading.

There is a lot of nervousness out there obviously and this has had a direct effect on the venture stocks. We saw that in 2008 as people stay away from junior stocks when they are nervous unless it’s a great story. Plus when the senior markets tumble you also get a lot of selling because of margin calls and this adds to the selling of juniors as people in margin calls get dollar for dollar back in margin from selling stocks that don’t qualify for margin. I wish I was more optimistic.

New core on the web site, just joking, i was getting use to have update, core pics, maps etc… It will take something big to move GGI up substentially.

GGI – anyone hearing anything? It is time companies give it’s investors an update if there are delays. There was a stream of updates and then suddenly – nothing for 4 weeks now. There may be a very good reason for the delay but when it goes beyond the norm, investors have a right to know. Jon, that interview you had with Regoci, it will soon be irrelevant don’t you think?

Dan1, I go back to my comment over the weekend…DBV started drilling in mid-Oct. 2013 (5 holes) and reported its discovery Monday, Jan. 20, 2014, during the middle of the Cambridge Show after a weekend halt…GGI started drilling in mid-Oct. 2014 (5 holes), so the fact they haven’t reported yet is consistent with DBV’s timeline…would be ironic if GGI were to report just before or during this year’s Resource Show – clearly a strong possibility the way the stars are lining up….in GGI’s case, it appears the lab had to take some extra time with regard to the dark mineralized unit (they hit a major abundance of this structure) that has never been drilled into before in the district (strengthens the case that this indeed is significant)…3rd discovery, 3rd deposit (different type) if this unit runs…my gut tells me it will, and the district changes…I’m sure Regoci has much on his plate….he also has to know certain facts (including all info from the lab) before reporting to shareholders and investors…especially if this is big, Regoci will make sure they get it right in terms of disclosure…don’t worry about interview relevance – we’ll get our part right, too…

GGI seems to be going backwards… not a good sign… 10 cents. Better dump it and buy back …

Jeff – your right on the level 2 issue. Also, I mentioned the day of the halt that Kyler was in S.A. and I was guessing Ecuador. I hear it is producing 500 thousand a month. This could be a bad time for gold, but ya never know. I think EQT will react well at open, but then…………

Noticed insiders bought 69,000 shares of VGN today so obviously that big bid at .06 is insiders buying, I think VGN has a share buy back program in the works.

On the negative side TMX Money shows insiders selling 500,000 shares of ELT, hopefully that’s just related to the recent financing.

Thanks Jon. Excellent post 31.

Big PR tonight by T.NHC that validates their financials against shortseller accusations.Do some DD,people.You have a chance to recoup losses on other plays with this one.

Possible big runup tomorrow,with a conference call on Thursday.NHC trades on both the TSE and NYSE.The price has dropped from $8.00 to $3.40 on a short attack.

The accusations have been proven wrong by a 3rd party investigation and Q3 has met analyst expectations,with Q4 about to be released with huge numbers indicated by the company.

Expect a long run because 5 institutions have rated NHC a buy to strong buy with a price target of $10-12 dollars.2016 guidance is supposed to be over $300 million in revenue with strong EBITDA.

Only 48 million shares in the float.A major lender and all analysts backed up the company every step of the way.Vindication is now at hand.

Over 6 million shares short with only 48 million float.

Good post #31. Still a few weeks away then.

Theodore – nice try.

T.NHC pre-market is up 34% in the US.Don’t miss this guys.This will run big on the Q3,then a conference call on Thursday will drive it up more,then Q4 will drive it even further,then something else is expected.

This could see a double or more in one week.This rest of this market is garbage and nothing more than slot machine gambling.

Robin – Gem. V is looking good. Have you done DD, been buying?

Kootenay Silver to aquire Northair Silver corp. Nice addition to an already awesome land package. Now if we can just get silver to go up.

Interesting acquisition, DBReese, in terms of how it positions KTN…INM also reported nearly $3 million in cash/short-term deposits thru August 31, most of which is probably still there…relative to Gold, Silver has come catching up to do…any nice jump in Silver is obviously one trigger that would give KTN a good boost…

George,I’ve concentrating on other things.I’m keeping an eye on it,but will wait for volume to come in before committing.You have to be able to get out and that takes volume.

Just made an easy 23% profit on NHC this morning,and now will hopefully get chance to buy in cheaper for the next move tomorrow.

The junior market is garbage.Might as well play the slots in Orillia.Better odds of making money.

WRR- The bids looks good this morning !

Guy – the bids looked even better couple days ago with over a mil. at .03 and looked what happened.

Yes but we got rid of a big player

WRR – I just don’t like the fact that just about every trade ANON was on the sell side. Maybe leak in drilling results? Something not right IMO!!

ANON selling may or more likely means NOTHING. same applies to buying via ANON buying. lots of brokers use ANON to mask their house. and with discount trading as pervasive as it is in this segment of the mkt, it means that most trades are done via the cheapest house. trades that occur within the same house, ie 79-79, sometimes don’t even show (at least via SW), since the bank brokers in Canada, also use different trading platforms, for cost reasons, that aren’t well tracked. 1MM shrs at 3 cents is $30K of trading. in the scheme of things , aint much, but when nothing else is going on in the mkt, it looks like something I guess

The TSX Venture Exchange has accepted for filing documentation with respect to a non-brokered private placement announced May 21, 2015.

Number of shares: 666,667 shares

Purchase price: 15 cents per share

What are the thoughts on this DBV Private Placement?

Warrants: 333,333 share purchase warrants to purchase 333,333 shares (The warrants are subject to an accelerated exercise provision in the event the company’s shares trade at 35 cents or greater for five consecutive trading days.)

Warrant exercise price: 20 cents for a two-year period

Number of placees: one placee

Finder’s fee: Canaccord Genuity Corp. will receive $6,000 and 40,000 agent’s warrants that are exercisable into common shares at 20 cents per share for a two-year period.

Someone posted on here that there would be no problem with raising the cash. Was it Les? Will there be a new PP with a lower pricing?